The Start Of A “New” Cycle

By Peter Tchir of Academy Securities

The Fed finally cut rates on Wednesday and 2-year yields finished the week higher, 10s didn’t have the decency to rally on Fed day, and according to the Bloomberg WIRP function, the market is pricing in 2.92% by the end of the September 2025 meeting, instead of the 2.84% it had on Monday. So, while the cycle is “new” in terms of actually cutting, with a “surprise” 50 bps, it is difficult to argue that the bond market hasn’t already been pricing this in, perhaps too aggressively!

Stocks were more interesting, as they rallied, faded, rallied, and then faded on Fed day. We then had one of the “crazier” Thursday’s I’ve seen in a while, but on Friday it seemed like we were back to some buying fatigue, though we did have one strong rally off the lows.

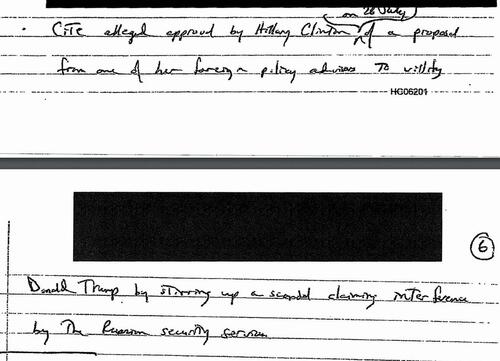

For those of you on Twitter, you might be familiar with Jim Cramer complaining about “pajama” traders. No one seemed to complain about the overnight session driving the show on Thursday as the entire gain for the day came during the overnight session. This chart might be off by a minute or two (not as granular as I would like), but it is clear what happened between 9:30am when the major U.S. exchanges “officially” opened (they all have some element of pre- and post-market trading), to when they closed. The market at best inched higher and probably closed moderately lower. Pretty unusual for an almost 2% up day! That is particularly true of late, when you would expect leveraged ETFs and 0DTE options to amplify the moves – but they didn’t. In a market that has been fraught with often multiple 1% intraday swings (see any number of recent T-Reports), we didn’t even get an intraday “trough to peak” move of 1%! All of that seems weird, and I’m told by some technical traders, that not only was that not constructive, but also the fact that Friday had little volatility and finished lower makes the market precarious, at least from a technical standpoint.

I do suspect that part of the market’s reaction Wednesday night was relief that the Yen didn’t rally (there was concern that a 50 bp move would cause dollar weakness and many still fear the Yen carry trade). Thursday night the Bank of Japan had the opportunity to be hawkish, but they chose not to be, which helped the dollar strengthen against the Yen, but didn’t seem to renew the enthusiasm for the carry trade.

All a bit weird, to say the least.

Torn on Our Own Analysis

We sent a lot of information out on the day of the Fed, including Fed Probabilities, where we had our top 2 probabilities as being a “Neutral 50 bp Cut” followed by a “Hawkish 50 bp Cut.” We actually felt that the Fed would try for the hawkish 50 (I think they did), but the market would interpret it as a neutral 50 (because as much as you jawbone, you did actually just cut 50). Our Conclusion Based on a Preponderance of Evidence was that it was somewhere between a neutral and hawkish 50 bps cut, leaving us with two choices on market reaction from our earlier report:

- Neutral 50. Some initial wavering in stocks and bonds, but then “rally mode.” We got the “initial wavering” but seemed to hit rally mode way faster than expected.

- Hawkish 50. Stocks and bonds sell off, maybe for a day or two, then we can start watching the data and earnings. While we were on edge for a hawkish 50, we certainly didn’t get two days of selling.

Based on our own pre-FOMC thinking, with a 50 bp cut, we should have been looking to buy the dip. We did not, as the bounce came faster and further than anything we expected (especially after Wednesday’s price action seemed to confirm our view that the market was already positioned too bullishly).

The fact that the rally on Thursday didn’t continue to scream higher is a minor miracle given that we seemed to miss our own takeaways, and Friday’s weakness encourages me to believe that we have yet to see the post-FOMC lows.

Going back to last weekend’s Great Debates, it is interesting to point out that the Philadelphia Semiconductor Index (SOX) finished the week only up 0.4%. AI will still be a driving force in this market, and it did not “catch on fire” like you might have felt it did (it certainly felt like it on Thursday after saying not to buy on Wednesday), but even with that, it wasn’t a particularly memorable week.

So what I think happened:

- On very low overnight volume, shorts got squeezed out. Traders who didn’t like the market’s initial response and shorted or kept shorts were stopped out. Anyone hoping for a Yen rally to help stocks got stopped out.

