The Emperor’s New Clothes

Authored by Peter Tchir via Academy Securities,

The “big” news on the week, at least the news that seemed to move markets the most, was China’s stimulus plans. It started with some monetary policy, which didn’t do much, but China followed up with fiscal stimulus, and the perception that there is more to come permeated the market thinking. We highlighted in Thursday’s The “Other” Chinese Bazooka that this time, the benefits would accrue much more to China and its companies, than to the U.S. and its companies.

Before delving into our take on how things will play out, let’s highlight just a couple of things from Academy’s Geopolitical Intelligence Group:

-

From Saturday, Israel Kills Hezbollah Leader.

-

And from Tuesday, September’s Around the World where we analyze the:

-

The Middle East and ceasefire discussions.

-

Iran sending ballistic missiles to Russia.

-

The U.S. potentially lifting restrictions on Ukraine’s use of some weapons in Russia.

-

The friction between China and the Philippines (which seems to take a back seat to Taiwan in our meetings, but we aren’t sure that it should).

-

-

Also, this seems like a good place to remind people about Academy’s Credit Focused Geopolitical Roundtable on October 10th, from 5:30 pm to 7:30 pm at Bobby Van’s near Grand Central, led by General (Ret.) Spider Marks. Please register here as space is limited.

-

Finally, while not as geopolitical-focused as the prior Thursday’s discussion on Bloomberg TV (from the 5 to 15 minute mark, with even more focus on geopolitics than usual), we had a lively discussion with Rick Santelli on CNBC live from the floor of the CBOT – which is always a treat. We focused on “bumpy landings” and China.

Maybe I Was Mean

But I really don’t think so.

After an overnight session that initially had U.S. indices rising with Chinese stocks (the Shanghai 300 did even better than the Hang Seng – 16% versus 13%), the performance sagged. Yes, U.S. shares eked out gains of less than 1%. That was nothing like we saw in Asia or even Europe (where the Stoxx 50 rose 4% on the week).

Also, following up on last weekend’s Starting a New Cycle? report, it was noticeable how much of the strength in the U.S. appears to occur overnight, or at the open.

Given that we should have seen some performance chasing on Friday, that seems concerning. September, which started out weak, just like August, managed to fight the “seasonals,” and the major U.S. indices are up around 2% with one trading day remaining. However, there is this lingering concern, for me, that the post-FOMC surge was “strange” and isn’t getting any material follow through.

It seems highly unlikely to occur 3 times in a row, but let’s not forget First Friday’s which have not been kind to markets. While it seems unlikely to occur again, there is nothing about recent trading that makes me believe that we aren’t susceptible to another bout of weakness at the start of October.

You Asked if I’m Scared

And I said so.

We had some great meetings last week in Minneapolis and Chicago. Somehow, with anything geopolitical, it seems that many people want to know “what scares you the most?”

In a world where:

-

Russia is threatening to use nuclear weapons.

-

China fired an ICBM into the Pacific, and there are ongoing risks with the Philippines and with Taiwan.

-

There is escalation in the Middle East (at least Isreal is increasing their attacks, and as discussed in The “Other” Bazooka, I’m in the camp that Iran just doesn’t have the firepower to retaliate effectively).

I answered that my biggest fear, right now, is that the U.S. will grab at a “carrot” offered by China, reducing the pressure on China’s economy and giving them the opportunity to buy a couple of more years to “properly” prepare for the competition with us.

While Sinead O’Connor sang “Through their own words, they will be exposed,” I think General Spider Marks puts it more eloquently – China has a history of “marching in plain sight.” Basically China tells us what they want to do (in this case, to become the economic powerhouse of the world) and we ignore that at our own risk.

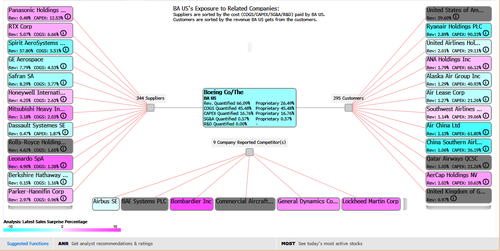

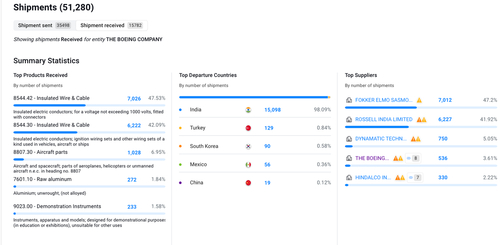

Nothing about the new stimulus plan does anything to derail my view that The Threat of Made By China is one of the biggest threats facing American (and European) companies. The threat to sales in China has already occurred. The threat to sales in Emerging Markets is occurring and we are seeing increasing amounts of competition from Chinese brands in Europe and even the U.S.

