Sunlight And Clouds – Not CO2 – Drive Earth’s Climate; ‘Shocking’ New Study Finds

Authored by Katie Spence via The Epoch Times,

This year’s summer months were characterized by cold outdoor pools that eagerly welcomed guests, concrete that scorched the soles of bare feet, and popsicles that melted in the relentless, blazing heat.

In August, the European Commission’s Copernicus report found that the global average temperature had reached record highs in the past 12 months, an increase of 1.51 degrees Celsius above pre-industrial levels.

Similarly, using satellite data, Roy Spencer and John Christy of the University of Alabama Huntsville determined that the average temperature in August was 0.88 degrees Celsius higher than the 30-year average from 1991–2020.

Extreme heat is not just an environmental crisis, it’s a serious threat to our public health—and communities across the country are struggling to respond,” Health and Human Services Secretary Xavier Becerra said in a news release.

“What we’re facing today wasn’t what we were experiencing 30 or 40 years ago. This is a different world we are in.”

On Aug. 14, President Joe Biden released the National Heat Strategy for 2024–2030, fulfilling a July promise to take additional action to address increasing temperatures, which the United Nations Intergovernmental Panel on Climate Change (IPCC) states is primarily caused by human-induced increases in carbon dioxide (CO2), a greenhouse gas.

“Stabilizing the climate will require strong, rapid, and sustained reductions in greenhouse gas emissions, and reaching net zero CO2 emissions,” Panmao Zhai, a Chinese climatologist, and co-chair of the IPCC Working Group I, stated in a press release.

“Limiting other greenhouse gases and air pollutants, especially methane, could have benefits both for health and the climate.”

Ned Nikolov, a physical scientist and researcher affiliated with Colorado State University, told The Epoch Times the IPCC is incorrect regarding CO2.

“The greenhouse theory claims that atmospheric composition is important,” Nikolov said.

“They are arguing that tiny increases of the carbon dioxide in the atmosphere cause global warming and that we must stop burning fossil fuel to avoid dangerous climate change.

“That is completely wrong.”

On Aug. 20, Nikolov and Karl Zeller, a retired U.S. Forest Service meteorologist, published their study that found that recent warming is not the result of increasing CO2.

Instead, after analyzing satellite data, the two researchers concluded that the Earth has warmed because it’s been absorbing more sunlight due to reduced global cloud cover.

Albedo and Climate

According to the National Aeronautics and Space Administration (NASA), Earth’s atmosphere is constantly working to balance the planet’s “energy budget”—the amount of energy entering and leaving it. After the Sun’s shortwave radiation—sunshine—reaches the Earth, the energy flows back into space as thermal radiation.

If this balance is disrupted, and more sunlight is absorbed or not enough heat escapes to space, Earth’s temperature will rise. An imbalance in the energy budget is known as radiative forcing, with the incoming radiation being shortwave and the outgoing radiation being longwave (or thermal).

Additionally, Earth’s albedo, the fraction of sunlight reflected back into space, impacts the amount of radiation that reaches the surface.

In its Sixth Assessment Report, the IPCC states that, due to increased atmospheric CO2 concentration from human greenhouse gas emissions, Earth’s energy budget is out of balance—more thermal energy is being trapped, resulting in elevated temperatures and warmer oceans.

A sign near Strasburg, N.D., on Jan. 11, 2024. Jack Dura/AP Photo

It also notes regarding the Earth’s albedo that, between 1950 and 1980, there was “evidence for a widespread decline of surface solar radiation (or dimming),” followed by “a partial recovery (brightening) at many observational sites thereafter.”

As to the cause, the IPCC states, “Multi-decadal variation in anthropogenic [human-caused] aerosol emissions are thought to be a major contributor (medium confidence), but multi-decadal variability in cloudiness may also have played a role.”

In addition, the IPCC said some studies show that “cloudiness” can play a role in “dimming” and “brightening.” But the contribution of aerosols and clouds to dimming and brightening is still debated, and “the origin of these trends is not fully understood.”

That, according to Nikolov, is where his study comes in.

Challenging the IPCC

“Climate is controlled by the amount of sunlight absorbed by Earth and the amount of infrared energy emitted to space. These quantities—together with their differences—define Earth’s radiation budget,” NASA’s Clouds and the Earth’s Radiant Energy System (CERES) website states.

