Futures are higher in a modest relief rally following the worst weekly loss of the year, triggered by cooling US jobs data that left economists and traders at odds as to how aggressively the Federal Reserve will cut interest rates. As of 8:00am ET S&P futures are 0.7% higher while Nasdaq futurs gained 0.8% after the underlying index ended last week with its steepest decline since November: both Mag7 and Semis higher in the premarket along with new index additions. Bond reversed some of their recent gains, with the 10-year Treasury yield jumping four basis points, the first increase in five days, aiding gains in the USD. Commodities are mixed with Energy higher and Ags/Metals lower but with soft patches of strength in base/softs. As JPM’s market intel desk writes, we enter a week with several major questions to answer and additional macro data points: near-term or deadcat bounce? 25 or 50bps? Who leads the election? Is AI dead?

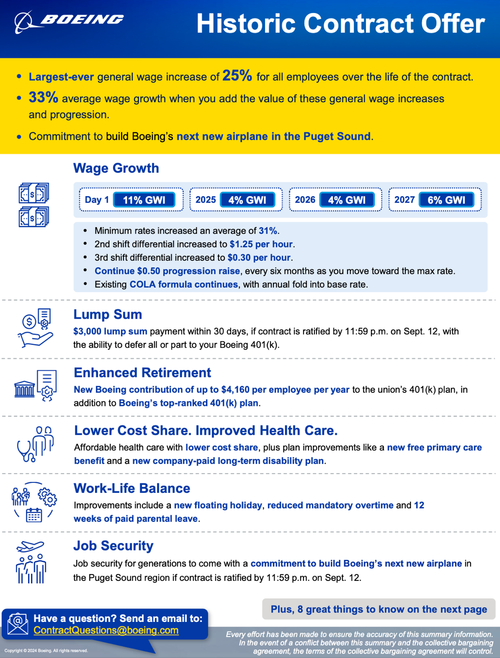

In premarket trading, Boeing rose 4.6% on optimism that a labor deal with its largest union will help the troubled US aircraft manufacturer avoid a potentially crippling strike at its Seattle-area factories. Palantir Technologies jumped 8.5% and Dell gained 5.5% following news that the companies will join the S&P 500. Here are some more premarket movers:

- B. Riley gained 5% after it said it’s in talks to sell a majority stake in Great American Group and has a commitment for financing of its brands portfolio.

- Savara (SVRA) rallies 5.7% after the drug developer gave additional data from a late stage trial of its investigative therapy for patients with a rare lung disease.

- Summit Therapeutics (SMMT) soars 34% after management presented over the latest data of its lung cancer drug, ivonescimab, which showed “statistically significant improvement” in progression-free survival compared to Merck’s Keytruda. Merck (MRK) slips 1.7%.

- Crypto-related stocks rise in premarket trading after Bitcoin snapped a four-day losing streak over the weekend.

September has so far been true to its painful reputation, and has seen both stocks and commodities slide amid concern about waning global growth. the VIX remains elevated after closing at its highest in a month on Friday. Some analysts are encouraging investors to take advantage of opportunities to position defensively with volatility poised to persist amid concerns over growth and the reaction by policymakers.

“If any investor in the market right now is not expecting volatility they are missing an opportunity to add quality to their portfolio,” Joe Quinlan, head of CIO Market Strategy for Merrill and Bank of America Private Bank, said in an interview with Bloomberg TV.

