Mediocre 5Y Auction Prices On The Screws, Lowest Yield Since March 2023

One day after a solid 2Y auction stopped “on the screws”, moments ago the $70 billion 5Y auction did it again, when it also closed on the screws, or right where the When Issued said it should, prompting questions whether we have ever had two consecutive “screw” auctions in a row.

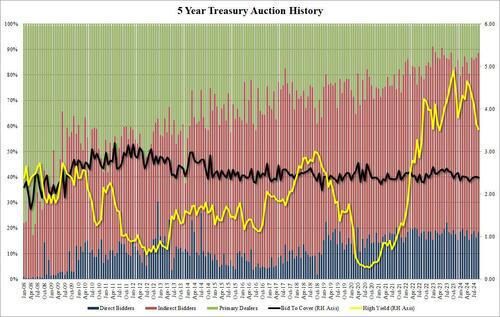

Today’s sale of $70 billion in 5 year paper priced at a high yield of 3.519%, right on top of the When Issued, and following 4 tails in the previous 5 auctions. This was also the lowest yield for the 5Y tenor since April 2023.

The bid to cover dropped to 2.38 from 2.41, and was also right in line with the six-auction average or 2.38; in fact as shown in the chart below 2.40 is where the average Bid to Cover has stopped on pretty much all auctions in the past decade.

The internals were also average, with Indirects awarded 70.31%, down from 70.54% in August but above the 68.0% recent average.

Overall, this was mediocre auction, one which helped push yields to session highs with the 10Y back up to 3.78% at last check.

Tyler Durden

Wed, 09/25/2024 – 13:23

via ZeroHedge News https://ift.tt/ewSuW3T Tyler Durden