Brent Tumbles Below $70 As Hedge Funds Least Bullish Oil On Record

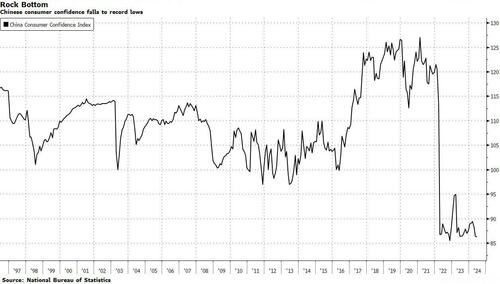

Oil just had its worst week in almost a year, and the new week is starting off just as bad amid concerns about oversupply and lack of demand by China, which now appears willing to risk a middle-class revolution – as employment tumbles and consumer confidence has never been lower – rather than stimulate the economy.

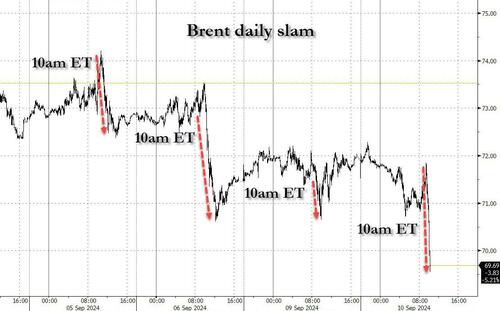

Brent tumbled ~10% last week even after OPEC+ postponed its supply hike by two months (amusingly it would have tumbled even more had OPEC+ not delayed its supply hike). Still, given plans to revive 2.2m b/d over the course of a year remain in place, the delay means they are simply kicking the can down the road. And then on Tuesday, it dumped another 2%, sliding below $70 for the first time since 2021, as part of oil’s now daily 10am slam, and as hedge funds are convinced there will be a soft-landing everywhere, certainly in chatbots, except in commodities where the hard-landing will somehow surpass the global financial crisis.

And even though commercial stockpiles tumbled to 2024 lows, market watchers – at least those who have no idea of what is actually taking place in the market – see stockpiles “building” through year-end and into 2025, according to Bloomberg, which forgot to turn off sarcasm mode.

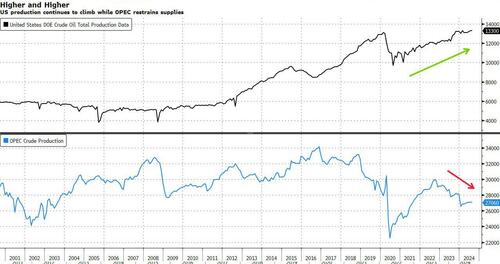

Meanwhile, production has been on the rise stateside, muting OPEC+ efforts to restrain supply, but that’s only to keep up with demand which – and one wouldn’t know this from looking at the price – is also steady and rising. Macquarie sees record US output of 13.9m b/d in 2024, with rigs in the Permian and Bakken basins producing more efficiently. Baker Hughes data show crude rigs have been edging up since their July lows.

It’s hard to fight this bearish mood — in a market that has failed to push higher in a sustained manner despite geopolitical tensions, a testament that demand woes overshadow other drivers.

As the latest sign of weak demand, Saudi Arabia cut pricing of its flagship crude grade for its main market in Asia next month.

