Global stocks are soaring after China pledged fiscal stimulus even as traders raised their bets on interest-rate cuts by major central banks (the two are contradictory but who cares). Futures on the S&P 500 climbed 0.8% as US-listed China stocks soared and Micron surged in premarket trading after the company reported stronger than expected earnings and guided higher. As of 8:00am ET, Nasdaq 100 futs jumped 1.5% and the Stoxx 600 index in Europe headed for a record close on the back of what is just shy of China’s “whatever it takes” moment. Treasury yields and the dollar edged lower while oil tumbled for a second day on a report from the FT (which is now doing Reuters’ price manipulation for it) according to which Saudi Arabia was reported to be weighing increasing output, and factions in Libya reached a deal that opens the way to the return of some crude production. Gold soared more than 1% to new all time highs as it prices in all the massive fiscal and monetary stimulus that are coming.

US-listed Chinese stocks jumped again in premarket trading after China’s top leaders pledged fiscal spending and measures to stabilize the property sector, showing more urgency to boost the economy. Alibaba +6%, Baidu +5%. Memory maker Micron surged 16% after giving surprisingly strong sales and profit forecasts, helped by demand for artificial intelligence gear. Here are some other notable premarket movers:

- Accenture climbs 3% after the IT services company reported its fourth-quarter results and gave a forecast.

- Meta Platforms gains 1.9% with analysts positive on the Facebook parent’s outlook in the wake of its Connect conference, which was seen as showing progress in its AI initiatives.

- New York Community Bancorp rises 3% as Barclays raised its rating to overweight, saying the bank is “well on its way to completing the targeted restructure and recapitalization of the balance sheet.”

- Sonos slips 6% as Morgan Stanley double downgraded the stock to underweight, saying that the speaker company’s app redesign will impact the top and bottom line.

- Southwest Airlines gains 3% after authorizing a new $2.5 billion stock buyback program and providing detailed plans to revamp customer-facing policies.

- Starbucks rises 2% following an upgrade to outperform from Bernstein, which says market optimism since the appointment of a new chief executive officer is fully warranted.

The promises by China’s Politburo, alongside growing expectations that the Fed and ECB will push ahead with more easing, buoyed markets on Thursday. Traders are waiting for a pre-recorded address by Federal Reserve Chair Jerome Powell and jobs data later Thursday, even as GDP is expected to be revised sharply lower.

“The message, over the last 10 days or so, from monetary and fiscal policymakers across the globe, has been clear and undeniable — the policy ‘put’ is well and truly back,” said Michael Brown, a strategist at Pepperstone Group Ltd. “The path of least resistance is likely to continue to lead to the upside, over both the short- and medium-term.”

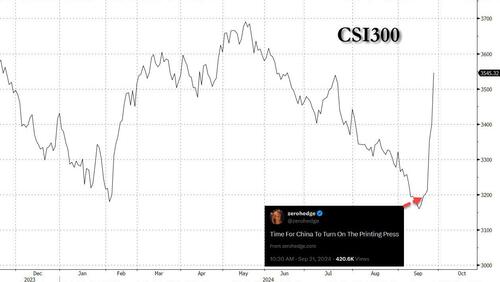

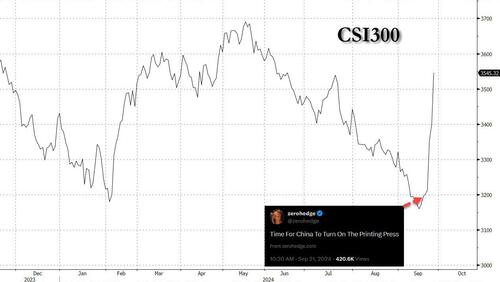

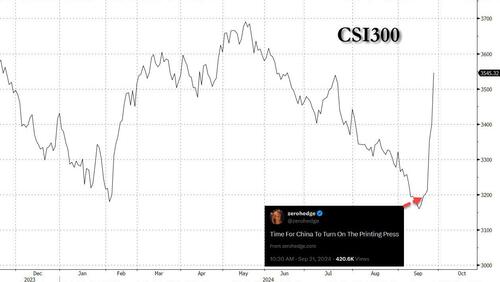

The bid to revive growth by China’s top leaders on Thursday added to a slew of measures from Beijing this week that have supercharged local assets. The CSI 300 Index is headed for its biggest weekly gain in almost a decade. But questions remain over the long-term impact of the measures.