- Retail (presumably across the globe) which associates Fed cuts with lower yields (isn’t always the case, especially out the curve) and in turn sees that as a sign to buy (despite that historically it has often not worked out well) also helped push the buying (probably explains the initial post-opening rally) to the highs of the day.

- Then, as the day went on, many longs decided to take profits, rather than trying to ramp things higher into the close (which surprised me as that has been a reasonably consistent trend).

- Liquidity is abysmal in BOTH directions. The moves to the downside still tend to be more severe, but there is little true depth of liquidity in this market, largely due to market structure.

On the Great Debates:

- On the AI front we can ignore the Fed chatter and get back to earnings, growth, and new evolutions versus the simple question of whether the current cost/benefit ratio encourages companies to continue to spend or to ratchet back a little until costs come down or results advance.

- On the Election front, the status quo of projected gridlock seems to be the most important and seems to be a consensus view. Secondly, each candidate seems to be finding plenty of things to say that are the opposite of what they have done or said in the past, in an attempt to appeal to undecided voters, and the market likes the middle.

- That leaves us with the Fed path.

What if the Economy Isn’t so Slow?

I’ve been in the “bumpy” landing camp for months. For much of that time I felt I had to push back on the “soft landing” crowd and argue (against consensus) that some industries, sectors, regions of the country, etc., could hit rough patches, while others could do okay. I was arguing, often feeling as though it was pointless, that the job data we were getting out of the NFP Establishment Survey seemed misleadingly strong. However, now we even have Powell climbing on board that bandwagon and questioning the validity of the data in his press conference!

I am happy to present the “bear” case. And I think the economy is far from out of the woods, but I think there is a chance that the economy “muddles” along, causing the Fed to be slow to cut further, while markets are forced to meander along until it becomes clear which direction earnings and the economy are headed. I’m still in the bumpy camp, but I just feel obligated (as an angry contrarian) to point out a few positives (or at least things that aren’t as bad as believed but seem to be getting overlooked):

- Consumer Credit. Consumer credit is rising and is back above trend (though not as bad as it looks once you adjust “trend” for the wage inflation “shock” that we’ve had alongside the price inflation shock). We are tracking delinquencies, and they remain “mixed” versus 2018 and 2019, which is our “benchmark” and again, something that Powell seemed to discuss. He did focus more on jobs using the 2018/2019 framework, and we enjoyed seeing him opt to use our idea of ignoring, as much as possible, anything from 2020 until at least early 2023.

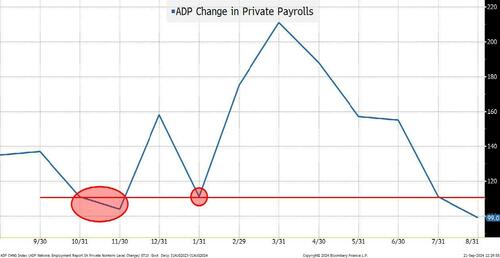

- Jobs. What if ADP is the most realistic methodology?

- While not “great” by any stretch of the imagination, we had some weakness last year as well and even in January (which at the time, was probably dwarfed by the initial NFP Establishment data). Maybe this argues that the Fed should have started cutting earlier (which I think they should have), but it also shows less deterioration than we might otherwise be led to believe and certainly not much out of the ordinary relative to last year. While people (apparently, including Powell) will question the validity of the next NFP report, let me finally say two positives on the data (that might make it more realistic).

- The BLS may have many rules in place that force it to be slow to alter their methodology but given last month’s data (post the big revisions), they seem to have “nerfed” the birth/death model contribution. To me, the birth/death model was producing too great of a share of the total number of jobs and was likely missing shifts in EIN applications that were a function of the GIG economy and no longer translated at the same rate into job creation. If they are “nerfing” this number (making it smaller than it would have been based on the same inputs a year ago) then the data is more likely to be reflective of the real economy – suggesting smaller downward revisions.

- I think the “seasonal” adjustments are off as they include the Covid close and re-opening and are somewhat influenced by weather patterns affecting building in the northeast (as a primary example) where they “boost” jobs in the winter, but then take away jobs in the summer. As the building is occurring in the south and southwest, that “boost” in the winter is too high and the subtraction in the summer is too high as well (even more so, when you consider that some construction gets shut down due to high heat in the summer). If I’m right on this seasonal adjustment, then we could see better data start to creep into the actual data, creating some potential for positive job surprises (still not roaring, but maybe stabilizing at a “replacement” type of level).

