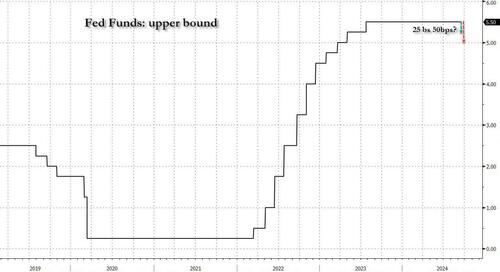

It’s finally Fed day, and futures are up up small with Tech in line and small-caps lagging having largely priced in a 50bps rate cut already (the risk clearly is to the downside if Powell goes 25bps). As of 8:15am, S&P futures are unchanged and less than 1% from all time highs, with the cash index rising for 7 consecutive days, while Nasdaq futures gain 0.2% with Mag7 mixed, and Semis weaker with NVDA -40bps; GOOG +70bps and MSFT +29bps.

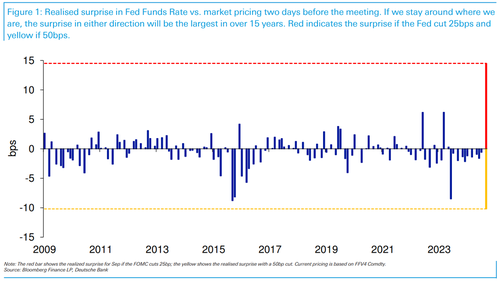

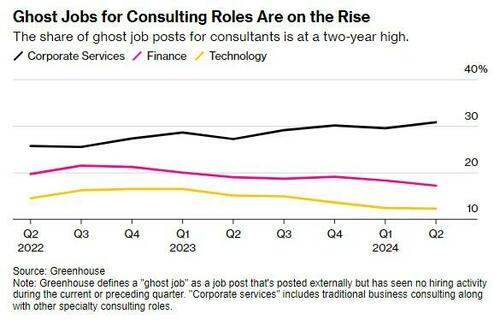

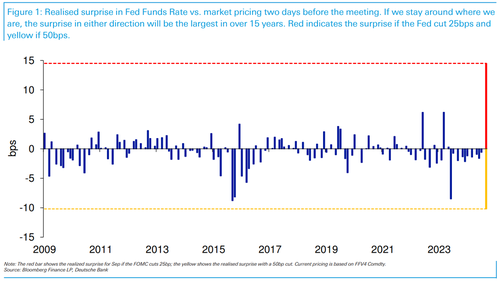

While futures are flat now, they certainly won’t be after 2pm, as the uncertain ahead of today’s Fed decision is unprecedented while wages in a dovish direction are record high. As DB’s Jim Reid notes, “futures are pricing in a 69% chance of a 50bp cut, and given the uncertainty that’s still looming, we can expect a decent market reaction whatever the decision is tonight. You’d have to go back over 15 years to find such an uncertain situation this close to the decision. A lot of money will be made and lost today.“

Bond yields are mixed with the curve twisting steeper; the USD is lower to start the day, trading near 2024 lows. Commodities see weakness in Energy and Metals but strength in Ags. Today’s focus is on the Fed and the press conference.

In premarket trading, Alphabet gained after its Google unit won a court fight over competition with the European Union. Aperol maker Davide Campari NV’s shares fell 6.7% as its chief executive officer resigned after just five months. Here are some other premarket movers:

- 23andMe co-founder and Chief Executive Officer Anne Wojcicki told employees that she remains committed to taking the genetic testing company private following the resignation of its independent board members. Shares are down 9.7%.

- Applied Therapeutics shares jump 40% after the company completed its late-cycle review meeting with the FDA on the ongoing New Drug Application review of govorestat.

- GE HealthCare shares edge up 1.1% after BTIG upgraded the stock to buy from neutral saying the setup for the medical technology company has improved.

- Intuitive Machines shares rise 54% after the company said it got a contract from NASA with a maximum potential value of $4.82 billion.

- Super Micro Computer rose 0.8% as Needham & Co initiated with a recommendation of buy, saying the chip company has a first-mover advantage thanks to its “design of GPU-based compute systems and liquid cooled rack level solutions.”

