US futures are weaker but off overnight lows, as euphoria over China’s latest monetary bazooka stimulus fizzles with Asian shares paring gains into the close (traders now await the far more important fiscal bazooka) and as attention turns to the deteriorating US economy. As of 8:00am, S&P futures are down 0.1% after the index finished with its 41st record closing high on Tuesday, while Nasdaq futures drop 0.2% with weakness in Semis as US-listed Chinese tech stocks fell in premarket trading. Bond yields are mixed, and the USD has a slight bid as the yen trades just off a 3-week low. Commodities are mostly lower as it appears there is muted follow-through to China’s stimulus-induced buying. Today’s macro focus is on New Home Sales, Fed speakers scheduled Kugler at 4pm followed by Chair Powell tomorrow (slated to make pre-recorded opening remarks at the 10th annual US Treasury Market Conference Thursday at 9:20am with a text release expected) and the 2Y and 5Y bond auctions.

In premarket trading,Chinese stocks listed in the US were set to decline following a stimulus-driven rally. General Motors shares fell in premarket trading as did KB Home. Here are some of the biggest US movers today:

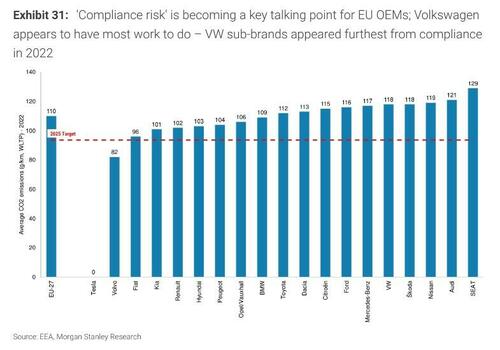

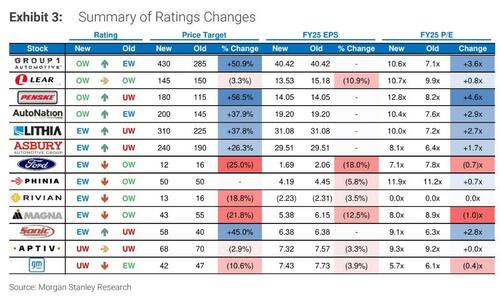

- General Motors shares fall 3.6% after Morgan Stanley analyst Adam Jonas cut the car maker to underweight from equal-weight. Jonas made several rating changes in his auto coverage, including downgrading Ford, Rivian, Magna International, and Phinia, and upgrading the dealers including AutoNation.

- HP Enterprise shares rise as much as 2.5% after the IT firm was upgraded to overweight from equal-weight at Barclays amid signs of a recovery in enterprise servers.

- KB Home shares drop 6.4% after the homebuilder reported earnings per share and net orders for the third quarter that fell short of the average analyst estimate.

- Stitch Fix shares fall as much as 20% after the online retailer’s forecasts for 2025 net revenue and adjusted Ebitda from continuing operations fell short of the average analyst estimates.

- DoorDash was raised to overweight from sector weight at KeyBanc Capital Markets, which sees the delivery company “gaining ground in its core and emerging verticals.”

Traders are seeking fresh catalysts with growth concerns lingering after last week’s half-point Federal Reserve interest-rate cut. Wednesday’s policy moves from China failed to ripple beyond Asian markets and investors are looking to a speech by Fed Chair Jerome Powell and price-growth data at the end of the week.

“We’ve been here before with China,” said Guy Miller, chief market strategist at Zurich Insurance Co. “Really potent fiscal as well as monetary policy is needed to change the direction of travel. So far that direction of travel has not changed.”

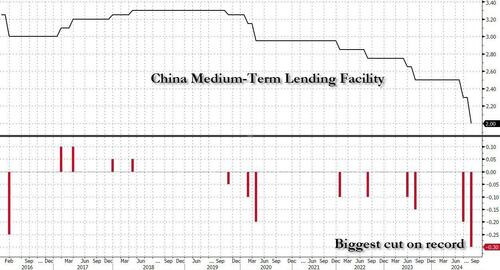

Meanwhile, China’s stocks rallied for a sixth day after the central bank lowered the interest rate charged on its one-year policy loans by the most on record. That followed its wide-ranging stimulus package announced the day before. Iron ore climbed and gold hit another record earlier in the session.