“I wouldn’t be surprised if tomorrow we are going to see a bit of a pullback,” Helen Jewell, chief investment officer at BlackRock Fundamental Equities EMEA, told Bloomberg TV. “This is what is happening in the markets right now — you end up risk on one day, risk off the next day. The Chinese economy is still very fragile.”

Back to the US, where money markets have flipped to favor a half-point cut by the Fed in November, and traders are now pricing almost 39 basis points of reductions after lackluster US consumer data earlier in the week. The US central bank’s preferred price metric and a snapshot of consumer demand will give more clues on the economy’s health on Friday. “The Federal Reserve is more concerned about growth than they let on,” said Vanguard Chief Economist Joe Davis on Bloomberg TV. “Our view is they are going to be more aggressive in the near term.”

Elsewhere, the Swiss National Bank made a 25 basis-point interest rate cut in an effort to contain the strength of the Swiss franc, which has had the strongest rally in nearly a decade.

European stocks soared on the back of China’s rally, tracking sizable gains in Asia after China’s top leaders ramped up urgent efforts to revive growth with pledges to support fiscal spending. The Stoxx 600 rose more than 1%, as hopes of fresh stimulus in China buoyed shares across several sectors, including mining, luxury and automotive. The energy sector is the only significant faller in early Tuesday trading, tracking a fall in oil prices. Here are the biggest movers Thursday:

- China-exposed sectors including European miners, luxury goods makers and automakers lead gains in the Stoxx 600 bourse after Bloomberg reported the country is considering injecting up to 1 trillion yuan ($142 billion) into its biggest state banks

- ASML and other European chip-equipment stocks rally Thursday after US memory-chip maker Micron gave an upbeat forecast for sales and profits, boosted by continued AI infrastructure investment

- Diageo rises as much as 5.5% after the spirits maker voiced confidence that growth will return as consumer confidence improves. Analysts note the firm keeping its guidance intact was unsurprising

- Evotec shares rise as much as 10% as the German pharmaceutical company enters a technology development partnership with Novo Nordisk in cell therapy with Evotec to receive an undisclosed amount in funding

- Pepco Group jumps as much as 6% after the discount retailer confirmed its FY2024 Ebidta target and signaled gradual improvement for like-for-like sales, with analysts seeing a supportive update

- H&M drops as much as 8.6% after the Swedish fast-fashion company reported misses on profitability due to costs and external factors. Jefferies sees “considerable” consensus cuts ahead

- Sodexo drops as much as 14% after Bloomberg reported the company is exploring a potential acquisition of US rival Aramark. A deal would require significant equity and debt, Jefferies warns

- European oil and gas sector stocks fell as much as 3.1%, their steepest decline in a month, as Brent futures tumbled on the prospect of more Saudi and Libyan supply

- Mutares shares fall as much as 28%, the steepest drop on record, after Gotham City Research said it’s short the stock in a critical report about the German investment company

- BASF falls as much as 2.2% after the chemicals firm said ahead of its CMD it would cut its dividend and is considering asset sales to counter higher energy prices and slowing China demand

- Ubisoft falls as much as 20% after the French video-game maker cut its bookings guidance for fiscal 2025. Analysts say these warnings confirmed investor fears around game delays

- Nordic Semiconductor shares slump as much as 18% after giving financial targets ahead of its CMD. The guidance implies cuts to consensus estimates for FY25 revenue growth, Morgan Stanley says.

Earlier in the session, Asian stocks jumped amid renewed enthusiasm in the tech sector and further policy support from China.

The MSCI Asia Pacific Index rose as much as 2.1%, with chipmakers Samsung Electronics and Taiwan Semiconductor Manufacturing Co. among the top contributors to the advance following Micron Technology’s surprisingly strong forecast. Japanese benchmarks gain more than 2% as the yen edged lower. Hong Kong and mainland China shares surged after the nation’s top leaders delivered a forceful pledge to increase fiscal support and stabilize the property sector to revive growth. Consumer shares outperformed after China said it will give one-off cash handouts to people in extreme poverty before a weeklong holiday, while financial stocks were supported by news of a possible capital injection into state banks. “Asian markets are soaking in an ocean of optimism thanks to China’s unusual and all-in determination to gear up momentum into the Golden Week and the year-end,” said Hebe Chen, an analyst at IG Markets Ltd. “The region, having broadly built up the risk-on sentiment following Fed’s rate cut last week, is clearly staging a striking relief rally.”

