Authored by Peter Tchir via Academy Securities,

The Great Debates

Another in a string of “interesting” weeks! Stocks surged on the week, with the S&P 500 rising 4% and breaking 5,555, which was discussed by many as being a critical level to breach. The Nasdaq led the way, up almost 6% on the week, but many of the laggards started to catch up. ARKK (a proxy for “disruption”) rallied a whopping 10% on the week! The first time in a while that I think it performed like a truly high-beta play on the market!

On the surface, a “simple” week of rallying, but we had some moments of downside, most critically on Wednesday as the S&P opened down more than 1.5% only to stage a “stunning” (at least for me) turnaround, finishing the day up over 1% (the Nasdaq trading was even more volatile).

As we continue to see the market whipsaw (the major indices are below where they rallied to in August, after the early August fear), I think that we can keep this week’s T-Report simple (my travel week was a bit draining) and cover the major bases, by sticking to the theme of “Debates.”

The Presidential Debate

I hate treading into this area as it is fraught with danger. So I will stick to what I think I know, from the data and commentary I’m collecting:

-

Unlike the last debate, both Trump and Harris are likely sticking around for the election! (I figured I’d start with something easy).

-

According to the betting odds, it seems that Harris has edged up slightly on most betting platforms. Not by much, but I think based on that we can assume that the debate seemed to work in her favor versus his favor (which might be backed up by the fact that Trump has now said he will not do another debate – though that could change on a moment’s notice).

So why did we sell off so hard overnight and at the open only to recover?

-

There were some comments regarding AI, which we will discuss later (it certainly helped).

-

The markets are pricing in that the Republicans will control the Senate, which means that we can start pricing in a split government and Wall Street does like gridlock. One view, which I agree with, is that if you are voting against someone as opposed to for someone, there is a greater probability of splitting your ticket – helping keep gridlock on the table. Gridlock will be generally good for Wall Street as opposed to the “risk” of a full sweep, which would likely scare the markets.

-

As you know, I’ve been avoiding getting very specific on what I think either candidate’s campaign promises will mean for the economy after the election – namely because they are just that – “promises” from politicians on the campaign trail that rarely come to fruition. While I think we all have a sense of how Trump might govern if elected (since he already served 4 years as president) we are all trying to figure out how Harris would govern if elected. What seemed to give a lot of people comfort was a series of stories indicating that she is being pressured by large donors to move to the center. From my seat, she does seem to have changed her messaging over time – from when she was a prosecutor to when she was running for Senate, so maybe she will adopt a policy more centric than what she has advocated for in the fairly recent past. That is a bet that Wall Street seems to be making, and it seems reasonable to me.

The key for the election, from a Wall Street standpoint, seems as simple as:

-

Wall Street would like gridlock. The anticipation of gridlock is helping bonds because the market would be able to discount the likelihood of some of the bigger deficit-producing “promises” ever becoming reality.

-

Wall Street will like any sense that politicians are already pivoting towards the center as the election nears and they try to win over moderates and independents.

Only 7 more weeks of campaigning!

The Rate Cut Debate

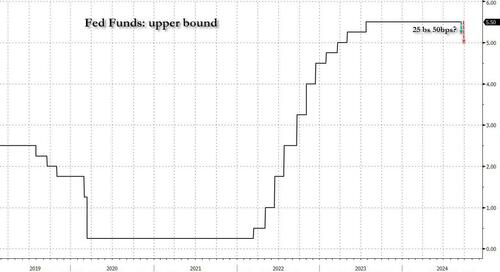

According to the WIRP (Interest Rate Probability on Bloomberg) function, the market has priced in a total of 3 cuts in the next 2 meetings (to be honest, I had to check if the thing is working, because it certainly felt like 4 or more cuts were being priced in).

The meeting this week is priced in at 50/50 for a 50 bp cut. As someone who advocated for a July cut (and even thought 50 in July would be appropriate – Building the Case for Rate Cuts), I should be in the 50 bp camp (it is certainly what I think they should do, but will they?).