Meanwhile, Europe’s Stoxx 600 index paused a two-day rally, with German software developer SAP SE dropping 4% on news that it and other companies are being probed by the US. Healthcare and personal-care subindexes were the best performers, while the automotive and tech subgroups lag. Stoxx 600 was little changed, slipping 0.1% to 519.25. Here are the biggest movers Wednesday:

- Valmet gains 11%, the most since June, after the Finnish pulp and energy equipment manufacturer said it got an order valued at over EU1b from Arauco for a complete pulp mill in Brazil

- Air France-KLM shares rise as much as 8.4%, the most since December, after JPMorgan double-upgrades the stock to overweight, predicting a pick-up in earnings momentum

- Rentokil stock rises as much as 5.1% as the pest controller says Brian Baldwin, head of research at activist Trian Fund Management, will join the board as a non-executive director

- Helvetia gains as much as 4.5%, to its highest since 2020, after J.P. Morgan initiated coverage with a recommendation of overweight, citing unappreciated future earnings potential

- Orion gains as much as 5.2% after Jefferies upgrades to buy and sets a Street-high target, based on a higher peak sales estimate for key drug Nubeqa, with peak sales seen as high as €1.3b

- CCC soars as much as 10% after the Polish footwear retailer’s final 2Q earnings surpassed the preliminary figures, and its strong 3Q trading update was seen as a positive signal for 2024

- SAP declines as much as 4.3% after federal court records showed the software maker is among companies being investigated by the US for potentially conspiring to overcharge government agencies.

- Truecaller shares fall as much as 9.4%, the most in a year, after KPCB Holdings Inc. and Peak XV Partners offered 15 million shares at an 8.4% discount versus Tuesday’s close

- Immofinanz shares fall as much as 15% and to their lowest since December after an unidentified holder offered 3.4 million shares in the Austrian real estate company; shares are down 4% YTD

- Melexis shares drop as much as 57% to hit a seven week low after Kepler Cheuvreux downgraded the semiconductor integrated circuit maker and slashed earnings estimates

- AXA shares drop as much as 2.2%, the most since early August, after CIC Market Solutions cut its recommendation on the insurance group to neutral from buy, seeing limited upside for the stock

- Rightmove shares drop as much as 1.6% after the UK online property portal rejected a third takeover proposal from REA Group, saying the £6.1b bid continues to undervalue the business

Europe’s darkening economic outlook has fueled bets the ECB will cut rates again next month, while economists at HSBC Holdings Plc predict policy makers will start cutting interest rates at every meeting between October and April. “The worry has been that all the economic data is looking quite shaky,” said Anwiti Bahuguna, global asset allocation CIO at Northern Trust Asset Management, where the region’s stocks have been cut to market weight from overweight. “At the beginning of the year we did think we would see a nice uptick but it started to slow down way more than any of us anticipated,” she told Bloomberg TV.

Earlier in the session, Asian stocks were little changed after jumping earlier in the day, as a policy-driven rally in China started to lose momentum after skepticism kicked in. The MSCI Asia Pacific Index edged up only 0.1% after gaining as much as 1%. TSMC, BHG Group and Tencent were among the biggest boosts. The gauge was still set to gain for a fifth day and reached its highest level since Feb 2022. Benchmarks in Sri Lanka, mainland China and Taiwan rose the most, while other markets took a breather after gains in the previous session.