- United States Steel shares advance 4.0% after a US security panel granted Nippon Steel permission to refile its plans to purchase the American steel company for $14.1 billion.

- VF Corporation shares rise 3.3% after the North Face owner was upgraded to overweight from equal-weight by analysts at Barclays, who expect to see an improvement in the company’s fundamentals over the next four to six quarters.

- Victoria’s Secret shares gained 1.6% in premarket trading after the lingerie retailer’s stock was upgraded to equal-weight from underweight at Barclays, which said the “worst is behind the company.”

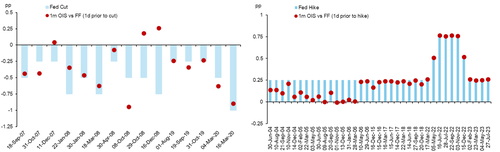

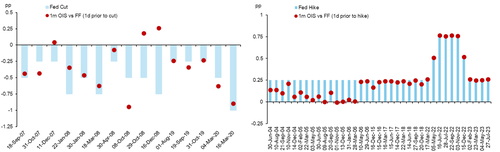

As everyone know, today is when the Fed will cut rates for the first time since March 2020, and all eyes are on the decision at 2pm ET with the FOMC set to deliver their first surprise since the start of the pandemic when the market was debating a 75bps or 100bps cut (in the end nobody remembers it, but what everyone does remember is that that easing cycle sparked the worst inflationary tsunami in generations). In recent cutting cycles, the Fed has surprised on the dovish side during crises (Covid & GFC) but has also under-delivered cuts on some occasions (Sep 2019).

Investors are looking for the Fed to ease policy sufficiently to respond to recent signs of weakness in the economy, achieving a soft landing without stirring concerns that conditions are worse than markets appreciate.

“If they’re doing 25 basis points this time, the likelihood that they can get to a hundred basis points by year end is pretty slim,” said Justin Onuekwusi, chief investment officer at St James Place Management. “So if you don’t get 50, then you’re going to get significant moves in market pricing.”

But while investors see greater scope for the larger adjustment, economist opinions are flipped, and largely anticipate the FOMC will reduce rates by only a quarter point to a range of 5% to 5.25%, though while 114 see a modest cut, 9 economists expect a half-point move.

Fresh quarterly projections in the form of the so-called “dot plot” released at the end of the central bank’s two-day meeting will offer further insight into the path ahead for borrowing costs and the economy. Chair Jerome Powell will also hold a press conference.

“I think they will go 25, but if they do go 50 — how they talk about this will be extremely important,” Torsten Slok, chief economist at Apollo Global Management, said on Bloomberg TV. “That is why the dot plot coming along with the statement today is critical for rates expectations.”

It’s not just the Fed, of course, and we also get the BOJ Friday, although there the market expects nothing from the central bank. Even so, the Japanese yen climbed as much as 0.8%, signaling expectations of a narrowing divergence in policy between the Fed and the Bank of Japan. In the UK, money markets see the Bank of England delivering modestly less easing after services inflation rose to 5.6% in August from 5.2% in July, while the headline figure held at just above the 2% target. The pound strengthened and yields on UK government bonds rose after Wednesday’s data.

European stocks are lower, with technology and heath care stocks falling the most. Auto and banking shares were the biggest outperformers. Stoxx 600 falls 0.4% to 515.48 with 384 members down, 192 up, and 24 little changed. Here are the biggest movers Wednesday:

- Reckitt Benckiser advances as much as 3.3% to hit a six-month high after people familiar with the matter said the company started early discussions with some of the potential suitors for its homecare assets, which could fetch more than £6 billion in a deal

- Ubisoft shares rise as much as 6.2% after BMO Capital Markets raises the video-game maker to outperform from market perform, saying the stock is now “too cheap to ignore” following a selloff triggered by concerns over the Star War Outlaws game

- IHG gains as much as 1.8% after an upgrade to buy at Goldman Sachs, which named the company as its preferred pick among European hotel stocks. Shares in Whitbread edge lower as the broker cuts its rating to neutral

