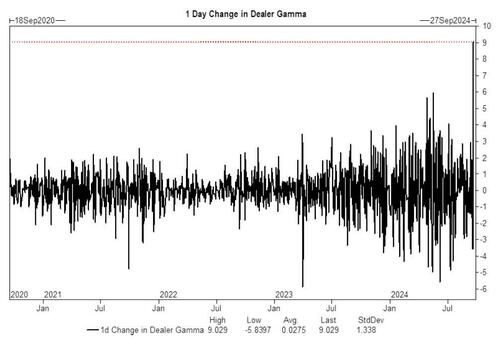

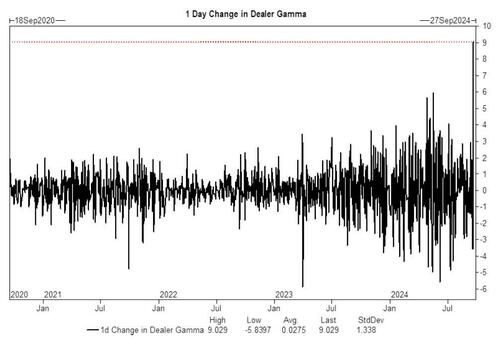

Futures are higher with both tech and small-caps outperforming as a record $9 billion surge in dealer gamma stabilizes markets and buoys the ongoing meltup despite the start of buyback blackout.

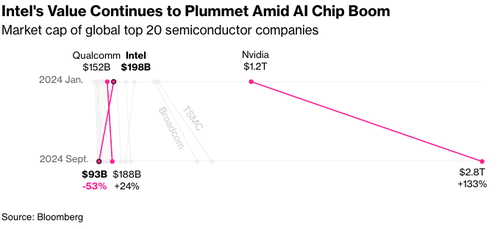

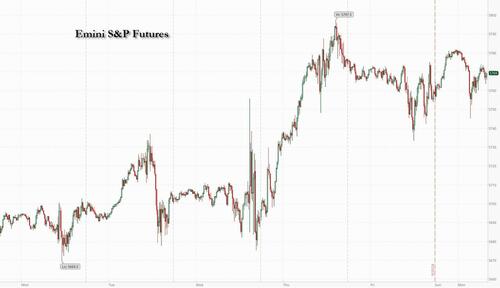

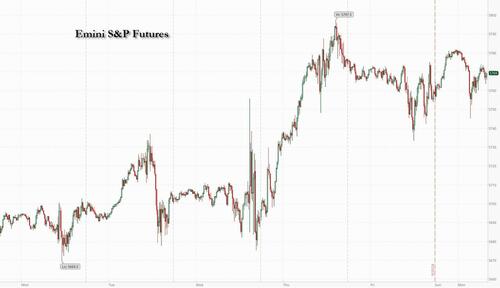

As of 8:00am, S&P futures are up 0.1%, hovering near record highs after the Fed’s jumbo rate cut last week, and erasing an earlier slide that was sparked by the latest recessionary set of European PMI numbers; Nasdaq futures rise 0.2% with semis higher, NVDA up +40bps and INTC +4% on a report Apollo is considering a $5 billion investment in Intel, and follows news that Qualcomm is in discussions to acquire the company. Bond yields are slightly higher as the yield curve twists steeper; USD is stronger but off its best levels of the day. Commodities are higher led by Ags and Energy while Metals are weaker. Post-Fed, we have a somewhat quieter macro data week that will be dominated by Fedspeak but also updates on Flash PMIs, regional activity indicators, Q2 GDP, Personal Income, and Consumer Confidence. One of the market narratives will be the presence/absence of negative seasonality (the 2nd half of September is historically the worst period for the market).

In premarket trading, Intel rose 4% after Apollo Global Management Inc. offered to make a multibillion-dollar investment, according to people familiar with the matter, in a move that would be a vote of confidence in the chipmaker’s turnaround strategy. General Motors declined 2% as Bernstein cut the recommendation on the automaker’s stock to market perform, saying data suggests that there might be rising earnings headwinds.Here are some other notable premarket movers:

- Ciena rises 3% as Citi upgraded the communications equipment firm to buy, saying the overhang from excess inventory and weak demand is gradually lifting.

- Constellation Energy gains 3% as Morgan Stanley raised its price target for the stock, pointing to the company’s plan to invest $1.6 billion to revive its Three Mile Island plant.