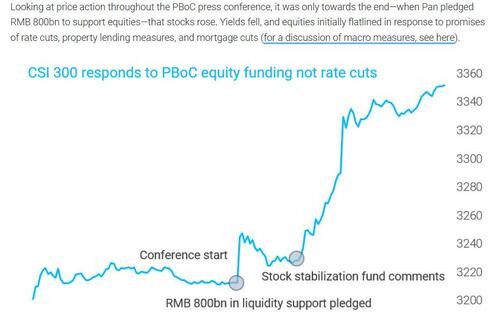

Investors are cautiously optimistic that the policy barrage announced Tuesday has put a floor under China’s stock slump, with expectations that more fiscal support will follow. The CSI 300 Index rose 1.5% at close after climbing as much as 3.4% on the day. The gauge remained 0.9% lower for the year. A slowdown in the world’s second-largest economy had been a major overhang for Asian stocks, and a meaningful recovery as a result of the policy support may help drive gains across the region.

“We believe the concerted effort should put a floor to market sentiment in the near term,” James Wang, head of China strategy at UBS Investment Bank Research, wrote in a note. “While the immediate measures would benefit A-share companies, we believe the regulator’s desire to improve company governance would benefit all MSCI China companies.”

In FX, the Bloomberg Dollar Spot Index rises 0.2% having reversed course after falling earlier to the lowest since January. The yen is the worst-performing major currency, falling 0.7% against the greenback. The Swiss franc is not far behind. The Swedish krona falls 0.3% after the Riksbank cut borrowing costs by a quarter point and raised the possibility of a bigger move in coming months.

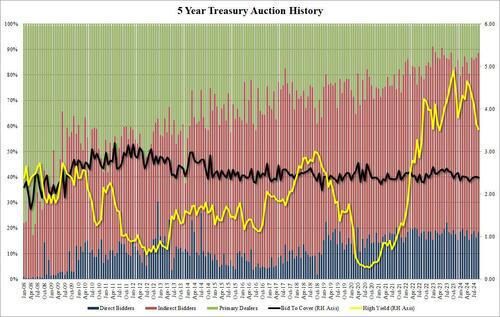

In rates, treasuries edge lower, with yields higher by 2bp-3bp vs Tuesday’s close, following similar price action in core European rates during London morning. US 10-year yields around 3.76% are ~3bp cheaper on the day, keeping pace with bunds and gilts; 5s30s spread is flatter by around 1bp as 5-year sector underperforms ahead of the auction. An auction of new 5-year notes during US afternoon follows good demand for Tuesday’s 2-year note sale. The $70b 5-year note auction at 1pm New York time, second of this week’s three coupon sales, has WI yield near 3.51%, about 14bp richer than last month’s, which tailed by 0.3bp

In commodities, oil prices are down ~0.3%, with WTI trading around $71 a barrel.

Looking at today’s US economic data calendar, we get Mortgage applications (up 11.0%, vs 14.2% last week) and August new home sales at 10am. Fed speakers scheduled include Kugler at 4pm; Chair Powell is slated to make pre-recorded opening remarks at the 10th annual US Treasury Market Conference Thursday at 9:20am with a text release expected

Market Snapshot

S&P 500 futures down 0.2% to 5,782.00

Brent Futures down 0.1% to $75.07/bbl

Gold spot up 0.0% to $2,657.41

US Dollar Index little changed at 100.41

Top Overnight News

- China doubled down on stimulus measures with the PBOC cutting its one-year interest rate by 30 bps, the most on record. Stocks extended gains and the offshore yuan strengthened past 7 per dollar for the first time since May 2023. BBG

- China test fires ICBM into the Pacific, its first such launch since the summer of 2021 and a show of force ahead of a Xi-Biden phone call expected in the coming weeks. FT

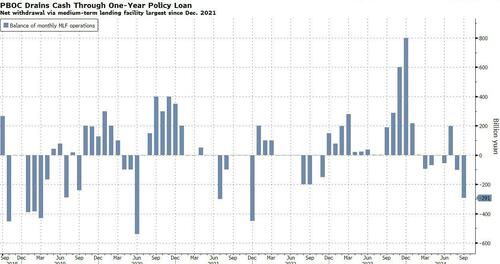

- GIR on PBOC’s Easing: PBOC Governor Pan hinted at follow-through to lending and deposit rates, as well as the likelihood of another RRR cut in Q4. More important than the measures themselves is the signal that domestic weakness has become uncomfortable for top policymakers (which in turn suggests underlying activity could be missing the 5% growth target by significantly more than the official 4.7% yoy GDP growth figure implies). The key question now is whether policymakers will add meaningful fiscal support to the mix; government borrowing has picked up substantially since midyear, but spending has not. GIR

