Authored by Robert Burrowes via Global research,

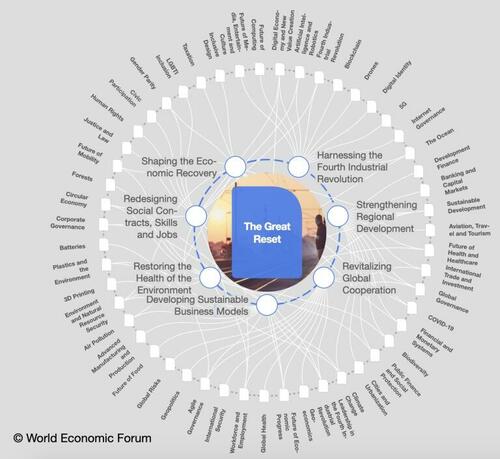

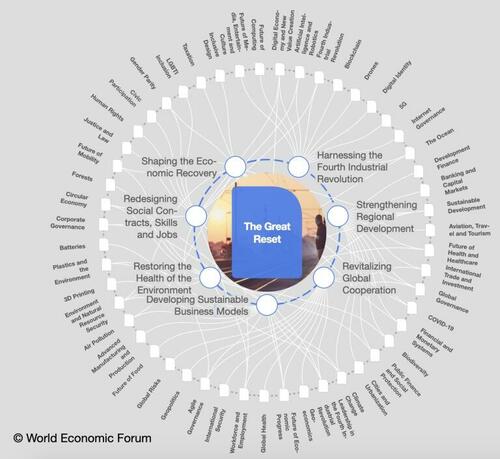

If you spend just a few minutes checking out ‘The Great Reset’ website of the World Economic Forum, starting at the page ‘Now is the time for a “great reset”’ – which includes a copy of what it calls ‘The Great Reset Transformation Map’ – and spend two minutes watching the World Economic Forum’s video ‘8 Predictions For The World In 2030’, you will quickly recognize that the WEF intends imposing profound changes to about 200 areas of human life by 2030.

