Goldman’s Take On Energy Markets Ahead Of ‘Rocket Fuel’ In Gulf Propelling Francine Towards Louisiana

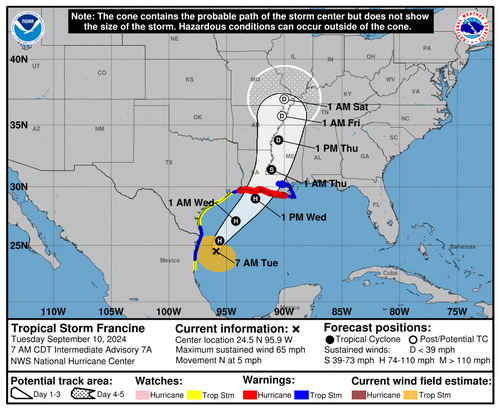

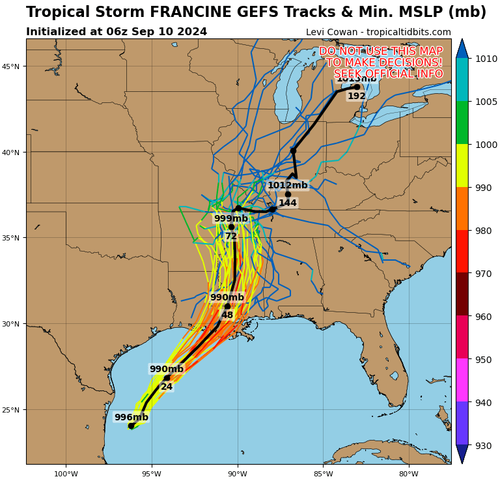

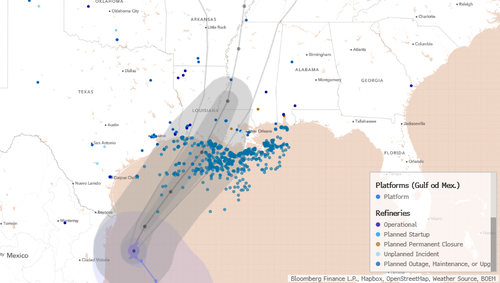

Tropical Storm Francine churned off the Texas Gulf Coast early Tuesday with sustained winds of 65 mph. The storm is expected to strengthen into a hurricane later today as it traverses northeast toward the Gulf Coast and becomes a looming threat for dozens of offshore oil and gas platforms and inland refineries.

“The storm is starting to get its act together,” AccuWeather hurricane expert Alex Dasilva told USA Today, adding that warm waters across the Gulf served as “rocket fuel” for the storm.

The latest weather models expect Francine to strengthen into a category two system tomorrow afternoon or evening and make landfall on the Louisiana coast.

On Monday, Chevron, Exxon Mobil, and Shell announced workers at offshore rigs in the storm’s path were being evacuated and drilling activities suspended.

Goldman’s Robert Quinn provided a helpful breakdown of what’s happening in energy markets ahead of the storm’s landfall in an area home to a bulk of America’s energy complex, including refining.

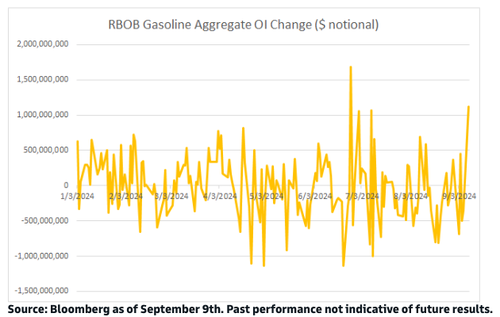

Product markets strengthened on September 9th due to the looming threat of Francine. The tropical storm threatened to become a hurricane by September 10th and barreled towards the Gulf Coast, forcing some oil drillers to halt production. RBOB Gasoline registered a sizeable open interest gain: $1.1bn, the 2nd largest 1 day jump in 2024. Given the locality of OI increases, a combination of outright and short-dated spread buying probably transpired. The general low stock environment plus underwhelming financial positioning prompted the influx from discretionary strategies. That said, the price reversal barely dented the current negative trend. Thus CTA shorts are not yet vulnerable.