- Iran’s President Masoud Pezeshkian said plans are underway to discuss a nuclear deal following a “positive” meeting with Emmanuel Macron. He earlier warned that Israeli attacks on Lebanon “cannot go unanswered.” BBG

- Eurozone wage growth is easing according to a new ECB study, news that could pave the way for continued monetary easing. RTRS

- White House is taking a hands-off approach to the East/Gulf Coast dock worker labor talks w/just days to go before a potential strike. RTRS

- US House Foreign Affairs Committee recommended contempt of Congress charges against Secretary of State Blinken, for failing to appear at a hearing regarding the Biden administration’s handling of the 2021 withdrawal from Afghanistan.

- Swaps traders raised their wagers to about 75 bps of Fed easing by year-end — implying a half-point move at one of the two remaining meetings. Positioning figures show a sharp increase in open interest in two-year note futures and a marked uptick in bets in December futures linked to the SOFR. BBG

- AI is better at pricing currencies than humans, according to ING, which is using such a model for the time-consuming task. Bain predicted the global market for AI-related products will near $1 trillion by 2027. BBG

- Berkshire sold another 21.6M shares of BAC for ~$860MM, dropping its stake to ~814MM/10.5% (Berkshire may stop selling at ~700M shares). Barron’s

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive as Chinese markets continued to rally following the stimulus boost. ASX 200 was rangebound with strength in mining and materials offsetting the underperformance in financials and tech, while the latest monthly CPI data from Australia matched estimates and slowed to a 3-year low although core inflation remained above the 2%-3% target. Nikkei 225 swung between gains and losses and traded both sides of the 38,000 level with little fresh catalysts, while Services PPI data was firmer than expected but slowed from the prior month’s revised print. Hang Seng and Shanghai Comp rallied amid ongoing optimism following the stimulus announcements, while the PBoC also conducted an MLF operation with the rate cut by 30bps to 2.00% which it had flagged during Tuesday’s press briefing.

Top Asian news

- PBoC conducted a CNY 300bln 1-year MLF operation with the rate lowered to 2.00% from 2.30%.

- US hopes to discuss fentanyl with China at the APEC Summit in November.

European bourses, Stoxx 600 (-0.2%) are almost entirely in the red (ex-SMI), with indices taking a breather/giving back some of the hefty gains seen in the prior session. European sectors are mixed vs initially holding a negative bias at the open. Healthcare tops the index alongside Travel & Leisure; the latter benefiting from gains in Air France (+7%) following a double broker upgrade at JP Morgan. Tech lags, hampered by losses in SAP (-3.5%) amid a US probe. US Equity Futures (ES -0.2%, NQ -0.3%, RTY -0.1%) are modestly lower across the board, with slight underperformance in the NQ following on from the gains seen in the prior session.

Top European news

- ECB’s Villeroy says cannot allow France’s situation regarding deficit to last; must deal with debt problem as spread widens. Not realistic for France to bring deficit down below 3% level within a three-year timeframe.

- BoE’s Greene says it is appropriate to take a gradual approach to removing restrictiveness. Greene outlines three cases in the economy and subsequent risks. In the first case, the global shocks that drove up inflation continue to fade, and the persistence of inflationary pressures dissipates with a less restrictive stance of monetary policy than in other cases. In the second, a period of economic slack is required to bring inflation sustainably to target in the medium-term. In the third, structural changes in the economy that impact wage- and price-setting require monetary policy to remain tighter for longer. Says, like many others on the MPC, she does not fit squarely in any of these cases. However, at the moment, she places the greatest probability on being in the second case. Wage growth has also fallen but remains above what our suite of models can explain. Says that a lot of the latest decline in UK services inflation is in the more volatile components; cannot get the ticker tape out yet. Remains concerned about wage pass-through to inflation. May be seeing some impact from UK economic policy uncertainty, causing business to stay on the sidelines.