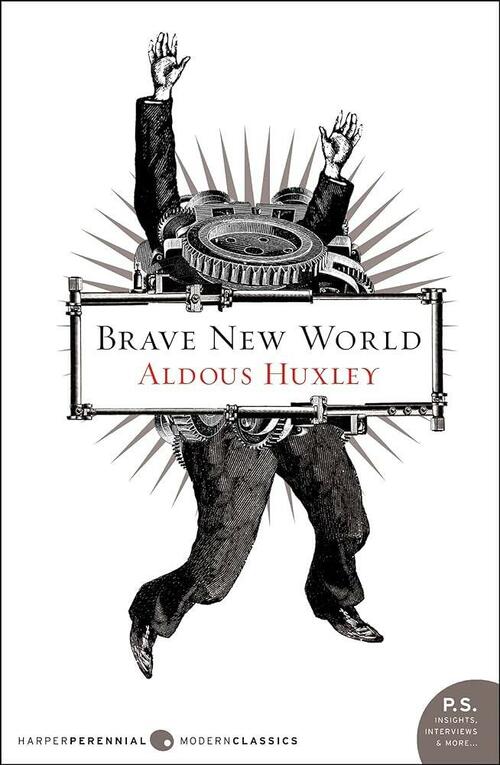

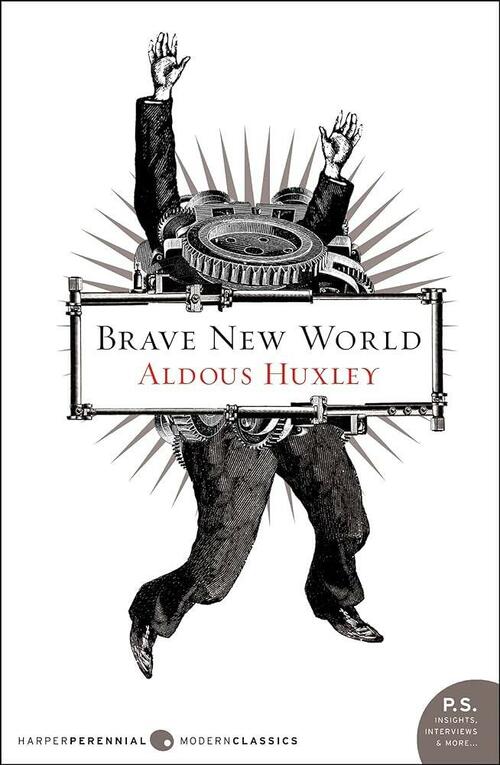

If you also spend just a few hours reading Aldous Huxley’s Brave New World and George Orwell’s Nineteen Eighty-Four – you will soon discover that the Elite program currently being imposed on us is far more onerous than anything presented in the dystopian novels written by Huxley and Orwell. Technology, after all, has advanced dramatically in ways that neither Huxley nor Orwell anticipated.

You will need to do a little further investigation, however, to discover that a range of tools – including genocides and wars, famines in some locations and serious economic dislocation in others, the Covid-19 ‘death shot’, 5G, geoengineering, Artificial Intelligence and synthetic biology – is being used by Big Brother to kill off a substantial proportion of the human population.

And, while hidden in plain sight, successively deploying a wide range of technocratic tools that are progressively imprisoning those left ‘alive’ as transhuman slaves.

In broad summary, this is being done by enclosing the Commons ‘forever’ and forcing people off their properties – for a discussion of how this is being achieved using ‘managed retreat’, see the series of articles by Kate Mason starting with ‘Managed Retreat New Zealand: Shhhh….be careful not to let the community know’ – and into a ‘Smart City’ prison.

These Smart City prisons will employ a dense network of 5G towers to facilitate communication and enable total control, where the imprisoned transhuman slaves will be geofenced to confine their movements to within 5 kilometres of where they are imprisoned.

And the detail in the Elite plan tells us exactly how it is being done.

Given that the Elite plan requires all 8 billion humans to submit, one way or another, and it is a lot easier to have people willingly submit to their death or transhuman slavery rather than contend with any resistance, the dystopian future being rolled out is being presented as a combination of necessary (to deal with various threats, including those posed by a non-existent virus and climate disruption), private (to ensure the integrity of your identity), safe and secure (from various online and other threats) to ensure maximum compliance. Of course, an avalanche of propaganda is also being used to obscure the view of what is really taking place.

Thus, initially, each surviving individual will have a Digital Identity, which will have attached to it a social credit score (determined by such factors as your personal, educational, employment and legal records and your internet search history to measure your degree of submission to Elite programs).

Traditional national currencies, which put money in your hands to spend or save as you liked, are being replaced by Central Bank Digital Currencies (CBDCs). Your allotment of this ‘currency’ will be determined by your social credit score, attached to your Digital Identity and programmed so that it can only be spent within your 5km radius and only at approved locations, in approved amounts on approved products or services.

In addition, a dense network of facial recognition cameras (which take a three-dimensional image of your face thus removing any confusion between you and your identical twin, should you have one) and license plate readers will ensure that every movement (including if in a driverless car) you make is tracked and monitored by the Artificial Intelligence program controlling your sector. And the network of loud hailers (installed on 5G towers, street lights and elsewhere) will facilitate the sharing of routine directives as part of the means by which approved behaviour is elicited and enforced.

But ultimately, as Elites have known for millennia, it is food that is the ultimate weapon of control.

Our Identity as Homo Sapiens Threatened by Synthetic Biology, Humans Fiddle While Humanity Burns, Will It be Near-Term Death or Transhuman Slavery?

As former US Secretary of State articulated in 1973: ‘Who controls the food supply controls the people’.

And, as Professor George Kent eloquently explained in 2008, it is in the interest of the Elite that people are hungry. See ‘The Benefits of World Hunger’.

So any critical analysis of what is being imposed on humanity must take careful account of how food – and the farming of it – is being utterly transformed.

In essence, the Elite plan is to feed us genetically mutilated, synthesized and poisoned trash and insects, profit from our ill-health, force small farmers off their land, undermine rural communities, and utterly transform the ancient practice of farming into a corporate, technocratic operation.

If you want some of the detail, there are excellent sources that highlight the importance of buying organic/biodynamic food while organizing to grow your own, and making sure that your local trading community can defend your food sources against the advancing technocracy.