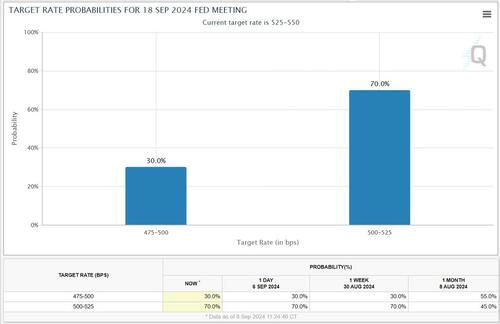

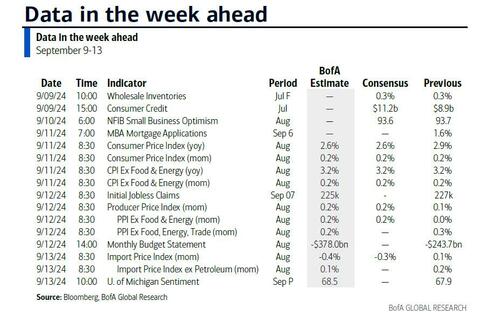

Meanwhile, attention remains glued to the Fed as it nears its September FOMC decision: the choice facing Fed officials — whether to start easing gradually with a 25bps cut or to front-load rate cuts, by going 50bps — is bound to be contentious. With recession fears also resurfacing, investors are scrutinizing economic data for clues on the likely rate path. Wednesday’s US consumer-inflation numbers are next on the radar. US data Friday showing weaker payrolls growth reinforced the view that the labor market is cooling and sent stocks reeling. Traders reacted by increasing bets on a 50 basis-point Fed cut this month, even though Goldman said the jobs report wasn’t bad enough to justify a rate cut of that magnitude.

Others like JPM and Lombard Odier disagree with Goldman, and see a 50bps cut as justified: “We are leaning towards a 50 basis point cut, front-loading in September,” Nannette Hechler-Fayd’herbe, chief investment officer for EMEA at Bank Lombard Odier, said in an interview with Bloomberg TV. “I don’t think they have much to lose to actually making a bigger cut in September with 50 basis points. It’s a great possibility for them to initiate an insurance against whatever softer data are coming.”

Tech also led a rebound in European stocks, rebounding after the worst week in 18 months, as trader attention turns to US inflation data and the European Central Bank rates decision later in the week. The Stoxx 600 gained 0.6% with consumer products declining the most, weighed down by Ubisoft after a downgrade at Cantor Fitzgerald and luxury firms Kering and Burberry after ratings cuts at Barclays. OCI gains after the firm agreed to sell its methanol business to Methanex in a deal worth over $2 billion. Here are the most notable movers:

- Baloise shares gain as much as 2.5% after activist investor Cevian Capital told the Financial Times it has increased its stake in the Swiss life insurance company to around 9.4%.

- OCI shares rise as much as 5.7% to the highest since April 2023 after announcing it will sell its global methanol business to Methanex in a $2.05 billion deal.

- Entain shares climb as much as 8.1% after the gambling group reported a return to online revenue growth in the UK & Ireland sooner than expected.

- Viscofan shares advance as much as 3% after Berenberg re-initiates on the Spanish maker of sausage casings with a buy recommendation.

- Norwegian salmon stocks jump as Carnegie flags the possibility that the country’s Conservative Party may propose a “significant” cut to the current resource tax for the sector from the current 25% level.

- Adidas shares fall as much as 3.9% as Barclays downgrades the German apparel firm to equal-weight.

- Kering shares drop as much as 2.5% after the luxury firm was downgraded at both Barclays and RBC, with the former also cutting its rating on Burberry (-5.0%.)

- Kion shares fall as much as 2.7%, the worst performer on the Stoxx 600 industrials index, after Citi downgrades to neutral on likely “sluggish” near-term growth.

- Subsea 7 shares drop as much as 4% to the lowest since May after BNP Paribas Exane cuts its recommendation to neutral from outperform, citing fragile picture and volatile outlook for oil markets.

- Computacenter shares fall as much as 7.3%, hitting a one-year low before paring losses, after the technology and services provider reported a sharp drop in profits during the first half.

- Ubisoft shares fall as much as 5.5% to the lowest since 2014 as Cantor Fitzgerald downgrades the stock to neutral from overweight.

- SigmaRoc shares fall as much as 5% after the construction materials company reported interim results.

Earlier in the session, Asian equities closed at their lowest level in over three weeks, as technology stocks slid on concerns over US economic growth. The MSCI Asia Pacific Index fell as much as 1.8%, before recouping some of the losses, with chipmakers Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. among the biggest drags. Japanese shares pared losses, with the Nikkei 225 Average closing 0.5% lower after plummeting more than 3% during the day, helped by a weakening yen. Taiwan’s key stock gauge fell 1.4%, while Hong Kong benchmarks were set for a fifth straight day of declines.

Weak US non-farm payrolls data Friday sparked concern that the Federal Reserve is moving too slowly to support the world’s largest economy. While investors try to gauge the size of the Fed’s rate cut next week, the Bank of Japan’s recent move to tighten policy has put upward pressure on the nation’s currency, fanning concerns over carry trades.