- Keurig Dr Pepper ticks 1% higher after an upgrade at Citi, which predicts volume improvement in the US coffee unit in the second half.

- Moody’s and S&P Global (SPGI) slip about 1% as Raymond James cut its recommendations on both, seeing risks to their estimates.

- Palantir slips 1% as Raymond James downgraded its recommendation on the data-analysis software company, saying the stock’s recent strong performance and rich valuation leave little room for error.

- Pinterest gains 2% on a buy-rating initiation from Deutsche Bank, which said the Internet platform is able to attract an “affluent, high purchase-intent user base.”

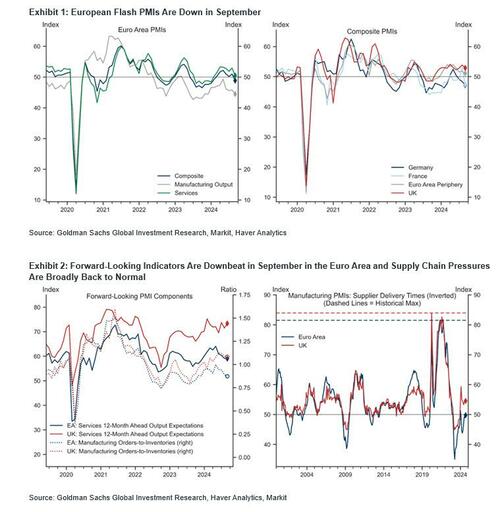

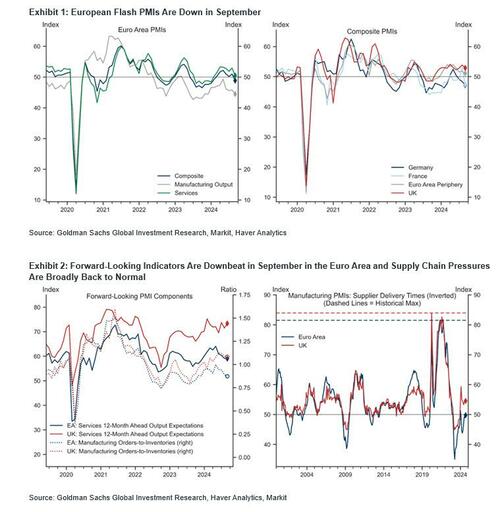

The overnight session was busy in Europe, where weak PMI data for France and Germany on Monday was followed by numbers that showed the euro-area’s private-sector economy shrank for the first time since March. The composite Purchasing Managers’ Index by S&P Global dropped to 48.9 in September from 51 the previous month — below the 50 threshold separating growth from contraction. Analysts had expected the measure to slip only marginally, to 50.5. As a result, investors are increasingly wary of European assets as the region’s manufacturing downturn deepens and political turmoil in France continues.

“The market is almost demanding a more aggressive rate cut, especially after what we have seen the Fed has done,” Marija Veitmane, senior multi-asset strategist at State Street, said on Bloomberg TV. The ECB “is definitely behind the curve,” she said.

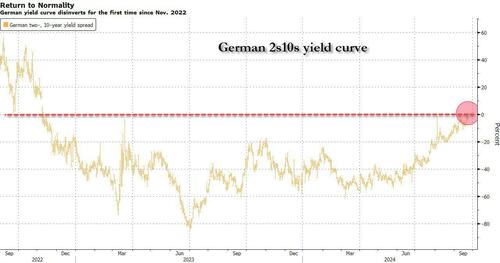

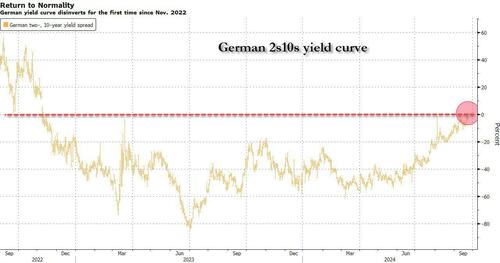

A key segment of the German yield curve disinverted as traders bet the ECB will need to accelerate the pace of interest-rate cuts after the euro-area private-sector economy shrank for the first time since March. The rate on two-year bunds fell below the 10-year equivalent on Monday, bringing the spread between the two tenors above zero for the first time since November 2022. It’s a phenomenon already seen in the US and UK, as the Federal Reserve and Bank of England also loosen monetary policy.