See ‘Sickening Profits: The Global Food System’s Poisoned Food and Toxic Wealth’ and

‘The Future of Food’ and watch

‘The Synthetic Transformation of our Food Systems – Focus on Australia’ which is summarized here:

‘The True Extent of Biotechnology Experimentation – It’s Happening Now’.

In short, what the few examples above make clear is that we face a near-term future in which the control mechanisms will be all-pervasive.

Of course, you might still try to act outside the parameters of your social credit score – spend more money, spend it on something not approved in your case, grow your own food, travel outside your zone… – but the computer programs run by artificial intelligence will ensure that this does not happen by deactivating your ‘permission’ or, if this does not work instantly or other action is required, despatch a transhuman or technocratic police officer to intervene. If you still show signs of resisting the transhuman police officer, robot or drone sent to intercept you, it will, for example, simply fire an electromagnetic weapon to make you vomit until you comply.

See ‘Policing the Elite’s Technocracy: How Do We Resist This Effectively?’

For a wider, more detailed overview of some key technocratic, economic, political and other threats, see

‘We Are Being Smashed Politically, Economically, Medically and Technologically by the Elite’s “Great Reset”: Why? How Do We Fight Back Effectively?’,

and for discussions of threats that are less well known, such as those posed by geoengineering, synthetic biology and artificial intelligence, see

Geoengineered Transhumanism: How the Environment Has Been Weaponized by Chemicals, Electromagnetism & Nanotechnology for Synthetic Biology and watch

‘AI Exterminating Humans Through Synthetic Biology’.

Of course, while the program has been planned by the Elite and designed by its agents, it is not actually being implemented by the Elite or its agents. The entire ‘Great Reset’ program is being implemented by people like you and me who take orders without pondering the significance of their particular order and how it fits into the wider Elite program, just like the person putting together a bullet in a factory doesn’t ponder who will be killed by it.

It is less frightening, as the residents of the Brave New World know, to follow orders without thought or reference to conscience. It is less frightening to not ask questions and just ‘go along’. In essence, it is less frightening ‘not to know’.

And that is why these two dystopian novels end the way they do: Huxley and Orwell were astute observers of their fellow humans and knew how easily they submit. After all, being submissive is far less frightening than resisting. But even if we do somehow ‘know’, we are good at concealing our cowardice behind our favourite delusion, ‘taught’ to you in early childhood: ‘I am doing what I am told and that is the right thing to do.’ Which, in essence, is why so many people got repeatedly vaxxed and even the bulk of those who didn’t prefer to complain rather than act.

See ‘The Elite’s 5,000-Year War on Your Mind is Climaxing. Can We Defeat it? (Parts 1 & 2)’.

Anyway, with changes being made to 200 areas of human life, the Elite has not left much to chance or even many gaps through which one might sneak. Which means that effective resistance now is the only realistic possibility for averting life under Big Brother or Mustapha Mond and his fellow world controllers.

Of course, as the books illustrate superbly, there is no point seeking redress by asking Big Brother or Mustapha Mond. Similarly, if we seek redress through the Elite or its agents, we will not succeed.

See ‘The Elite Coup to Kill or Enslave Us: Why Can’t Governments, Legal Actions and Protests Stop Them?’

And because the Elite program is so complex and sophisticated, if our resistance is to be effective it must be strategic. That is, we must focus on directly resisting the key foundational components of the Elite program ourselves. Otherwise, our resistance will simply be absorbed and dissipated to come to nothing.

Resisting the Brave New World of the Technocracy

The intention of the Elite’s advancing technocracy is to kill off vast numbers of humans and transhumanize and enslave the rest.

And given the sophistication and savagery of the program, defeating it will require commitment, persistence, courage and enormous strategically-focused effort by a large number of people.

‘We Are Human We Are Free’ is strategically-designed to defeat the Elite program and will succeed if enough people participate. You can read the 30 strategic goals identifying the critical points of resistance on the website with one-page flyers, identifying the minimum areas for action, available in 23 languages.

Conclusion

Aldous Huxley and George Orwell were well placed to perceive trends in society and prescient enough to warn us in novels written many decades ahead of ‘crunch time’. Sadly, humanity failed to take advantage of their warnings.

This means that we must act now if we are to have any chance of averting imposition of the Elite’s technocracy, including destruction of the global economy, even as their genocidal program advances.

Time is running out.