China Fires A Monetary Bazooka… It Won’t Be Enough

By Bas van Geffen, Senior Macro Strategist at Rabobank

A fresh coat of paint

After widespread speculation on social media, a Chinese zoo has finally admitted that their “panda bears” are actually “panda dogs”. Or, well, just some regular dogs with painted furs. In similar fashion, the Chinese government now seems to admit that the economy is in a worse state than hoped.

Yesterday, the central bank had already announced a 10bp cut to its 14-day repo rate. More importantly, the PBOC announced a rare press conference for today’s session – sparking market speculation that further measures were forthcoming. Indeed, today Governor Pan Gongsheng unveiled a substantially bigger stimulus package than earlier attempts to stem the bleeding in the property sector:

-

First of all, the PBOC lowered the amount of reserves banks have to hold by 0.5 percentage points, and Pan added that –depending on conditions– the reserve requirement may be reduced by another 25 to 50 basis points before the end of the year. This should –theoretically– unlock CNY 1 trillion in additional liquidity.

-

Whether this liquidity will be drawn depends on demand. To encourage borrowing, the PBOC cut the 7 day reverse repurchase rate from 1.7% to 1.5%, and Pan stated that the medium-term lending facility rate is expected to be cut by 0.3%. The loan prime rate and deposit rates will probably fall by some 20 to 25 basis points.

-

Crucially, these lower rates will not only apply to new borrowers, but also to outstanding loans. Homeowners will be allowed to renegotiate mortgage terms with their current lender, and the central bank is looking into allowing people to switch between banks.

-

Prior easing measures mostly helped new buyers, and not existing homeowners. That led to a flood of early repayments, weighing on China’s banking sector. Of course, the refinancing plan could still affect banks’ balance sheets and profitability, but Pan expects this to be less impactful as financing rates will fall in tandem. The PBOC governor expects that this should lower interest rates on existing mortgages by some 0.5% on average.

-

The central bank calculated that this should lower the mortgage burden for some 150 million people, cutting the annual interest payments by CNY 150 billion. However it is unclear whether only mortgages for first homes may be refinanced (as was the case last year), or if this is also applicable to mortgages for second homes. Since these second-home mortgages come with significantly higher rates, that may partially determine how effectively this proposal will stem early repayments.

-

Additionally, the central bank is clearly looking to revive demand for property. First, the minimum downpayment on second homes will be cut to just 15% of the purchase amount, from an already-low 25%. And secondly, the PBOC will double down on its re-lending programme for state-owned enterprises that buy up unsold property. The central bank will now provide liquidity equal to 100% of the value of the bank loans used for this purpose, up from the previous cap of 60%.

And on top of the support measures aimed at the real estate sector, China is also propping up equity markets:

-

The PBOC will set up a swap facility that gives securities firms, funds, and insurers access to central bank liquidity for the purchase of equities;

-

The central bank is also exploring a re-lending facility that provides listed companies and major shareholders with liquidity to buy back shares.

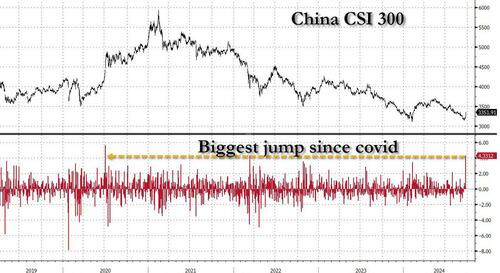

Traders certainly welcomed the comprehensive set of measures. China’s equity indices gained 4% on the day, if this was not simply the result of the stimulus that directly targets China’s stock markets. But, despite this exuberance, are the plans really more than a fresh coat of paint to make things look new and shiny again?

We doubt that the PBOC has done enough to revive the real estate sector, kick-start the domestic economy, and to effectively mitigate the risks of deflation. Mortgage rates and borrowing restrictions may have been lowered, but will households really start purchasing (second) homes again if economic uncertainty is still this high? Broader fiscal measures may be needed to revive consumer confidence, bolster the real estate sector, and to kick-start the domestic economy in order to achieve the government’s growth target.

Whereas the PBOC pleasantly surprised markets today, the Australian central bank stuck to its script. The RBA left the cash rate on hold at 4.35% today, as expected by virtually everyone. The Board’s statement was little changed from August. Policymakers continue to emphasise that inflation remains too high, aggregate demand remains above aggregate supply, and that the labour market is operating beyond estimates of the NAIRU.

In the press conference Governor Bullock mentioned that the RBA did not explicitly consider a rate rise at this meeting. That’s a change from previous meetings where a rate rise was explicitly considered. Our Australia strategist believes this to mean that the hawkish bias of the RBA is all but gone. Recent forward indicators (PMIs) suggest that output prices are rising at a slower pace even as input price gains remain elevated. This suggests that the demand/supply imbalance is no longer so great that firms have pricing power to fully pass on higher supply chain costs. Our house view has been for a first RBA rate cut in May, but today’s meeting clearly skews the balance of risks towards an earlier cut, rather than later.

Tyler Durden

Tue, 09/24/2024 – 11:45

via ZeroHedge News https://ift.tt/KXrCzRT Tyler Durden