A slate of Fed speakers later Monday including regional presidents Raphael Bostic and Austan Goolsbee may give fresh insight on the pace and scope of easing. Further out, the Fed’s preferred price metric and data on US personal spending will be in focus on Friday.

European stocks were little changed with defensive plays in the food, telecoms, real estate and utilities sectors faring best, while real estate and utilities outperform as banks drag with Commerzbank among the biggest laggards after German government said it wouldn’t sell any more shares in the lender. Here are the biggest movers Monday:

- Rightmove shares rise as much as 5.3% after Australia’s REA Group made a third cash and share offer for the UK property portal, with analysts noting the offer may still be too low

- Barry Callebaut gains as much as 3% after Stifel raised its target for the world’s largest bulk chocolate maker, citing a recent drop in cocoa bean prices and encouraging harvest signs

- Zalando shares rise as much as 2.3% to hit their highest level since April after analysts at RBC and Stifel nudged-up their price targets on the clothing retailer

- Paradox Interactive shares rise as much as 8.4%, before paring gains, after the Swedish game publisher was named ‘stock of the week’ by local business newspaper DI

- Commerzbank declines as much as 6.2% after Germany said it won’t sell any more shares in the lender, in a move that demonstrates its opposition to a takeover by Italian rival UniCredit

- LVMH shares drop as much as 1.6% while shares in Kering decline as much as 2.9% after both stocks were downgraded to neutral at Bank of America on concerns of a luxury slowdown

- Alphawave IP shares slump as much as 43% to a record low after the Canadian semiconductor firm booked an Ebitda loss in the first half and reduced outlook for the full year

- Genmab falls as much as 4.3%, the most in a month, as Nordea cut its fair price target on the Danish biotechnology firm, saying it needs “significant investment” to advance its drug pipeline

- 11 Bit Studios tumbles as much as 39%, the most on record, after the disappointing release of its Frostpunk 2 strategy-survival game, with Santander and Ipopema both cutting their rating on its stock

Investors are increasingly wary of European assets as the region’s manufacturing downturn deepens and political turmoil in France continues. Weak PMI data for France and Germany on Monday was followed by numbers that showed the euro-area’s private-sector economy shrank for the first time since March. Meanwhile, the widening yield gap between France and Germany shows investors remain on edge over France’s political and fiscal challenges since President Emmanuel Macron called a surprise election in June.

A new French cabinet named late Saturday is a patchwork of conservatives and centrists who haven’t always worked smoothly together, and opposition blocs in parliament are threatening no-confidence votes that could topple the government. Investors are concerned that were the government to collapse, it would jeopardize the administration’s ability to pass a budget through parliament over the coming weeks.

Elsewhere, Asian markets were lifted by speculation China is close to announcing fresh stimulus, after a cut to a short-term policy rate and a rare economic briefing scheduled for Tuesday. The MSCI Asia Pacific Excluding Japan Index rose as much as 0.3%, extending gains for a third session. Top contributors to the advance include TSMC, SK Hynix, Xiaomi and Hon Hai Precision Industry. The benchmark in the Philippines closed in bull-market territory, while shares in South Korea and Taiwan also rose. Markets in Japan were closed for a holiday.

China’s CSI 300 Index finished the day 0.4% higher, helped by the central bank’s cut in a short-term policy rate. Several regulators are also scheduled to hold a briefing Tuesday on financial support for economic development, fueling speculation officials are preparing to ramp up efforts to revive growth. Chinese stocks listed in Hong Kong capped their seventh day of gains, the longest winning streak since Jan. 2019.

“The start of the Fed easing cycle should lead to more stimulus from China, particularly as the 5% growth target seems difficult to achieve,” Mohit Kumar, chief strategist and economist for Europe at Jefferies International Ltd., wrote in a note. The “stimulus measures should also be beneficial for Europe.”

In FX, the Bloomberg Dollar Spot Index rose 0.3% and the yield on 10-year Treasuries was little changed at 3.73%. The euro fell, weakening 0.5% against the greenback and toward the bottom of the G-10 FX leader board. Only the Swedish krona has seen a larger decline. The pound drops 0.3% after UK PMI also fell short of expectations, albeit to a lesser extent. Australia’s dollar appreciated on China stimulus hopes.

