Stockman: What The Coming US Election Means For America’s Fiscal Future

Authored by David Stockman via InternationalMan.com,

When in the course of history’s twists and turns dire necessity becomes the mother of invention the hour is usually late. That’s the case with America’s septic fiscal derangement at the present time. There is simply not a snowball’s chance in the hot place that either the Trumpified GOP or the beltway blob-controlled Democrats will lift a finger to deflect America’s fiscal doomsday machine from its appointed rendezvous with disaster.

The latter stems from the UniParty’s bargain with the fiscal devil. It amounts to a coalition of convenience dedicated to the fierce perpetuation of the fiscal status quo at all corners of the budget.

For its part, the Trumpified GOP now says it will no longer be accused by the Dems of planning to throw granny out into the snow. Instead, its very own party platform now says no cuts from Medicare or Social Security. Not even a single thin dime is to be squeezed from what will be the staggering $36 trillion cost of these two programs over the next decade.

That’s right. Neither wing of the UniParty will now even utter the words entitlement reform or spending cuts in the same sentence with Social Security, which alone will cost $20 trillion over the next decade, or Medicare, which will clock in at $16 trillion.

The GOP also reiterates its long standing refrain of no tax increases in any way, shape or form. In fact, it calls for an extension of the expiring Trump tax cut (2025) at a deficit cost of $4.5 trillion over the next decade.

Such an extension, however, would bring down Federal revenues to an average of just 16.5% of GDP—the lowest level since the 1950s. And, no, it won’t even out in the wash of higher “growth” either because CBO’s Rosy Scenario already assumes loads of cumulative real growth owing to no recession or any other economic upset for the next 10-years. Effectively, CBO’s 2.0% real growth with no recession for a decade is the same thing as 3.0% growth interrupted by a normal cyclical downturn and recovery.

In any event, the resulting revenue number of $58 trillion over the 2025-2034 decade would actually give the idea of soaring red ink an altogether new definition. That’s because the baseline spending level during the same period according to CBO’s latest projections is just under $85 trillion or 24% of GDP. So as the Trumpified GOP would have it, Joe Biden’s parting public debt of $36 trillion would reach upwards of $65 trillion by the mid 2030s.

At the same time, the Beltway Blob on the Dem side of the aisle is dug in deeply on the Medicaid/ObamaCare complex and safety net programs like Food Stamps, SSI, unemployment insurance, family tax credits and child nutrition, which would cost about $13 trillion over the decade.

And when push comes to shove in the cauldron of legislative battle, the GOP doesn’t have the cojones to dislodge the Dem defenses in this corner of the budget, either, despite rampant abuse and weak to non-existent work requirements for most of these programs.

Finally, we come to the Forever Wars, the Washington global hegemon, the military/industrial/intelligence/security assistance complex and the $15 trillion of baseline spending over the next decade for defense, international relations and veterans. As it happens, the neocons, war-hawks, the internationalist busy-bodies and the beltway racketeers which infest both parties have locked up this bulging corner of the budget tighter than a drum.

In fact, there is so much loose change seeping through the budgetary cracks of this $15 trillion Warfare State bonanza that the defense think tanks, international NGO’s and multitudinous military contractor lobbying arms are in high clover. The massively swollen national security budget thus funds its own lobbying and self-justification force—a self-licking ice cream cone, as it were.

Therefore, and to summarize: From a slate of $85 trillion of total baseline spending over the next decade we have the following UniParty “No Go”” zones:

-

Medicare and Social Security: $36 trillion.

-

Medicaid, ObamaCare and the Safety Net: $13 trillion.

-

The National Security Budget: $15 trillion;

-

Net Interest on the Debt: $13 trillion.

-

Total UniParty No-Go Zones: $77 trillion.

-

Percent of Baseline Spending: 91%.

In short, the frozen in place UniParty fiscal equation amounts to—

-

A revenue take at 17% of GDP at best.

-

Politically frozen spending at 24% of GDP—or far worse in the likely event that the weighted average cost of Treasury debt happens to rise above the absurdly low 3.0% level assumed by CBO.

-

Annual deficits of 7-8% of GDP or 2X the assumed nominal GDP growth rate as far as the eye can see.

-

A runaway public debt that reaches $65 trillion by 2034 and 166% of GDP or $150 trillion by 2050.

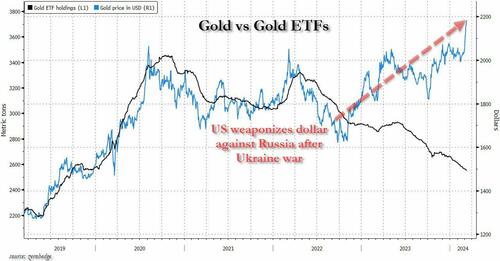

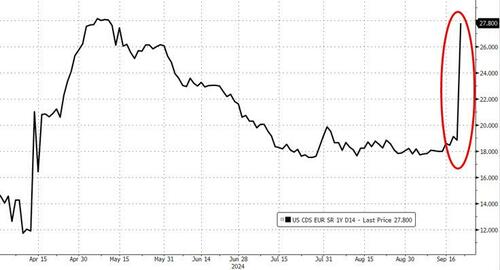

Needless to say, long before the public debt reached $150 trillion the financial system would implode because even the Keynesian mad-men, mad-women and mad-theys domiciled in the Eccles Building couldn’t come up with an excuse to monetize even a small share of the tsunami of public debt now coming down the pike. And make no mistake, the only reason we are at $36 trillion today is that the Fed has enabled it politically. That is, by massively monetizing the public debt it has temporarily deferred what would have otherwise been a severe crowding out of private borrowers and escalation of yields in the bond pits.

