Goldman Commodity Traders: Gold Buying On Our Desk Has Been Relentless, And Silver Is Starting To Move Too

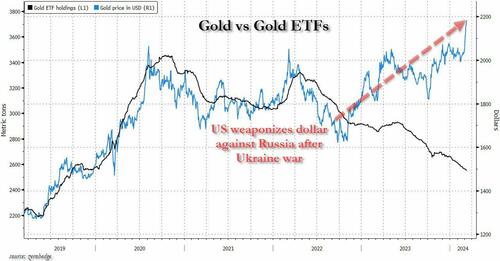

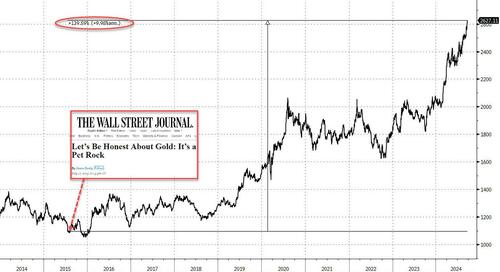

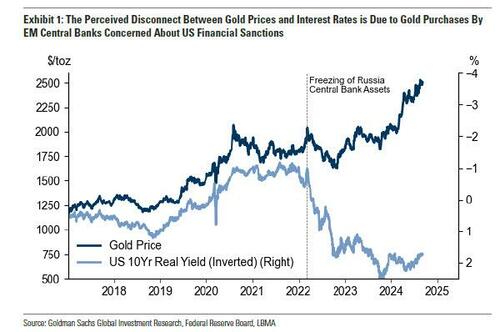

Something remarkable happened to the price of gold back in early 2022 around the time of the Ukraine war: having previously tracked gold ETF inflows to the tick, the price of gold suddenly disconnected and exploded higher even as “paper gold” as some call it, slumped. We showed this for the first time back in April with the following chart which showed the clear decoupling between paper and physical gold in 2022.

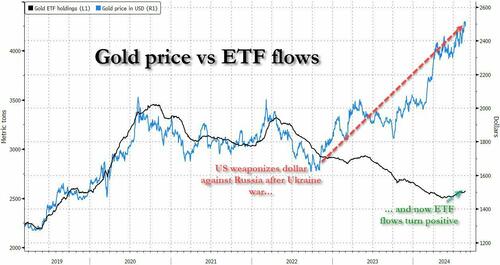

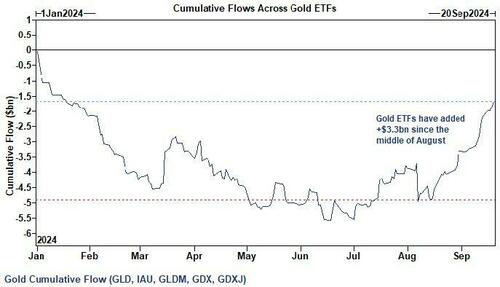

A few months later, and two years after gold ETF holdings continued to drop even as the price of gold rose, it finally happened: attempts at brute gold price manipulation via shifts in ETF holdings finally ended, and with gold at all time highs, ETF flows finally turned positive, a move which we noted would send gold surging even higher (it did).

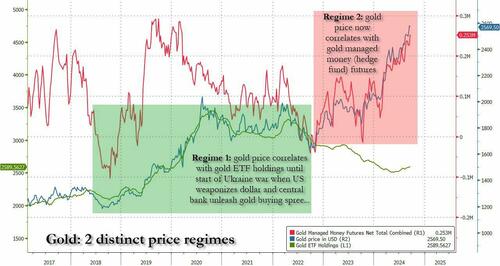

Which brings us to this weekend, and yet another remarkable observation: while gold did correlate very closely with ETF holdings in the years prior to the Ukraine war (regime 1), since then gold has completely lost all correlation with ETF holdings, and instead has been correlating tightly with another data series: Managed Money (i.e., hedge fund) net futures (regime 2).

Of course, it’s not really just hedge fund buying: as we first explained back in 2022, central bank – mostly Chinese central bank – buying was the biggest driver behind gold’s (physical) decoupling with paper holdings and prices (ETFs). But while many central banks keep their purchases hidden from the public and disclose only what they want to disclose, especially in the case of the PBOC, here hedge funds – perhaps due to their ability to collect and trade on “non-public” central bank information – have become the barometer and real-time indicator of central bank purchasing. As such, spot gold prices are now directly correlating with net gold managed futures (Bloomberg ticker CFCDUMMN), as can be seen on the chart above.

But where things get interesting is that even ETF flows are now turning positive, and when combined with continued central bank buying, combined with record Indian gold imports, combined with unprecedented demand for physical in the US, no wonder that gold is hitting new all time highs day after day.

