The EU Retreats Further Into A World Of Self-Delusion

Authored by Conor Gallagher via NakedCapitalism.com,

The situation in Europe is getting so bad on so many different levels, the Brussels crowd had to bring in “Super” Mario Draghi to save the day — or at least write a report telling them what to do…

Draghi has spent time at Goldman Sachs, the European Central Bank (ECB) during the sovereign debt crisis, and as unelected prime minister of Italy during the early days of the Covid pandemic and runup to Project Ukraine. Depending on where you sit, he could be an odd choice to chart a path forward; while Draghi knows his way around a crisis control center, he’s also plenty experienced at creating them.

He was one of the chief architects of the EU’s disastrous economic war against Russia and he’s always been a grim reaper for working class citizens of his native country of Italy. No wonder that for months the neoliberal, war-loving spreadsheet crowd in Brussels has eagerly awaited the report as if it is manna from heaven that will help deliver them from the corner they have backed themselves into.

Curiously, his report was delayed by months, which only increased the anticipation, and it finally dropped last week, conveniently timed at another crisis point. Project Ukraine is quickly unraveling and pressure is coming from all directions for Berlin to give the go ahead for joint EU debt in order to make the EU “competitive” again and buy a bunch of weapons to do something (nobody is too sure of what exactly) about Russia. Indeed, Draghi’s report doesn’t say, nor does it ever consider making nice with Moscow.

That’s because the report, “EU Competitiveness: Looking Ahead” is a political document more than economic one intended to not only give cover to the bloc’s disastrous Russia policies, but continue to double down. And it is already being used as more ammunition for those in the Baltics, Poland, the media, US-funded think tanks in Europe, and more who are calling on Germany to support debt for an extended Cold War. Specifically, they wanted Super Mario to tell them how to get out of the predicament of their own making without changing course on Russia and a host of other issues, and Draghi delivered — as long as you don’t let reality get in the way. His answer? More money. Lots of it.

He calls for massive infusions of cash into multiple sectors: green, tech, energy, and of course defense. According to Draghi, the price tag is a minimum of 800 billion euros annually until 2030.

Asked if his message was “implement your report, or die?” he replied that “It’s ‘Do this, or it’s a slow agony.’”

The EU certainly needs an economic plan, but Draghi’s report never questions whether ongoing belligerence toward Moscow (and loss of pipeline Russian gas) is in the bloc’s best interest and it never mentions Brussels’ obsession with austerity, which is once again being forced on member countries. From a purely economic standpoint, the report is trash economics that reads like something out of the late-stage USSR, according to economist Philip Pilkington.

But it does plug nicely into the political economy of today’s EU, which is being subsumed under Washington and NATO. It is engaged in open economic war and an proxy war in Ukraine against Russia, both of which have hurt working class citizens across the bloc. The austerity-obsessed EU is once again forcing its member states to enact austerity budgets. Draghi’s report was requested by European Commission President Ursula von der Leyen, who is working to amass more power to her mostly unaccountable throne, and is one of many voices calling for a defense union and militarization and the ability to borrow and potentially levy taxes to pay for those debts.

Source: https://x.com/WhiteHouse/status/1454246494010318850

So while Draghi’s report is ostensibly about across-the-board bloc “competitiveness” (there’s plenty on weakening antitrust, for example), Russia still dominates the conversation in the halls of power. Von der Leyen wants to create an “air shield” against Russia. The EU’s new High Representative for Foreign Affairs and Security Policy is proposing a €100 billion (to start) eurobond issue to pay for more weapons to be used against Russia.

And Poland, one of the biggest backers of the war against Russia, might also be getting additional input over a whole lot of EU money. Piotr Serafin, a Tusk confidant and Poland’s European commissioner in Brussels, looks likely to be in charge of the EU Commission budget portfolio, one of the most powerful positions as the bloc is set to sort out its seven-year spending plans.

What these people do with a blank check in the name of competitiveness?

The very same week Draghi’s report came down, so did another from Nicole Koenig, head of policy for the Munich Security Conference, commonly referred to as “Davos with guns.” It is set to welcome in current NATO figurehead Jens Stoltenberg as its new chairman next year, and Koenig endorses the idea of a debt-based fund to fuel weapons purchases as part of a European defense union.