In FX, the Bloomberg Dollar Spot Index rose 0.3% and outperformed G-10 peers after republican nominee Donald Trump pledged a 100% tariff on goods from countries that shun the greenback. Dollar-yen rose 1% to 143.80, after a report showed Japan’s GDP expanded at an annualized pace of 2.9% in the second quarter, slightly lower than the preliminary estimate. Some leveraged funds which initiated short dollar-yen positions in anticipation of a stocks-fueled risk-off price movement have since exited, according to Asia-based FX traders; the pound drops to around $1.30. “The US labor market data provided mixed news for US rates and together with soft Japan GDP data, are seeing investors reduce their short USD/JPY positions,” said David Forrester, senior FX strategist at Credit Agricole CIB in Singapore.

In rates, treasuries are cheaper across the curve, paced by bunds as stock index futures erase some of Friday’s big losses. As traders continue to assess the likely size of Fed rate cuts, focus is chiefly on Wednesday’s August CPI data as policymakers are in a self-imposed quiet period until the Sept. 18 decision. Two-year Treasury yields rise 6bps to 3.7% as speculation swirls around the Fed’s interest-rate tightening while the 10-year is around 3.74% is ~3bp cheaper on the day; bunds in the sector are ~2bp wider vs US while gilts keep pace: European bond yields are higher after Mario Draghi’s report on EU competitiveness called for as much as €800 billion of new spending a year.

In commodities, WTI adds 1% to ~$68.34. Spot gold is steady at $2,496/oz. Most base metals rise; LME copper outperforms peers.

Looking at today’s calendar, we get July wholesale inventories (10am), August New York Fed 1-year inflation expectations (11am) and July consumer credit (3pm). We also saw another disappointing print from China’s CPI, PPI overnight. Oracle reports earnings.

Market Snapshot

- S&P 500 futures up 0.6% to 5,450.50

- STOXX Europe 600 up 0.6% to 509.45

- MXAP down 1.3% to 179.60

- MXAPJ down 1.2% to 557.40

- Nikkei down 0.5% to 36,215.75

- Topix down 0.7% to 2,579.73

- Hang Seng Index down 1.4% to 17,196.96

- Shanghai Composite down 1.1% to 2,736.49

- Sensex up 0.3% to 81,426.34

- Australia S&P/ASX 200 down 0.3% to 7,988.09

- Kospi down 0.3% to 2,535.93

- German 10Y yield little changed at 2.23%

- Euro down 0.3% to $1.1047

- Brent Futures up 1.4% to $72.02/bbl

- Gold spot down 0.3% to $2,491.00

- US Dollar Index up 0.40% to 101.58

Top Overnight News

- A New York Times survey showed former President Trump ahead of VP Harris at 48% vs 47% among likely voters nationally which was the first major poll to show a drop in the support for Harris, while it lowered Harris’s lead in the overall average of polls to 2.5% and just 0.3% in the key swing state of Pennsylvania, according to the Telegraph.

- Former US President Trump threatened a 100% tariff for countries that turn away from the dollar: Bloomberg.

- China’s inflation falls short of expectations in Aug, with the PPI coming in -1.8% (vs. -0.8% in Jul and worse than the consensus at -1.5%) and the CPI climbing 0.6% (up from 0.5% in Jul, but a tad below the consensus at +0.7%). WSJ

- Japan’s Q2 GDP is revised lower (to +2.9% from +3.1%) due to softer consumption, creating challenges for the BOJ as the central bank proceeds with plans to tighten policy. RTRS

- Mario Draghi on Monday unveiled his proposal for jumpstarting Europe’s economy, including massive spending and the issuance of more joint debt. WSJ

- Russia’s elite is increasingly starting to question the Putin’s war in Ukraine according to the heads of the US and UK intelligence agencies. FT

- Trump is leading Harris nationally by 1 point (48-47%) according to the latest NYT/Siena poll (28% of voters felt they needed to know more about Harris vs. just 9% who feel that way toward Trump). NYT

- Yellen said recent economic data is indicative of a soft landing, not recession (“we’re seeing less frenzy in terms of hiring and job openings, but we’re not seeing meaningful layoffs”). CNBC

- Hamas makes fresh demands in ceasefire negotiations, making a deal even more unlikely (Biden will probably leave the White House without a Gaza ceasefire agreement in place). WaPo

- Schumer warns of the risks of a shutdown ahead of the 9/30 budget expiration deadline (he favors a short-term extension until after the election). BBG

