Via Kitco News,

“History doesn’t repeat itself, but it often rhymes,” is a popular quote attributed to Mark Twain, and is an important concept to think about with the current state of the world amid ramping geopolitical tensions and deteriorating economic conditions.

Roughly 100 years ago, ‘rhyming’ circumstances were setting the stage for the Great Depression and a Second World War, and if we aren’t careful, there is the potential for the global economy to sink into a deep recession/depression while chatter about the potential for World War 3 is also on the rise.

With major conflicts now including Ukraine v. Russia, the growing threat of Russia v. NATO, Israel v. Palestine, Israel and the U.S. v. Iran, and China threatening Taiwan, among others, while we cannot say that WWIII is underway, it’s not a stretch to say that we are a world at war.

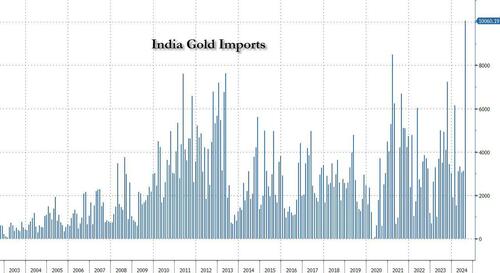

Naturally, the circumstances the world finds itself in are causing consternation for investors, who desperately want to maintain their wealth despite the mounting headwinds they face in doing so, leading many to question if gold, and to a lesser extent, Bitcoin (BTC), could potentially offer protection.

Kitco Crypto reached out to experts on geopolitical and financial matters to get their take on the likelihood of World War III happening in the foreseeable future and what it would mean for gold and Bitcoin.

“There are two forces at work here,” said Martin Armstrong, an economic forecaster and founder of Armstrong Economics.

“First, we have the Neocons who have waged endless wars since the 1960s.”

“Even Robert MacNamara wrote a book and on YouTube you will see his interview before he died explaining they thought Russia was behind Vietnam, but they were wrong; it was just a civil war,” he noted. “You can examine every war and you will find it was based on lies. Tony Blair’s video on YouTube is his Apology for the Iraq War. Again, they were wrong.”

“The Neocons have been relentless in their thirst for endless wars,” Armstrong said. “You have Blinken threatening China over Taiwan when they held 10% of the US debt. That are now net sellers. They only see war – not the economics or the country.”

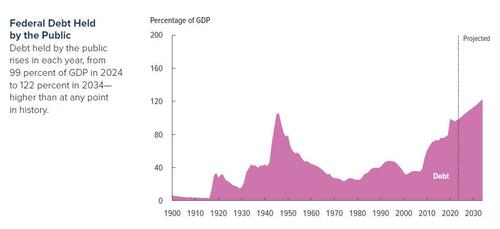

“Second, virtually every country in Europe is now chanting war with Russia thanks to NATO, also a Neocon organization,” he highlighted. “The monetary system of the West is based on endless deficits spending. The default comes regardless of the debt level. The default in these Ponzi scheme unfolds when they cannot find a buyer for the new debt that enables them to pay off the old.”

“This is what we now face for the first time because Biden/Harris Administration has allowed the Neocons to run foreign policy,” Armstrong said. “Governments now NEED to create WWIII for like WWII, all of Europe defaulted on their debt, Britain went into a moratorium, but defaulted on the loans from the USA.”

He suggested that this is the real reason behind the surge in governments exploring the creation of central bank digital currencies (CBDCs).

“This is the real issue behind pushing for CBDCs to eliminate physical money and then everything is traceable,” Armstrong said. “I have spoken with government on both sides of the Atlantic. They assume moving to digital, they will increase tax collection by 35% and terminate the underground economy.”

“Europe routinely cancels its paper currency to prevent people from hoarding cash,” he noted. “America has never done that, which is why the dollar has been the reserve currency someone in China can hold dollars but not euros. Also, the US is a consumer-based economy, so this is why the dollar has been the reserve currency, for Europe needs to see to Americans, as do Asians.”

As for what the potential for WW3 means for investors, Armstrong said it underscores the need to invest in tangible assets.

“Because they will default on debts in the West and this is universal, the only safe place for capital long-term has been tangible assets,” he said. “Some have called it the Everything Bubble, for they do not understand that this is a divestiture from public assets to private.”

“This has been precious metals, real estate, and shares with tangible assets,” he highlighted. “Precious metals in the form of coins will most likely become the currency of the underground economy. Even if you look at the German Hyperinflation, the replacement currency in 1925 was backed by real estate. Tangible assets survive the collapse of currencies.”

As for the effect a major global conflict would have on financial markets, Armstrong said that governments are prepared for this and will take full advantage of it to ‘solve’ their growing list of economic problems.

