“Immigration Does Not Work, Not Even Economically” – German Govt Needs €10BN More In Welfare Payments Than Initial Forecasts

The German federal government has “miscalculated” billions in welfare payments, known as citizens’ money, with their initial estimate of €36 billion far short of the €46 billion reportedly needed.

In documents obtained by Bild newspaper, the German labor ministry assumes an average of 2.9 million people are in need of welfare parents in the documents for the “2025 budget,” dated from August 2024. However, this document indicates that the expenditure on standard rates and accommodation costs is expected to total €45.6 billion, which is a far cry from the €36 billion set in the 2025 citizen’s allowance budget.

The huge discrepancy has sparked outrage, but Hubertus Heil’s (SPD) labor ministry told Bild that the figures published “are not comprehensible and are methodologically based on several false assumptions… For example, a significant portion of the costs of accommodation are to be covered by the municipalities and are therefore not relevant to the federal budget in the amount stated.”

However, Heil’s denial did not specify how far off Bild’s figures were, and notably, Bild was citing internal documents from the ministry itself.

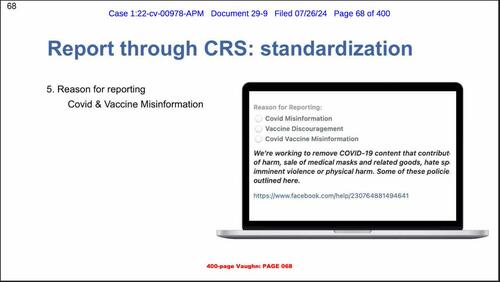

The huge sums paid out due to citizens’ money has become a politically explosive subject, first due to the enormous costs it is placing on the German taxpayers, second due to the fact that the German economy is facing a worker shortage, and third due to the huge number of foreigners taking advantage of this welfare system, as half of all recipients are foreigners and many of the others who are German citizens also have a migration background.

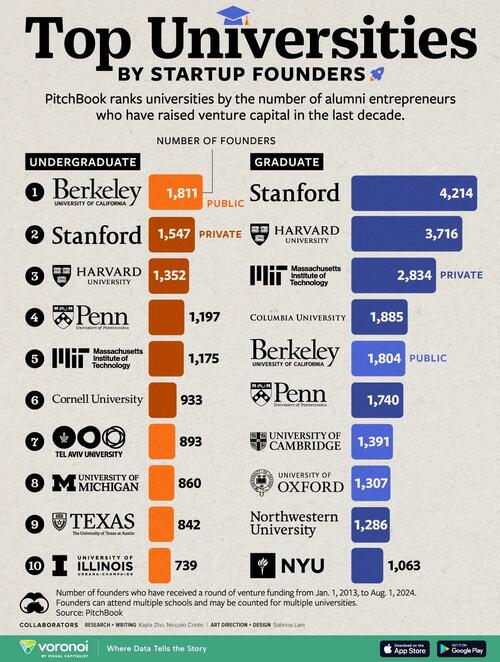

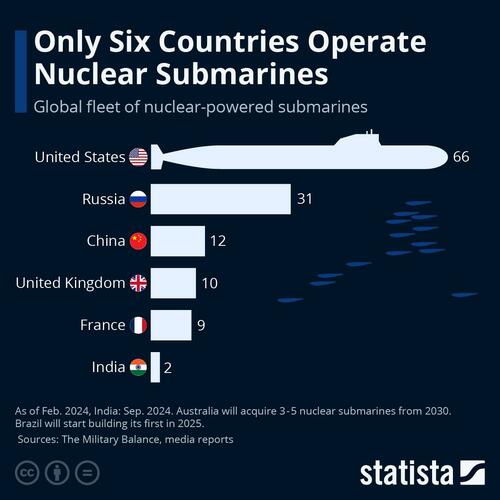

“Immigration doesn’t work, not even economically. And if one were to differentiate between Germans based on their migration background, the picture would be even more devastating,” MEP Maximilian Krah, who is a member of the AfD but remains unaffiliated in the European Parliament, wrote on X. He shared a graph showing how few Germans are actually receiving welfare payments.

Einwanderung funktioniert nicht, auch nicht ökonomisch. Und würde man bei den Deutschen noch nach Migrationshintergrund differenzieren, wäre das Bild noch verheerender. pic.twitter.com/2NF3bP22Mf

— Dr. Maximilian Krah MdEP (@KrahMax) September 25, 2024

However, he is not the only one calling into question Heil’s numbers. Most recently, the Federal Audit Office also cast doubt on Heil’s budget, stating that the labor ministry’s figures could only happen as budgeted if “600,000 people entitled to benefits would stop receiving them altogether” in 2025. These experts complained at the time that this was “not very realistic.”

Other parties are also attacking Heil. CDU’s group vice-chairman Jens Spahn said the matter “bordered on deliberate deception.”

Meanwhile, budget spokesman for the CDU/CSU parliamentary group, Christian Haase, said: “Heil is deliberately budgeting for false figures in order to conceal the problems with the citizens’ allowance,”

“This is a scandal,” he added.

CDU general secretary Carsten Linnemann said the ruling left-liberal government “continues to lie to itself, the budget will blow up in its face.”

Even the Free Democrats (FDP), who belong to the ruling government, slammed the budget figures. FDP politician Torsten Herbst said he expected “the labor minister to present realistic figures in his draft budget.”

However, some of the harshest statements came from the AfD, which wrote on social media: “Labor Minister Hubertus Heil (SPD) suddenly presents a new budget gap of almost €10 billion in the citizen’s allowance. According to the minister’s documents, his department expects citizen’s allowance costs of almost €46 billion for 2025, although only €36 billion were officially reported.”

The party is now recommending mass deportations totaling 1.3 million people to plug the budget hole, which it claims would bring the welfare payments back in line with the original sum budgeted.

“It must be remembered that around half of the citizen’s allowance recipients are foreign citizens! Simply by deporting the approximately one million Syrians (as of the end of 2023) who no longer have a reason to flee, the citizen’s allowance costs could be reduced enormously. The same applies to the approximately 300,000 foreigners who are required to leave the country (as of mid-2024).

“The Federal Audit Office had already cast doubt on the Minister of Labor’s sugar-coated figures weeks ago, stating that the figures would only be correct if the number of citizens’ allowance recipients fell by around 600,000 in 2025. Either Heil really miscalculated in an amateurish way or – which is much more likely – he deliberately wants to mislead the population. In both cases, such a Minister of Labor is completely unacceptable and underlines that the SPD does not care about our country.”

Tyler Durden

Fri, 09/27/2024 – 02:00

via ZeroHedge News https://ift.tt/xvzKy0q Tyler Durden