Despite all the buildup to Draghi’s report and it being accompanied by similar calls from the Munich Security Conference and every American plutocrat-funded think tank, the immediate response out of Germany was mostly nein.

Germany’s Finance Minister Christian Lindner said plainly that “Germany will not agree to this.”

Lindner is part of the three party ruling coalition that would be unable to garner 33 percent of the vote if elections were held tomorrow. His fiscally conservative Free Democratic Party currently polls around 3-4 percent — not even enough to get them seats in the next Bundestag.

Friedrich Merz, the leader of the Christian Democratic Union (CDU) and current odd-on favorite to be the next chancellor of Germany, said the following: “I want to say this very clearly, now and in the future, I will do everything I can to prevent this European Union from spiraling into debt.”

The CDU currently polls around 31-33 percent nationally. The insurgent party on the left and right, the Alternative for Germany (17-19 percent) is anti-EU and would never support joint borrowing. I haven’t seen a position from the Sahra Wagenknecht Alliance (7-10 percent), but would imagine its hyperfocus on German working class issues means it is also not in favor.

Robert Habeck, leader of the war mongering Greens (10-12 percent), is in support.

Chancellor Olaf Scholz is remaining silent on the issue, omitting any mention of it from his Wednesday speech to the Bundestag. While he has in the past made his opposition known, it’s worth knowing if his thinking has changed as it did repeatedly for nearly every step of escalation in Ukraine. Scholz’s government enjoys record unpopularity, and his Social Democratic Party is being decimated — in the European elections they were embarrassed, in recent state elections they were thrashed, and in national polling they have fallen from 26 percent of the vote in the 2021 election to 14 percent currently.

So yeah, the timing for Berlin to deal with such major European funding requests is not ideal. From another point of view, though, maybe there’s no better time to take advantage of the chaos and get the green light from the lame duck government in Berlin. There are once again rumblings that Scholz should step aside and clear the way for his pugnacious defense minister Boris Pistorius who has been pounding the table for endless military spending ever since he was plucked from the obscure position as the Saxony State Minister of the Interior and Sports.

Secretary of Defense Lloyd J. Austin III is greeted upon arrival to the Ministry of Defense in Berlin by German Defense Minister Boris Pistorius and US Ambassador Amy Gutmann Jan 19, 2023. (DoD photo by U.S. Air Force Tech. Sgt. Jack Sanders)

Any attempt to enact a joint borrowing scheme would require unanimity from the European Council, which is composed of all the bloc’s heads of state, but there is a belief that if Germany goes along others like the Netherlands can be persuaded.

Germany is dealing with its biggest political upheaval since World War II, it’s deindustrializing, and it’s in a recession largely caused by structural problems and its own missteps. Standards of living are declining following years of record immigration, and it’s all combining to produce the most unpopular government in modern German history.

Despite all Germany’s problems, it is still the most powerful economy in Europe that drives the bloc, and any major EU changes must run through Berlin.

And everyone is pressing now.

Poland and the Baltics are haranguing for more. Southern Europe is on board. Countries like Italy and France have supported joint borrowing for years.

US-funded think tanks stateside and in Europe, which really act as plutocrat-funded shadow governments, are pumping out piece after piece about how Europe (Germany) must use joint debt to fund defense.

Here’s yet another recently-released report from the Council on Foreign Relations, “From the Ukraine Conflict to a Secure Europe.” It argues like so many others that the EU, as an auxiliary to NATO, must take the lead role in ensuring that Russia is bordered by unfriendly states:

A European pillar based on the EU would go a long way toward easing if not eliminating the continuing tension between NATO and the EU in the field of security. For all practical purposes, the EU would become a member of the alliance, and cooperation between the two entities should be seamless. Non-NATO EU members would thus enjoy an implicit Article 5 security guarantee, which would be extended to new members as the EU expanded to include non-NATO allies in the Balkans and the former Soviet space.

Unfortunately for Germany and the EU, that will also include propping up whatever is left of Ukraine and probably making sure its bondholders are made whole while still finding spare change to bring Armenia, Moldova, Georgia, and who knows, Kazakhstan(?) on board as well. How to pay for all the color revolution efforts, bribes, military hardware, state aid, and everything else required by the EU’s now-openly subservient role to US imperial ambitions? The CFR piece cites Macron’s big April speech at the Sorbonne as a blueprint, which of course requires common EU debt.