“Governments are not stupid. They will seek to impose capital control to prevent capital fleeing,” he said. “This will most likely dominate Europe. Just look at the actions they take during war.”

“Abraham Lincoln closed the gold market before it reached $200 in greenbacks in 1864 and claimed people were making money off the blood of others,” he noted. “During World War I, all of Europe closed the share markets, fearing people would sell and take their money to America. The US share market crash by 10% on anticipation that it too would close, which it did the week of July 27th, and did not reopen until December 7th. This was again for capital controls fearing Europeans would sell US shares and take the money home, which did not happen.”

“The lesson we must learn historically from wars is that governments will impose capital controls, and this may be when they attempt to switch canceling paper dollars and forcing everyone into CBDCs,” Armstrong warned.

If this were to occur, “Physical gold and silver will be the only form of money to survive under these conditions,” Armstrong said.

As for ‘digital gold’ and the growing cryptocurrency ecosystem, he warned that they “are entirely dependent on the PowerGrid.”

“As you see already in Europe, targeting people for comments is unfolding just as it has been shown that the Biden Administration conspired with social media to censor and create the cancel culture to shut down free speech,” he noted. “Anything that will transact through the internet will be vulnerable to the government assuming the PowerGrid is even functioning during war.”

For these reasons, Armstrong suggested it would be “best that precious metals are in the form of recognizable coins that the uneducated will accept, such as a $20 gold piece or silver coins dated pre-1965.”

When asked if alternative currencies could benefit from a world where certain countries shun the currencies of adversaries, Armstrong stressed that “All currencies are fiat.”

“The real scheme with these CBDCs is that the IMF is planning to replace the dollar and have already quietly created their own digital currency, and because of the sanctions the US imposed on Russia removing them from SWIFT, this is what gave the drive to establish BRICS.”

“It was geopolitical, not fiat-based,” he added. “The US threatened China with the same sanctions if they helped Russia. Countries realized that the American Neocons have used the dollar as a weapon, and that is what divided the world economy.”

As for going back to a gold standard, Armstong noted that the main problem with doing so is that people have become so accustomed to valuing things in fixed fiat terms that they don’t know another way to approach determining the true value of things.

“A gold standard has always failed when it has been fixed to a specific value,” he said. “Bretton Woods collapsed because you fixed gold at $35 per ounce, but you did not limit the amount of dollars created. A three-year-old could figure out such a system would collapse.”

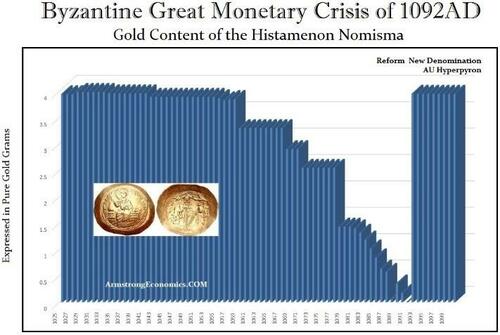

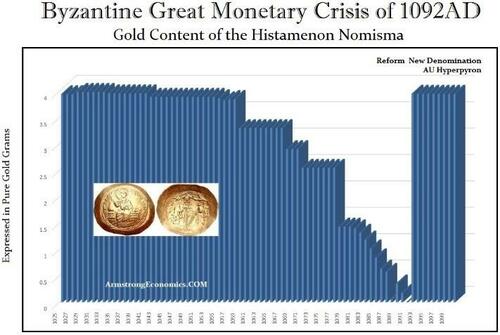

“The only gold standard that has ever survived is when its value freely floated,” Armstrong stressed. “The Byzantine Empire was based purely on gold that floated in value, it too collapsed due to wars and spending that was unrestrained.”

“As Margaret Thatcher once said, socialism works until you run out of other people’s money,” he noted. “The same can be said of government relentless spending to retain power.”

Asked whether the powers that be could use an escalation in war to overshadow a potential economic collapse, Armstrong said, “Wars have been the driving force behind all monetary crises.”

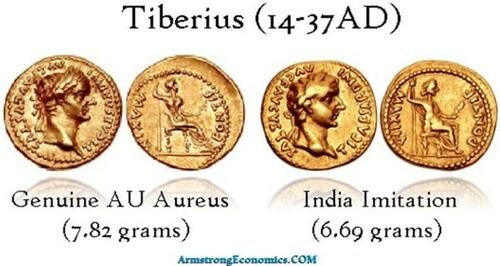

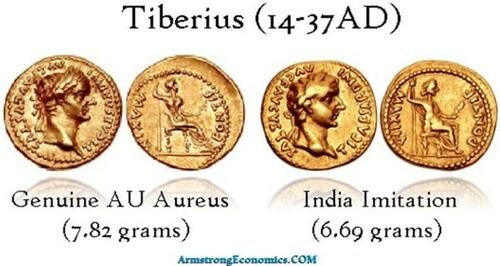

“The value of a currency is always based on confidence,” he explained. “When the Roman Emperor Valerian I was captured in battle in 260 AD by the Persians, despite the fact that coinage was of precious metals, they still carried a premium over the precious metal because, like the dollar today, Rome was the consumer economy that everyone wanted to sell to. India routinely struct imitation Roman gold coins illustrating that there was a premium to the gold when struck by Rome.”