- U.S. antitrust enforcers are intervening early to examine whether a handful of big tech companies such as Nvidia are using their leverage to establish dominance over the burgeoning artificial-intelligence market. WSJ

- Tesla exported 23,241 China-made vehicles in August vs 27,890 in July, via CPCA.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks suffered firm losses as the region took its opportunity to react to last Friday’s disappointing US jobs data, while participants also braced for this week’s key events including the latest US CPI report. ASX 200 declined with the index pressured by underperformance in gold stocks and the top-weighted financials sector. Nikkei 225 gapped beneath the 36,000 level with sentiment not helped by disappointing Japanese Q2 GDP revisions. Hang Seng and Shanghai Comp conformed to the negative mood with the former dragged lower by notable weakness seen in the energy-related stocks after recent oil price pressures, while the mainland also reflected on softer-than-expected CPI data and sharper PPI deflation.

Top Asian news

- Japan’s LDP’s says Japan’s inflation is still weak when excluding external factors; cannot say Japan has achieved BoJ’s 2% inflation target

- PBoC may have sold long-dated bonds and bought short-dated ones last week, signalling a warning that authorities aim to maintain a tight grip on the market, according to Shanghai Securities News.

- US Treasury Secretary Yellen said she would welcome a visit to the US by her Chinese counterpart and that she may return to China, while she added the US relationship with China needs to be prioritised and nurtured.

- Typhoon Yagi killed 21 people and wreaked havoc on infrastructure and factories in Vietnam.

- China Auto Industry Body CPCA says China sold 1.92mln passenger cars in August, -1.1% Y/Y (vs 1.73mln cars in July).

- Acer (2353 TT) August (TWD) Consolidated Revenue 22.82bln, +5.2% Y/Y

European bourses, Stoxx 600 (+0.5%) began the session on a firmer footing and continued to edge higher as sentiment continued to improve as the session progressed. European sectors are entirely in the green; Tech is the best performer, propped up by gains in semi-conductor names, as they attempt to pare back some of the last week’s hefty losses; ASML (+2.5%), BE Semi (+2%). Luxury is towards the foot of the pile, hampered by a double broker downgrade for Kering (-2.7%), with poor Chinese inflation metrics also not helping. US equity futures (ES +0.6, NQ +0.8%, RTY +0.3%) are entirely in the green, attempting to pare back some of the hefty losses seen in the prior session. Data docket for today is light, but Tech traders will be focused on Apple’s iPhone event later today. Apple’s (AAPL) new iPhone will use Arm’s (ARM) next-gen chip technology for AI, according to FT. Boeing (BA) said it reached a tentative agreement with the International Association of Machinists and Aerospace Workers and district lodges for a 25% wage hike, according to Reuters. Elsewhere, Dalian Airlines Boeing (BA) 737 flight has suffered engine malfunction on Monday en route from Dalian to Beijing, safely returned to Dalian airport, according to Chinese State Media.

Top European news

- UK PM Starmer defended the decision to scrap winter fuel payments for 10mln pensioners to shore up public finances and said his government must be prepared to be unpopular, according to FT.

- UK labour market cooled noticeably in August as job placements declined sharply and pay growth slowed, according to a monthly survey by the Recruitment and Employment Confederation and KPMG cited by Reuters.

- Italy expects 2025 GDP growth of at least 1.2%, according to a Treasury junior minister cited by Reuters.

- European banks are on course for zero growth in mortgage lending for the first time in a decade this year due to high interest rates but a recovery is expected from next year, according to FT.

- Former ECB President Draghi’s report: says EU must spend an additional EUR 750bln per year to compete globally; calls for EU to move towards regular joint debt issuance.

FX

- DXY is on the march this morning with USD gains strongest vs. CHF and JPY. DXY has picked itself up from a 100.58 base on Friday to a current session peak of 101.59.

- EUR is losing ground to the USD after slipping back onto a 1.10 handle last Friday. The current session low at 1.1046 is still a bit away from last week’s 1.1026 trough.

- Cable has slipped below the 1.31 mark and slipped under last week’s low at 1.3087 after failing to hold above 1.32 last week. UK-specific newsflow light today, but will see the region’s jobs report on Tuesday.

- JPY is the laggard across the majors after posting a run of four consecutive sessions of gains and following downward revisions to Q2 GDP. USD/JPY has picked itself up from a 141.77 base on Friday to a current session high of 143.43 (still sub-Friday’s peak at 144.04).