- Campari shares slide as much as 6.7%, hitting the lowest level in more than four years, after the CEO of the Italian drinks maker resigned for “personal reasons”

- Lonza shares fall as much as 2.9% after being downgraded to hold from buy at Intron Health, which says the Swiss company’s recently purchased biologics manufacturing facility in Vacaville, California, could “turn out to be a strategic misstep

- Pandox shares dropsas much as 4.5%, the most in about six weeks, after the Swedish hotel property manager offered 10.8 million Class B shares at a discount via ABG Sundal Collier, DNB Markets, Svenska Handelsbanken, Skandinaviska Enskilda Banken

- Legal & General slides as much as 2.2% after agreeing to sell its UK housebuilding unit Cala Group to funds managed by Sixth Street Partners and Patron Capital for an enterprise value of £1.35 billion

- EQT slip as much as 2.5% after being downgraded to sell from neutral at UBS, with the bank seeing both earnings and valuation risk from the Stockholm-based asset manager

Earlier, Asian stocks traded in a narrow range, with the MSCI Asia Pacific Index steady. Toyota Motor was among the biggest boosts while TSMC dragged on the regional benchmark. Equities fell in India and Taiwan, while key gauges gained in Japan and mainland China. Markets in Hong Kong and South Korea were closed for holidays.

The rates market is currently pricing -40bps (60% probability of 50bps), while commentary the last few days has skewed towards 50bps too, including from former Fed official Dudley and Goldman trader Josh Shiffrin who notes broadly weaker data since Jackson Hole should lead the committee to a larger cut, even as the bank’s chief economist Jan Hatzius continues to call for 25bps amid Fed commentary just ahead of the blackout period. While they think a 50bp cut would be a sensible precaution against further labor market softening, the Fed leadership has communicated a sufficiently dovish reaction function for the bond market to price rate cuts between 25bp and 50bp for several meetings, which also lowers borrowing rates today. On the dots, Goldman expects the median dot to imply three 25bp cuts in 2024 followed by quarterly cuts to just above the longer-run rate thereafter.

In FX, the dollar weakened ahead of the Fed decision where market pricing suggests a near coin flip between a 25- and 50-bp interest-rate cut. The Japanese yen and New Zealand dollar vie for top spot among G-10 peers, each rising 0.6%.

In rates, treasury futures are under pressure in the early US session, following wider losses across core European rates in what’s been a fairly muted session ahead of the fraught Fed announcement at 2pm New York time. Treasury yields are cheaper by 1.5bp-2bp across a marginally steeper curve — spreads remain within 1bp of Tuesday’s close. The 10-year at 3.66% is near session high, higher by around 1.5bp on the day with bunds and gilts in the sector cheaper by an additional 1.2bp and 3bp. Ahead of the Fed decision, swaps market prices in around 39bp of rate-cut premium and a combined 115bp over this year’s three remaining meetings. Further out, a combined 250bp of cuts are priced in by the end of next year. There’s been a surge in open interest in October fed funds futures over the past three sessions, skewed toward long positions targeting a 50-basis-pointc cut this week. In Europe, gilts fell, lagging German counterparts, as traders pare Bank of England rate cut bets after UK CPI rose in line with expectations.

In commodities, oil turned lower after a two-day gain as signs of higher US stockpiles countered concerns that Middle East tensions may escalate further. WTI drops more than 1.5% to $70.10 a barrel, unwinding Tuesday’s gain.

Spot gold is steady near $2,570/oz. We urge readers to use our partners JMBullion for all their gold-buying needs.

Looking the day ahead now, the main highlight will be the Federal Reserve’s policy decision and Chair Powell’s subsequent press conference. The US economic data calendar also includes August housing starts/building permits (8:30am) and July TIC flows (4pm). We’ll also hear from the ECB’s Holzmann, Vujcic and Nagel.