In rates, treasuries extended yield-curve steepening trend led by German bond market, where 2s10s spread turned positive for the first time since November 2022 after a gauge of private-sector activity shrank for the first time since March. US front-end yields are richer by ~2bp with longer-dated yields slightly cheaper on the day, steepening 2s10s spread by nearly 3bp; 10-year around 3.75% is little changed on the day, trailing German 10-year by ~5bp. A key segment of the German yield curve normalized as traders bet the European Central Bank will need to accelerate the pace of interest-rate cuts after the euro-area private-sector economy shrank for the first time since March. German two-year yields fall 7 bps to 2.16%, below the 10-year equivalent as the curve bull-steepened sharply after the PMI data, widening 2s10s by 3.2bp, 5s30s by 4bp

In commodities, oil prices pared an earlier gain to trade little changed, with WTI near $71.10 a barrel. Spot gold reversed course to fall $3 after earlier touching a record high as the worsening strife in the Middle East fueled wagers on further price gains in the metal due to its haven status.

Bitcoin edges higher and climbs above USD 63.5k, with Ethereum also gaining and holding above USD 2.6k.

The US economic data calendar includes August Chicago Fed national activity index (8:30am) and September S&P Global manufacturing and services PMIs (9:45am); ahead this week are consumer confidence, new home sales, 2Q GDP revision, durable goods orders, personal income and spending and University of Michigan sentiment. Fed speakers scheduled include Bostic (8am), Goolsbee (10:15am) and Kashkari (1pm); Bowman, Kugler, Collins, Powell, Williams, Barr, Cook and Kashkari are slated later this week

Market Snapshot

- S&P 500 futures little changed at 5,763.50

- STOXX Europe 600 up 0.2% to 515.04

- MXAP up 0.2% to 186.88

- MXAPJ little changed at 584.36

- Nikkei up 1.5% to 37,723.91

- Topix up 1.0% to 2,642.35

- Hang Seng Index little changed at 18,247.11

- Shanghai Composite up 0.4% to 2,748.92

- Sensex up 0.3% to 84,801.54

- Australia S&P/ASX 200 down 0.7% to 8,152.95

- Kospi up 0.3% to 2,602.01

- German 10Y yield little changed at 2.15%

- Euro down 0.6% to $1.1094

- Brent Futures down 0.3% to $74.30/bbl

- Gold spot down 0.2% to $2,617.77

- US Dollar Index up 0.44% to 101.16

Top Overnight News

- Today the U.S. Commerce Department is expected to propose prohibiting Chinese software and hardware in connected and autonomous vehicles on American roads due to national security concerns. RTRS

- China cut its 14-day reverse repo rate by 10bp (from 1.95% to 1.85%) and injected ~CNY75B worth of liquidity via the policy tool; China’s PBOC tomorrow will hold a briefing on providing support for the economy, a move sparking speculation of further stimulus steps. WSJ

- Eurozone flash PMIs for Sept slump below expectations as growth cools, with manufacturing coming in at 44.8 (down from 45.8 in Aug and vs. the Street 45.7) and services at 50.5 (down from 52.9 in Aug and vs. the Street 52.3). S&P

- Oyo, the India-based hotel firm, is buying Motel 6 from Blackstone in a deal worth $525MM (the transaction will be a part of Oyo’s US expansion plans). WSJ

- Russia’s red lines have been shredded and its nuclear threats are repeatedly ignored, forcing Putin to search for new sources of deterrence. WaPo

- Israel and Hezbollah exchange flurry of fire over the weekend as fighting continues to dramatically escalate between the two sides. Israeli strike in Lebanon on Friday didn’t just take out a senior military commander (Ibrahim Aqil), but an entire class of senior leaders, part of a deliberate plan to eliminate those most critical to the terror group’s ability to fight a war. WSJ / CNN

- Israel warns Lebanese civilians to evacuate from villages where Hezbollah is storing weapons as the IDF intensifies air strikes. Israel stepped up air strikes against Hezbollah in southern Lebanon this morning, urging civilians to move out of the area. The IDF struck multiple targets as the two sides move closer to an all-out war. NYT / BBG

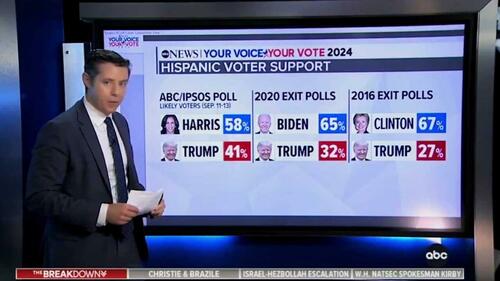

- Kamala Harris is expected to release new economic proposals this week with the proposals aimed at middle-class wealth-building and the economic incentives for business to facilitate that, according to Reuters sources. It was also reported that Harris accepted a CNN debate invitation and challenged former President Trump to a debate although Trump rejected the offer and said it was ‘too late’ for another debate.