- Riksbank cuts its Rate by 25bps as expected to 3.25% (prev. 3.50%); policy rate may also be cut at two remaining meetings this year, with a 50bps cut possible at one of those meetings; rate expected to be cut at a clearly faster pace than before.

- HSBC now see the ECB cutting rates at every meeting, starting from October, according to Bloomberg

FX

- USD is firmer and attempting to recoup some lost ground vs. peers after the selling pressure seen in the wake of Tuesday’s US Consumer Confidence data. DXY has climbed above the 100.50 level and is towards session highs.

- EUR is flat vs. the USD and continuing to eye a test of 1.12 after yesterday’s Consumer Confidence-led dollar weakness. EUR/USD has been as high as 1.1198 today. If 1.12 is breached, the YTD high rests just above at 1.1201.

- Cable has pulled back a touch after its recent run of gains which saw the pair trade on a 1.34 handle for the first time since March 2022. Comments from BoE’s Greene this morning have underlined the cautious stance being taken by the MPC relative to some of its peers within the G10 space; commentary which sparked little move in the GBP.

- JPY is on the backfoot vs. the USD and the laggard across the majors, trimming yesterday’s gains vs. the greenback. Fresh fundamentals have been lacking for Japan ahead of the LDP leadership race on Friday. For now, the pair is contained within its recent 140-145 trading band.

- AUD a touch softer vs. the USD following soft inflation metrics overnight which put Y/Y CPI within the RBA’s target band on a headline basis (core remains above the top end). AUD/USD Printed another YTD high overnight, breaching the 0.69 mark for the first time since Feb 2023.

- SEK saw some fleeting weakness vs. the EUR following the Riksbank’s decision to cut rates by 25bps (as expected) whilst signalling that the policy rate could be cut at two remaining meetings this year. Furthermore, the statement noted that a 50bps cut is possible at one of those two meetings.

Fixed Income

- USTs are flat/very slightly lower ahead of 5yr supply later today. Treasuries saw very modest pressure following a poor Gilt auction; a move more pronounced in Bunds/Gilts.

- Bunds are under modest pressure and held around Tuesday’s best at 135.01 for most of the morning, but took another leg lower after the the dire UK auction; Bunds fell to a 134.68 trough ahead of the German auction, which passed without issue.

- Gilts were flat and unreactive to commentary from BoE’s Greene who outlined her preference for a gradual approach to removing policy restrictiveness. Following the Gilt auction, which had a lower b/c and much wider tail, Gilt Dec’24 futures fell from 99.23 to 99.15 before extending to a 98.99 low.

- UK sells GBP 3.75bln 4.00% 2031 Gilt: b/c 2.98x (prev. 3.29x), average yield 3.814% (prev. 4.074%), tail 1.6bps (prev. 1.9bps).

- Italy sells EUR 2.75bln vs exp. EUR 2.25-2.75bln 3.10% 2026 BTP Short Term & EUR 2.5bln vs exp. EUR 2-2.5bln 1.50% 2029 & 2.40% 2039 BTPei Auctions.

- Germany sells EUR 2.424bln vs exp. EUR 3bln 2.40% 2030 Bund: b/c 2.4x (prev. 2.2x), average yield 2.0% (prev. 2.25%) & retention 19.2% (prev. 17.6%)

Commodities

- Crude is slightly subdued following the gains seen in the prior session, spurred on by the Chinese stimulus efforts but was unable to benefit from the draws in private sector inventory data. Brent’Nov sits at the foot of a USD 74.73-75.35/bbl parameter.

- Precious metals hold a downward bias with losses of some 1% seen in spot silver and spot palladium, whilst spot gold trades sideways amid a lack of drivers but cushioned by the increasingly tense geopolitical landscape. XAU eked another fresh all-time-high overnight at USD 2,670.60/oz (vs low 2,651.41/oz).

