Key Recession Indicator Gives Stronger Recession Signal In August

Authored by Mike Shedlock via MishTalk.com,

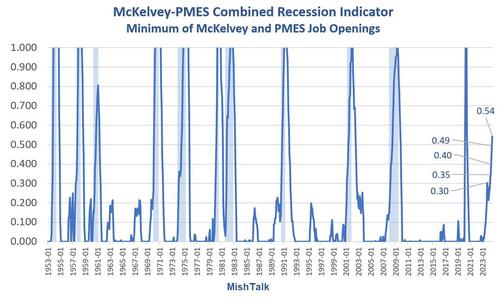

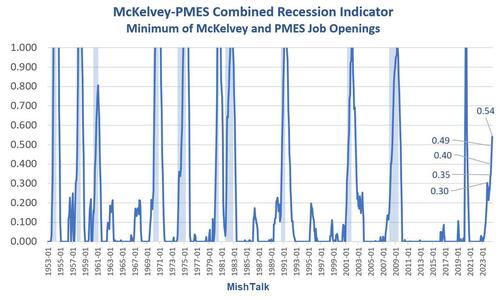

A modified McKelvey recession indicator with no false positives or false negatives since 1953 suggests we are in recession now.

100 percent of the time, with no false positives or negatives, under current conditions, the economy has been in recession.

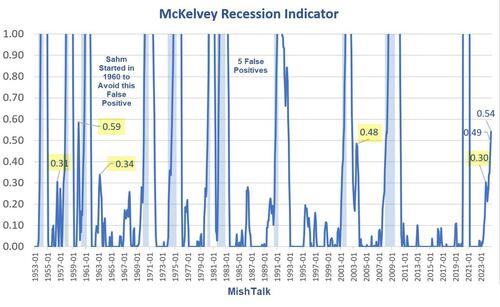

What is the McKelvey Recession Indicator?

Take the current value of the 3-month unemployment rate average, subtract the 12-month low, and if the difference is 0.30 percentage point or more, then a recession has started.

Edward McKelvey, a senior economist at Goldman Sachs, created the indicator.

The problem with the indicator is that it has many false positives.

Claudi Sahm Revision

Claudi Samn, a former Fed economist, revised the rule, claiming it as her own, without credit to McKelvey, then set the indicator to 0.50.

Because that still had false positives, she started her series in 1960.

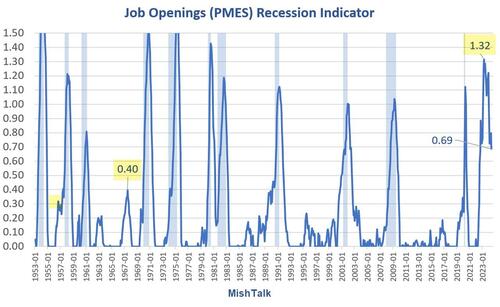

PMES Acronym

PMES is my acronym for Pascal Michaillat and Emmanuel Saez, economists at the University of California in Santa Cruz.

PMES is their initials. I am not sure that PMES is right but somehow I don’t think the name McKelvey-Michaillat-Saez will catch on.

It is brilliant work to add a second indicator that eliminates the false negatives and false positives.

I struggled with the idea of adding a second indicator for a long time before stumbling on their work.

Also, and I cannot emphasize this enough, credit goes to Regis Barnichon for the data and idea used by PMES and me in the charts in this post.

What Is the PMES Second Indicator?

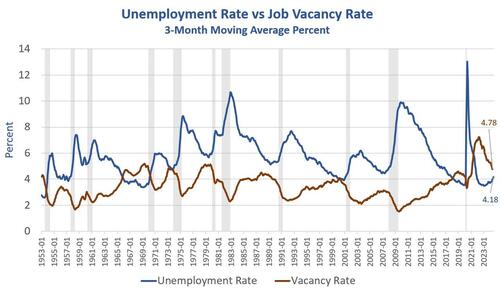

The PMES recession indicator combines job vacancy rates with unemployment data. The indicator is the minimum of the McKelvey indicator—the difference between the 3-month trailing average of the unemployment rate and its minimum over the past 12 months—and a similar indicator constructed with the vacancy rate—the difference between the 3-month trailing average of the vacancy rate and its maximum over the past 12 months.

Vacancy Rate

The vacancy rate is defined as the ratio of job openings to the labor force. The BLS Job Openings and Labor Turnover (JOLTS) report only dates to December of 2000.

Regis Barnichon, in 2010 described Building a composite Help-Wanted Index

This paper builds a measure of vacancy posting over 1951–2009 that captures the behavior of total—print and online— help-wanted advertising, and can be used for time series analysis of the US labor market.