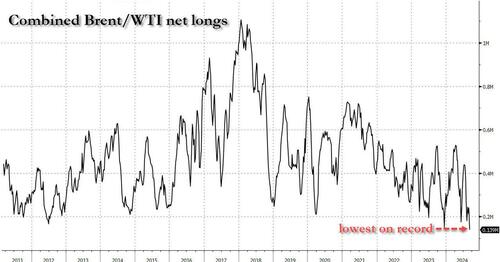

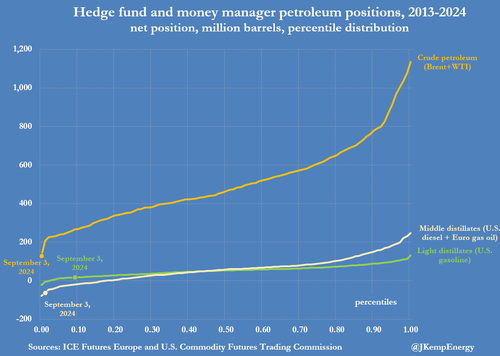

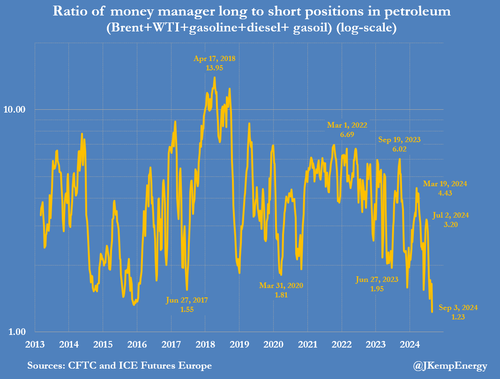

The silver lining: hedge funds have once again restarted slashing bullish oil bets, with net longs tumbling to a record low. Usually this marks the bottom.

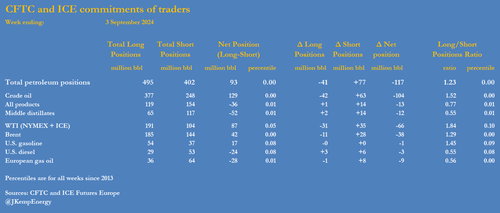

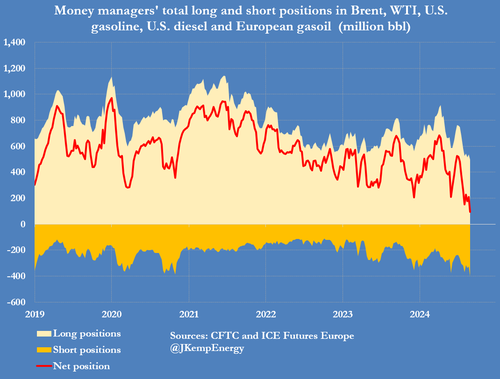

As energy expert John Kemp writes, hedge funds and other money managers sold the equivalent of 117 million barrels in the six most important futures and options contracts over the seven days ending on September 3.

The combined position was reduced to just 93 million barrels, the lowest for at least a decade. Fund managers were sellers across the board, including NYMEX and ICE WTI (-66 million barrels), Brent (-38 million), European gas oil (-9 million), U.S. diesel (-3 million) and U.S. gasoline (-1 million).

Negative sentiment extended to refined fuels, with extremely bearish positions across gasoline and especially in diesel and other middle distillates.

Funds had sold middle distillates in seven of the most recent nine weeks, slashing their position by 123 million barrels since the start of July.

Bearishness across all crude and fuels contracts showed investors bracing for a further deceleration in consumption growth, amid signs of a downturn in manufacturing across the United States, Europe and China.

The most recent positions were reported two days before Saudi Arabia and its OPEC⁺ allies announced on September 5 that they would postpone scheduled output increases for two months.

Prior to the announcement, positioning had become extremely stretched on the downside, creating conditions for a sharp price rebound if and when fund managers trim bearish short positions and start to rebuild bullish long ones.

For the moment, however, sentiment has remained very negative, with investors focused on the threat of an industrial downturn pushing prices down even more. Even the OPEC⁺ announcement failed to arrest the downtrend as traders interpreted it as confirming the deteriorating consumption outlook.

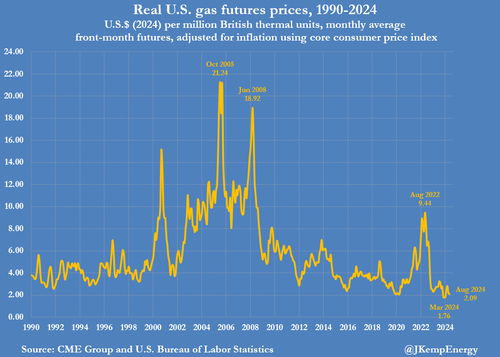

Inflation-adjusted front-month WTI prices have slumped to an average of $69 per barrel so far in September, the lowest since early 2021, when the coronavirus pandemic was still raging, with real gas prices nearing record lows as the Harris/Biden oil trading desk does everything in its power to slam commodity prices as low as possible ahead of the election.

Tyler Durden

Tue, 09/10/2024 – 10:39

via ZeroHedge News https://ift.tt/GEF8J2u Tyler Durden