China Launches More Stimulus: PBOC Cuts Rates, Announces Rare Press Conference On Support For Economy

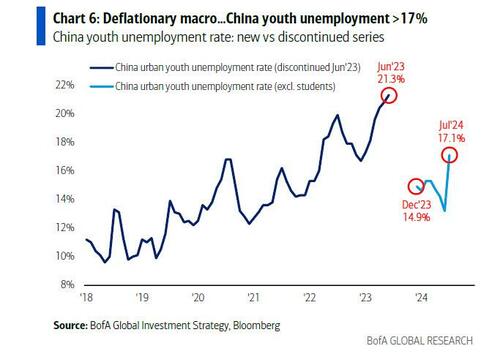

One month ago, when describing the rapid deterioration in China’s economy – including the crumbling welfare state, the country’s dwindling savings rate, the soaring youth unemployment and jump in labor strikes and overall social discontent – we said that despite its stubborn unwillingness to stimulate the economy, “Beijing will have no choice but to blink in the end, and that will mean unleashing a much delayed stimulus bazooka that likes of which have not been seen yet.”

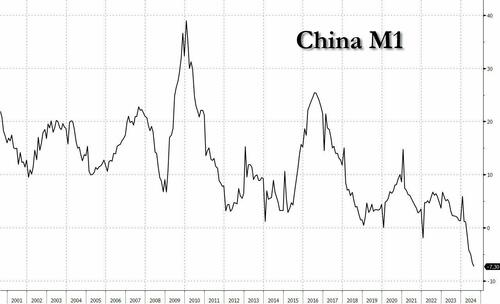

Then, last Friday, when pointing out the record plunge in the China’s all-important M1 monetary aggregate…

… we said that it’s time for China to turn on the printing press.

Time For China To Turn On The Printing Press https://t.co/IDBjhxAs90

— zerohedge (@zerohedge) September 21, 2024

We had to wait just a few hours for this prediction to come true, and while it’s not the full-blown massive bazooka we expect will be revealed in due course (as the alternative is civil insurrection), overnight China’s central bank lowered a key short-term policy rate and pumped more liquidity into the financial system, in its latest effort to boost the sagging economy.

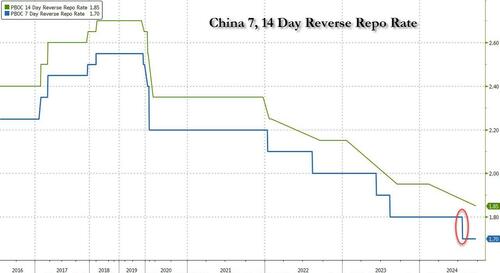

Early on Monday, the People’s Bank of China cut the 14-day reverse repurchase interest rate by 10 basis points to 1.85%, and injected 74.5 billion yuan, equivalent to $10.6 billion, of liquidity via the policy tool, it said on its website.

The latest cut is a reflection of the reduction in the 7-day reverse repo rate in July, during which the PBOC didn’t conduct a 14-day reverse repo operation, said Zhiwei Zhang, an economist at Pinpoint Asset Management.

The central bank also injected 160.1 billion yuan through 7-day reverse repo agreements, keeping the interest rate unchanged at 1.7%, it said Monday.

Last week, the PBOC unexpectedly held its benchmark lending rates steady, despite rising expectations for easing following the U.S. Federal Reserve’s own rate cut. But with its economy in shambles, it’s just a matter of time before Beijing scrambles to catch down to the Fed.

Economists anticipate the Chinese central bank will lower its 7-day reverse repo rate—now seen as the key rate for pricing benchmark lending rates—in the coming months, as the Fed’s cut gives it more room for monetary policy easing.

But more important than the rate cut, China also announced plans for a rare briefing on the economy by three top financial regulators fueling speculation officials are preparing to ramp up efforts to revive growth. According to Bloomberg, authorities announced that central bank governor Pan Gongsheng will hold a press conference tomorrow on financial support for economic development, alongside two other officials. Minutes later, the People’s Bank of China lowered the 14-day reverse repurchase rate, catching up with reductions initiated in July.