In FX, the Bloomberg Dollar Spot Index falls 0.2%. The Swiss franc rises 0.2% even as the Swiss National Bank cut borrowing costs by 25 bps and warned of more to come if needed.

In rates, treasuries are richer across the curve with yields lower by around 2bp vs Wednesday’s close, following wider gains in bunds with the German curve bull-steepening. US 10-year yield at around 3.75% is ~4bp richer on the day with bunds in the sector outperforming by around 1bp; curve spreads are little changed. Focal points of US session include jobless claims and 2Q GDP revision, $44 billion 7-year note auction and packed slate of Fed speakers, several at regulators’ annual US Treasury Market Conference. Bunds also rallied as traders boost bets on the ECB cutting interest rates next month. German 10-year yields fall 3bps to 2.15%.

In commodities, oil prices dropped sharply, with WTI down ~2% on the prospect of more Saudi and Libyan crude supplies. Spot gold rises $11, soaring to a new all time high.

Looking at the US economic data calendar includes 2Q final GDP revision, August durable goods orders and weekly jobless claims (8:30am), August pending home sales (10am) and September Kansas City Fed manufacturing activity (11am). Fed speakers scheduled include Collins (9:10am), Bowman (9:15am), Powell (9:20am), Williams (9:25am), Barr and Cook (10:30am) and Kashkari (1pm)

Market Snapshot

- S&P 500 futures up 0.8% to 5,826.25

- STOXX Europe 600 up 1.2% to 525.34

- MXAP up 2.1% to 193.59

- MXAPJ up 2.0% to 609.37

- Nikkei up 2.8% to 38,925.63

- Topix up 2.7% to 2,721.12

- Hang Seng Index up 4.2% to 19,924.58

- Shanghai Composite up 3.6% to 3,000.95

- Sensex up 0.3% to 85,429.48

- Australia S&P/ASX 200 up 1.0% to 8,203.66

- Kospi up 2.9% to 2,671.57

- German 10Y yield little changed at 2.16%

- Euro little changed at $1.1142

- Brent Futures down 2.4% to $71.67/bbl

- Gold spot up 0.5% to $2,669.74

- US Dollar Index little changed at 100.92

Top Overnight News

- US House voted 341-82 to pass a stopgap government funding bill and the US Senate also voted 78-18 to pass the bill that would fund the government until December 20th.

- New York City Mayor Adams was indicted following a federal corruption probe and believes he will be charged by the federal government with crimes but added that if charges are filed, they will be entirely false and based on lies, while he won’t resign if he has to face charges.

- China’s leaders have vowed to intensify fiscal support for the world’s second-largest economy, fueling markets with hopes of more intervention just days after the central bank announced the biggest monetary stimulus since the pandemic. The politburo, led by President Xi Jinping, pledged on Thursday to “issue and use” government bonds to better implement “the driving role of government investment”, in comments that come as analysts warn that China is in danger of missing its official economic growth target this year. FT

- China is considering injecting up to 1 trillion yuan ($142 billion) of capital into its biggest state banks to increase their capacity to support the struggling economy, according to people familiar with the matter. BBG

- Saudi Arabia is proceeding with plans to ramp production later this year as the country abandons hope for Brent to hit $100 and instead focuses on recapturing market share (the Kingdom is “resigned to a period of lower oil prices”). FT

- Swiss National Bank cut its main policy rate by 25bp (as expected) and said further reductions may become necessary as inflationary pressures in the country have “decreased significantly”. RTRS

- White House is pushing for a Lebanon ceasefire and doesn’t think Netanyahu wants a wider war. WSJ

- Hezbollah is scrambling to find ways to retaliate without sparking a broader war in the Middle East; Lebanon’s PM expresses hope that a ceasefire can be reached between Hezbollah and Israel. WSJ

- Harris promised to be “practical” and “pragmatic” in her approach to the economy if elected president as she outlined a series of tax incentives worth ~$100B over 10 years. WSJ

- Sam Altman may become $10 billion richer through OpenAI’s for-profit move, which would give him a 7% stake. A final decision hasn’t been made, according to people familiar. BBG

- Micron soared +15% premarket after providing a better-than-expected forecast for the current quarter. Semiconductor stocks including SK Hynix and Tokyo Electron also jumped in Asia. BBG