You Asked for the Truth and I Told You

I keep trying to come up with a “positive” spin for the global economy on China’s stimulus efforts. But here is what I keep coming up with:

-

Chinese stocks should continue to rally as many investors have been caught underweight the stocks.

-

Chinese stocks will continue to rally because when you look at some of their big names, they trade at a fraction of the multiples of our big names. They probably should, but in a market where many people have spent the last two years trying to catch rotations (including myself, with some modicum of success), the narrative behind “Chinese Stocks are Cheap” seems pretty powerful.

-

You should see Chinese spending increase and it will be heavily allocated to their own brands.

-

This influx of spending and capital will buy the Chinese companies time (and money and scale) to make further inroads regarding their foreign aspirations – which again, should help Chinese stocks.

-

Will their phones get better and cheaper? Will more and more people, including foreigners, fly on Chinese airplanes? Will their chip industry continue to grow and improve?

-

What is the risk that China is able to shift to using more and more Chinese made chips for items requiring mid-to-high level (but not state-of-the-art) tech?

-

All of this is occurring while the U.S. is:

-

Starting another round of theater on the debt ceiling (highly unlikely that we don’t pay anything on time, but highly likely that both sides get to spend a bunch of $$$ on their priorities as part of the “kick the can” negotiations).

-

Political leaders on all sides are more focused on the election than on governing (at least it seems that way to me).

-

About to enter, what many other political systems seem to find awkward, a period of time where we will have a new president, who won’t assume control for almost 3 months after the election. An election that could be mired in controversy – even if it shouldn’t be (there is some small tail risk, I don’t think it is big, but it is there).

At some level, even I’m forced to acknowledge that much of this “doesn’t sound like tomorrow’s problem,” but I fear it is and the markets will continue to price it in, like I think we saw most of Thursday and Friday.

A Big Week on the Economic Data Front

Lots of information coming out, and I’m continuing to lean towards the potential that the jobs data comes in “better” than expected. One thing that would really rattle markets (I think) would be an upward revision in Non-Farm Payrolls. Even writing that seems weird, but since consensus is now so fully on board the “jobs data has been inflated” boat, it is getting very crowded. If I’m correct on the problems with seasonals (too many additions to start the year, too many subtractions in the summer) and if the BLS has “corrected” some of their modelling assumptions around the birth/death model, it wouldn’t surprise me to see a beat on the headline number AND upward revisions. Not sure I want to bet on that, but…

Finally, the discussion is clearly headed towards the “Neutral Rate.” The good thing about that is we all know it is a number somewhere between 0% and 5%.

Seriously, I think we will find that the market is pricing in a terminal rate of sub 3% by the end of the July 2025 meeting and this number is “too low, too quick” (thinking more like 3.5% being the terminal rate and not getting there until the end of the year, unless we go from “bumpy” to “clunky” landing).

Bottom Line

If you want to play the China stimulus (and I do), do it direct via Chinese stocks (I use FXI and KWEB) and don’t assume U.S. “proxies” will do well.

I think oil is the biggest beneficiary of geopolitical risk, but I’m leaning towards “escalation to deescalate” in the Middle East and even, though more hesitantly, between Russia and Ukraine.

On the rates side of the equation, I think 10s and 30s are susceptible to moves higher on steepening, deficit concerns, debt ceiling negotiations, and auctions – call it 4% on 10s.

I continue to like credit as I think that investors should be heavily overweight credit, especially at the front end (2-years and in) and think that the competition from private credit funds and even some big banks to get money out to customers will help support credit spreads from the bottom (lower rated entities) on up.

Now that I’ve actually listened to (I cannot get the song out of my head) and read the lyrics to “Emperor’s New Clothes,” I cannot tell if the song is uplifting, or really depressing. And while I think China might be exposed as “being naked,” I think they are in the process of buying themselves (and their companies) time and that we will aid and abet them in their efforts to spur their economy forward, and we are not seeing the danger to ourselves.

Maybe too heavy, maybe too melodramatic, but it is the path that keeps jumping out at me.

In any case, let’s hope the first week of October starts better than the first weeks of August and September, but I’m starting to believe that we may see a three-peat!

Tyler Durden

Sun, 09/29/2024 – 15:10

via ZeroHedge News https://ift.tt/GT9flcy Tyler Durden