Yet Germany remains opposed.

The country is dealing with its own budget woes and is cutting almost everywhere except on the military. It has a constitutionally-enshrined cap on spending, known as the debt brake, which it tried to sneak around last year, but a court struck it down. And Berlin is even cutting contributions to the EU rather than looking to back bloc-wide debt.

At issue is how EU debt would be repaid. It would either be done through the creation of new EU budget resources, such as taxes levied by the bloc, or through an increase in member states’ contributions to the budget.

Following the release of Draghi’s report, German bond yields rose as investors placed bets on more spending and, therefore, more rate hikes. As I understand it, it would also make the currency stronger since the debt would be safer, and that would be about the final nail in the coffin of the German model as a stronger euro would be another strike against Germany’s export-oriented industry — or whatever is left of it.

At the same time that German yields rose, however, Italy’s borrowing costs fell. That’s because if the EU and its AAA rating covered the debt of poorer member states or borrowed directly to cover member states’ energy crisis needs and more military spending, countries like Italy would have an easier go of it.

Italy currently pays a little under five percent on its 10-year debt, while the EU pays just over three percent. That’s why countries across the EU south, which face higher borrowing costs, are in favor of EU-wide bonds. Countries like Italy in southern Europe have faced decades of privatizations, budget cuts, and wage suppression in efforts to appease the market gods all to no avail.

How fitting that it would be that joint debt might finally get the go-ahead, not to improve the lives of citizens, but to spend hundreds of billions on a bunch of weapons that will leave them bankrupt and still outclassed by Russian firepower and manpower. Maybe there’s some hope for some military Keynesianism militarism effect, but at least to start with, it will likely be funding overpriced and ineffective American weapons.

One can read in Draghi’s plan or Macron’s Sorbonne speech about their concerns for the working man, European families, as well as the climate, and should a plan for joint debt go through there will no doubt be efforts to spin it that way (there already are) but it’s not hard to see where the priorities lie.

The release of his report comes at the same time that the EU is pushing more austerity on its members states. Brussels is then turning around and using those artificial budget shortages as a reason to borrow at the EU level to cover military expenses.

Bloomberg reported back in March that EU officials and investors are using the fiscal rules to push for an EU-wide bond program that would bring investors bigtime profits while allowing the bloc to ramp up military spending without individual nations incurring more debt. See? Win-win, except for the vast majority of Europeans who work for a living and will continue to see social services crumble while life gets more expensive.

This is not a plan to “save” Europe. It is part of the ongoing effort to recreate Europe as a neoliberal paradise for the financial sector and an anti-Russian servant to Washington.

No hundreds of billions in weapons purchases and streamlining will make a difference in Ukraine or in some hypothetical war agaisnt Russia, but it does take advantage of the self-inflicted crisis to shift more power to Brussels, reward investors, and punish workers holding back productivity. The report laments how the US is so much more “successful” in the realms of private equity and venture capital, and has such higher productivity in sectors like healthcare. Yes, who wouldn’t want to emulate the US healthcare system? Maybe all the military hardware will be useful in disciplining the local population in the name of competetiveness, however:

We should be moving to a four day work week, not a six day one. Forty percent or more of of jobs are either pointless or actively harmless. Get rid of them to start. https://t.co/Ubdr4Q5VCi

— Ian Welsh (@iwelsh) July 2, 2024

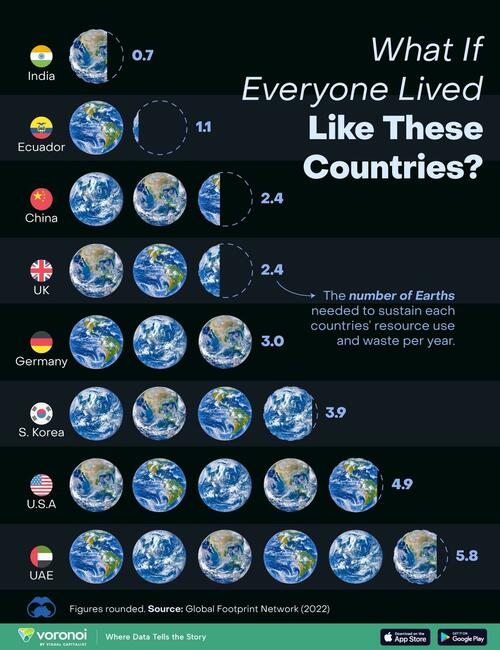

Think a lot more EU spending will benefit the bloc’s climate goals. There’s a good chance it could take money away from energy investment as Draghi’s report calls for Brussels to free up funding by modifying the European Investment Bank Group’s lending policies and the EU’s sustainable finance frameworks and environmental, social and governance rules to allow for defense investments instead. And let’s not forget that militaries and warfare are the biggest emitters around.