Market Snapshot

- S&P 500 futures little changed at 5,639.50

- STOXX Europe 600 down 0.4% to 515.30

- MXAP little changed at 183.10

- MXAPJ down 0.2% to 572.52

- Nikkei up 0.5% to 36,380.17

- Topix up 0.4% to 2,565.37

- Hang Seng Index up 1.4% to 17,660.02

- Shanghai Composite up 0.5% to 2,717.28

- Sensex down 0.2% to 82,876.71

- Australia S&P/ASX 200 little changed at 8,142.07

- Kospi up 0.1% to 2,575.41

- German 10Y yield little changed at 2.17%

- Euro up 0.2% to $1.1131

- Brent Futures down 0.9% to $73.05/bbl

- Gold spot up 0.0% to $2,569.66

- US Dollar Index little changed at 100.80

Top Overnight News

- Japan posts soft economic data, w/exports coming in +5.6% Y/Y in Aug (down from +10.2% in Jul and below the consensus forecast of +10.6%), with exports to the US falling for the first time in nearly three years, while machine orders dipped 0.1% M/M in Jul (vs. the Street +0.5%). RTRS

- UK inflation for Aug was inline w/the consensus, including headline CPI (+2.2%, flat vs. Jul), core CPI (3.6%, up 30bp vs. Jul), and services CPI (5.6%, up 40bp vs. Jul). RTRS

- Citadel Securities shelved plans to join the ranks of bond dealers that trade directly with the Fed. BBG

- Google won a legal fight with the EU over a €1.5 billion fine for preventing rivals from placing online ads. BBG

- They’ll go 50 [today]. The communication has been confusing but if you follow the path of the data, and the language of Jay Powell at Jackson Hole, it leads me to 50. Powell was very dovish at JH. Didn’t want further weakening in labor market, and data since has been broadly weak. If you follow that line, he will push for a bigger cut given how far they are from neutral. GS GBM (Josh Schiffrin)

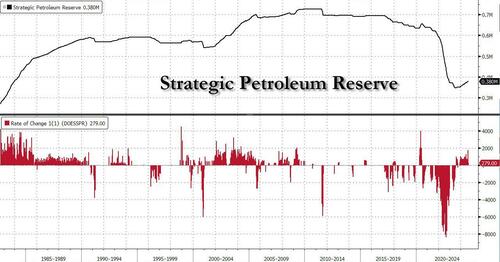

- US crude inventories rose by almost 2 million barrels last week, the API is said to have reported. That would be the biggest surge in almost three months if confirmed by the EIA. Still, supplies at Cushing fell closer to the level that’s seen as its operational minimum. BBG

- Nippon Steel was allowed to refile its plan to buy US Steel, people familiar said, probably pushing a decision on the takeover past November. Joe Biden, Kamala Harris and Donald Trump have said they oppose the deal. BBG

- China’s Foreign Ministry says it is taking countermeasures against some US firms regarding their weapons sales to Taiwan; measures incl. freezing property within China owned by the firms: RTRS

- Retailers in the US plan to hire fewer seasonal workers this year (~520K people vs. ~564K in 2023). RTRS

- Blackrock will launch a >$30B AI investment fund w/MSFT (Microsoft) to build data centers and energy projects related to the technology. FT

- Former Atlanta Fed President Lockhart said he sees a normal 25bps rate cut by the Fed but wouldn’t be surprised by 50bps.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly rangebound with participants lacking conviction heading into the crucial Fed policy decision. ASX 200 was contained amid light macro newsflow and a quiet overnight calendar heading into this week’s central bank updates. Nikkei 225 initially rallied on currency weakness but then reversed course and briefly wiped out its gains after mixed data and as the JPY nursed some of its losses. Some BoJ policymakers are reportedly worried that they may not be able to increase interest rates much further as a stronger JPY would result in cheaper imports, slow inflation and impact corporate earnings, via WSJ citing sources. Shanghai Comp initially struggled for direction on return from the holiday closures before retreating below the 2,700 level. Hong Kong participants were absent from the market, while the weak activity data from over the weekend had little impact and the PBoC delayed its MLF operations once again.

Top Asian news

- PBoC said it will conduct a Medium-term Lending Facility loan rollover on September 25th.

- US is urging Vietnam to avoid Chinese cable-laying firm HMN Technologies and other Chinese companies in its plans to build new undersea cables, while Washington shared intelligence with Hanoi about possible cable sabotage.