- Antipodeans are both softer vs. the USD but NZD more so with NZD/USD extending on Friday’s downside. AUD/USD is seeking some comfort in higher coppers but ultimately is lower vs. the USD following soft Chinese inflation metrics overnight

Fixed Income

- USTs are pulling back following a session of gains on Friday in the wake of the August NFP print and comments from Fed’s Waller, Williams and Goolsbee. Today’s data docket remains light, focus is on NY Fed SCE, but traders will ultimately be attentive of the Presidential Debate on Tuesday and CPI on Wednesday. From a yield perspective, the 10yr has recovered to circa 3.75% after briefly taking out the August low @ 3.667%.

- Bunds are following suit to the losses in global fixed-income markets. Fresh EZ-driver remains light. However, this is not set to remain the case with the ECB rate decision on Thursday looming large. From a yield perspective, the German 10yr is back within the 2.2-25% band after a sharp move on Friday which briefly dragged it as low as 2.147%.

- Gilts are on the backfoot after an indecisive session on Friday. In terms of UK specific updates, a monthly REC/KPMG report showed the UK labour market cooled noticeably in August as job placements declined sharply and pay growth slowed. From a yield perspective, the UK 10yr is just below the 3.95% mark.

- China’s Finance Ministry says it will issue up to EUR 2bln of Euro Sovereign Bond in Paris on Sept 23.

Commodities

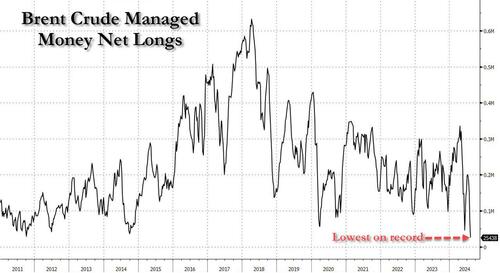

- Crude is on a firmer footing, in what has been a choppy session for the complex thus far. Softer-than-expected Chinese inflation metrics have been unable to cap overnight gains, but also in the context of bullish OPEC+ headlines last week. Brent’Nov currently sits in a USD 71.42-72.21/bbl range.

- Spot gold is incrementally softer, but has clambered off lows in the European session and now looking for a test of USD 2.5k to the upside.

- Base metals are mostly firmer despite the softer-than-expected Chinese inflation metrics overnight and fairly resilient to the Dollar strength seen this morning; positivity may stem from increased bets of Chinese stimulus efforts. 3M LME Copper reclaimed USD 9k/t.

- Morgan Stanley lowers Q4 Brent price forecast to USD 75/bbl (prev. USD 80/bbl); Still estimates surplus in 2025 but slightly smaller than before; unless demand weakens more, Brent likely to remain anchored around mid-USD70/bbl. Lowers Q1 2025 target to USD 75/bbl (prev. USD 78/bbl). Says OPEC+ announcement to delay start of planned oil output increases signal that group remains focused on balancing the market.

- Iraq set October Basrah medium crude OSP to Asia at a discount of USD 0.50/bbl vs Oman/Dubai average, according to SOMO.

- Kuwait’s Emir accepted the resignation of Deputy PM and Oil Minister Al-Atiqi, while Kuwait’s Minister of Finance Al-Fassam was appointed as the acting Minister of Oil, according to Reuters.

