Gloom Surrounds Jeff Currie’s Super-Bull Copper Thesis As China Woes Cap Prices At $9,500

Veteran commodities analyst Jeff Currie appeared on Bloomberg TV on Tuesday to explain how his bullish thesis for copper, which he called “the most compelling trade I’ve seen in my 30-year career” in mid-May, has been completely derailed or delayed by mounting economic woes in China.

Let’s begin with Currie, who led commodities research at Goldman Sachs for nearly three decades and now serves as the chief strategy officer of the energy pathways team at Carlyle Group, appeared on Bloomberg’s Odd Lots on May 17 to discuss why copper was the best trade he has seen in his entire career.

At the time, when copper was trading at the all-time high of $11,104.50 a ton on the LME, Currie was all googly-eyed about being the biggest copper bull cheerleader:

You know, it is the most compelling trade I have ever seen in my 30 plus years of doing this. You look at the demand story, it’s got green CapEx, it’s got AI, remember AI can’t happen without the energy demand and the constraint on the electricity grid is going to be copper.

And then you have the military demand. So unprecedented demand growth against unprecedented weakness in supply growth because we have not been investing, it’s teed you up for what I would argue is the most bullish commodity that I actually, I just quote many of our clients and other market participants say, you know, it’s the highest conviction trade they’ve ever seen.

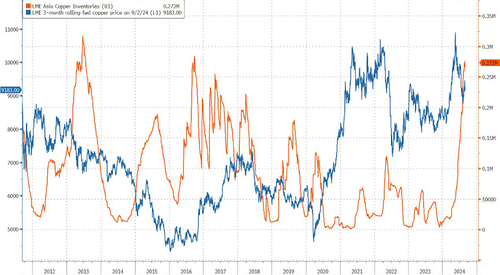

Fast-forward 3.5 months, and LME copper is trading just below $9,000 a ton. He joined Bloomberg TV on Tuesday to explain soaring inventories in Asia and a property market downturn in the world’s second-largest economy were some of the key reasons behind copper’s fall from grace.

How did Currie not see the property market downturn 3.5 months ago? Oh, do we have questions for him…

Copper “still has a floor based upon that strong structural supply story, but it has a cap on the upside based upon that weakness in demand,” he said, adding, “I would say $8,500 on the bottom, $9,500 on the top until we start to see the policy begin to create some strength in China.”

Currie top-ticked the copper market in his bull call in May.

Meanwhile, earlier this week, Goldman revealed to clients that it exited its long-term bullish position on the base metal and slashed its 2025 price forecast by nearly $5,000. This seismic shift comes amid overwhelmingly weak economic data from China this summer and elevated levels of refined copper production being exported from the world’s second-largest economy into global markets.

Goldman’s Samantha Dart and Daan Struyven told clients:

“Copper rally delayed. In copper we’ve observed significant price elasticity of both supply and demand this summer. As a result, the sharp copper inventory depletion we had expected will likely come much later than we previously thought.”

There’s nothing to see here—just a massive rise in LME Asia copper inventories.

About those smartest people in the room…

Tyler Durden

Wed, 09/04/2024 – 17:20

via ZeroHedge News https://ift.tt/vc8n0j3 Tyler Durden