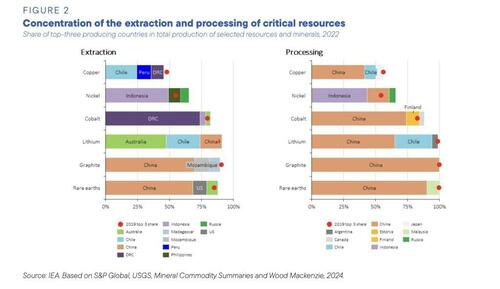

And as the EU cements its role as an underling to Washington and NATO, it will almost certainly need to proceed with further “de-risking” from China the same way it did with Russia. Yet, China dominates multiple stages of the green tech industry. From Draghi’s report:

Some believe that there is little chance that Draghi’s and all the others’ plans come to fruition. Personally, judging by how Project Ukraine has gone and the West’s overall vitriol directed at Russia, I think it’s safer to assume Europe is a long ways from spent and that the EU will continue to dig.

I guess we’ll see. It will certainly be clarifying to see if Germany has an ounce of sovereignty left or if it will give in on its sacred cow. As Ukraine continues to flounder and reaches the inevitable conclusion, it’s likely the calls on Germany to relent will only grow louder and more recriminating.

As the hysteria over Europe’s “agonizing death” reaches a fever pitch it’s worth remembering that there’s one option that always goes unmentioned by the likes of Draghi, Macron, and company.

The Failed Logic Behind the Draghi Report (and All the Others Like It)

Let’s take a step back and really look at what Super Mario is saying in his 400-page screed.

It’s all about EU competitiveness. Well, there are plenty of issues, but one of the biggest reasons the EU’s slow decline became a full-blown crisis is energy. What happened? Here’s Draghi’s story:

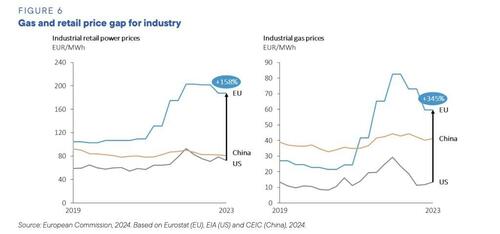

Europe has abruptly lost its most important supplier of energy, Russia. All the while, geopolitical stability is waning, and our dependencies have turned out to be vulnerabilities…EU companies still face electricity prices that are 2-3 times those in the US. Natural gas prices paid are 4-5 times higher. Europe was able to satisfy its demand for imported energy by procuring ample pipeline gas, which accounted for around 45% of the EU’s natural gas imports in 2021. But this source of relatively cheap energy has now disappeared at huge cost to Europe. The EU has lost more than a year of GDP growth while having to re-direct massive fiscal resources to energy subsidies and building new infrastructure for importing liquefied natural gas.

There’s more:

High energy costs in Europe are an obstacle to growth, while lack of generation and grid capacity could impede the spread of digital tech and transport electrification. Commission estimates suggest that high energy prices in recent years have taken a toll on potential growth in Europe. Energy prices also continue to affect corporate investment sentiment much more than in other major economies. Around half of European companies see energy costs as a major impediment to investment – 30 percentage points higher than US companiesii. Energy-intensive industries (EIIs) have been hit hardest: production has fallen 10-15% since 2021 and the composition of European industry is changing, with increasing imports from countries with lower energy costs. Energy prices have also become more volatile, increasing the price of hedging and adding uncertainty to investment decisions.

Notice the lack of agency in Draghi’s telling? It’s as if a natural disaster swept down from the heavens, destroyed all the pipelines transporting Russian gas to the EU, and now prevents them from ever being repaired. In reality, the decision is wholly that of the Scholzs, Macrons, and von der Leyens of Europe (and their benefactors). Notice in the following graphs that prices were a little higher than the US, but where does the divergence really start to take off?