- US House Republicans unveil three-month stopgap bill to avert a government shutdown which would fund the government through December 20th and omits changes to voter registration that Trump had called for.

- Apollo offered to invest as much as $5 billion in Intel, a person familiar said, just days after Qualcomm was said to have floated a friendly takeover. The chipmaker is considering Apollo’s proposal. BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly positive albeit with gains capped amid a lack of fresh macro drivers and as weekend newsflow was dominated by geopolitical-related headlines, while Japanese participants were away for the Autumnal Equinox holiday. ASX 200 was led lower by the consumer-related sectors and with sentiment also not helped by a deterioration in the latest flash PMIs. Hang Seng and Shanghai Comp gained after the PBoC cut the 14-day reverse repo rate ahead of next week’s National Day holiday although this was not much of a surprise given that it was the first such operation since the PBoC’s short-term funding rate cuts in July, while automakers were mixed after reports the Biden administration is to propose barring Chinese software and hardware in connected vehicles.

Top Asian News

- PBoC injected CNY 160.1bln via 7-day reverse repos with the rate maintained at 1.70% and injected CNY 74.5bln via 14-day reverse repos with the rate lowered by 10bps to 1.85% from 1.95%, which follows the cuts to other funding rates in July.

- PBoC Governor Pan says will continue to maintain an accommodative monetary policy stance and enhance precision of monetary policy adjustments.

- US President Biden said his view is that Chinese President Xi is looking to buy diplomatic space to aggressively pursue China’s interests and is trying to minimise turbulence in diplomatic relations. Biden said that China continues to behave aggressively in the South China Sea and Taiwan Straits, while he noted the US sees engagement with China as important for conflict prevention and crisis management, according to Reuters.

- US President Biden’s administration is to propose barring Chinese software and hardware in connected vehicles on US roads with the Commerce Department expected to propose making prohibitions on software effective in the 2027 model year and prohibitions on hardware would be in January 2029, according to Reuters sources.

- US President Biden and Japanese PM Kishida reaffirmed a commitment to developing and protecting technologies like AI and semiconductors while increasing resilience to economic coercion, while they also discussed diplomacy with China and destabilising activities including in the South China Sea during a meeting on Saturday.

European bourses, Stoxx 600 (+0.3%) began the session on a tentative footing, trading on either side of the unchanged mark. Indices then took a dip lower ahead of the French PMI metrics, in-fitting with a broader risk-off mood; a move which has since stabilised, with indices now generally sitting in positive territory. Today’s slew of PMI metrics had little impact on the complex. European sectors hold a slight positive bias vs opening mixed, though the breadth of the market remains thin; Utilities takes the top spot alongside Telecoms. Banks lag given the takeover related weakness in Commerzbank (-3.6%). Consumer Products is also towards the foot of the pile, after several companies within the sector received downgrades at Bank of America. US Equity Futures (ES +0.1% NQ +0.1% RTY +0.1%) are flat/very modestly firmer, taking impetus from a tentative session seen in Europe thus far. Today’s US-specific data docket remains light, with focus only on the US PMI release; there are a few Fed speakers today, including Goolsbee, Kashkari and Bostic. “Speculation mounts over potential discontinuation of Nvidia’s (NVDA) H20 chip as US export review approaches”, according to Digitimes

Top European News

- French PM Barnier did not rule out a tax hike for the rich and is open to changes in pension reform with input from employers and unions, while he said they must protect France’s credibility with investors and the government will take pragmatic measures to limit immigration.

- French President’s Chief of Staff said Antoine Armand was named as Finance Minister and Jean-Noel Barrot was named as Foreign Minister, while Bruno Retailleau was named as Interior Minister.

- German Chancellor Scholz’s SPD narrowly beat the far-right AfD in elections in the eastern state of Brandenburg as exit polls showed the SPD at 31%-32% vs AfD at 29%-30%, according to BBC.