- China’s Ministry of Culture and Tourism says there was a 6.3% increase in domestic trips during this year’s mid autumn festival holiday since 2019, reaching 107mln trips.

- Japan’s Government says the economy is in moderate recovery; they keep economic assessment unchanged in September from August.

- Chinese FX regulator says global financial environment expected to improve as developed economies start rate cutting cycle. China’s FX market becomes more resilient, it will continue to play a positive role in stabilising market expectations and trading. Foreign institutes continued to increase China bond holdings in August. Foreign willingness to allocate Yuan assets remains stable.

European bourses, Stoxx 600 (-0.3%) began the session mixed/modestly lower, and slowly dipped lower as the morning progressed. European sectors hold a strong negative tilt; Optimised Personal Care tops the pile, propped up by gains in Reckitt, amid asset-sale related reports. Healthcare is found at the foot of the pile, hampered by losses in Novo Nordisk (-2.1%) after it was reported that Ozempic is “very likely” to be part of the next US price cut negotiations. US Equity Futures (ES +0.1%, NQ +0.1%, RTY +0.1%) are indicative of a very modestly firmer open, with traders mindful of today’s FOMC Policy Announcement, where the Fed is expected to deliver its first rate cut in 4 years. Alphabet’s Google (GOOGL) wins court challenge against EUR 1.49bln EU antitrust fine

Top European news

- Irish Central Bank lowered its 2024 HICP forecast to 1.6% from 1.7% and 2025 HICP forecast to 1.9% from 2.0%, while it cut its 2024 GDP forecast to -0.9% from 1.9% and raised 2025 GDP forecast to 4.6% from 4.4%. Furthermore, it stated that economic growth risks are tilted to the downside and risks to the inflation outlook are broadly balanced.

- The Times’ BoE Shadow MPC said the Bank should leave rates unchanged whilst increasing the rate at which it reduces its balance sheet from GBP 100bln per year to GBP 120bln.

- ECB’s Villeroy says the ECB is likely to continue cutting rates. Regarding France: the plan to cut the deficit would need a balance of around 75% from savings and 25% from higher taxes; for some big firms, could envisage extra effort being made in relation to their taxes.

- Maersk (MAERSKB DC) says due to significant terminal congestions in the Mediterranean and Asia ports, are experiencing substantial delays in vessel schedules. These congestions have resulted in extended waiting times at various ports, impacting ability to maintain a regular schedules.

- UK ONS says house prices increased by 2.2% to GBP 290,000 in 12 months to July 2024.

- Spain’s Economy Ministry revises down 2023 debt-to-GDP ratio by three percentage points, to 105%

FX

- USD is softer with all focus today on the FOMC rate decision. Heading into the release, markets assign a circa 60% chance of a 50bps reduction and a 40% chance of a 25bps move. DXY is currently within yesterday’s 100.56-101.02 range. The YTD low sits at 100.51.

- EUR is a touch firmer vs. the USD with fresh EZ drivers lacking as policymakers continue to downplay the chances of a rate cut next month; currently trading around 1.1130.

- GBP is firmer vs. the USD and EUR in the wake of the latest UK inflation data which printed in-line on a headline Y/Y basis but slightly firmer for core and services. Cable is now back on a 1.32 handle but below yesterday’s 1.3230 peak.

- JPY is firmer vs. the USD on a day which will contrast the respective policy paths of the Fed and BoJ. An extension of the downside could see the pair revisit the sub-140 levels.

- AUD/USD has extended its rally seen since the start of the week which has taken it from a 0.6697 base to a 0.6779 peak. NZD/USD is also on the rise with the pair gaining a firmer footing on a 0.62 handle.

- PBoC set USD/CNY mid-point at 7.0870 vs exp. 7.0828 (prev. 7.1030).

- BoC Deputy Governor Rogers said that the Bank wishes to see more progress on core inflation measures, adding that “there is still work to do”, according to Bloomberg.

Fixed Income

- USTs are lower and towards the bottom end of today’s 115-06+ to 115-13+ parameters. All eyes are on the Fed. The odds of a 50bps cut are currently just above the 60% mark with just under a 40% chance of a 25bps move.

