At some point early in 2011, I received a frantic phone call from a woman who was terrified that then-President Obama was going to “close the borders”.

She had apparently been reading some pretty dark forums on the Internet which had convinced her that Obama was going to prevent all US citizens from leaving the country… and she was intent on getting out of the country before that happened.

I spent the first part of our call trying to disabuse her of the rumor. While I acknowledge that anything is possible, I’m also a data-driven person… and there was simply zero credible evidence to suggest that President Obama was going to restrict all traffic into and out of the United States.

But, still, she wouldn’t listen. So I asked her what she wanted to do. She told me that she intended to pick up her entire life and move to Uruguay within the next 48 hours.

Well. Uruguay is a nice enough country. I lived there many years ago for a bit— it’s quiet, pastoral, and, well, there’s absolutely nothing going on. Which is fine. Some people like it that way.

Problem is, the woman I was speaking to had never been to Uruguay. In fact she had never even left the United States before. She didn’t even have a passport.

Not to mention she didn’t speak Spanish, barely knew the first thing about Uruguay, and didn’t know anyone living there.

Worst of all, she was planning on bringing her elderly mother who needed specialized care… without the first idea of how her mother would even be able to obtain the right medication in a foreign country.

But in her mind, these were all trivial concerns. Her fear of Obama closing the borders was the biggest threat in her life, and she had to act quickly.

I was pretty emphatic on the phone and told her that she was would be making the biggest mistake of her life. Fortunately, in the end, reason prevailed, and she didn’t go.

None of this is a knock on her; I’m sure that under normal circumstances she’s a perfectly intelligent person. But that phone call was a pretty stark case study in how powerful certain emotions can be.

Love (or at least infatuation), for better or worse, is one emotion that can make us do some completely irrational things… especially when we’re young and naive.

Hope is another overpowering emotion that can make people ignore obvious risks and dangers.

But perhaps none is more overwhelming than fear. Fear can paralyze us. It can make us lose all sense of reason. Our primate fight-or-flight response kicks in, and the human brain seems to turn off completely.

And given the sheer volume of gargantuan, looming risks in the world right now, it’s pretty easy to feel a certain degree of fear.

For starters, there’s been a lot of talk of “World War III” brewing. And, if we’re intellectually honest, this isn’t crazy. Between conflicts in the Middle East, growing tensions with Iran and China, the never-ending war in Ukraine (including Vladimir Putin’s threats to use nuclear weapons), etc., the prospect of a wider global war breaking out is completely reasonable.

The US national debt is another enormous problem— and not just for America, but for most of the world. It’s extremely likely to result in significant inflation, global economic hardship, and the loss of the US dollar as the world’s reserve currency.

Add to that the border crisis, rising crime, and economic malaise— all of which apply to both the United States and much of Europe.

And I doubt the current state of the US Presidential election, not to mention TWO assassination attempts, is making anyone feel any less fearful.

This is why we’ve been talking about the concept of a Plan B for over 15 years.

But the key is taking rational, sensible steps that put you in a position of strength, no matter what may or may not happen next.

There’s no magic pill, no single action that will solve every problem or eliminate all risk. But there are clear, common-sense approaches.

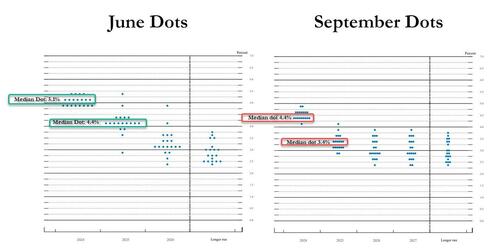

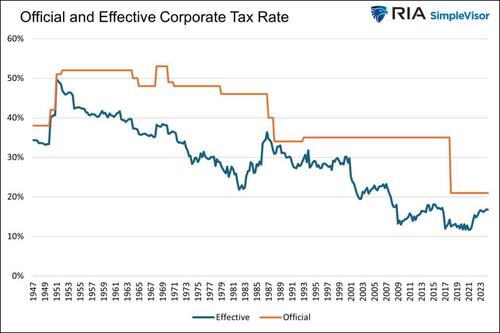

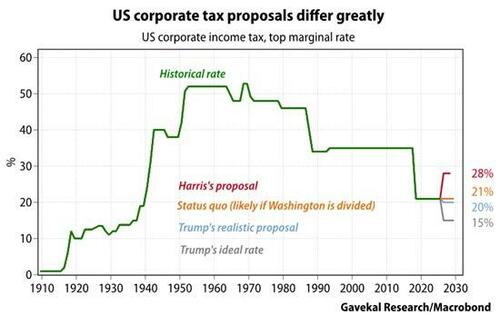

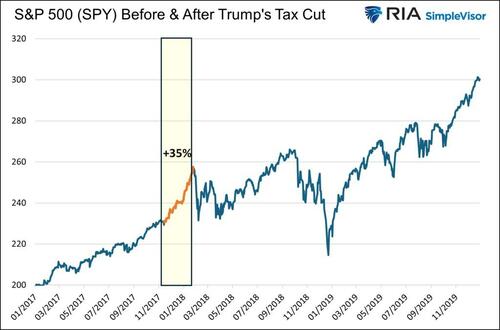

If Kamala Harris wins the presidency, for example, it’s highly likely that taxes will increase. They literally don’t have to do anything, and the 2017 tax cuts will expire next year.