A more detailed look at global markets courtesy of Newsquawk

Top Asian News

European bourses, Stoxx600 (+1.2%) are entirely in the green, with sentiment lifted from further Chinese stimulus efforts. Price action today has only really moved upwards, initially opening on a strong footing and gradually edging higher as the morning progressed. European sectors hold a strong positive bias; Consumer Products tops the pile, benefiting from significant strength in the Luxury sector amid further Chinese stimulus efforts; Basic Resources and Tech also gain. Energy is by far the clear underperformer, dragged down by losses in the crude complex. US Equity Futures (ES +0.8%, NQ +1.4%, RTY +0.9%) are entirely in the green, taking impetus from a strong European session, with sentiment lifted by further Chinese stimulus efforts; the tech-heavy NQ outperforms, owing to very strong Micron (+15% pre-market) results where it beat on top- and bottom-lines and provided solid guidance.

Top European News

- SNB cuts its Policy Rate by 25bps as expected to 1.00%; prepared to intervene in the FX market as necessary; Further cuts in the SNB policy rate may become necessary in the coming quarters to ensure price stability over the medium term.

- SNB outgoing Chairman Jordan says inflationary pressure has decrease significantly in Switzerland; strong CHF, lower oil, and electricity prices contributed to lower inflation forecasts; downside risk to inflation higher than upside risk. Further rate cuts may be necessary int in the coming quarters. Swiss economic growth will be “rather modest” in coming quarters. Says he sees no risk of deflation; further rate cuts “might” be necessary to ensure price stability (post-meeting press conference).

- SNB Vice-Chair Schlegel says measures to expand provision of liquidity for Swiss banks will further strengthen the sector. Comments on possible further rate cuts not unconditional, bank will examine the situation in December

- German Economic Institutes forecast inflation to go down to 2.2% this year from 5.9% last year; cuts 2024 forecast, sees economy shrinking by 0.1% in 2024 (prev. forecast +0.1%).

- “Hearing France will ask Brussels for a two year delay in reaching its 3% of GDP deficit target i.e. 2029 instead of 2027. Speculation rife in French press today”, Eurasia Group’s Rahman

- UK car manufacturing output fell 8.4% Y/Y to 41,271 units in August, according to SMMT.

- Swedish NIER think tank forecasts 2024 Swedish GDP +0.7% (vs +0.7% in August forecast).

- ECB rate decision is “wide-open”, according to Reuters sources; fight for a cut following weak data. Doves are pointing towards recent soft business survey data and weak German sentiment metrics. Hawks are arguing for a pause.

FX

- USD is broadly negative vs. peers (ex-JPY) in today’s risk-on environment. DXY is currently towards the top end of yesterday’s 100.22-99 range.

- EUR/USD is hovering just above yesterday’s 1.1121 low that was printed alongside a resurgence in the USD which dragged the pair back from its 1.1214 YTD high. EUR/USD saw a very modest dovish reaction to Reuters reporting that ECB’s October rate decision is now “wide-open” on account of recent soft data, which stands in contrast to sources after the Sept.

- Cable is attempting to claw back some of yesterday’s lost ground which saw the pair dragged lower from its multi-year peak at 1.3429.

- JPY struggling vs. the USD once again with the pair rising as high as 145.20 during today’s session. The next upside target comes via the 4th September high at 145.55.

- Both antipodes are at the top of the G10 leaderboard and enjoying the current risk-on environment. AUD/USD remains supported by the general positivity surrounding China after this week’s stimulus efforts by officials.

- EUR/CHF immediately fell from 0.9492 to 0.9436 following the SNB’s decision to cut rates by 25bps to 1.00%. A move which partially pared as the statement made clear that they are willing to intervene in the FX market as necessary and pointed to additional cuts being possible.

- PBoC set USD/CNY mid-point at 7.0354 vs exp. 7.0367 (prev. 7.0202).

Fixed Income

- USTs are contained with no follow through to the European-related updates. A particularly packed US agenda with 7yr supply (follows mixed 2yr & 5yr thus far) and numerous data points (quarterly PCE/GDP & weekly Claims) but the focal point is the speaker schedule with Fed’s Powell and Williams. USTs are holding within narrow 114-15+ to 114-19 bounds.