“The Roman Emperor Diocletian attempted to reintroduce silver that had vanished from circulation following the capture of Valerian I 26 years later in 286 AD,” he added. “He raised of the weight of gold coins from a norm of about 70–72 to the Roman pound to one of 60 to the Roman pound. The silver coinage was reintroduced at a rate of 96 to the Roman pound. And he introduced of the so-called follis—a copper coin of about 10 gm.”

“Just as Diocletian revised the monetary system and imposed wage and price controls to tackle inflation, we will see the same unfold,” Armstrong warned. “We will most likely see the US and Europe break apart into separate governments.”|

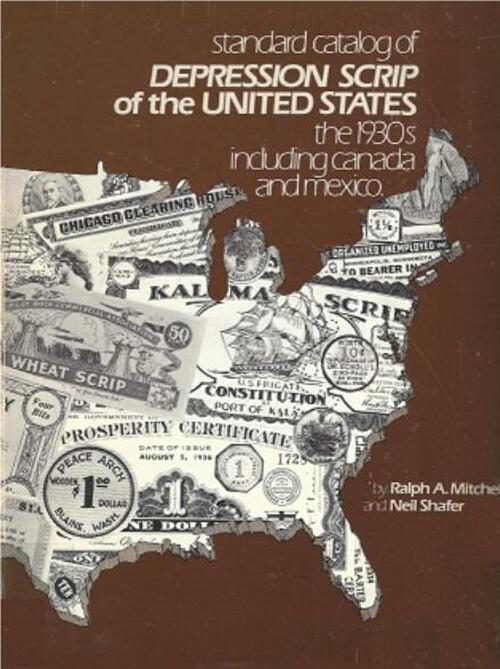

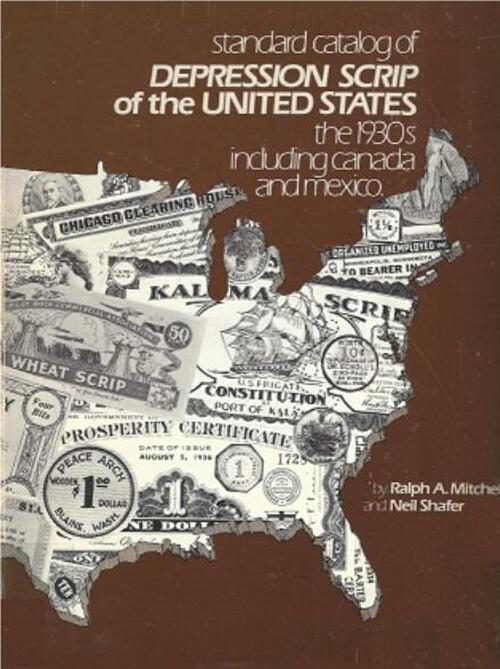

“Most people are unaware that during the Great Depression, over 200 cities issued their own money and collectors refer to these as Depression Scrip,” he highlighted.

“Currencies will also be fiat to some degree, for even when they were gold, they carried a premium based on their economic status,” Armstrong said. “We blame the currencies rather than governments. This is like a murderer claiming it was the gun that killed the people, not that he pulled the trigger. This is going to result in the fall of Republican forms of government.”

“Hopefully, this next version will be a real democracy where We the People decide do we go to war – yes or no,” he concluded. “The last cycle was the end of Monarchy. This one will be the end of republics, which tend to be the most corrupt in history. There was a major debt crisis in Rome and that is why when Caesar crossed the Rubicon, he did not have to fight his way to Rome, the senate fled, and the people cheered. This will unfold again by 2032 as it is becoming wider understood that governments are corrupt and in trouble worldwide.”

USD is too big to fail

Despite the rising number of smaller regional conflicts, Adam Koprucki, founder of RealWorldInvestor.com, doesn’t see a larger global conflict forming.

“It’s unlikely regional conflicts are going to morph into something larger,” he said. “The current administration has done a good job of stepping in where needed, but also drawing hard boundaries so they don’t risk driving up global tensions.”

That said, he noted that global tensions “always have an impact, the key is to monitor to see if the tensions will get worse, that’s when investors should worry. A major global conflict would likely disrupt supply chains and cause immediate and severe shocks in the financial market.”

