Trump Criticizes Zelensky, Reveals Private Message, Just Before Friday Meeting

GOP presidential nominee Donald Trump and President Volodymyr Zelensky are expected to meet at Trump Tower in New York on Friday amid Republican anger accusing him of stumping for Kamala Harris on the American taxpayer’s dime.

The meeting also comes two days after former President Trump blasted Zelensky for not reaching a peace deal with Russia. He also trashed Zelensky as the “greatest salesman on earth” just as Biden authorized $8 billion more in defense aid for Ukraine.

“Those cities are gone. They’re gone, and we continue to give billions of dollars to a man who refused to make a deal, Zelensky. There was no deal that he could have made that wouldn’t have been better than the situation you have right now,” Trump had told a campaign rally in North Carolina.

Following this, the former president charged Zelensky with making “little, nasty aspersions” toward him. “It’s a shame what’s happening in Ukraine, so many deaths, so much destruction. It’s a horrible thing,” Trump said.

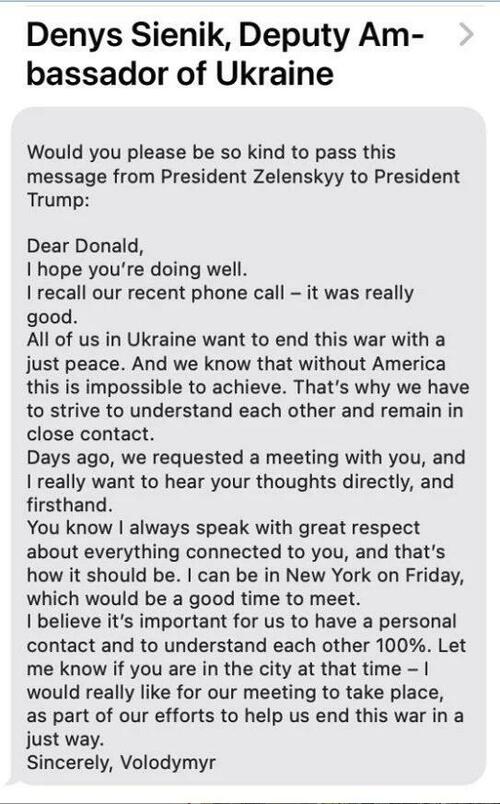

Earlier in the week, and after Zelensky publicly criticized J.D. Vance in a New Yorker interview, the Trump campaign had said a Trump-Zelensky meeting was highly unlikely. But by late Thursday that changed, and Trump revealed a personal and somewhat desperate sounding message that Zelensky sent him, urgently requesting a meeting. Trump posted the message in full to his Truth Social account.

The message emphasized that Zelensky always speaks “with great respect” about Trump and that the two “have to strive to understand each other and remain in close contact.” It was passed to Trump by Denys Sienik, the deputy chief of mission for Ukraine’s US embassy.

Below is the message from Zelensky to Trump as posted on Truth Social:

“All of us in Ukraine want to end this war with a just peace,” Zelensky wrote. And we know that without America this is impossible to achieve. That’s why we have to strive to understand each other and remain in close contact.”

“Days ago, we requested a meeting with you, and I really want to hear your thoughts directly, and firsthand,” he continued. “You know I always speak with great respect about everything connected to you, and that’s how it should .”

Yesterday’s Zelensky visit to the White House resulted in ongoing criticism from conservative circles saying Zelensky is basically acting as a prop for the Harris campaign, in order for her to be seen looking ‘presidential’. But so far the White House has not granted the main request Zelensky is seeking: the lifting of all restrictions regarding using long-range West-supplied missiles to strike Russia.

Zelensky will brief Kamala on his “success” in the invasion of Russia in Kursk and share his ambitions.

WTF? pic.twitter.com/tSVRzReIT0

— Russian Market (@runews) September 26, 2024

Trump has said of the Friday late morning meeting with Zelensky, “I look forward to seeing him.” He described, “We’ll see — I do believe I disagree with him — well, he doesn’t know me. I disagree, but I will say this: I believe I will be able to make a deal between President Putin and President Zelensky quite quickly.”

Zelensky has been pushing his ‘victory plan’ in Washington, and is expected to try and convince Trump to stay the course of strong Ukraine support if he takes the White House again after the November election.

Tyler Durden

Fri, 09/27/2024 – 09:10

via ZeroHedge News https://ift.tt/Cr8zpX7 Tyler Durden