Since March of 2000, the NASA team has been collecting satellite data to examine the energy exchange between the Earth and space.

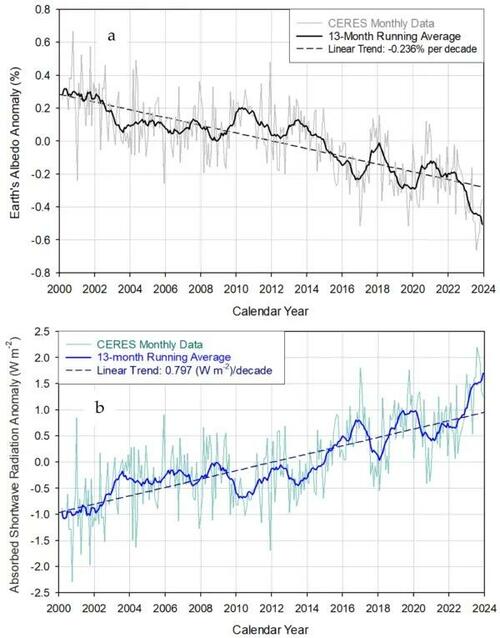

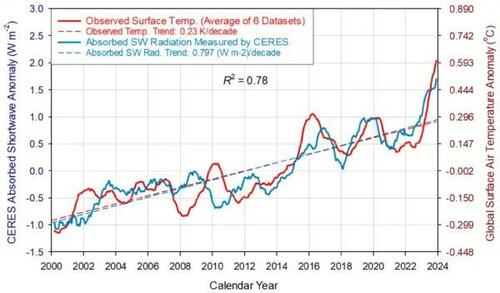

Using those measurements and a “novel climate-sensitivity model derived from independent NASA planetary data,” Nikolov and Zeller evaluated how Earth’s decreasing albedo impacted global temperature during the 21st century.

“CO2 is an invisible trace gas that does not interfere with sunlight. It’s believed to trap thermal radiation coming from the surface, but that’s a misconception because the absorption of longwave radiation by CO2 and heat-trapping are completely different physical processes. According to the 2nd law of thermodynamics, heat-trapping is impossible in an open system such as the atmosphere,” Nikolov said.

He added that while water vapor is also a greenhouse gas, it becomes visible when it condenses and forms clouds. And because clouds “reflect solar radiation back to space,” their impact on the climate is “measurable and significant.”

“Cloud formation is partially controlled by cosmic forces. When clouds decrease, the planetary albedo drops and more radiation reaches the surface, causing warmer temperatures.”

“In our paper, we show, using the best available observations from the [Clouds and the Earth’s Radiant Energy System] platform, that the warming of the last 24 years was entirely caused by the observed decrease of Earth’s albedo and not by increasing greenhouse gas concentrations as claimed by the IPCC.”

Figure 1. Monthly radiative anomalies derived from the CERES EBAF 4.2 dataset: (a) Earth’s global albedo calculated via dividing the reflected all-sky shortwave anomaly by the globally averaged incident solar flux at the TOA (i.e., the global insolation) and multiplying the resulting fraction by 100 to convert to a percent; (b) Earth’s absorbed solar flux calculated via multiplying the CERES reflected all-sky shortwave anomaly by −1 based on the fact that radiation absorption is opposite (and complimentary) to reflection. Courtesy of Ned Nikolov

Figure 7. Comparison between observed GSAT anomalies and CERES-reported changes in the Earth’s absorbed solar flux. The two data series, representing 13-month running means, are highly correlated with the absorbed SW flux, explaining 78% of the GSAT variation (R2 = 0.78). Also, GSAT lags the absorbed shortwave radiation between 0 and 9 months, which indicates that GSAT is controlled by changes in sunlight absorption. Courtesy of Ned Nikolov

Nikolov said that, in the greenhouse theory, atmospheric composition is “very important” for a planet’s global surface temperature.

By applying dimensional analysis to NASA’s data describing the environments of different planets and moons in the solar system—including Earth—Nikolov and Zeller discovered a new universal relationship across planetary bodies. This revealed that the atmosphere warms the surface not through longwave radiation emitted by greenhouse gases but through total pressure—adiabatically, without the loss or gain of heat—and that atmospheric composition has no effect on global temperature.