- Fitch affirmed Portugal at A- and revised the outlook to Positive.

- ECB’s Kazaks says services inflation is a concern, as is slow growth; direction for rates is downward.

- Spain’s Economy Minister says the Gov’t is lifting its 2024 GDP forecast to 2.7% (prev. 2.4%)

FX

- DXY is boosted by the post-PMI softness in the EUR. DXY has moved back onto a 101 handle and eclipsed last Friday’s high at 101.01. The next target comes via the 19th September high at 101.47, which could be tested following the US PMI metrics.

- EUR is the clear laggard across the majors after a raft of EZ-wide PMI data underscored the region’s soft growth outlook as the boost from the French Olympics proved to be short-lived. EUR/USD had been as high as 1.1167 overnight but has since slipped onto a 1.10 handle.

- GBP is lower vs. the USD but firmer vs. the EUR given the EZ’s awful PMI metrics. Cable was already on the backfoot in the run up to UK PMI metrics with USD boosted by the soft EUR. UK PMI data showed misses across the board but failed to add to Cable’s downside.

- JPY was initially softer vs. the USD and what looked to be an extension of Friday’s price action, but JPY has been able to claw back some gains vs. the USD. USD/JPY had been as high as 144.45, stopping just shy of Friday’s 144.49 peak.

- AUD has trimmed its opening gains vs. the USD but is just about holding above the 0.68 mark. NZD/USD is currently contained within Friday’s 0.6210-60 range.

Fixed Income

- USTs are little changed overall but toward 114-26+ highs given the bullish-bias from the morning’s European data points (discussed below). US PMIs are on the docket today, with a few Fed speakers dotted across the day, including Bostic, Goolsbee and Kashkari.

- A session of gains for EGBs, bolstered by a particularly poor set of Flash PMIs from France & Germany, with the nowcast for the latter pointing to a “0.2% decrease compared to the quarter before”. French number lifted Bunds to a 134.64 peak, before taking another leg higher following the German and EZ-wide figures to a session peak of 134.82; currently, Bunds sit around 134.55 and German yields are lower across the curve but with the short-end under more pressure than the long end.

- OATs are also firmer, with the bulk of action driven by aforementioned data points. Additionally, there is renewed focus on the French political backdrop into the fast approaching constitutional deadline to put forward a budget on October 1st.

- Gilts are propped up by the region’s own PMI release, which dropped from the prior by more than expected but remain indicative of a soft landing for the UK with services. The data took Gilts to a fleeting 100.00 peak, with resistance above at 100.09 from Friday and thereafter 100.39 from Thursday.

Commodities

- A choppy session for the crude complex this morning as the APAC geopolitical gains in the complex were wiped out amid risk aversion in European hours – not helped by the slew of dismal flash PMI data from the region, with the metrics overall endorsing the dovish bias. Brent’Nov in a USD 74.18-75.13/bbl parameter.

- Lower trade across precious metals but spot gold is slightly more cushioned than its peers, with spot silver and spot palladium posting losses of over 2% as the Dollar strengthened. Spot gold resides in a USD 2,613.89-2,631.41/oz range.

- Base metals are lower across the board as a function of the stronger Dollar and risk aversion, with little solace felt from the PBoC’s unscheduled 14-day reverse repo rate cut, although this was not much of a surprise. 3M LME copper has fallen back under USD 9,500/t.

- Chinese Government to revamp tax rebates for fuel oil imports, with change likely effective from October, via Reuters citing sources; would raise import costs for independent refiners and curb fuel oil imports

Geopolitics: Middle East

- “Renewed Israeli raids on southern Lebanon”, according to Sky News Arabia

- Israeli PM Netanyahu said that they inflicted a series of blows on Hezbollah in the past few days that it never imagined.

- Israel Defence Forces said during the weekend that it struck Hezbollah targets in Lebanon after over 100 rockets were fired towards northern Israel by the military group, while it added that strikes would continue and intensify against Hezbollah, according to Reuters. It was separately reported that IDF announced on Monday that it conducted widespread strikes on Hezbollah targets in Lebanon.

- Israel’s Defence Minister said Hezbollah is beginning to feel some of Israel’s military capabilities and Israel will continue its operations against the group until northern Israel residents can return home safely, according to Reuters.