- Gilts are underperforming. Despite an in-line headline print and mitigating factors from base effects and the prior survey period, slightly hotter-than-expected core and services Y/Y UK inflation points have sparked a modest hawkish reaction in Gilts.

- Bunds are pressured, in-fitting with peers. Specifics are somewhat light for EGBs with markets generally awaiting the FOMC. Bunds at the low-end of a 134.49-134.86 band, similarly to Gilts there is now limited support until the 134.00 mark. EZ HICP (Final) passed without reaction.

- German Debt Agency says issue of green federal security scheduled for November 5th has been cancelled.

- UK sells GBP 2.75bln 0.875% 2033 Green Gilt: b/c 3.55x (prev. 3.52x), average yield 3.731% (prev. 4.072%) and tail 0.9bps (prev. 0.7bps).

- Germany sells EUR 0.814bln vs exp. EUR 1bln 1.80% 2053 Bund and EUR 0.82bln vs exp. EUR 1bln 2.50% 2054 Bund.

Commodities

- Softer trade across the crude complex after the weekly Private Inventory data showed a surprise build in headline crude and larger-than-expected builds in other components of the release, which helped to pare some of the geopolitcal induced headlines seen in the prior session. The complex then took another leg lower amid Reuters reports which suggested Russia could hold off oil export cuts in October due to domestic refineries maintenance. Brent’Nov trades towards the bottom end of today’s USD 72.42-73.77/bbl intraday parameter.

- Flat/slightly firmer trade in precious metals as traders bide time ahead of the FOMC announcement whereby the main question around the Fed’s decision is the magnitude of the rate cut to kick off its easing cycle, with a 25 or 50 basis point cut under consideration.

- Base metals are on a firmer footing following early weakness as the DXY eased off best levels and after sentiment around Chinese markets recovered on their first day back from the long weekend, with Mainland China offered the first chance to react to its sub-par activity data from the weekend.

- US Private Energy Inventories (bbls): Crude +2.0mln (exp. -0.5mln), Distillate +2.3mln (exp. +0.6mln), Gasoline +2.3mln (exp. +0.2mln), Cushing -1.4mln.

- PBF’s 166k BPD Torrance California refinery reports unplanned flaring due to malfunction.

- Russia’s Kremlin, on Norway and elevated levels of caesium-137, says there is no alerts from Russian services about the high levels of such isotopes in the atmosphere.

- Russia could hold off oil export cuts in October due to domestic refineries maintenance, according to traders cited by Reuters; sources expect a small rise of exports by around several hundred thousands. Primorsk and Ust-Luga for September has been revised higher by 0.2mln tons to 6.2mln tons, sources state.

Geopolitics: Middle East

- At least 2,750 were injured and 9 died in the pager detonation incident across Lebanon, while the Lebanese Information Minister said the government condemned the pagers detonation as ‘”Israeli aggression”. Furthermore, Hezbollah promised to retaliate after blaming Israel for detonating pagers on Tuesday and Hezbollah Chief Nasrallah was reportedly not harmed in the pager blasts, according to a Senior Hezbollah source cited by Reuters.

- Israeli press cited sources that warned Hezbollah will pay a heavy price if it chooses escalation, according to Al Jazeera. It was also reported that senior Israeli military officials are preparing for a third Hezbollah War which is expected to begin almost immediately, according to Israel’s Channel 14. Furthermore, the security and military weight will shift from the Gaza Strip to the northern front, according to Al Jazeera citing Israel’s Channel 14.

- US officials cited by NYT stated that Hezbollah’s communication devices are Taiwanese and were hacked before they reached Lebanon, while they added that Israel hid explosives inside a batch of Taiwanese pagers imported into Lebanon.

- Taiwan’s Gold Apollo founder said the pagers in the Lebanon explosions were not made by the company and had their brand but production had been outsourced and were made by a company in Europe. Gold Apollo later stated that a company called BAC made the pagers used in the Lebanon blasts.

- “IDF Radio: Raising the alert level in air defense systems and air forces in anticipation of an attack by Hezbollah”, according to Al Jazeera.

