Bank of Canada Cuts Rates For Third Consecutive Month, Says “Expect Further Cuts”

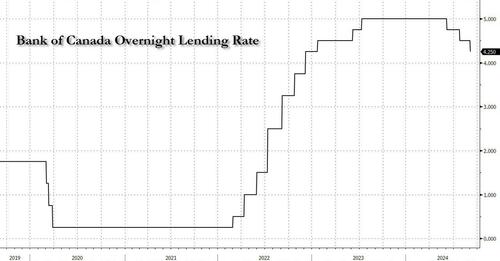

While Hungary may have already ended its rate cuts as prices surge and the currency tumbles, becoming the first central bank this cycle to prematurely end its easing cycle, other central banks have a ways to go before they get there, and moments ago the Bank of Canada cuts its overnight lending rate by 25bps for the 3rd consecutive time, as all economists expected, and citing continued easing in inflationary pressures.

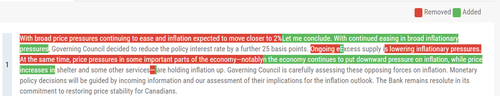

A redline of the latest two statements shows the bank’s reasoning for the continued rate cuts:

Commenting on the decision, BOC Governor Tiff Macklem reiterated that “it’s reasonable to expect further cuts” and that policymakers continue to assess the tension between economic weakness, which is putting downward pressure on inflation, and high costs for shelter and some services, which are keeping it elevated.

Still, realizing that it’s only a matter of time before the BOC pulls off its own Burds Fed, Macklem says inflation may bump up later in the year as base-year effects unwind, and there is a risk that the upward forces on inflation could be stronger than expected, at which point the central bank would of course be forced to abandon its easing campaign, hike rates and also lose all credibility.

“Overall weakness in the economy continues to pull inflation down. But price pressures in shelter and some other services are holding inflation up” the governor warned adding that “recent indicators suggest there is some downside risk to this pickup.”

“At the same time, with inflation getting closer to the target, we need to increasingly guard against the risk that the economy is too weak and inflation falls too much.”

Still, for now the most likely course is more rate cuts, even if that only assures more inflation down the road: “If inflation continues to ease broadly in line with our July forecast, it is reasonable to expect further cuts in our policy rate. We will continue to assess the opposing forces on inflation, and take our monetary policy’ decisions one at a time”, Macklem said adding that “as inflation gets closer to target, we want to see economic growth pick up to absorb the slack in the economy so inflation returns sustainably to the 2% target.”

Some more observations from the central bank:

INFLATION:

- Excess supply in economy continues to put downward pressure on inflation, while price increases in shelter and some other services are holding inflation up.

- Governing council is carefully assessing these opposing forces on inflation.

- High shelter price inflation is still biggest contributor to total inflation but is starting to slow.

ECONOMY:

- Preliminary indicators suggest economic activity was soft through June and July.

FX:

- Canadian Dollar has appreciated modestly, largely reflecting a lower USD and oil prices are lower than assumed in July monetary policy report.

LABOR MARKET:

- Canadian labour market continues to slow but wage growth remains elevated relative to productivity.

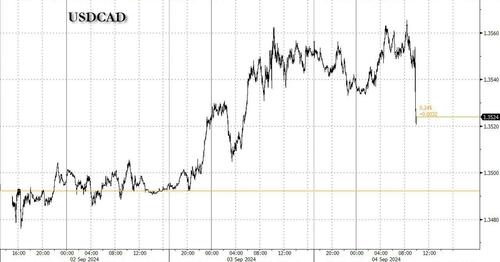

While the decision was widely expected, the USDCAD dropped to session lows after the announcement:

Tyler Durden

Wed, 09/04/2024 – 10:02

via ZeroHedge News https://ift.tt/6eSEsPm Tyler Durden