A Quarrel In A Faraway Land

By Benjamin Picton, Senior Macro Strategist at Rabobank

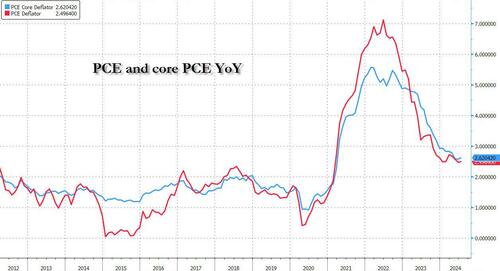

US Core PCE figures reported on Friday showed that inflation slowed a little more than expected in the year to July. Year-on-year price growth was 2.6% versus a consensus estimate of 2.7%, while the month-on-month figure printed in line with expectations at +0.2%.

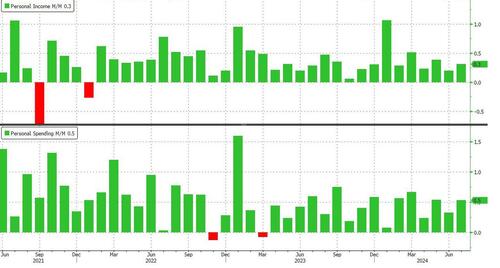

While inflation appears headed in the right direction, household finances may not be. Personal income rose a better-than-expected 0.3% in July, but was eclipsed by a 0.5% lift in personal spending. We have to go all the way back to January to find a month where personal incomes grew at a faster pace than expenditures.

My colleague Bas van Geffen noted on Friday that the recent upward revision in quarterly GDP growth to 3% is unlikely to be repeated in the months ahead as evidence mounts that consumers are feeling the pinch. While spending growth outstrips income growth we have seen a steady uptrend in average credit card balances and delinquency rates. Surely not a sustainable trajectory.

Of course, a Fed rate cut this month is virtually a done deal. The only question now is will they cut by 25bps, or 50? Futures market implied odds of a larger cut have climbed marginally since last Monday, stronger-then-expected GDP notwithstanding. This week has the potential to introduce plenty more volatility into estimate of the Fed policy path with ADP employment data and weekly jobless claims due out on Thursday and the all-important non-farm payrolls report set to drop on Friday.

This will be the first payrolls report since the July figures that combined with a BOJ rate hike to precipitate a miniature market panic a few weeks ago. The July report showed lacklustre employment growth of 114,000 in the month and the unemployment rate rising two-ticks to 4.3%, triggering the Sahm Rule in the process. This time around the consensus of surveyed economists is for employment to rise by 165,000 and the unemployment rate to fall to 4.2%, but markets have become increasingly sensitive to labor market data as the Fed has indicated greater focus on that half of its dual mandate, so a miss on payrolls would likely see a sharp response in OIS futures.

Markets are pricing in a terminal Fed Funds rate of ~3% by January of 2026. Superficially, there is no imagination involved in arriving at this number as it sums to the inflation target of 2% plus the Fed’s estimate of the neutral real rate of interest (r*) of 1%. Sub-2% 1 and 2-year inflation breakevens seem to tell a slightly different story, implying that the Fed is set to overshoot it’s inflation target while keeping real short rates at restrictive levels.

A disinflationary overshoot would probably require a more substantial deterioration in labor markets and a sharp slowdown in economic growth. Our US Strategist, Philip Marey, is expecting a downturn in the United States beginning in Q4, but he is also expecting the Fed to keep rates more restrictive than the market implies as inflationary policies proffered by candidates for the Presidency threaten to keep upward pressure on prices.

Politics was again in focus over the weekend as the far-right AfD (Alternative for Germany) party won the largest vote share in the German state of Thuringia and ran a very close second to the Christian Democrats in the state of Saxony. At face value the strong result for AfD reflects growing discontent with Olaf Scholz’s centre-left coalition’s record on immigration and the Ukraine War, but on a deeper level it is also an example of the tendency for voters to gravitate to the extremes of the political spectrum when the economy is not delivering for ordinary people. To underscore that observation, the far-left BSW handily outpolled Scholz’s SPD in Thuringia to claim 15.8% of the popular vote.

While Germans voted in larger numbers for parties opposed to supporting the Ukrainian war effort, Ukraine launched fresh drone strikes against a Russian oil refinery and Russia’s Deputy Foreign Minister indicated that the country’s nuclear doctrine is under review with the threshold for using nuclear weapons set to be lowered.

Currently, Russia’s position is that nuclear weapons will only be used in the event of an enemy nuclear attack, or if a conventional attack threatens the Russian state. The Kremlin is now set to relax its stance on the use of those weapons in response to Western powers providing armaments to Ukraine that have been used to strike targets inside Russia’s borders. Tensions over Western support have only been heightened by Ukraine’s surprise incursion into the Kursk region, which has embarrassed the Kremlin and resulted in the capture of thousands of Russian troops.

While Ukraine takes the fight up to Russia on its own territory, appetite in the West for continuing to support the war effort is clearly under strain. Donald Trump and JD Vance have made no secret of their scepticism that support for Ukraine meets the definition of ‘US vital national interest’, and the weekend’s election results suggest increasing war-weariness amongst Ukraine’s largest European supporter, who happens to be de-industrialising at precisely the wrong time.

In a nutshell, economic malaise threatens to accelerate the geopolitical fragmentation that Christine Lagarde warned of in April of last year, with attendant pressures on the political center who seem incapable of providing answers to the questions voters are asking. Disgruntled Western electors are beginning to view foreign entanglements in a similar way to Neville Chamberlain in 1938: “a quarrel in a faraway land between people of which we know nothing.”

Tyler Durden

Tue, 09/03/2024 – 07:20

via ZeroHedge News https://ift.tt/HVMEWd8 Tyler Durden