But that’s just the beginning, another reason why gold is set to soar is the Fed’s recent “recalibration”, whereby Powell launched the easing cycle with a jumbo rate cut which gold clearly thought was unnecessary, hence sending gold surging. This is how Rabobank’s Benjamin Picton put it this morning:

Gold prices traded at fresh all-time highs on Friday, closing well above the $2600/oz barrier. The rally in gold seems unstoppable at this point and resets on the all-time-high are becoming a frequent occurrence. This perhaps comes as no surprise given that the Fed wrong-footed many economists to start the easing cycle with a supersized rate cut even as growth has remained strong, inflation above target and the Federal deficit at eyewatering levels.

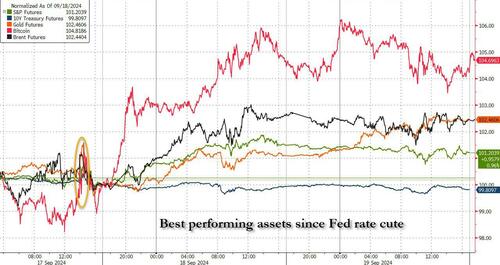

What was odd about the surge in gold, which has been the second best performing assets with just Bitcoin outperforming since last week’s rate cut…

… is that gold jumped even as Treasuries sank. As Picton put it, “usually we would expect a zero-yield asset that some disparagingly refer to as a “pet rock” to perform poorly when market yields are rising. Equity markets responded to the lift in long-end yields by closing the session flat in the case of the ‘money today’ Dow Jones, and down by 1/3rd of a percentage point in the case of the ‘money tomorrow’ (we hope!) NASDAQ.”

“So why was gold insensitive to higher yields while equities were not”, the Rabobank strategist asked rhetorically? His answer…

Perhaps markets simply picked up on Christine Lagarde’s comments in Washington about the parallels between the 2020s and the 1920s? Particularly the bit where she cautioned that adherence to the gold standard in the 1920s induced deflation (true) and contributed to the rise of economic nationalism.

Lagarde’s point is that deflation is worse than the alternative of inflation; so clearly it makes sense to get long “pet rock” while the world’s second most powerful central banker is openly hinting that she views the erosion of your salary and savings as the lesser of two evils. And speaking of pet rock, it is up 140% since it was dubbed that by the WSJ’s Jason Zweig in 2015.

But fundamentals aside, a far more proximal reason to turn bullish on gold has emerged, and it has to do with what we said up top: over the past 2 years, gold ETF holdings had declined, even as the price of gold rose. Well, not any more.

As Goldman’s ETF desk wrote in its weekly rundown report (full report available to pro subs) “the desk has been fielding increased demand for spot gold exposure via ETFs like GLD, GLDM, and IAU, and gold miners exposure via GDX” and as a result, the Goldman desk has acted as a better buyer across the gold complex, which aligns with broader market sentiment – both GLD & IAU haven’t witnessed an outflow in nearly a month. Since the middle of August, +$3.3bn has been added to Gold ETFs. In other words, it’s not just central banks and hedge funds that are ravenously buying gold: the biggest driver of gold upside in the decade prior to the Ukraine war, ETFs, are about to join the fray too!

And then there is silver.

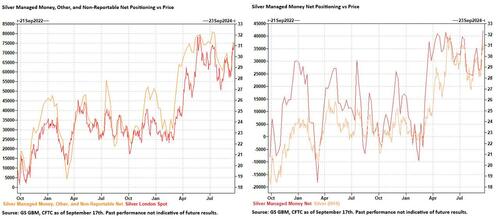

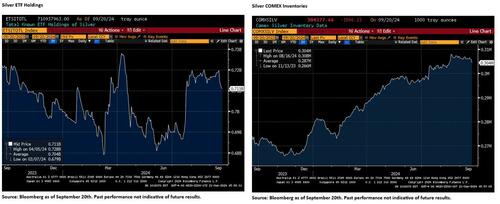

According to Goldman Trader Robert Quinn, while gold ETFs are finally rising, silver managed money longs (which recall have been the big driver in gold prices in the past two years) are soaring.

As Quinn observes, prior to the September Federal Reserve meeting, “speculative positioning in Silver futures surged, and Managed Money dominated. With Producers reiterating a tighter physical balance, lower US real rates and the Dollar served as incremental catalysts. After the Fed delivered a 50bps cut, silver price extended higher however flow indicators were more mixed.” Here are some more observations from the Goldman trader (full note available here):

- Prior to the September Federal Reserve meeting, speculative positioning in Silver futures surged. Per Commitment of Traders, combined Managed Money, Other, and Non-Reportable net length jumped $2.6bn from September 10th – 17th as price gained 8%. For context, the increase marked the 2nd largest over the past 5 years. New longs were the sole driver.

- Managed Money dominated. Managed Money purchased $2.3bn. Since late 2019, Managed Money Silver buying exceeded $2bn in only 3 other instances.

- With producers reiterating a tighter physical balance, lower US real rates and the Dollar served as incremental catalysts. In a presentation, Fresnillo highlighted strong end-user demand due to 5G, solar, automotive, and nanotechnology. In addition, US 5 year real rates decreased 8bps and the Dollar Index lost -0.7%, sparking investor appetite.