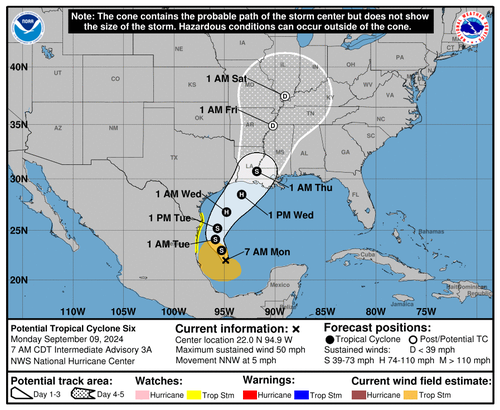

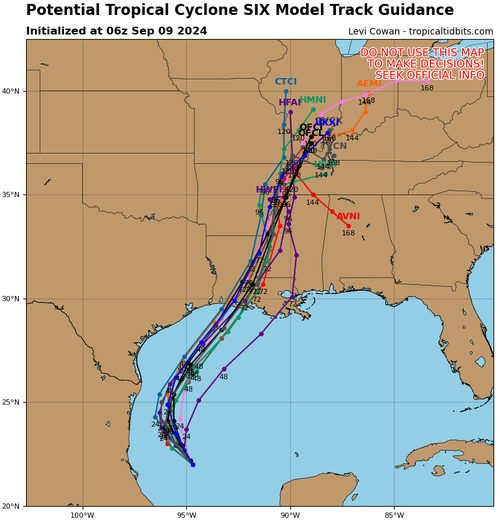

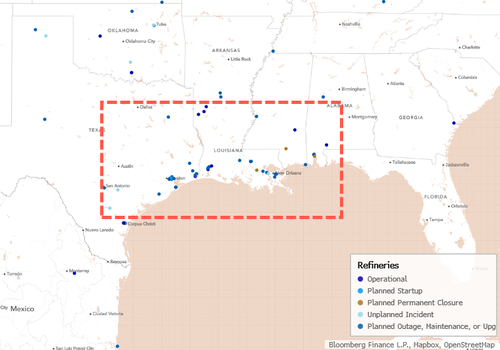

- NHC said a system in the Gulf of Mexico is likely to strengthen from Tuesday, increasing the risk of a life-threatening storm surge and damaging winds along the upper Texas and Louisiana coasts by mid-week, according to Reuters.

- NHC says increasing risk of life-threatening storm surge and hurricane-force winds along the Louisiana and upper Texas coasts by mid-week. Says disturbance expected to become a strengthening tropical storm today; threatening storm surge and hurricane-force winds along Louisiana and upper Texas expected by mid-week.

- Goldman Sachs still expects three months of OPEC+ production increases but pushed out the start date to December from October, while it maintained its USD 70-85/bbl Brent forecast range and December forecast of USD 74/bbl. Furthermore, it still sees risk to its forecast range skewed to the downside given high spare capacity, risks to demand from weakness in China and potential trade tensions.

- Trafigura executive said in APPEC that soft China demand is worrying markets and OPEC is sending confused messages to the market, while the executive added that oil market sentiment is soft at the moment.

- Russian Energy Minister said Russian coal exports to China decreased by 8% Y/Y 45mln tons in the first half of 2024 and no sharp growth is expected although coal exports to China are expected to increase to at least 100mln tons starting in 2025, according to TASS.

- Russia forces attacked energy facilities in seven regions in the past day, according Ukraine’s Energy Ministry.

Geopolitics: Middle East

- Israel conducted a strike which killed three Lebanese paramedics in the southern Lebanese town of Faroun, while Hezbollah launched a “squadron of missiles” targeting an Israeli military headquarters in response which resulted in casualties, according to Reuters.

- Lebanese media reported that the Israeli army targeted the town of Kafr Kila in southern Lebanon with surface-to-surface rockets and mortar shells, according to Sky News Arabia.

- Israeli army said three Israeli civilians were killed in a shooting attack on the Jordan border, while Israel closed its land border crossings with Jordan after the deadly attack at the Allenby Bridge crossing, according to Israel’s airport authority, according to Reuters.

- Syrian media reported explosions in the city of Tartous and that Israeli aircraft conducted shelling on the Damascus countryside.

- Yemen’s Houthis claimed they shot down a US MQ-9 drone conducting hostile acts over the Marib governorate’s airspace.

- UK MI6 spy agency head Moore said he suspects that Iran will try to get revenge for the death of Hamas leader Haniyeh, while Moore also commented that it is too early to say how long Ukraine can hang on in Kursk.

Geopolitics: Other

- Iran officially denied reports that it supplied Russia with ballistic missiles to aid its war in Ukraine, although an Iranian MP admitted to a deal of sending ballistic missiles to Russian forces fighting in Ukraine in exchange for soybeans and wheat, according to The Telegraph. Furthermore, Ukraine expressed concern over reports of a possible Iranian missile transfer to Russia and called on the international community to increase pressure on Tehran and Moscow, according to Reuters.

- Russian military is to join Chinese drills in sea and airspace in Sea of Japan and Sea of Okhotsk in September, according to Xinhua.

- Russian forces took control of Novohrodivka in eastern Ukraine, according to RIA.