- Inflation. I stand by our simple “Covid bubbles” model and think that inflation is beaten (at least for now). If I had only one data point that I could use, I’d use the Manheim Used Auto Index and I’m comfortable with how it is behaving. With so many mortgages locked in at rates below 4%, this cut (or even the next few) will do little to create a wave of refinancing, meaning that it won’t help spending much. I’m not sure 50 bps on credit cards does much, but I do think 0.5% lower on the trillions in money market funds may slow spending in the coming weeks. Those who are taking the income and spending it will be quicker to change their behavior than those paying the interest.

- GDP. Atlanta Fed GDPNow. My understanding is that it has been better at predicting the official number (however accurate that number is) than the economist’s estimates. Driving back to 3% does not strike fear into anyone.

I think the path to rate cuts will be slower than the market is currently pricing in.

The Neutral Rate

This is the rate that is neither too loose nor too tight in terms of monetary policy. That seems like a pretty important number to me. If I know the neutral rate is X% and the economy is chugging along a bit above trend growth (another important, but possibly mythical number), then the central bank can add 50 bps to X and should get the right amount of cooling. A red hot economy might need X + 1.5%. There are two major problems:

- No one knows what to add to X to get the appropriate response in a reasonable period of time (I suspect because that depends on so many variables, of which the Fed Funds rate is only 1).

- No one has a clue what the heck the Neutral Rate is.

Monetary policy boils down to adding/subtracting Y (a number they don’t really know) to/from X (the Neutral Rate) which they also don’t really know!

The purpose of that rant (aside from making me calm down a bit, as rants seem to be a good way to do that), is that I suspect the Fed will be discussing the neutral rate and the terminal rate much more in the coming months. I assume (probably incorrectly) that the terminal rate the Fed poses as the long-run target rate in their projections should probably be roughly the neutral rate (I think their goal would be neutral monetary policy). Which in turn is probably some guestimate of R* and long-run stable inflation estimates (more wild guesses, but I digress and am starting to hurt my own head).

But, we’ve been running at 5% or higher on Fed Funds since May 2023 and until this month, the Fed didn’t think the economy had slowed enough to dial back? It took the Fed over a year to get to 5%, so initially they didn’t think it was necessary to be that high (nor, I suspect, for that long). What if we didn’t get the slowing, because the neutral/terminal rate should be significantly higher than 2.875%? Maybe we’ve been adding the mythical Y to the wrong X?

The real neutral rate will likely get discussed more and more, since now that the official cutting has begun, we can all switch to debating the timing and size of future cuts, and where will it end.

Without a recession, I expect the neutral rate/terminal rate/R* and other important (but entirely guessed at) factors impacting monetary policy will get more attention.

Bottom Line

Moderately higher rates from 2 years on out as we price in a slower Fed, a smaller Fed, and an end point that is higher and takes longer to reach. I think at least 25 bps on 2s vs 10s and think that as we get some more debt ceiling debates, we see the 10-year get back to at least 3.9% with far more risk of moving 50 bps higher than 50 bps lower from here.

Equities. Let’s watch the great AI debate, the election, earnings, and the economy. While I’m nervous that the price action since late Thursday morning gives me confidence that we have an opportunity to buy this market cheaper, remaining small is important when volatility is so high. Adding to disruption, commercial real estate and small caps/value make sense, but again, I think we have to build smaller positions.

On Credit, I feel I’m spending more and more time defending private credit. I like credit as a whole here, as my equity concerns are still more about valuations than economic slowdowns. I continue to think that private credit, for now, is helpful to the overall credit picture and that the debt ceiling debate will once again push investors to be even more overweight credit products at the front end, relative to T-bills (if they can). If you are in the New York area, don’t forget to register here for the October 10th, 5:30 to 7:30pm, Geopolitical and Credit Roundtable led by General (ret.) Spider Marks at Bobby Van’s GCT location.

Lots to digest and I feel awkward pointing out some potential positives on the economy while remaining cautious on equities, but we seem to be in a “good news” is bad sort of environment and positioning is too aggressively long stocks (even with the alleged money on the sidelines, which I think is on the sidelines for a reason and will remain there).

While “officially” the rate cutting cycle has started, don’t get too excited, as it was well telegraphed and is still likely pricing in too much!

Tyler Durden

Sun, 09/22/2024 – 19:15

via ZeroHedge News https://ift.tt/HuxO0vl Tyler Durden