- Bunds spent the first part of the session in proximity to the unchanged mark and generally unreactive to today’s geopolitical updates. Bunds saw some very modest upside to reports that ECB doves were pushing for an October cut, taking it to an initial 134.71 peak. Thereafter, further impetus was driven by reports around France’s fiscal situation, which contributed to the bid in Bunds to a 134.78 peak.

- OATs were lifted out of modest losses following the aforementioned ECB sources and then once again on reports that France will be requesting the EU for a two-year extension. OAT-Bund 10yr yield spread has widened above 80bps to its highest since early August

- Gilts are slightly softer with no real follow through to the above ECB sources and UK specifics somewhat light. Holding around the 98.55 opening mark, briefly dipped to a fresh WTD base of 98.41.

Commodities

- Hefty losses in the crude complex this morning emanated from an unwind of risk premium from constructive geopolitical updates, in which reports suggested that senior US officials anticipate a ceasefire deal along the Israel-Lebanon border “in the coming hours”. Benchmarks as low as USD 67.16/bbl and USD 70.72/bbl for WTI and Brent respectively.

- Precious metals are buoyed by the softer Dollar but spot gold sees the shallowest gains (+0.5%) vs silver (+1.0%) and palladium (+2.4%), potentially amid the constructive geopoltical updates.

- Base metals are firmer across the board amid the softer Dollar and risk-on mood across the market, with sentiment also seeing continued tailwinds from China’s stimulus bazooka. 3M LME copper trades towards the top of a 9,781.00-9,922.50/t range.

- Saudi Arabia is reportedly prepared to abandon its unofficial USD 100 crude target in order to regain market share, via FT citing sources; add, in a sign that Saudi is resigned to a period of lower oil prices. Sources add that Saudi is committed to bringing back production as planned on 1st December. Reportedly unwilling to continue surrendering market share to other producers.

- Russia’s Deputy Energy Minister Sorokin says Russia see oil production costs increasing as “Oil will be harder to extract”.

- BP (BP/ LN) said it secured offshore facilities and removed some non-essential personnel from Argos, Atlantis, Mad Dog, Na Kika, and Thunder Horse platforms, while it is working toward safely ramping up production across its Gulf of Mexico portfolio.

- Citi forecasts Brent at USD 74/bbl in Q4-2024; sees overall fundamental supply and demand bearishness winning out over time, with a forecast for USD 60/bbl for 2025.

- Iraq’s August total oil exports at 105.8mln barrels. according to the oil ministry cited by Reuters

Geopolitics: Middle East

- “Senior US officials have said that they expect a ceasefire deal to be implemented “in the coming hours” along Israel-Lebanon border”, according to Walla News’ Elster.

- “US official says Israel and Lebanon expected to decide “within hours” whether to support the truce”, via Sky News Arabia; echoed by Cairo sources thereafter.

- Kann’s Stein reports a statement from Israeli PM Netanyahu’s coalition members, Smotrich, Ben Gvir and ministers from the Likud party, saying that they “oppose the ceasefire”. Furthermore, opposition leader Lapid says the ceasefire should be accepted for only seven days. Lapid adds that even a minor violation of the ceasefire would result in the return of Israel to the attack “with all its strength and throughout Lebanon”.

- Source in Israeli PM Netanyahu’s says “There is a green light for a ceasefire in order to start negotiations”, via Al Jazeera.

- “There are ideas and discussions, but there is no result so far”, “The discussions are not only related to Lebanon, but include Gaza”, according to Sky News Arabia sources.

- “Israel’s Channel 12: Netanyahu ordered the Israeli army to ease attacks in Lebanon against the backdrop of ceasefire talks”, according to Al Jazeera.

- “Israel’s Channel 12 quoting government sources: Israel sets terms for truce and estimates that Nasrallah [Secretary-general of Hezbollah] will not agree to them”, according to Al Jazeera.

- Qatar foreign ministry spokesperson says not aware of direct link between 21-day Lebanon ceasefire proposal and the Gaza ceasefire proposal; there is not yet a formal mediation track working towards a ceasefire in Lebanon.

- Israeli Prime Minister’s Office says “the news about a ceasefire are incorrect. This is an American-French proposal, to which the prime minister did not even respond.”, via Amichai Stein on X.

- Israeli PM Netanyahu says he has instructed military to keep “fighting at full power”.

- “Israeli Foreign Minister: There will be no ceasefire in the north”, according to Sky News Arabia.