Barnichon says HWI and JOLTS “closely track each other. In particular, the composite HWI does a good job of matching the level of JOLTS job openings over 2000–2009, indicating that the MISM can successfully model the share of online advertising.“

It is that overlap period that validates the second indicator.

Minimum Indicator

To decide whether or not there is a recession, PMES takes the minimum of either McKelvey or Job Openings.

If either one is below 0.3 percent, there is no recession.

Pascal Michaillat notes “For some reason, the Sahm indicator provided by the St. Louis Fed is sometimes negative. This is strange given that—by definition—a variable cannot be lower than its minimum over the past 12 months. Our indicators are never negative.”

I explained that in my prior post on this subject.

The reason for the Sahm negative discrepancy is Sahm does not include the current month in the 12-month lookback period.

A Sahm chart is rife with negative numbers. This never made any sense to me either, but that is why.

My charts, as do those of PMES, set the lookback period properly to eliminate negative numbers.

That touches all the background bases. Now let’s look at the two charts individually that comprise the lead chart.

Unemployment Rate vs Job Opening Rate

McKelvey Recession Indicator

The problem with McKelvey is five false positives, the last one being October 2023.

Claudia Sahm started her series in 1960 to avoid a huge false positive in 1959.

Job Openings PMES Recession Indicator

The PMES indicator, in isolation, also yields false positives. However, the false positives do not overlap with the false positives by PMES alone.

Here is the lead chart again for convenience (The minimum of McKelvey and PMES).

McKelvey-PMES Recession Signal

I propose a trigger of 0.40 or a write-off of the October 2023 value that barely touched 0.30 then did not exceed 0.30 for another six months.

McKelvey hit 0.34 in April, 0.35 in May, 0.40 in June (my preferred trigger), 0.49 in July, and 0.54 in August.

The rising consistency strengthens the signal.

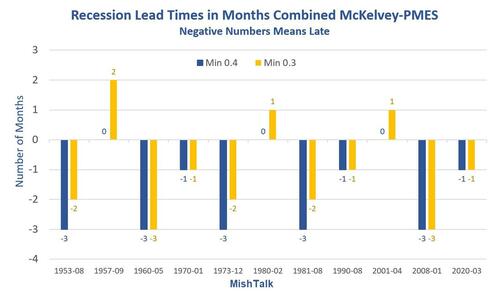

Recession Lead Time In Months Combined McKelvey-PMES

These are very impressive numbers vs Sahm at 0.50 which has at least one false positive and lag times as great at 7 months.

Combining the triggers eliminates the false positives and negatives and allows the use of a lower trigger (0.30 or 0.40 instead of 0.50 or 0.60) straight up.

Michaillat and Saez note “The minimum [combined] indicator is always faster than the unemployment indicator, except in 2008 when it called the Great Recession 3 months later than the unemployment indicator. The slight delay is because job vacancies took some time to drop at the onset of the Great Recession.”

I note that since 1953, every time the economy was in the current state, the economy was in recession.

That does not make the odds 100 percent because everything is up to the NBER, the official arbiter of recessions.

Pascal Michaillat Update

Pascal provides his update today: Has the Recession Started?

He says “With August 2024 data, our indicator is at 0.54 percentage points, so the probability that the US economy is now in recession is 48 percent. In fact, the recession may have started as early as April 2024.”

I calculate 0.54 independently, but will take the over line on 48 percent odds.

The signal is relatively high and rising consistently. Job revisions are hugely negative, and the Fed Beige Book shows flat to declining economic activity in 9 of 12 Fed districts.

Recent Economic Data

September 3: Construction Spending Growth Slows in May, Stops in June, Negative in July

September 5: Small Businesses Reducing Workers for the Last Four Months

September 5: Fed Beige Book Shows Flat or Declining Economy in 9 of 12 Fed Districts

Payroll Report: Manufacturing Sheds 24,000 Jobs, Government Adds 24,000, Big Negative Revisions

Earlier today I reported Payroll Report: Manufacturing Sheds 24,000 Jobs, Government Adds 24,000, Big Negative Revisions

Other than a small 0.1 percent improvement in the unemployment rate, this was a very poor jobs report with private payrolls only +74,000.

Following my jobs post, Lacy Hunt pinged me with this comment that he said I could share:

“Spot on! Also, I think that it is fair to exclude the birth/death adjustments which was a big number by my seasonal adjustment. Excellent report.”

Thanks Pascal and Lacy!

Tyler Durden

Sun, 09/08/2024 – 10:30

via ZeroHedge News https://ift.tt/ikzxLKW Tyler Durden