Here are Quinn’s highlights:

-

Product markets strengthened on September 9th due to the looming threat of Francine. The tropical storm threatened to become a hurricane by September 10th and barreled towards the Gulf Coast, forcing some oil drillers to halt production. October RBOB Gasoline and Diesel contracts closed +1.3% and +1.2% respectively. Front calendar spreads tightened, with October-November RBOB recovering off its record low.

-

RBOB Gasoline registered a sizeable open interest gain. Aggregate open interest surged $1.1bn, marking the 2nd largest 1 day jump in 2024.

-

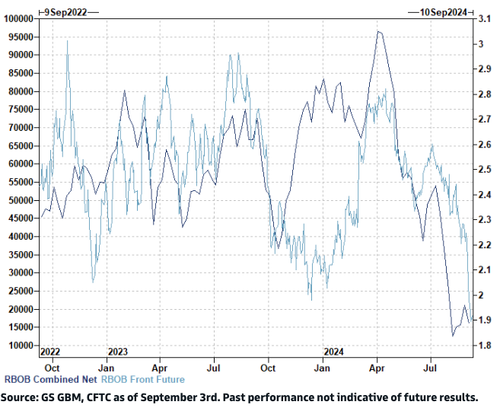

Given the locality of OI increases, a combination of outright and short-dated spread buying probably transpired. November (+$675mm) and December (+$300mm) led. October declined a modest -$125m, considering the presence of index roll activity.

-

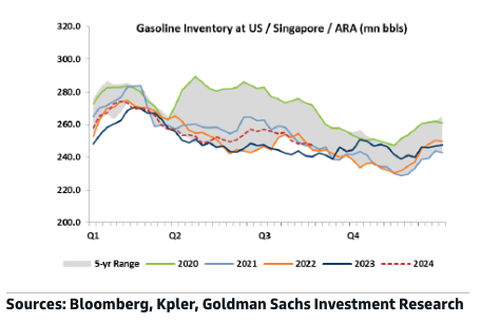

The general low stock environment plus underwhelming financial positioning prompted the influx from discretionary strategies. Per Goldman Sachs Investment Research, Gasoline inventory across the globe resides at the bottom end of the 5 year range. Furthermore, as of the last Commitment of Traders update on September 3rd, combined Managed Money, Other, and Non-Reportable net RBOB Gasoline length sat just above the multi-year min.

-

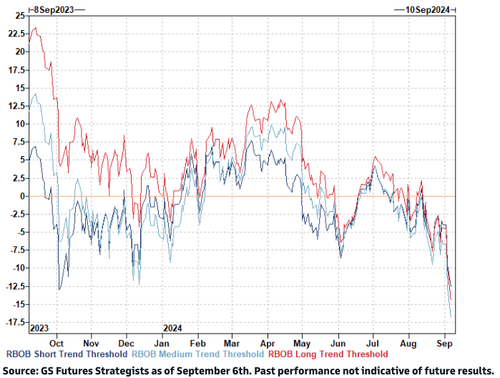

That said, the price reversal barely dented the current negative trend. Thus CTA shorts are not yet vulnerable. According to GS Futures Strategists’ Modelled Funds analysis, a move of ~11% is necessary to turn any of the 3 momentum thresholds.

Quinn’s chart pack.

RBOB Gasoline October-November Calendar Spread

RBOB Gasoline 1 Day Aggregate Open Interest Change ($ notional)

RBOB Gasoline Inventories

RBOB Gasoline Managed Money, Other, and Non-Reportable Net Positioning vs Price

RBOB Gasoline Momentum Signals

While WTI futures have slid in recent weeks due to China and US slowdown fears, prices have found a temporary bottom around $68/bbl handle ahead of the storm’s landfall.

Energy traders have all eyes on the Louisiana area.

Tyler Durden

Tue, 09/10/2024 – 11:35

via ZeroHedge News https://ift.tt/wneCstb Tyler Durden