- “Lebanese PM denies signing ceasefire agreement after meeting with Blinken and Hochstein”, according to Al Arabiya.

- US, France and partners proposed an immediate 21-day ceasefire across the Lebanon-Israel border and called for a ceasefire in Gaza. US President Biden and French President Macron said it is time for a settlement on the Israel-Lebanon border that ensures safety and security to enable civilians to return to their homes and they have worked together in recent days on a joint call for a temporary ceasefire to give diplomacy a chance to succeed. Furthermore, they called for broad endorsement and immediate support from the governments of Israel and Lebanon, while the statement was endorsed by the US, Australia, Canada, EU, France, Germany, Italy, Japan, Saudi Arabia, UAE, and Qatar.

- Israel and Hezbollah communicated details of the US-France proposal and will announce their response soon, while The Washington Post cited US officials stating that Hezbollah will not directly sign the ceasefire agreement.

- US President Biden said an all-out war is possible in the Middle East, but there is also a possibility of a settlement and said there needs to be a two-state solution, according to an ABC interview.

- French Foreign Minister told the Security Council that the situation in Lebanon may reach the point of no return and that Lebanon which is already considerably weakened, will not be able to be restored after a war between Israel and Hezbollah. Furthermore, he said war is not inevitable and there is no alternative to diplomacy. The Foreign Minister also noted that important progress was recently made on a temporary ceasefire in Lebanon and efforts will continue.

- Israeli source said they are approaching a crossroads to make decisive decisions that will determine where the war is heading and noted that talks on the north aim to provide an opportunity for a settlement that prevents a major war, according to Israeli press.

- Israeli press Hayom cited an Israeli source stating there is no prospect of reaching a ceasefire at least in the next few days.

- Israeli UN envoy said Israel would prefer a diplomatic solution in Lebanon and if diplomacy fails, then Israel will use all means at its disposal. The envoy added that diplomacy will be better for Israel and Lebanese people, as well as noted that Israeli PM Netanyahu will arrive on Thursday and address the UN General Assembly on Friday while Israel’s UN envoy also commented that Iran is the spider at the centre of the web of violence and there can be no peace in the region until we dismantle this threat.

- Iran’s Foreign Minister said the region is on the brink of a full-scale catastrophe and Israel has crossed all red lines, while he added that the UN Security Council must intervene to restore peace and security. Furthermore, he said that Israeli leaders must understand their crimes won’t go unpunished and Iran will not remain indifferent in case of a full-scale war in Lebanon.

- UN Secretary-General Guterres told the Security Council that ‘hell is breaking loose’ in Lebanon and diplomatic efforts have intensified to achieve a temporary ceasefire to allow for aid deliveries and pave the way for more durable peace. Guterres stated all parties must immediately return to a cessation of hostilities, while an all-out war must be avoided at all costs and that Lebanon cannot become another Gaza.

- Lebanon’s PM told the Security Council that Israel is violating their sovereignty, while Lebanon’s PM responded ‘hopefully yes’ when asked if a ceasefire can be reached soon, according to Reuters.

Geopolitics: Other

- US is reportedly preparing USD 8bln in arms aid packages for Ukrainian President Zelensky’s visit, according to sources via Reuters. It was later reported that President Biden’s administration announced USD 375mln for Ukraine defence aid which includes HIMARS, Javelin missiles and TOW missiles, according to the White House and State Department.

- Russian President Putin proposed to update Russia’s nuclear strategy and said that a number of clarifications have been proposed with regard to the definition of conditions for the use of nuclear weapons. The proposal stated that aggression against Russia by any non-nuclear state, but with participation or support of a nuclear state, is proposed to be considered as their joint attack on the Russian federation, while Russia reserves the right to use nuclear weapons in case of aggression against Russia and Belarus.

- China’s Foreign Minister said in meeting with EU’s top official that China is committed to de-escalating the situation in Ukraine and China will not give up efforts to strive for peace in Ukraine.

- South Korea’s National Intelligence Service said North Korea possesses enough plutonium and uranium to make at least double-digit nuclear weapons, while it added that North Korea could possibly conduct a 7th nuclear test, according to Yonhap.

- Russia’s Kremlin says changes to Russian nuclear policy in the document on state nuclear deterrence have now been formulated; changes should be considered a signal to “unfriendly” countries. Will subsequently make a decision on whether or not to publish nuclear documents. There are two documents on nuclear policy. Signal to the west is that there are consequences if Western countries participate in an attack on Russia with various means.