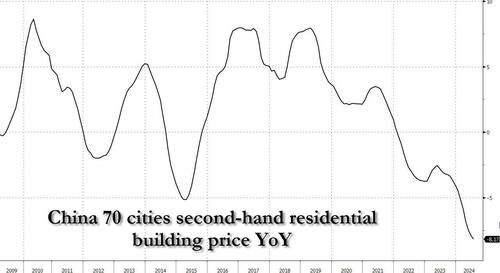

The moves bolstered expectations that PBOC will further lower rates, after the US Federal Reserve finally started cutting last week easing pressure on China’s need to defend its currency. A slew of disappointing data in August raised concerns that President Xi Jinping’s government could not only miss its annual growth target of around 5% without unleashing more support, but is gambling with a total deflationary collapse of the Chinese economy, where housing is now at the lowest level since the global crisis.

Meanwhile, traders understandably are pricing in more stimulus, with the yield on China’s 10-year government bonds falling to a fresh low of 2.03% in the Monday morning session. The benchmark CSI 300 Index for onshore stocks marked their fourth straight day of increases, the longest streak in two months.

“I do expect the PBOC to cut the 7-day reverse repo rate as well as the reserve requirement ratio in the coming months,” said Zhiwei Zhang, president and chief economist at Pinpoint Asset Management. The briefing will give regulators a chance to “shed light on their policy stance,” he added.

Others were more willing to cut to the chase: according to Evercore ISI’s Neo Wang, PBOC Governor Pan Gongsheng’s planned presence at a rare joint briefing by top financial regulators scheduled for Tuesday makes a cut to reserve requirement ratio for financial institutions look likely. Pan may personally announce the RRR reduction, just like he did at a Jan. 24 press conference, two weeks ahead of time, when authorities tried to halt a $6 trillion stock-market rout. Wang said that the medium-term lending facility maturity wall before year-end also justifies a RRR reduction, and added that the presser is also valuable for any hint at the likelihood of future loan prime rate cuts.

That event kicks off at 9 a.m. — 20 minutes before the PBOC’s daily announcement on its short-term policy loans and their costs, in contrast to more typical 10 a.m. start times.

While the Fed’s bigger-than-expected half-percentage point slash has given central banks across Asia more room to move, not all are immediately following suit. Indonesia’s central bank unexpectedly reduced its main rate last week, but the Bank of Australia is set to hold on Tuesday, echoing last week’s decision by Japan’s monetary authority which is on a hiking path.

Unfortunately, even another RRR cut is unlikely to achieve much: China’s string of rate cuts has done nothing to stimulate an economy that most recently expanded at the slowest pace in five quarters, and to contain a years-long real estate crisis that’s wiped out an estimated $18 trillion in wealth from households has crushed appetite for spending and pushed China into its longest streak of deflation since 1999.

That means real interest rates — which are adjusted for changes in prices — have stayed elevated, weakening the impact of any moderate easing. A plunge in revenue from land sales has also held back fiscal spending, leaving indebted local governments struggling to pay their bills and with little bandwidth to invest in growth-boosting projects.

Now, the focus is on whether China’s fourth-quarter growth can get “remotely close” to the annual target, said Ken Wong, Asia equity portfolio specialist at Eastspring Investments, adding that a 4.8% expansion looked most likely for 2024. “Monetary policy could help,” he said, “but ultimately getting the consumer to spend, and building up consumer confidence, is going to be key to China.”

Economists in a Bloomberg poll pinpointed enforcement of the housing rescue package China unveiled in May as the single most-impactful way officials can give the economy a kick. So far, uptake has been weak with only 29 of some 200 cities heeding the call to absorb a housing glut.

“It is also needed for the PBOC to guide lower the interest rates on existing mortgages,” said Credit Agricole Chief China Economist Xiaojia Zhi, responding to the Monday cut. Regulators are also working on a proposal that would allow mega cities such as Shanghai and Beijing to relax restrictions for non-local buyers, Bloomberg News previously reported.

The PBOC’s decision to lower the 14-day rate to 1.85% from 1.95% Monday came ahead of the week-long nationwide break that begins Oct 1. The central bank typically offers fortnight-long loans ahead of extended breaks, previously doing so in February ahead of the week-long Lunar New Year break. The last time officials cut the RRR came on the cusp of the Lunar New Year holiday, as they looked to smooth liquidity.

“A bigger package is needed” than Monday’s 10-basis-point trim, said ANZ Chief Greater China Economist Raymond Yeung. “Other policy measures in the tool box such as RRR cut, MLF cut and mortgage rate cut will likely be announced.”

Tyler Durden

Mon, 09/23/2024 – 13:05

via ZeroHedge News https://ift.tt/MQL5mW8 Tyler Durden