Any Iron Ore Rally Is “To Be Faded”; Goldman Warns

China’s PBOC rolled out the monetary cannons to prop up the world’s second-largest economy, unveiled in an exceptionally rare overnight briefing by the central bank chief alongside top securities and financial regulators. The key takeaway: The breadth of action only suggests Beijing is extremely worried about what’s coming down the pipe.

Notably, the PBOC’s stimulus package follows about a week after the Fed’s emergency-like 50bps interest rate cut. Despite what seems like coordinated global monetary easing, Goldman analysts remain unconvinced that this coordinated effort will stabilize specific commodity prices, such as iron ore.

On Tuesday, Goldman’s Thomas Evans told clients to “fade iron ore rallies”…

“Any rally is to be faded. The only concern is potential short covering ahead of the long holiday in China given how short the market is at the moment. In the short term, market can be very choppy due to crowded short positioning and policy shock to the upside. In the long term, steel overcapacity and growing supply in iron ore are the two biggest headwinds to ferrous supply chain, which can’t be fixed any time soon. The indicator to watch is whether, when and how much iron ore production would be cut from junior miners for market to rebalance,” Evans said.

Evans noted, “Physical traders continue to buy fixed-price cargoes on the seaborne market below $100. CTA hold off from adding more shorts but seem to be rolling their shorts along the curve. Consumer interest seem to remain around 90$/mt along the curve. In options, both topside and downside gamma in prompt months are well bid upon higher realized volatility, in spite of the upcoming Golden Week decay.”

The analyst said the market cannot rebalance “until steel capacities are shut down and junior iron ore miners cut production.”

He provided an overview of the iron ore market:

Pre-holiday restocking is 60-70% done. Steel mills buy dips aggressively to replenish feedstock inventory for the Golden Week. The physical market liquidity sees the best week in Sep.

Traders hold off from offering down due to high purchase cost. Portside PBF basis (phys/fin spread) widens to a shy of +10rmb/mt from minus 5rmb/mt a month ago, implying phys holds up more firmly than paper on the way down.

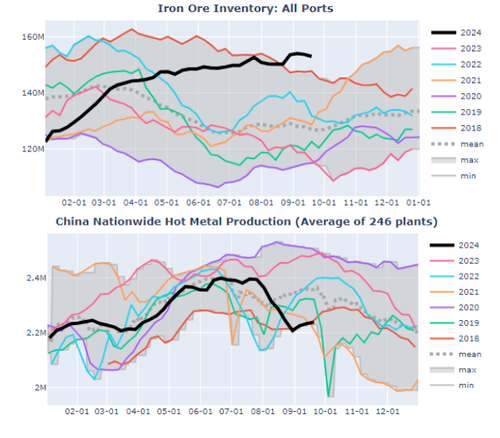

IO inventory extends the draw by nearly 2mnt WoW on back of active restocking from onshore mills. Pig iron output picks up marginally on steel margin expansion to positive territory. Nothing to complain about the phys market. It is all about the excessive bearish sentiment and outlook that leads to the relentless sell off.

IO shipment from majors keeps the strong momentum. It is widely expected that IO inventory on port would build to above 160mnt+ by end of the year. We need to see a lower IO price for longer to trigger production cut from mining juniors to rebalance the market.

Seaborne premium market is faced with strong headwinds. PBF/NHGF/MACF all trade at discount of -$0.7/-2.9/-4.9/mt respectively due to abundant supply on water, port inventory overhang and negative import arb. It is said that Northern ports in China have run out of space for IO storage, leading to 1-week demurrage VS normally 1-2 days . Therefore, port authority is forcing traders with high inventory to move cargoes out of the ports ASAP.

The RB play of long everything (base/precious) VS short ferrous come into the spotlight again, which results in sharp underperformance in IO VS other industrial commodities. Short IO is mostly favored by both macro and discretionary fund managers to express bearish views in China’s distressed property and the loose IO SND.

Iron ore inventories remain well above average for this time of year, plus hot metal production in China is still seasonally in range. All of this combined, plus soft demand is a recipe for a continued bearish outlook.

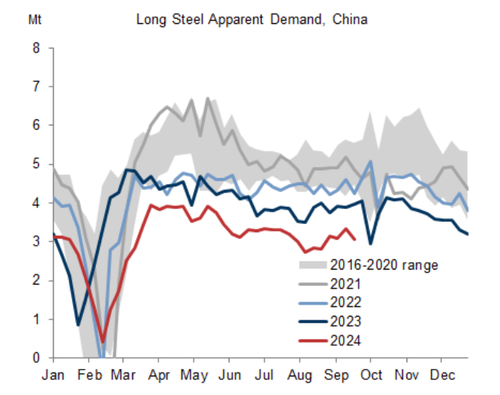

Steel demand…

The big takeaway is that junior iron ore miners need to cut production to rebalance steel capacities. Until that happens, iron ore rallies should be sold, as per Goldman. Last week, the bank lowered its price forecast for the industrial metal.

Tyler Durden

Tue, 09/24/2024 – 15:30

via ZeroHedge News https://ift.tt/hXbZTqE Tyler Durden