- Base metals are marginally softer as they take a breather from yesterday’s surge. 3M LME copper trades closer to the bottom of a USD 9,755.50-9,924.00/t range.

- US Private Energy Inventory (bbls): Crude -4.3mln (exp. -1.4mln), Distillate -1.1mln (exp. -1.6mln), Gasoline -3.4mln (exp. -0.02mln), Cushing -0.0mln.

- NHC said a storm surge and hurricane warnings were issued for the Gulf Coast of Florida, while it added that Helene’s large size will likely cause an extensive area to be affected by the storm’s hazards.

- Kazakhstan’s energy ministry says Kashagan oil field (400k BPD) to suspend operations for 38 days for maintenance.

- NHC says Helene strengthening as the centre approaches the north-eastern coast of the Yucatan Peninsula, new tropical storm watches and warnings for portions of the US.

Geopolitics: Middle East

- “Israeli strikes on Lebanon expanded to reach the Keserwan and Chouf areas in Mount Lebanon”, according to Sky News Arabia

- Israeli Defence Minister Gallant said they have more strikes ready against Hezbollah, while he added that they must continue until they achieve their goal and ensure the safe return of Israel’s northern residents to their homes.

- Israel conducted a strike on Jiyyeh which is south of Lebanon’s capital Beirut, according to security sources cited by Reuters.

- Sirens sounded in Tel Aviv and its surrounding area, as well as in central Israel, while explosions were heard in the sky of Tel Aviv caused by the interception of rockets, according to Sky News Arabia. Furthermore, Israel’s military said after Tel Aviv sirens were activated a missile was detected crossing from Lebanon and was intercepted.

- Iran-backed Iraqi militia claimed responsibility for overnight drone attacks on Golan, according to Times of Israel.

- Hezbollah confirmed its senior commander Ibrahim Qubaisi was killed in an Israeli strike on Beirut, while it was separately reported that Hezbollah said it targeted Israel’s Atlit navy base south of Haifa with drones.

- Hezbollah urged Iran in recent days to launch an attack against Israel as fighting between the Lebanese militant group and the Israeli military dramatically escalated, but Iran has so far refrained, according to Axios.

- Lebanon’s Foreign Minister said US President Biden’s UN speech was not strong and not promising, while the official added that the US is the only country that can really make a difference in the Middle East, as well as noted that Lebanon itself cannot end the fighting and needs US help despite disappointments of the past.

- Iran’s President Pezeshkian said the international community must immediately stop the violence and work to reach a permanent ceasefire in Gaza, while he added Tehran is ready to work with parties to the 2015 Nuclear Act pact to resolve the standoff and is ready to improve ties with the world.

- Iran’s President Pezeshkian met with French President Macron in what is described as a good meeting in which they discussed Gaza and a nuclear deal. Iran’s President said he expects a group of countries to meet on the nuclear deal, while Macron warned Iran’s President about Tehran’s continued support for Russia’s war in Ukraine.

- IAEA chief Grossi said he sees a willingness from Iranian officials to re-engage in a more meaningful way, while he will visit Tehran in the coming weeks and is aiming for October. Grossi said Iran is continuing the development of its nuclear programme at a regular pace and any future nuclear talks will be different from the 2015 nuclear deal with a bigger role for the IAEA expected. Furthermore, he noted the need to start preparing now for possible future negotiations between the West and Iran.

- Iran is brokering secret talks to send Russian anti-ship missiles to Yemen’s Houthis, according to Reuters citing sources. The report noted that experts said this would increase the Houthis to strike Red Sea commercial shipping and raise the threat to US and allied warships, while experts also stated that Houthis could use the missiles on land to threaten Saudi Arabia.

- “Israel Broadcasting Corporation: Israeli preparations for a possible ground operation in Lebanon”, according to Sky News Arabia.

- Israeli Military says a drone crossing into Israeli territory from Syria was intercepted by IDF fighter jets south of the Sea of Galilee.