- After the Fed delivered, Silver price extended higher. During September 17th – 20th, Silver rose 1.7%.

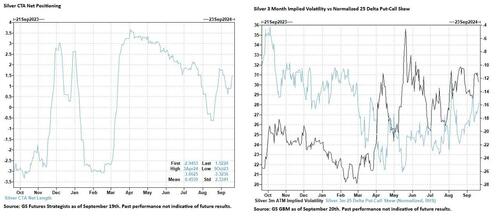

- However flows were more mixed. GS Futures Strategists’ CTA model exhibited long augmentation. That said, ETF Holders continued to sell into strength, similar to what they have been doing with gold until they finally capitulated in recent months. This, too, won’t last. Moreover, 3 month implied volatility cheapened while normalized 25 delta put-call skew richened. Call holders potentially booked profits.

- That said, the term structure has yet to reflect a stressed system. Throughout the aforementioned price strength, December-March Silver actually declined. This seemed consistent with several indicators. First, Producer, Processor, Merchant, and User shorts resided below average on September 17th. Secondly, COMEX inventories only recently retraced from a 1 year peak. Thus despite Fresnillo’s rhetoric, physical participants possess capacity to facilitate more speculative longs.

Of course, just like with the gold meltup, there is only so much physical that sellers and shorts can unload, lowering the price, before silver too explodes higher, and since its convexity is much greater than that of gold, it wouldn’t be surprising to see silver outperform gold substantially in the coming year.

Finally, those curious what Goldman’s commodity research desk thinks, here is a link to the team’s latest note “Fed Support to Gold Prices; The Rates Relationship Isn’t Broken” in which they make two points which ZH readers have known for a long time: “first common argument against Fed support to gold prices is that the traditional relationship between interest rates and gold prices would have broken down, as suggested by the divergence in their levels since 2022…

… the perceived disconnect between gold prices and interest rates is actually due to increased gold purchases by EM central banks concerned about US financial sanctions and rising US debt. This surge in central bank demand has elevated gold prices and reset the relationship between gold prices and absolute interest rate levels.”

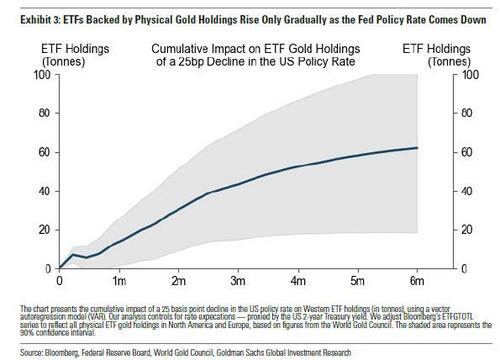

They then go on with the second common argument against gold which is that “the gold market would already have fully priced in the Fed interest rate cutting cycle. While the bond market has priced in more interest rate cuts than our economists’ baseline forecast (for three consecutive cuts in 2024, and an eventual terminal rate of 3.25-35%), we find that ETFs backed by physical gold holdings rise only gradually as the Fed policy rate comes down. Specifically, we find that the boost to ETF holdings from a policy rate cut rises gradually for about six months using a statistical model, which also controls for policy rate expectations proxied with the US 2-year Treasury rate.1 Increases in ETF holdings matter for gold prices.”

And here is a stunning admission from Goldman gold analyst Lina Thomas, which until a few years ago could be heard only among the “tinfoil” gold bug blogosphere: “gold ETFs are fully backed by “allocated” physical gold, rising ETF holdings reduce the physical supply of gold available to the market (in contrast to paper gold, which is typically not backed by physical gold).”

Translation: the surge in gold ETF buying is only getting started.

So, in light of the above, Goldman’s commodity team reiterates its “long gold trading recommendation and our price target of $2,700/toz by early 2025” for three reasons:

- We believe that the tripling in central bank purchases since mid-2022 on fears about US financial sanctions and US sovereign debt is structural and will continue, reported or unreported.

- Fed rate cuts are poised to bring Western capital back into gold ETFs, a component largely absent of the sharp gold rally observed in the last two years. Since ETF holdings only increase gradually as the Fed cuts, this upside is not yet fully priced in.

- Gold offers significant hedging value to portfolios against geopolitical shocks including tariffs, Fed subordination risk, debt fears, and recessionary risks. Our analysis suggests an additional upside of 15% in gold prices under a hypothetical rise in financial sanctions equal to the rise seen since 2021 and a similar upside if US CDS spreads widen by 1 standard deviation (13bps) amid rising debt concerns.

Add to this the technicals and flow issues described above and the move in gold is just getting started.

More in the full notes available to pro subs here, here and here.

Tyler Durden

Mon, 09/23/2024 – 16:40

via ZeroHedge News https://ift.tt/VwYrNy0 Tyler Durden