- Israel’s military chief said operations against Hezbollah are a message to anyone in the Middle East looking to harm Israeli citizens, while he added that Hezbollah will keep getting hit until it understands that Israel will return its citizens to their homes safely. Furthermore, he said Israel is well-prepared for the next stages planned in the coming days, according to Reuters.

- IDF spokesman said they have monitored preparations by Hezbollah to launch attacks on Israel and Hezbollah has turned southern Lebanon into a confrontation arena, while the spokesman added that they will hit Hezbollah hard and will work to reduce its power and keep it away from the border. Furthermore, Israeli media stated that warplanes attacked deep into Lebanon 120 km from the border, as well as noted that Hezbollah is preparing to carry out intensive attacks in the coming hours, while the IDF spokesman responded that the army will do whatever it takes to restore security to northern Israel when asked about the possibility of a ground incursion into Lebanon.

- Hezbollah said it targeted Ramat David Airbase with dozens of missiles in response to repeated Israeli attacks on Lebanon, according to a statement. Hezbollah also stated its top commander Ahmed Wahbi was killed during Israel’s strike on Beirut suburbs.

- Hezbollah’s Deputy Leader said the confrontation with Israel entered a new phase of an open-ended battle of reckoning.

- Islamic Resistance in Iraq launched cruise missiles and explosive drones towards Israel’s north and south, while it said it targeted with drones a military post in northern Israel on Sunday morning and launched a drone attack on a target in Jordan Valley in ‘occupied territories’.

- Iran’s Supreme leader Khamenei said Israel is committing “shameless crimes” against children, not combatants, while he called for inner strength among Muslims to eliminate the ‘malignant cancerous tumour’ from Palestine.

- Iran’s Revolutionary Guards said they arrested 12 operatives collaborating with Israel and planning actions against Iran’s security, according to SNN.

- US directly warned Israel against a full-blown war with Hezbollah, according to the FT. It was separately reported that the UN special coordinator in Lebanon said with the region on the brink of imminent catastrophe, it cannot be overstated enough that there is no military solution that will make either side safer, according to Reuters.

- Qatari Al Jazeera TV said Israeli forces stormed its bureau in West Bank’s Ramallah with a military order to close it for 45 days.

- A bomb explosion killed a police officer in the security details of foreign ambassadors in northwest Pakistan, while all foreign diplomats were safe and were reported to travel back to the capital of Islamabad.

OTHER

- Ukrainian President Zelensky thanked the military for a new attack on Russian arsenal and said the end of the war against Russia depends on the decisiveness of Ukraine’s partners, as well as noted that Ukraine’s defences would be better if its partners provided the needed weapons and permission to use them.

- Russian Defence Ministry said Russia hit Ukrainian energy facilities with high-precision weapons and drones, according to agencies.

- Russian Foreign Ministry said Moscow will take no part in the follow-up to the Swiss-organised peace summit.

- US official said Quad leaders expressed concern about the Russian-North Korean relationship, as well as about the South China Sea and maritime disputes.

US Event Calendar

- 08:30: Aug. Chicago Fed Nat Activity Index, est. -0.20, prior -0.34

- 09:45: Sept. S&P Global US Services PMI, est. 55.2, prior 55.7

- 09:45: Sept. S&P Global US Manufacturing PM, est. 48.6, prior 47.9

- 09:45: Sept. S&P Global US Composite PMI, est. 54.3, prior 54.6

Central bank speakers

- 08:00: Fed’s Bostic Gives Speech on Economic Outlook

- 10:15: Fed’s Goolsbee Speaks in Fireside Chat

- 13:00: Fed’s Kashkari Participates in Q&A on Childcare

DB’s Jim Reid concludes the overnight wrap

As the dust settles on the FOMC last week, the main highlights for this coming week are likely to be the core US PCE reading on Friday, an abundance of Fedspeak giving insight into last week’s surprise 50bps cut, the flash global PMIs today, flash CPIs in France and Spain alongside Tokyo CPI on Friday, and central bank decisions from Australia (tomorrow, no change expected), Sweden (Wednesday, -25bps expected) and Switzerland (Thursday, DB expect -50bps).