US Event Calendar

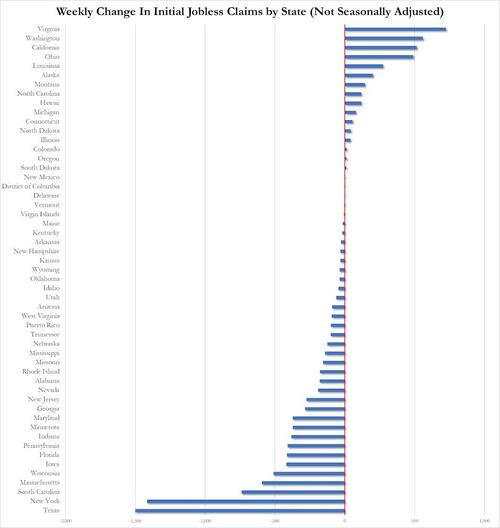

- 08:30: Sept. Initial Jobless Claims, est. 223,000, prior 219,000

- Sept. Continuing Claims, est. 1.83m, prior 1.83m

- 08:30: BEA annual revisions to GDP/National Economic Accounts

- 2Q GDP Annualized QoQ, est. 2.9%, prior 3.0%

- 2Q Personal Consumption, est. 2.9%, prior 2.9%

- 2Q GDP Price Index, est. 2.5%, prior 2.5%

- 2Q Core PCE Price Index QoQ, est. 2.8%, prior 2.8%

- 08:30: Aug. Durable Goods Orders, est. -2.7%, prior 9.8%

- Aug. Durables-Less Transportation, est. 0.1%, prior -0.2%

- Aug. Cap Goods Ship Nondef Ex Air, est. 0.1%, prior -0.3%

- Aug. Cap Goods Orders Nondef Ex Air, est. 0.1%, prior -0.1%

- 10:00: Aug. Pending Home Sales (MoM), est. 1.0%, prior -5.5%

- Aug. Pending Home Sales YoY, est. -5.5%, prior -4.6%

- 11:00: Sept. Kansas City Fed Manf. Activity, est. -5, prior -3

Central Bank Speakers

- 09:10: Fed’s Collins, Kugler Participate in Fireside Chat

- 09:15: Fed’s Bowman Speaks on Eco Outlook at Mid-Sized Bank Coalition

- 09:20: Fed’s Powell Gives Pre-Recorded Opening Remarks

- 09:25: Fed’s Williams Gives Remarks at Conference

- 10:30: Fed’s Barr Gives Remarks at Conference

- 10:30: Fed Governor Cook Joins Roundtable on AI and Workforce Develop

- 13:00: Fed’s Kashkari Hosts Fireside Chat with Michael Barr

- 18:00: Fed Governor Cook Delivers Speech on AI and Labor Force

DB’s Jim Reid concludes the overnight wrap

Investor risk appetite has maintained its momentum over the last 24 hours, aided by strong earnings from Micron Technology after the US close last night. It’s true the S&P 500 (-0.19%) saw a slight pullback from its record high the previous day, but since that earnings release, futures on the index are up another +0.46% this morning, and those on the NASDAQ 100 are up by an even stronger +0.84%. Moreover, the major equity indices in Asia have posted fresh gains as well, with the Nikkei (+2.35%) currently on track to close at its highest level since late-July, before the market turmoil began in earnest over early August. And that advance has been seen across the board, with gains for the Hang Seng (+2.32%), the CSI 300 (+0.71%), the Shanghai Comp (+0.64%) and the KOSPI (+2.07%) as well.

One trend that’s been helping sentiment is growing optimism about the economic outlook, particularly given the Fed’s 50bp rate cut last week, and yesterday brought fresh evidence that lower rates were already having a stimulative effect on the US housing market. So the hope is that given the lags of monetary policy, we’ll see further good news and data improvements over the coming months, especially as we’re now seeing a globally synchronised cycle of rate cuts.

In terms of that data, yesterday’s release from the Mortgage Bankers Association showed that the contract rate for a 30yr fixed mortgage was down to a two-year low of 6.13% over the week ending September 20. Moreover, housing market activity was picking up a bit as well, with their purchase index reaching its highest level since early February. Elsewhere, another effect of lower rates has been the ongoing rise in gold prices, as it’s seen as a classic inflation hedge that tends to benefit from falling interest rates, given it doesn’t pay any interest itself. Indeed, this morning it’s currently trading at $2,662/oz, and with just a few days of Q3 remaining, it’s currently on track for its best quarterly performance since Q1 2016.

