Goldman Reveals Shocking Collapse In Visits To Chat-GPT Website

OpenAI’s ChatGPT continues to lead the generative AI chatbot space, but the initial hype—lasting just over a year—appears to be fading quickly, as reflected in the latest monthly website traffic data.

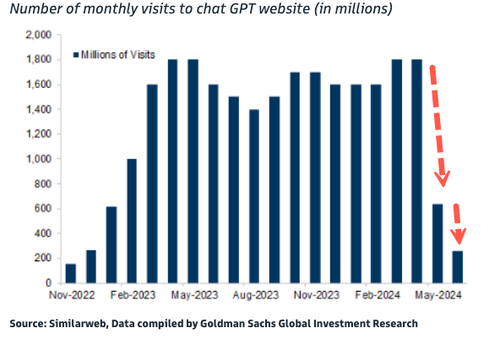

New data from Goldman’s Peter Oppenheimer, citing analytics firm Similarweb, reveals that the total number of monthly visits to ChatGPT’s website sharply declined from spring through mid-summer, as reported in a note to clients on Thursday.

Here’s more from Oppenheimer:

“Furthermore, the original ‘excitement’ about chat-GPT is fading in terms of monthly users (Exhibit 11). This does not mean, of course, that the growth rates in the industry will not be strong, but it does suggest that the next wave of beneficiaries may come from the new products and services that can be created on the back of these foundation models.”

The implosion in monthly visits doesn’t suggest an end to OpenAI; instead, customers are bored with GPT-4 or have gravitated to other large language models powered by big tech, such as xAI’s Grok. There’s a very real possibility that some users have found no need to integrate chatbots into their daily lives.

As OpenAI’s LLMs become more advanced, ChatGPT will also improve, allowing the startup run by Sam Altman to unveil new premium chatbots where it can charge white-collar workers well above the $20 a month (current rate for GPT-4).

On Thursday, The Information said executives at OpenAI have discussed new pricing models that cost as much as $2,000 per month for upcoming advanced LLMs, such as a new reasoning-focused LLM dubbed “Strawberry” and a new flagship LLM called “Orion.”

People with direct knowledge of OpenAI’s proposed subscription price, which could soon cost some users $2,000 a month for premium LLMs, said nothing is final, suggesting there are ‘strong doubts the final price would be that high.’

The Information pointed out, “Still, it’s a notable detail because it suggests that the paid version of ChatGPT, which was recently on pace to generate $2 billion in revenue annually, largely from $20-per-month subscriptions, may not be growing fast enough to cover the outsize costs of running the service. Those costs include the expenses of a free tier used by hundreds of millions of people per month.”

On Friday, Goldman’s Jacob Malmstrom commented on Oppenheimer’s note to clients:

“Since 2010 a lot has happened, at least in the markets, which Peter Oppenheimer writes in his latest Global Strategy Paper (I wish I could say the same about my golfgame but on that front I’ve moved from a 12 to 21 handicap). The technology sector has since 2010 generated 32% of the Global Equity return and 40% of the US equity market returns. Over the same time EPS growth for the Global Tech sector has been 400% while all other sectors together have achieved c.25% from the peak pre-GFC. Peter notes that when new technologies come to life it’s associated with enthusiasm and stock prices rise which evidentially can lead to bubbles. When new technologies are introduced, like we are seeing now with AI, investors tend to underestimate new entrants or companies that can use these products to generate higher returns in existing product categories. Peter argues that tech is likely to continue to dominate returns. Concentration risk are however high and investors should look to diversify their portfolios to improve risk-adjusted returns while getting access to winners in smaller tech companies and other parts of the market. Hence he continues to like his basket of “Ex-Tech compounders”…”

Meanwhile, venture capital firm Thrive Capital and a handful of big tech companies, such as Apple and Nvidia, are planning to invest in OpenAI at (or around) a $100 billion valuation.

Tyler Durden

Fri, 09/06/2024 – 11:05

via ZeroHedge News https://ift.tt/ObiWCwu Tyler Durden