- Italian PM Meloni said what must not happen is to think that the Ukrainian conflict can be resolved by abandoning Ukraine to its fate and that the decision to support Ukraine is aligned with Italy’s national interest which will never change. Meloni added that the Western World’s decision to support Ukraine after Russia’s invasion led to the current stalemate which is the pre-condition for peace talks.

- CIA Director Burns said there was a genuine risk of the potential use of tactical nuclear weapons in the fall of 2022, while Burns added that he doesn’t see any evidence today that Russian President Putin’s grip on power is weakening, according to Reuters.

- North Korean Leader Kim Jong Un emphasised the importance of strengthening naval power, according to KCNA. Furthermore, North Korean media also reported that Chinese President Xi called for deeper strategic communication and cooperation with North Korea, while Russian President Putin said a comprehensive partnership between Russia and North Korea will be strengthened in a planned way.

US Event Calendar

- 10:00: July Wholesale Inventories MoM, est. 0.3%, prior 0.3%

- July Wholesale Trade Sales MoM, est. 0.2%, prior -0.6%

- 11:00: Aug. NY Fed 1-Yr Inflation Expectat, prior 2.97%

- 15:00: July Consumer Credit, est. $12b, prior $8.93b

DB’s Jim Reid concludes the overnight wrap

The week after payrolls is often quiet, but with the 25bps vs 50bps Fed debate for next week raging, there will be plenty of opportunity for volatility as the market flits between the two. With the Fed now in its media blackout period ahead of next Wednesday’s almost certain first cut in the cycle, it looks to us that 25bps is just the more likely based on what the Fed have been telling us. However, given past form if they do decide 50bps is firmly on the table it is probably likely that well-informed press contacts will give us a steer. However, if that materialises it may be nearer to this time next week rather than the next few days. So 25 vs 50 will be the main market focus this week.

Wednesday’s US CPI and Thursday’s PPI will probably help move that debate on, but it seems employment is more important at the moment and Friday’s mixed employment report had arguments for both sides, so the swing factor is probably how the committee view labour markets rather than inflation. Before we preview the inflation data and review Friday’s employment report, the other two main global highlights are the US presidential election debate between Harris and Trump tomorrow night, and the ECB decision on Thursday, likely to be a 25bps cut (see DB’s preview here). The election seems to have fallen down the pecking order of market topics since Harris replaced Biden as the Democratic candidate. However Trump has edged back in the lead on the betting odds now, and RealClearPolitics’ average of various odds puts Trump at 51.5% as of this morning. This, the debate, and the fact that it’s now only 2 months to polling day means that this will soon become the most important topic again in markets alongside the Fed and any US recession fears.

In terms of more minor data and events this week, today sees the 1-yr NY Fed inflation expectations series and July US consumer credit. Tomorrow sees the NFIB small business optimism survey, the latest UK employment data, China trade, Italian IP and a 3yr UST auction. Outside of the aforementioned US CPI, Wednesday sees UK monthly GDP and a 10yr UST auction. Thursday will obviously see US jobless claims in addition to a 30yr UST auction. Friday sees the US University of Michigan consumer survey. See the rest of the week ahead in the day-by-day calendar at the end.

In terms of Wednesday’s US CPI, DB is expecting headline (+0.20% forecast vs. +0.15% previously) and core (+0.23% vs. +0.17%) CPI to be around the same level. This is in line with consensus. This would equate to YoY headline CPI dropping 30bps to 2.6%, with core unchanged at 3.2%. As our economists point out, the three-month annualised rate would remain below 2% (1.9% vs. 1.6% in July) and with the six-month annualised rate falling by 20bps to 2.6%. A surprise increase in rents in July will mean this category again sees a lot of focus for August. Our economists think we’ll return closer to June’s tamer levels. Indeed they anticipate primary and owners’ equivalent rents to rise by 0.32% (vs +0.49% in July) and 0.30% (vs. +0.36% in July), respectively. As for PPI on Thursday, headline (+0.2% vs. +0.1%) and core (+0.2% vs. unch.) should post similar gains to their CPI counterparts. As always, we will pay closest attention to the categories that feed into the core PCE deflator – namely, health care services, airfares and portfolio management. Challenging base effects should cause the year-over-year growth rate of core PCE to tick up to 2.7%.