Still, we don’t think that the public debt will get to the financial implosion point because we do not believe that American democracy is inherently suicidal. In fact, even in the context of today’s tightening fiscal vice we see the emergent shadows of a path to resolution or at least a stick-save not too far down the treacherous road ahead.

To wit, it is now exceedingly likely that Donald Trump will not only win the 2024 election, but it is also possible that his return to the Oval Office could trigger the Great Realignment that might finally shatter the UniParty’s death grip on the fiscal equation.

To be sure, we italicize the “possible” part for good reason: The Donald is one of the most unstable, inconsistent and unpredictable politicians to ever prance upon the stage of presidential politics in America—so anything can happen, even a worse mis-governance disaster than his first time around the barn.

But our impression is that he is bitterly resentful of the manner in which the UniParty and its RINO wing undermined and ruined his first presidency. So this time he may actually allow himself to be guided and re-directed by the fantastic posse of brilliant dissidents—Robert Kennedy, Nicole Shanahan, Tulsi Gabbard, Vivek Ramaswamy, Tucker Carlson, Elon Musk and JD Vance—who have recently joined or rallied to his campaign. Call it the Good Squad.

Indeed, it is this flying wedge of anti-Washington statesmen and intellects that could constructively harness and channel the Donald’s own inchoate instincts to drain the swamp. If their natural leader, RFK, can use his co-chairmanship of the transition organization to keep the neocons, RINOs and anti-abortion howlers out of the key posts in the next administration, it would make all the difference in the world. And if he could manage to parlay that role into Chief of Staff and de facto deputy president after the inauguration it would obviously be all to the better.

That’s because the GOP needs a big purge. It has been hijacked and led astray from is core fiscal mission during recent decades by ideological factions—neocons, tax cons, right to lifers, nativists and militant nationalists. But during a Trump Administration, which is led or strongly influenced by the Good Squad, the Donald’s promise to settle the Ukraine disaster quickly via partition of the artificial country that Lenin, Stalin and Khrushchev built could trigger the very realignment that is sorely needed.

To wit, much of the neocon Never Trumper brigade has already migrated to the Dems and will cement their departure through specious claims of being “Republicans for Kamala” during the balance of the campaign. But where the potential deal of the century with Putin will have its biggest impact on the Realignment will be among the neocon ranks of Republicans on Capitol Hill.

Upon the Kennedy-Trump led rapprochement with Putin, these befuddled souls will either—

-

Retire from Congress disconsolately.

-

Switch parties to join the rest of the bitter-end Never Trumpers.

-

Or, in the main, see that their whole world view was wrong. That is, after a deal to split up Ukraine, Estonia did not fall, Poland remained free, the Brandenburg Gate was still visited by tourists not Russian troops, and that, alas, NATO could be disbanded with no harm done to Homeland Security.

In turn, what amounts to bringing the Empire Home could finally pave the way for breaking the fiscal deadlock. A Trump foreign policy formulated by the Good Squad would enable at least a 50% cut in defense spending and $5 trillion of savings from the baseline National Security budget over the next decade.

Beyond that, we seriously doubt that even the Good Squad could talk the Donald out of his 10% across the board tariff. But if it is applied to all of America’s $3 trillion of annual imports and not used as a club to start an economic war with China, so be it. A VAT (value added tax) would be a better instrument—but a Trumpified stealthy version might function as a second best alternative under the circumstances.

In any event, a stealthy VAT could generate $3-4 trillion of incremental revenue over a decade, without getting into the mischievous and counter-productive business of raising income, payroll or corporate taxes. And with the fiscal ball rolling in this manner, it is conceivable that another $4 trillion in interest savings, corporate boondoggles, green energy waste and the like might also be cobbled together by a realigned government led by the Good Squad.

Needless to say, $13 trillion of savings over the next decade would decisively stifle the current race to fiscal doom.

Finally, what happens if by some off chance Kamala wins? Or if the Good Squad gets squeezed out and shunted aside in a second Trump White House by the same protectionist, nativist and right-wing loonies who screwed the pooch the first time around?

Well, that’s why Bobby Kennedy will remain on the ballot in 40 states and thereby have the electoral base for a Realigned Anti-Washington Party in 2028. Coalesced around the leadership of the Good Squad and after 4 years of dismal partisan warfare between Kamala and the old guard GOP on Capitol Hill the electorate could be fairly begging for a Realignment next time around.

* * *

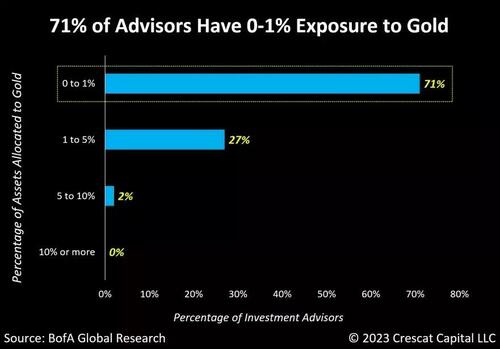

The truth is, we’re on the cusp of an economic crisis that could eclipse anything we’ve seen before. And most people won’t be prepared for what’s coming. That’s exactly why bestselling author Doug Casey and his team just released a free report with all the details on how to survive an economic collapse. Click here to download the PDF now.

Tyler Durden

Mon, 09/23/2024 – 17:40

via ZeroHedge News https://ift.tt/3usCp4T Tyler Durden