Draghi doesn’t investigate further. But as Russian President Vladimir Putin recently put it for the hundredth time at the Eastern Economic Forum in Vladivostok:

It is very strange, and I cannot get my head around it. They up and blew up the gas pipeline in the Baltic Sea. They blew up both Nord Stream 1 pipelines and one Nord Stream 2 pipeline. The second one is fully functional, though. What stops the German government from pressing the button, coming to terms with us and turning it on? How much is it? 25 billion cubic metres through one pipeline?…It was the Poles who shut down the Yamal-Western Europe pipeline. Now Ukraine is closing [transit through Ukraine], and the Nord Stream 2 route along the Baltic Sea bed is not turned on. Well, if they don’t want to, they don’t have to. It will be a loss for them. For us, there will be a certain reduction in revenues, but it’s no big deal.

The EU’s self-imposed lack of competitiveness now requires hundreds of billions to rectify. Since reports are the theme of the week, here’s one more: the German business association BDI released a study claiming that 20 percent of industrial value creation in the country is under threat. At the top of the list of causes is high energy prices and it says Germany needs about $1.55 trillion of investment by 2030.

That’s not all, of course. Not only did the EU harm itself by refusing pipelined gas from its neighbor, it now must spend billions arming itself to supposedly protect against that very same neighbor it launched a proxy war against.

Maybe instead of harming oneself economically, antagonizing your neighbor, continuing to run around like headless chickens warning that the Russians are about to overrun Europe if you don’t spend billions attempting to militarize, you could just not do any of that.

The EU could just stop all this now. The goal was clearly to cause a collapse of the Putin government, install a puppet friendly to the West, and exploit Russia. It failed.

Time to go hat in hand and start begging and maybe in time regain some of what has been lost. Russia has no designs to conquer Europe. So there’s no need to drop hundreds of billions on weapons that, at best, would help escalate to a nuclear war.

Instead get 400 pages of smart-sounding economic nonsense in line with all the think tank fantasies about the EU taking the Russia baton from the Americans who will turn their attention toward China.

Or in Draghi-speak:

With the return of war in the EU’s immediate neighborhood, the emergence of new types of hybrid threats, and a possible shift of geographic focus and the defense needs of the US, the EU will have to take growing responsibility for its own defense and security. The EU’s defense industrial base is facing structural challenges in terms of capacity, know-how and technological edge. As a result, the EU is not keeping pace with its global competitors.

He adds that Brussels must encourage mergers in the defense industry, and companies should have no restrictions on accessing EU funding. Currently, bureacrats are forced to concoct schemes to get around the ban on the EU budget funding defense purchases as EU law stipulates that such funds go to boring old items like agriculture and regional development. But who needs stuff like that when you can point long-range missiles at Moscow and be targeted in return?

Will open-ended spending on defense do what all the weapons to the Ukraine proxy war and unprecedented sanctions couldn’t do?

I guess we’ll see. Draghi’s smart-sounding report is a good companion peace to the recent argument that they just need to keep up the pressure until…Putin dies of old age. That’s the thinking from former senior CIA analyst and Principal Deputy National Intelligence Officer for Russia and Eurasia at the National Intelligence Council Peter Schroeder, writing at Foreign Affairs that, “what is certain is that, at some point, he will die.” More:

The evidence suggests that on Ukraine, Putin simply is not persuadable; he is all in. For him, preventing Ukraine from becoming a bastion that the West can use to threaten Russia is a strategic necessity. He has taken personal responsibility for achieving that outcome and likely judges it as worth nearly any cost. Trying to coerce him into giving up is a fruitless exercise that just wastes lives and resources.

Did it really takes hundreds of thousands of lives lost and hundreds of billions spent for brain geniuses like Schroeder to understand what Russia had been telling them along? Well, if we read on we get to this:

If Putin is unwilling to halt his assault on Ukraine, then the war can end in only one of two ways: either because Russia has lost the ability to continue its campaign or because Putin is no longer in power.

We’ll see how that works out. If it doesn’t, well, hopefully Draghi is still kicking so he can get to work on another report.

Tyler Durden

Tue, 09/17/2024 – 05:00

via ZeroHedge News https://ift.tt/YS3FJUp Tyler Durden