Geopolitics: Other

- China’s PLA rocket force successfully launched an intercontinental ballistic missile with a simulated warhead in international waters in the Pacific Ocean with the launch said to be routine and part of the rocket force’s annual training, according to Xinhua. China notified relevant countries ahead of the missile launch, while China’s Defence Ministry said the launch was not directed at any country or target and was in line with international laws and practices.

- Former US President Trump was briefed by US intelligence officials regarding threats from Iran to assassinate him, according to his campaign.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications, prior 14.2%

- 10:00: Aug. New Home Sales MoM, est. -5.3%, prior 10.6%

- 10:00: Aug. New Home Sales, est. 700,000, prior 739,000

Central Bank Speakers

- 16:00: Fed’s Kugler Speaks on Eco Outlook at Harvard Kennedy School

Government agenda

- 9:30 a.m. ET: Antony Blinken meets with Foreign Ministers of the Gulf Cooperation Council Member States in New York City ~

- 11:15 a.m. ET: Joe Biden joins ABC’s “The View” for a live interview in New York

- 11:30 a.m. ET: Antony Blinken participates in a G20 Foreign Ministers Meeting

- 1:15 p.m. ET: Antony Blinken hosts a multilateral meeting on building on progress to restore security in Haiti

- 2:00 p.m. ET: Joe Biden hosts a bilateral meeting with General Secretary Tô Lâm of Vietnam

- 3:15 p.m. ET.: Kamala Harris will deliver remarks at a campaign event in Pittsburgh, Pennsylvania

- 3:30 p.m. ET: Joe Biden hosts an event with world leaders launching a Joint Declaration of Support for Ukrainian Recovery and Reconstruction

- 4:30 p.m. ET: Antony Blinken participates in a ministerial on Sudan

- Janet Yellen will travel to New York, New York for private meetings and events on the sidelines of the United Nations General Assembly (UNGA).

- USTR Ambassador Katherine Tai will meet with Germany’s State Secretary Jörg Kukies

DB’s Jim Reid concludes the overnight wrap

Morning from Paris where the last time I was here 7 weeks ago I was trying to get away from Mickey Mouse giving me a hug on the hottest day of the year. This time a hug from Mickey would have warmed me up on a cold wet evening last night.

Markets are more adhering to a Disney script at the moment and have continued to push higher over the last 24 hours, with the S&P 500 (+0.25%) inching up to its 41st record high this year, even as weak US data hit risk appetite and investors dialled up the chances of more aggressive rate cuts. However it was a difficult day for a one-size-fits all narrative, with a fairly divergent performance across different asset classes. To be fair there was plenty of good news, and China-exposed stocks did very well globally after their initial stimulus announcement just over 24 hours ago. This has carried on overnight with the PBoC cutting the medium-term lending facility from 2.3% to 2%, the largest cut since they started using the tool to guide policy in 2016. Chinese equities are again outperforming this morning. Meanwhile gold prices (+1.08%) have hit another all-time high of $2,657/oz as more US rate cuts are priced in. But the weak US numbers prevented a more aggressive advance in US equities as they played on lingering fears about a potential downturn given the jobs numbers over recent months.

In terms of that US data, the main point of concern was the Conference Board’s consumer confidence print for September, where the headline reading slipped back to 98.7 (vs. 104.0 expected), and the monthly decline of -6.9pts was also the largest in just over three years. And if that wasn’t enough, the much-followed differential between those saying jobs are plentiful versus hard to get fell back to 12.6, which is the narrowest it’s been since March 2021. At the same time, we also had the Richmond Fed’s manufacturing index for September, which fell to its weakest level since May 2020 at -21 (vs. -12 expected).

Those releases saw investors dial up the chance that the Fed would deliver another 50bp rate cut at their next meeting in November, and futures raised the probability from 54% to 62% on the day. And in turn, that led to a fresh steepening of the yield curve, with the 2yr yield (-4.9bps) closing at a fresh two-year low of 3.54%, whilst the 10yr yield (-2.1bps) saw a smaller decline to 3.73%. That meant the 2s10s was up to 18.4bps by the close, which is the steepest it’s been since June 2022, just before it became apparent that the Fed would start hiking rates by 75bps.