- “Israeli media: The commander of the Northern Command presented the Chief of Staff and the political level with a series of plans to launch a ground operation in Lebanon”, according to Cairo News.

Geopolitics: Other

- Russia’s Tver regional governor ordered a partial evacuation of Toropets town after a Ukrainian drone attack sparked a fire.

- North Korea fired suspected ballistic missiles which fell shortly after and appeared to have landed outside of Japan’s Exclusive Economic Zone.

- Taiwan’s Defence Ministry said a Chinese aircraft carrier group sailed through waters to the northeast of Taiwan on Wednesday and then sailed to the southeast of Japan’s Yonaguni island, while NHK reported that a Chinese navy aircraft carrier temporarily entered Japan’s contiguous waters in a first such entry.

US Event Calendar

- 07:00: Sept. MBA Mortgage Applications, prior 1.4%

- 08:30: Aug. Housing Starts, est. 1.32m, prior 1.24m

- Aug. Housing Starts MoM, est. 6.5%, prior -6.8%

- Aug. Building Permits, est. 1.41m, prior 1.4m, revised 1.4m

- Aug. Building Permits MoM, est. 1.0%, prior -4.0%, revised -3.3%

- 14:00: Sept. FOMC Rate Decision (Lower Bound, est. 5.00%, prior 5.25%; Upper Bound, est. 5.25%, prior 5.50%

- 16:00: July Net Foreign Security Purchases, prior $96.1b

- 16:00: July Total Net TIC Flows, prior $107.5b

DB’s Jim Reid concludes the overnight wrap

Do you think the Fed will cut 25bps or 50bps today? If you feel like taking part in our flash poll click on the hyperlink underneath these two numbers above to provide a one click response. It’ll be great if you can take a second to take part. It’ll be interesting to see how far this is away from current market pricing. I’ll publish the answers in a CoTD today later.

As it stands right now, futures are pricing in a 69% chance of a 50bp cut, and given the uncertainty that’s still looming, we can expect a decent market reaction whatever the decision is tonight. You’d have to go back over 15 years to find such an uncertain situation this close to the decision. A lot of money will be made and lost today.

I’ve waivered both ways over the last few days and I’m surprised the Fed has left pricing so uncertain at this stage. However in an era of heavy forward guidance it’s refreshing to see a little less certainty. If that was more widespread I think it would be more rather than less helpful. If you think you know exactly what the central bank will do it is likely to promote more over exuberance in markets which in turn requires a bigger opposite reaction later. I’m sure they’ll be those taking the opposite view though.

In terms of what our US economists expect, their view is the Fed will go for a 25bp cut today but Matt Luzzetti agrees its an incredibly balanced call. He decided against changing his view to 50bps as he believes that even though there’s a compelling risk management case for a larger cut, Fed communications before the blackout period and the balance of data don’t clearly argue for a larger cut. If the Fed do cut by 25bps, then they expect the median dot to show two further 25bps cuts this year, and then a string of reductions in 2025 that take the fed funds rate much closer to neutral by end-2025. Either way, they think Fed Chair Powell will face a communications challenge, as a 25bp cut would raise questions about the Fed falling behind the curve, whereas a 50bp cut would mean Powell needs to avoid sending negative signals about the economy. Click here for their full preview.

If the Fed do go for the larger 50bp cut today, it wouldn’t be the first time that they’ve begun a cycle of rate cuts with a larger move. In both 2001 and 2007 they opened with a 50bp cut, although in those two cases a recession followed within 3-4 months, so that’s hardly inspiring from the Fed’s perspective. The most recent example of a 50bp rate cut came in March 2020, again as the economy was deteriorating sharply given the pandemic, which was then followed up by a 100bp cut just 12 days later. So this is partly why there’s the theory that a dovish decision could panic the markets today, with the argument saying that if the Fed do go for a 50bp cut, that implies they’re pretty worried about where the economy stands right now.