As for a potential exodus from the U.S. dollar in favor of gold or Bitcoin, Koprucki said that “Unless there is concern about the stability of the U.S. dollar or severe inflation,” he doesn’t think “investors would immediately flock to gold, but more likely so than Bitcoin – which is still extremely volatile.”

When asked if alternative currencies could benefit from a world where certain countries shun the fiat currencies of adversaries, Koprucki said, “Sure, but those countries who would embrace alternative currencies likely already have an unstable fiat currency, so their adaption may not cause further adaption.”

“I think fiat currencies are generally here to stay,” Koprucki concluded. “A transition to another currency would be unheard of. As long as the U.S. government is backing the dollar, it will remain the preeminent currency. The world is too interconnected and dependent on the US Dollar now.”

Bitcoin in a WWIII scenario

“As global tensions rise, the possibility of regional conflicts escalating into a World War III scenario remains uncertain, but the financial implications are clear,” said Dr. Tonya M. Evans, Esq., an expert in crypto policy and law and full professor of law at Dickinson Law. “Historically, wars weaken fiat currencies, prompting investors to seek safe-haven assets like gold. However, Bitcoin and cryptocurrencies are emerging as new alternatives.”

“Bitcoin’s decentralized nature makes it a valuable hedge against inflation and currency devaluation, especially in regions where traditional banking systems may collapse,” she said. “Unlike fiat currencies, Bitcoin’s supply is capped, which protects it from inflationary pressures exacerbated by conflict.”

Evans suggested, “In a global conflict scenario, Bitcoin (in particular) could serve as both a trusted store of value and an alternative and censorship-resistant means of transferring wealth across borders, particularly for those seeking to avoid sanctions or economic fallout.”

“While gold remains a trusted safe haven, Bitcoin’s portability and accessibility offer a distinct advantage in times of crisis,” she concluded. “In my opinion, Bitcoin and cryptocurrencies provide a unique opportunity for financial resilience, potentially becoming even more crucial as the world navigates increasing geopolitical instability.”

Gold to be the go-to safe haven

To help predict what would happen if a global war were to escalate, Jim Cagnina, market analyst at NinjaTrader, used several recent examples to support his outlook.

“Russia invaded Ukraine on February 24, 2022, and since then, the S&P 500 is up approximately 27.5%. Hamas attacked Israel on October 7, 2023, and since then the S&P 500 is up approximately 29.7%,” he noted. “US-based risk assets anchored around regulated exchanges, on the longer term, are sensitive to domestic fundamental factors such as interest rates and inflation. If anything, geopolitical tensions outside the US tend to prop up US-based assets.”

“On-shoring or near-shoring capabilities of the US are more formidable than in the past,” he added. “A good example is the construction of the new 1,100-acre development of TSMC’s advanced semiconductor manufacturing fabrication facility in Phoenix, Arizona. As things get tense overseas, the US can and will pivot.”

Cagnina said another potential result would be a shakeup in the oil market.

“Regarding Crude Oil, OPEC+ seems to be losing its primacy with respect to setting global oil prices,” he noted. “With a potential increase in production being contemplated by OPEC+, the attitude seems to be ‘if you can’t beat them, join them.’”

As for Bitcoin, Cagnina said, in his opinion, it is “too esoteric and volatile to be considered a flight to quality investment.”

“In my experience, most investors struggle to explain what Bitcoin is and its practical purpose clearly,” he said. “Bitcoin futures average true range based on a 14-day look back is over $3,000 or more than 5% on any given day. I would think that flight to quality assets would not typically subject investors to 5% daily fluctuations, which would defeat the purpose. Furthermore, the supply of Bitcoin is highly inelastic, more so than gold.”

“Gold, on the other hand, can act as a flight to safety instrument,” Cagnina added. “Major industrial countries that can afford it have been adding to their gold reserves, most notably the US, Russia, China, Japan, Singapore, and Brazil. I would argue that this is one of the main reasons for gold’s recent appreciation. This accumulation of reserves will reduce supply for the rest of us resulting in additional appreciation as investors completely buy in.”

As for the U.S. dollar, he said he believes that “the US will maintain its world reserve currency status.”

“The dominance of US foreign aid contributions and that of the European Union helps lock emerging economies’ dependency on the US dollar and EURO concerning transactions for goods and services,” he noted. “Central clearing, strong GDP, and strong contract law will be barriers for alternative currencies becoming dominant.”

“In my opinion, if there is another major global war, it will look and be fought completely differently than in the past,” Cagnina concluded. “The currencies that will do well, I think, will be between alliances that can maintain good contract law during the conflict. Deep pockets certainly will help. Having said that, let’s pray that a World War II level conflict never happens.”