Fedspeak will probably dominate the week until we reach that core PCE number with Bostic (voter – dovish) opening up proceedings today, followed by Goolsbee (non-voter – dovish) who may give indications that he is looking for a continuation of large rate reductions. Tomorrow and Thursday, Bowman will tell us why she was the first governor to dissent at an FOMC since 2005. Kugler (voter – neutral) speaks on Wednesday and then takes part in a fireside with Collins (non-voter – dovish) on Thursday. Also on Thursday we have the 10th annual US Treasury Market Conference. Powell opens it up with pre-recorded remarks with Williams (voter – dovish) and Barr (voter – dovish) also speaking. So a busy array of speakers and plenty of focus of all of them.

In terms of data, Thursday’s final reading of US Q2 real GDP (expected to be unchanged at 3.0%), and the personal income and consumption report which contains the core PCE will be the main highlights. DB expect core PCE to post a +0.18% gain in August, helping the YoY rate tick up a tenth to 2.7%. The GDP report includes 5 years of revisions up to Q1 2024 so that will be an interesting curiosity that could slightly reshape how we think about this cycle. Elsewhere in the US, tomorrow’s consumer confidence, Wednesday’s new home sales, Thursday’s durable goods orders and Friday’s advance goods trade balance round out the week. The full day-by-day week ahead appears at the end as usual.

Over the weekend Olaf Scholz’s SPD party has narrowly held onto first place in Brandenburg, pipping far right AfD with around 30.9% of the votes to the latter’s 29.2%. This has been an SPD stronghold since unification in 1990 and the popular regional premier did distance himself from the federal government during the campaign so there is less of a read through to national politics than could be thought at first glance. There will also be some concern that this is the third regional election in a row where the AfD has come first or second with around 30% of the votes. Perhaps some tactical voting stopped them winning over the weekend? However no main party will power-share with them so at the moment there is limited implications of their current poll standings, but their rise continues to be on a broadly upward path.

Asian equity markets are mostly trading higher this morning but with trading volumes light due to a holiday in Japan. As I check my screens, the Hang Seng (+0.82%) is leading gains with the CSI (+0.64%) and the Shanghai Composite (+0.73%) also higher. Overnight, the People’s Bank of China (PBOC) have cut its 14-day reverse repo rate (RRR) to 1.85% from 1.95% and have announced a press conference for tomorrow hosted by the top three financial market regulators on “financial support for economic development” according to the official release.

Elsewhere, the KOSPI (+0.30%) is also seeing small gains, reversing course from a negative opening. S&P 500 (+0.33%) and NASDAQ 100 (+0.65%) futures are firm but with US Treasuries not open yet due to a holiday in Japan.

Looking back at last week now, risk assets put in a strong performance, as the Fed delivered a 50bp rate cut and US data continued to point away from a downturn. That combination of the Fed easing into a soft landing has historically proved to be a very favourable one for US equities, and last week was no different, with the S&P 500 up by +1.36% over the week (-0.19% Friday). Moreover, the index hit another all-time high on Thursday, surpassing its previous record from mid-July and marking its 39th all-time high of 2024 so far.

That equity advance was supported by a strong advance for the Magnificent 7, which were up +2.63% over the week (despite -0.40% on Friday). Notwithstanding the slight softening on Friday, there was also an outperformance for banks on both sides of the Atlantic, with the S&P 500 banks index up +4.33% (-0.35% Friday), and the STOXX Banks up +2.67% (-0.10% Friday). Over in Asia, there were solid advances as well, with the Nikkei up +3.12% (+1.53% Friday). However, Europe didn’t share in these gains as the STOXX 600 was down -0.33% over the week after a -1.42% decline on Friday.

Other risk assets responded more positively, and US HY spreads came down -21bps over the week (+3bps Friday), whilst IG spreads were down -5bps (no change Friday). Similarly, Brent crude oil prices were up +4.02% over the week (-0.52% Friday), marking their strongest weekly performance since February. And with the Fed cutting rates by 50bps, there was a bit more concern about inflation again, which pushed gold prices up to a new all-time high in nominal terms of $2,622/oz, having risen by +1.71% over the week (+1.16% Friday).

Meanwhile for sovereign bonds, there was a more mixed performance, but a clear pattern was a curve steepening on both sides of the Atlantic. For instance, the US 2s10s yield curve ended the week at 14.6bps, which is its steepest level since June 2022, just before it became apparent that the Fed would accelerate their rate hikes up to a 75bp pace. That came as the 10yr yield rose +8.9bps (+2.7bps Friday) to 3.74%. Meanwhile in Germany, yields on 10yr bunds were up +5.9bps (+1.0bps Friday) to 2.21%.