The market dial between 25bp and 50bp continued to waver over the last 24 hours. It had marginally shifted it back towards 25bps earlier yesterday, as neither the retail sales nor the industrial production data suggested the economy was heading into a sharper downturn. In fact, the Atlanta Fed’s GDPNow estimate was updated on the back of those, and it now expects Q3 growth to come in at an annualised +3.0%, up from +2.5% before. So well away from recession territory as it stands. In terms of the specifics, the headline retail sales print was stronger than expected at +0.1% (vs. -0.2% expected), and the previous month was revised up a tenth to +1.1% as well. Then on industrial production, the headline figure was up +0.8% in August (vs. +0.2% expected), and that outperformance more than outweighed the three-tenths downward revision to the previous month. That led futures to initially dial back the chance of a 50bp cut, with the probability falling from 71% at Monday’s close down to as low as 62% intra-day. However, the pattern of a drift towards 50bp pricing in the absence of newsflow then re-emerged, with the probability rising to 66% by the close and further up to 69% as we type this morning.

This backdrop led to an up-and-down session for US equities. The resilient data saw the S&P 500 reach an all-time intra-day high of 5670 (+0.67% at the peak) early on but it later gave up those gains to close little changed on the day (+0.03%). This did still represent a 7th consecutive advance, and the equal-weighted version of the S&P 500 (+0.14%) advanced to a new all-time high. As we pointed out in yesterday’s Chart of the Day (link here), if you look at the Fed rate cut cycles since 1957, this one has seen the strongest advance for the S&P 500 in the year leading up to the cuts. So it’s unusual to see monetary policy eased against the backdrop of such buoyant equity gains.

There was some divergence across sectors yesterday, with cyclical stocks including energy (+1.41%) and consumer discretionary (+0.62%) leading the way within the S&P 500. By contrast, defensive sectors declined, including healthcare (-1.01%) and consumer staples (-0.93%). The outperformance of small-caps was another continued theme of recent days, as the Russell 2000 (+0.74%) outpaced the S&P 500 for a 4th consecutive session. Meanwhile in Europe, equity markets closed before the US gave up its gains, with the STOXX 600 (+0.40%), the DAX (+0.50%) and the FTSE 100 (+0.38%) all moving higher.

In the meantime, sovereign bond yields moved off their recent lows, as the strong US data saw investors slightly dial back the likelihood of rapid rate cuts. By the close, that meant the 2yr yield was up +5.4bps to 3.61%, whilst the 10yr yield was up +2.8bps to 3.65%. The uptick in rates was echoed in Europe, where yields on 10yr bunds (+2.1bps), OATs (+2.7bps) and BTPs (+2.0bps) each moved a bit higher as well.

The rise in US rates was led by breakevens, which ticked up for the 5th session in a row as oil prices continued to recover from their post-2021 low seen last week. Brent crude was up +1.31% to $73.70/bbl, in part amid renewed concerns over Middle East escalation after a wave of pager explosions in Lebanon that appeared to target Hezbollah, which in turn blamed Israel for the attack.

In Asia markets are pretty flat with most just above or below the flat line including China where markets have resumed trading after the early week holiday. Hong Kong and South Korea are still closed for holidays.

Early morning data showed that Japan’s export growth slowed sharply in August, rising +5.6% y/y (v/s +10.6% expected), up for a ninth straight month and against a downwardly revised +10.2% y/y increase the previous month. Meanwhile, the value of imports grew +2.3% y/y in August, versus a +13.4% increase expected by Bloomberg. As a result, the trade deficit stood at -695.3 billion yen (v/s -628.7 billion yen last month) compared with the forecast of a deficit of -1.43 trillion yen. A reminder that the BoJ are widely expected to keep interest rates on hold at its two-day meeting ending Friday.

Looking at yesterday’s other data, the German ZEW survey came in noticeable lower than expected, with the expectations component down to an 11-month low of 3.6 (vs. 17.0 expected). The current situation also fell back to -84.5 (vs. -80.0 expected), which is the lowest reading since May 2020. Meanwhile in Canada, inflation fell a bit more than expected in August, with CPI coming down to +2.0% (vs. +2.1% expected).

To the day ahead now, and the main highlight will be the Federal Reserve’s policy decision and Chair Powell’s subsequent press conference. Data releases include the UK CPI for August, along with US housing starts and building permits for August. We’ll also hear from the ECB’s Holzmann, Vujcic and Nagel.