A Few More Things To Watch

By Peter Tchir of Academy Securities

As discussed in the Fog of War, we are starting to get some economic data. The market did not like yesterday’s data, where ISM Manufacturing was weak, but it really didn’t like the mix – employment and new orders components were below 50, with prices paid beating 50. JOLTS and durable goods will be interesting today, along with the Beige Book which might give an inkling into what the Fed sees region by region and how they might vote for rates at the September meeting.

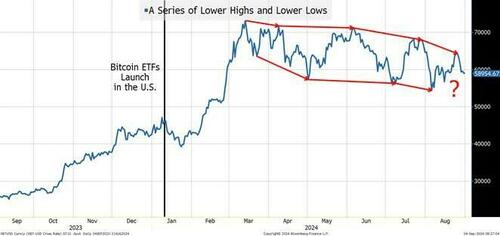

Away from that I’m watching Bitcoin and the Bitcoin ETFs closely as well as NVDL.

I’m watching NVDL as it seems an obvious example of “retail” froth. The need to own a single company stock in a daily leveraged vehicle seems bizarre to me. You can add in a bunch of the VIX ETP’s that have also seen some strong inflows into the “froth” bucket.

The FBI/IC3 warned about North Korea Aggressively Targeting the Crypto Industry. They mention the Bitcoin ETFs in the report. The so-called “spot” ETFs “own” crypto to support the value of the fund (similar to how a stock or bond or even futures based ETF owns stocks or bonds or futures). But I don’t worry about the holdings of a “traditional” ETF getting hacked or stolen or lost. Do we need to worry about that for a crypto based ETF?

While I don’t pay a lot of attention to Bitcoin on a daily basis, but with a total market capitalization of over $1 trillion it is significant and the rise from $30,000 last autumn to above $55,000 has likely helped support a lot of consumption here and abroad. Is that at risk?

The “halving” was supposed to be a big support for bitcoin (though I’m not sure why getting paid ½ of what you used to do, for roughly the same work was supposed to for miners, especially if you don’t get the necessary “inflation”) but so far that hasn’t helped.

Many would argue that geopolitical risk should be good for bitcoin and there is no shortage of geopolitical risk (add Turkey wanting to join the BRICS to the list). We have seen from time to time what seemed like potentially “bad actors” selling into times of crisis as they wanted to raise the “fiat” to spend. Could that be happening here as well?

Bitcoin isn’t high on my list of worries for the economy, but it has made it to my list of things to keep an eye on.

Tyler Durden

Wed, 09/04/2024 – 11:30

via ZeroHedge News https://ift.tt/z4a8KGE Tyler Durden