The Fed doesn’t like to surprise markets (though it is probably more against surprising on the negative side than on the positive) which leaves them in a bit of a quandary with markets pricing in a 50% chance. At that level, a 25 bp cut would surprise the market negatively (I cannot shake the impression that the contracts used to estimate the WIRP are less aggressive on the cut front than other markets). Let’s also not forget that on 9/11 (a day we should never forget and that still brings tears to my eyes, reliving that horrible time) the market was “only” pricing in a 17% chance of a 50 bp hike.

I’d go 50, but for a group that decided not to cut at all in July, has the data been good enough on the inflation front (maybe) or weak enough on the job front (maybe) to cut 50?

Either way I expect at least one dissent, as at least one person will say they wanted 50 if they go with 25, or someone will argue that 25 was right, if they go with 50. I find the dissent “fascinating” since I think (facetiously) that as far as “Chairmen” go, Mao and Stalin had more dissenters than the Fed Chair gets, which has always seemed weird to me.

Is this a Fed that is willing to cut 50 and risk seeing either an uptick in inflation or job creation? That is probably what will drive the debate at this meeting!

In any case:

-

75 in the next 2 meetings sounds correct (though I’m leaning towards 25 then 50).

-

More “interesting” is that the market is pricing in 10 cuts, getting down to 2.86% by next September – which seems far too fast.

-

I’m not sure that the terminal rate will still be in the 2.75% to 2.875% range based on the dots. The median was 2.75% but the average was 2.875%. I don’t see it dropping and could see a case where it moves up a smidge – but that is only useful at the margin.

-

They would need to revise their dots for next year downwards rather significantly! Are they really prepared to do that?

The risk from the Fed is to disappoint holders of longer-dated bonds and equities, with more of the risk coming from what they say about the next year or so, than what they do at this meeting – though a 50 bp cut would allow markets to ignore any hawkish comments (which seems like a path the Fed would not like to go down – as it really would decrease their ability to jawbone).

The AI Debate

From a macro/econ/market perspective, the AI debate remains incredibly important as the AI stocks remain big drivers of most market moves. As discussed in Gell-Mann Amnesia Effect, it is a debate surrounding valuations and current (call it next year or so) cost versus benefit. Is the cost of implementing AI outpacing the benefit? Has the market priced in competition or other risks? Or, is the risk still that the market hasn’t yet digested the true impact of AI?

Markets did respond to some industry leaders giving positive comments on the outlook and if “buy the dip” remains strong in any sector, it is the AI and chip sector (though NVDL actually saw the leveraged version of NVDA shares outstanding decrease on the week).

What I’m starting to play with is Open AI o1 (also known as Strawberry). It is designed to be a “reasoning model for solving hard problems.” It seems interesting at first blush. It is much slower than ChatGPT but seems to try to come up with actual answers (rather than what sometimes seems like glorified search results). It wouldn’t tell me who will win the election (something about data only until October 2023) or what the stock market would do (which I guess is bad, since it would be great to day trade this market perfectly and capture all those 1% moves, but probably good, as I’d have less reason to exist).

Speaking of which, I’ve been told this model is scoring 95% on average on the LSAT.

I just started to play with this, but since I’ve been on the “overvalued” side of the equation, I wanted to make sure people see this as soon as possible, as it could be another seminal moment in AI! While everyone was talking 50 bps on Thursday and Friday, this new version was released on September 12th , so I’m not sure how much, if anything, is priced in. However, given the valuations, even with this sort of advancement (if it is truly as impressive as it sounds), was it already priced in?

Bottom Line

My biggest fear, in both directions, for stocks and bonds (and even credit), remains that there seems to be very little depth in terms of liquidity.

Be small, be nervous, and expect volatility to continue – in both directions and for moves to be outsized relative to the news or information flow!

The “peaceful” days of summer seem like a distant memory already, and those days weren’t even that peaceful this summer!

Good luck, and I do wish the Fed would come out at 10am ET, as the hours ahead of the Fed are dull and filled with nothing but time to second guess every position you have, regardless of how much time, effort, and preparation went into setting up those positions!