“Adiabatic heating (a.k.a. compression heating) is a well-known thermodynamic process. This revolutionary discovery about the physical nature of the atmospheric thermal effect (currently known as greenhouse effect) was published in [our] peer-reviewed literature in 2017,” Nikolov said.

“This is why when you get up in elevation, it gets cooler—either in the mountains or when you’re flying on an airplane—because the pressure drops with height.”

He compared the Moon’s surface temperature, as measured by NASA, compared to Earth’s global temperature to evaluate the thermal effect of the atmosphere.

“The data shows that the Moon is a perfect, airless equivalent of Earth because it orbits the Sun at the same distance as Earth but has no atmosphere. So, the temperature difference between Earth and the Moon gives us the net thermal effect of the Earth’s atmosphere.”

Nikolov found that the Moon was about 88 degrees Kelvin cooler on average than the Earth. That’s significant, he said.

“Currently, the greenhouse theory claims that without an atmosphere, the Earth would only be about 33 degrees colder than it is now. Some estimates even say only 18 degrees cooler.

“So, the present theory grossly underestimates the actual thermal effect of our atmosphere. However, this 88-degree thermal enhancement is due to total pressure.

“And that’s one of the fundamental differences between the greenhouse theory and our new climate concept.”

Through analyzing the Earth’s Energy Imbalance (EEI), “calculated as a difference between absorbed shortwave and outgoing longwave radiation at the top of the atmosphere,” Nikolov and Zeller discovered that the scientific community had misinterpreted it.

“EEI is not caused by ‘heat-trapping’ resulting from increasing atmospheric greenhouse gasses as currently claimed, but ‘arises from adiabatic dissipation of thermal energy in ascending air parcels in the troposphere due to a decreasing atmospheric pressure with height,’” Nikolov said.

Specifically, using mathematics, Nikolov and Zeller showed that EEI is an “apparent phenomenon” rather than a “real imbalance,” which they said necessarily implies no long-term heat storage in the Earth system by increasing greenhouse gases and no “warming in the pipeline,” as claimed by the latest Report by the IPCC.

Where Are the Clouds?

Nikolov said Earth’s reduced cloud cover could have several causes, including galactic cosmic rays, solar wind, and interactions between the Sun’s and Earth’s magnetic fields.

“We have hypotheses about what’s driving the cloud cover changes, but we don’t have an exact mechanism or a conclusive theory,” Nikolov said.

“This is why we cannot mathematically describe it yet in a model to make predictions. ”

He called for “large-scale interdisciplinary research into the physical mechanisms controlling the Earth’s albedo and cloud physics,” as they are “the real drivers of climate on multi-decadal time scales.”

“The current climate science acknowledges that the clouds have been declining, and the Earth’s albedo has been decreasing, but they attribute it to an internal climate variability. This is incorrect! Changes of cloud cover and albedo are externally forced. Identifying this external forcing is where future research has to focus instead of studying carbon emissions and [greenhouse gas] radiative forcing,” Nikolov said.

Clouds are seen in Western Australia on June 14, 2024. Susan Mortimer/The Epoch Times

If rising global temperature was due to greenhouse gasses, there should have been more warming than observed, he said.

“The simple fact is that the solar forcing alone explains the entire warming of the 21st century and leaves no room for any anthropogenic forcing.

“This inconvenient truth for the UN’s Climate Agenda might explain the absence of discussion in the 2021 IPCC Sixth Assessment Report about the decrease of Earth’s albedo since 2000 observed by [NASA’s Clouds and the Earth’s Radiant Energy System] and its impact on recent warming.”

In response to the question “Is the Sun causing global warming?” on its website, NASA states, “No. The Sun can influence Earth’s climate, but it isn’t responsible for the warming trend we’ve seen over recent decades.

“The Sun is a giver of life; it helps keep the planet warm enough for us to survive. We know subtle changes in Earth’s orbit around the Sun are responsible for the comings and goings of the ice ages. But the warming we’ve seen in recent decades is too rapid to be linked to changes in Earth’s orbit and too large to be caused by solar activity.”

The IPCC did not respond to The Epoch Times’ request for comment regarding Nikolov’s findings by the time of publication.

Tyler Durden

Mon, 09/16/2024 – 20:55

via ZeroHedge News https://ift.tt/JLEKt9v Tyler Durden