That data weakness was also apparent in Europe yesterday, as the Ifo’s business climate indicator from Germany fell by more than expected in September, coming in at 85.4 (vs. 86.0 expected). That’s the weakest in 8 months, and the news contributed to a similar curve steepening in Germany, with the 2s10s curve (+4.3bps) up to 4.8bps by the close, which is the steepest since November 2022. The move happened as investors similarly raised their expectations for ECB cuts, with a growing probability priced in that they’ll accelerate the pace and start moving at every meeting rather than every other meeting. Indeed, the likelihood of an October cut has now risen from 26% on Friday, to 41% on Monday after the flash PMIs, to 63% by yesterday’s close, so there’s been a decent reassessment of the outlook. This came as we heard some mixed comments from the ECB’s Nagel who suggested that some factors weighing on growth are likely to be “temporary”, though Germany’s growth outlook “remains weak this year”. This backdrop led to a fresh rally among European sovereigns, with yields on 10yr bunds (-0.9bps), OATs (-2.2bps) and BTPs (-2.9bps) all moving lower.

While investors were concerned about the weak economic data, it wasn’t all bad news yesterday. In fact, China-exposed stocks did very well in the US and Europe after the stimulus announcement yesterday. For instance, the CAC 40 (+1.28%) was the biggest outperformer among the main European indices as it contains several luxury goods firms. The DAX (+0.80%) also put in a strong performance, lifted by automakers like BMW (+3.55%) given their exposure to Chinese markets. Meanwhile in the US, the NASDAQ Golden Dragon China Index (+9.13%) had its best daily performance since November 2022. That index is made up of companies which are traded in the US, but where a majority of business is done in China.

For equities more broadly, it was a fairly mixed performance, but ultimately the S&P 500 (+0.25%) still managed to reach another all-time high. Significantly, it also meant that the index is now up +20% on a YTD basis for the first time this year, and if it can maintain that into year end, it would be the first time that it recorded two back-to-back annual gains above +20% since 1997-98. The Philadelphia Semiconductor Index (+1.31%) was a significant outperformer, aided by a +3.97% gain for Nvidia. But there were also points of weakness, with 49% of the S&P 500 constituents lower on the day, as financials (-0.92%) and utilities (-0.76%) underperformed. Over in Europe, the gains were relatively strong, with the STOXX 600 (+0.65%) posting another advance.

Asian equity markets are largely continuing their upward trend this morning with Chinese markets notching outsized gains on the back of the MLF rate cut we mentioned at the top. This is the second cut to the MLF in recent months following a reduction to 2.3% in late July. As I check my screens, the CSI (+2.19%) is leading gains across the region having initially risen as much as +3.2% with the Hang Seng (+1.97%) and the Shanghai Composite (+1.74%) also among the top performers. Meanwhile, the Nikkei (+0.34%) is holding on to its gains with the KOPSI (+0.02%) swinging between gains and losses. Elsewhere, the S&P/ASX 200 (+0.08%) is also struggling to gain traction. S&P 500 (-0.16%) and NASDAQ (-0.23%) futures are edging lower.

Turning our attention back to Australia, consumer price inflation slowed to a three-year low of 2.7% y/y in August, down from a +3.5% gain in July, but aligning with market forecasts. Core CPI inflation remains elevated and above the RBA’s target range but did also ease. The trimmed mean inflation rate slowed to an annual 3.4%, from 3.8% in July.

In FX, the offshore yuan briefly hit its strongest level in over 16 months this morning, strengthening to 6.9951 before settling to trade at 7.0107 against the dollar.

To the day ahead, and data releases include French consumer confidence for September, along with US new home sales for August. Meanwhile from central banks, we’ll hear from the BoE’s Greene and the Fed’s Kugler.