That means more money out of everyone’s pockets going to feed a government beast that wastes taxpayer money on the most insane ways imaginable.

They’ve spent billions of dollars to build a whopping SEVEN electric vehicle charging stations. TENS of billions have been given away to their sworn enemies in Iran and Afghanistan. Hundreds of billions were spent to pay people to stay home and NOT work.

This is how they spend your hard-earned money. Yet if you plan head, there are plenty of completely legal ways to reduce your tax burden, now and in the future.

Inflation is another looming problem, especially with at least $22 trillion in new debt expected over the next 5-10 years.

But there are ways to mitigate inflation’s impact as well. Real assets are trading at historically low valuations (and we’ve been especially bullish on the prospects of gold mining companies, which are incredibly cheap at the moment).

Our premium subscribers also hear all about sensible asset protection strategies, because in a struggling economy, frivolous lawsuits become more common risk.

And with general security threats like rising crime and the possibility of war, it makes sense to have a second residency.

That doesn’t necessarily mean you need to buy a house abroad. But going through the process of obtaining legal residency in a safe, peaceful country, far removed from these issues, is a smart move.

I have a close friend who recently obtained legal residency in New Zealand. His reasoning is that if World War III breaks out and the nukes start flying, that’s where he would want to be.

His reasoning is sound. But notice that he’s not picking up his life tomorrow morning, abandoning all caution, and heading to a new place that he doesn’t know.

He’s traveled to New Zealand many times. He already has a small network. He knows where he would live. He has already filed the paperwork to obtain residency.

So if the proverbial ever hits the fan, he’ll already all the basics in place. If not, he still has residency in a country that he enjoys spending time. There’s not much downside to his plan.

The same thinking applies to second passports.

For example, you might be surprised to find you’re already eligible for a second passport through ancestry.

There’s rarely* any downside to obtaining a second passport. Think of it like fire insurance on your home— you might never need it. But you’ll be damn glad you have one in case the need ever arises.

And in many cases, a second passport you obtain today can also be passed down to your children and grandchildren, so that future generations can obtain the same benefit for decades to come.

But remember the key to a Plan B is staying rational and not letting fear take hold. Making fear-based Plan B decisions is almost always a colossal waste of time and money.

As an example, I recently found out that there are some people on the Internet selling Pakistani citizenship. And when I heard about this initially I thought it was a joke. It’s not.

There are far more legitimate places in the world where one can obtain citizenship in exchange for a financial investment in the country, so-called “Economic Citizenship” or “Citizenship Investment Programs” (CIPs).

St. Kitts, as well as several other Caribbean nations, are famous for their citizenship by investment programs, which start around $250,000 these days.

But if that’s way too much money for you, and you don’t qualify for citizenship by descent, the most rational approach is to pursue legal residency. It’s a perfectly reasonable option.

In places like Mexico, Costa Rica, or, yes, even Uruguay, residency costs almost nothing.

There are far more legitimate places in the world where one can obtain citizenship in exchange for a financial investment in the country, so-called “Economic Citizenship” or “Citizenship Investment Programs” (CIPs).

St. Kitts, as well as several other Caribbean nations, are famous for their citizenship by investment programs, which start around $250,000 these days.

But if that’s way too much money for you, and you don’t qualify for citizenship by descent, the most rational approach is to pursue legal residency. It’s a perfectly reasonable option.

In places like Mexico, Costa Rica, or, yes, even Uruguay, residency costs almost nothing.But I’m sure some people are fearful enough right now that obtaining a Pakistani passport seems like a good idea.

Well, a few paragraphs earlier I wrote that there’s rarely* any downside to obtaining a second passport. Note the asterisk. Pakistani citizenship is one of the few exceptions where there actually is downside.

Sure, for an EXTREMELY limited group of people, Pakistani citizenship might make sense. If your dream is to move to Karachi, then, great, go for it.

But for the vast majority of people, paying $20,000 for a Pakistani passport is— AT BEST— a total waste of money.

If you’re a US citizen, then most likely you’ll end up getting a knock at the door from the Department of Homeland Security. They’ll assume you’ve been radicalized and are operating some sleeper cell, so you and your family will probably end up on some terrorist watch list.

As a matter of fact, the latest moron who tried to kill Donald Trump this week had apparently planned to purchase Pakistani passports in some bizarre plot to recruit people from the Middle East to fight against Russia for Ukraine.

In a separate incident, a Pakistani national had traveled to Iran, before heading to the US, where he tried to hire hitmen to kill Trump… but ended up in an FBI sting.

Suffice it to say, red flags go up around Pakistani passports. This is not a country where most people should want to obtain a second passport, and there’s zero upside in investing a single dollar or minute of your time on such a terrible idea.

Remember, the name of the game is Plan B. Not Plan Stupid.

Source

from Schiff Sovereign https://ift.tt/wlTno1r

via IFTTT