Overnight in Asia, the negative market momentum has continued, with sizeable losses across the major indices. In part, that’s because they’re reacting to the US payrolls number on Friday, but the data from Asia this morning has also been underwhelming. For instance, Japan’s GDP growth in Q2 was revised down on the latest reading to +0.7%, having previously been at +0.8% on the initial estimate. On top of that, China’s inflation was also weaker-than-expected in August, with CPI only up to +0.6% (vs. +0.7% expected), whilst the PPI reading fell further into deflationary territory at -1.8% (vs. -1.5% expected).

Against that backdrop, the Nikkei is down -1.23% this morning, putting the index on course for a 5th consecutive daily decline. Otherwise, the CSI 300 (-1.06%) and the Shanghai Comp (-0.92%) are both on track to close at their lowest level since February, and there’ve also been losses for the Hang Seng (-2.01%) and the KOSPI (-0.48%). That said, it does look as though the equity selloff has begun to stabilise elsewhere, as US equity futures are pointing higher this morning, with those on the S&P 500 (+0.38%) and the NASDAQ 100 (+0.54%) both advancing. US Treasury yields have also risen this morning, with the 10yr yield up +3.6bps to 3.74%, which comes as investors are modestly dialling back the probability of a 50bp rate cut next week, which now stands at 31%.

Looking back at that US jobs report on Friday, our economists published a chart book on it here with everything you could possibly want to know. But in brief, the positives were that payrolls rebounded in August (headline 142k vs. 89k in July, and private 118k vs 74k) and the unemployment rate (4.2% vs. 4.3%) retraced some of its prior rise with average hourly earnings (+0.4% vs. +0.2%) increasing alongside a one-tenth increase in the work week (34.3hrs vs. 34.2hrs). On the negative side, the previous couple of months saw payrolls revised meaningfully lower, and the 3m average of payrolls growth is now at the lowest since the early days of the pandemic.

Our economists continue to believe that most of the rise in unemployment from the cycle lows is due to an increasing supply of labour, so the story is so far about less labour demand rather than lay-offs. This was a point that both New York Fed President Williams and Fed Governor Waller made on Friday afternoon after the report. Neither speech provided a smoking gun for a 50bps hike and therefore we think on balance they’ll start with 25bps next week.

In terms of market performance last week, markets saw a significant risk-off move, with the S&P 500 suffering its worst weekly performance since the week of SVB’s collapse in March 2023, with a -4.25% decline. The index lost ground every day of the week, ending the week with a further -1.73% loss after the jobs report. Those losses were even bigger for the NASDAQ, with the index falling -5.77% (-2.55% Friday), its worst decline since January 2022. So with just a week into the month so far, September is certainly living up to its reputation as a very bad one for equities. Globally it was much the same story, with Europe’s STOXX 600 down -3.52% (-1.07% Friday), Japan’s Nikkei down -5.84% (-0.72% Friday), and the MSCI EM Index down -2.28% (-0.11% Friday).

On the rates side, there were some very volatile moves after the jobs report, but Treasury yields ultimately closed at their lowest levels in over a year for the most part. For instance, the 2yr Treasury yield was down -27.1bps over the week (-9.7bps Friday) to 3.65%, which is its lowest closing level since September 2022. Similarly, the 10yr Treasury yield fell -19.4bps last week (-1.8bps Friday) to 3.71%, the lowest closing level since June 2023. With the sizeable steepening on Friday, the 2s10s curve ended the week in positive territory at +6bps, ending its longest period of inversion that had lasted since July 2022. Breakevens accounted for most of the decline in yields, with 2yr breakevens -17.4bps lower on the week to 1.49%, their lowest since November 2020. Those rates moves came as markets dialled up the amount of rate cuts priced by December from 100bps to 115bps over the week.

Over in Europe, there were similar if more moderate moves on the rates side, and the 10yr bund yield ended the week down -12.8bps (-3.6bps Friday) at 2.17%. That is its lowest closing level since February, and the moves came as investors also grew more confident that the ECB would dial up the pace of their rate cuts over the year ahead. In fact, the amount of rate cuts priced by the June 2025 meeting went up from 133bps a week ago, to 151bps by the close on Friday. So almost an entire extra 25bp cut was priced in.

Finally, one trend supporting those rate cut expectations were falling commodity prices, which took out another source of inflationary pressures. In particular, Brent crude oil prices ended the week at $71.06/bbl, their lowest closing level since December 2021. Indeed, by the end of last week they’d fallen for 6 consecutive sessions, and the weekly decline of -9.82% for Brent crude was the biggest since October 2023.