With rapid rate cuts being priced in for the months ahead, that also helped to drive a fresh round of curve steepening on both sides of the Atlantic yesterday. 2yr Treasury yields (+2.1bps) rose modestly to 3.56%, up from the two-year low the previous day, while the 10yr yields rose by +5.7bps to 3.78%, their sixth increase in seven sessions. That meant the 2s10s curve in the US steepened for a 6th consecutive session, moving up to 22bps, which is the steepest it’s been since June 2022. Obviously that’s good news for those viewing a steeper curve as a signal of economic strength, but we also know that the last four US recessions only began after the inversion had finished, once the curve was back in positive territory again. So depending on the context, a steeper curve has been a bit of a mixed signal historically.

Today we’ll get some more US data that should help shape perceptions on the outlook, including the weekly initial jobless claims. They’ve been improving over recent weeks, and last week saw the 4-week average fall to its lowest since early June, so that’s helped to reassure investors about the current state of the US labour market. The other report of interest today will be the annual revisions to the US national economic accounts, which will cover 2019 through to Q1 2024. Last year that saw the growth rate for 2022 revised down by two-tenths, alongside revisions to previous years. So it’ll be interesting to see how that affects our understanding of recent economic history.

In the meantime, US equities lost some ground in yesterday’s quiet session, with the S&P 500 down -0.19%. Energy stocks (1.90%) led the decline, pulled down by a decline in oil prices, with Brent crude down -2.27% to $73.46/bbl. But the softness was broad-based, with both the equal-weighted S&P 500 (-0.65%) and the small cap Russell 2000 (-1.19%) underperforming. On the other hand, the tech mega caps outperformed, with Magnificent 7 (+0.44%) reaching a two-month high as it posted a third consecutive advance.

The equity tone was also negative in Europe, with growing fears about the outlook given the weak data of recent days, including from the flash PMIs. In turn, that meant the major equity indices fell across the continent, with losses for the STOXX 600 (-0.11%), the DAX (-0.41%) and the CAC 40 (-0.50%).

Staying on Europe, sovereign bonds saw a similar sell off to the US. Yields on 10yr bunds (+2.6bps) moved higher, whilst OATs (+5.0bps) underperformed to push the Franco-German 10yr spread up to 79.3bps, just 0.2bps from where it stood on August 5, at the height of the recent market turmoil after the US jobs report. This came as French budget minister Laurent Saint-Martin said to the National Assembly’s finance committee that “in 2024 the public deficit risks exceeding 6% of gross domestic product, according to the latest estimates we have.”

One difference compared to the US was the more marginal curve steepening in Europe, though the German 2s10s curve did inch up to its steepest since November 2022, at 4.9bps. This came as markets slightly dialled back their expectations for ECB rate cuts for this year, with the amount expected by December’s meeting down -1.1bps to 47bps, after rising by nearly 12bps over the previous four sessions. On this topic, our European economists published an update of their ECB view overnight. They think the latest data might not yet be quite weak enough to trigger an October ECB cut, but now expect a more rapid easing cycle with back-to-back 25bp cuts from December through to mid-2025, and they do not rule out a 50bp cut in December.

Elsewhere in Europe, the trend towards rate cuts continued yesterday, and the Riksbank delivered a 25bp cut in their policy rate to 3.25% as expected. That marks their third rate cut this year, and they also signalled that further reductions were ahead, with their forecast for the average policy rate in Q4 at 3.11%, with a further decline to 2.38% in Q2 2025. Back in June, their policy rate forecast stood at 2.94% in Q2 2025, so that’s a noticeably more dovish path relative to last quarter.

To the day ahead, and US data releases include the third reading of Q2 GDP, the preliminary August reading for durable goods orders, the weekly initial jobless claims, and pending home sales for August. Meanwhile in the Euro Area, we’ll get the M3 money supply for August. From central banks, we’ll hear from Fed Chair Powell, the Fed’s Collins, Kugler, Bowman, Williams, Barr, Cook and Kashkari, along with ECB President Lagarde, Vice President de Guindos and the ECB’s Schnabel.