Authored by Lance Roberts via RealInvestmentAdvice.com,

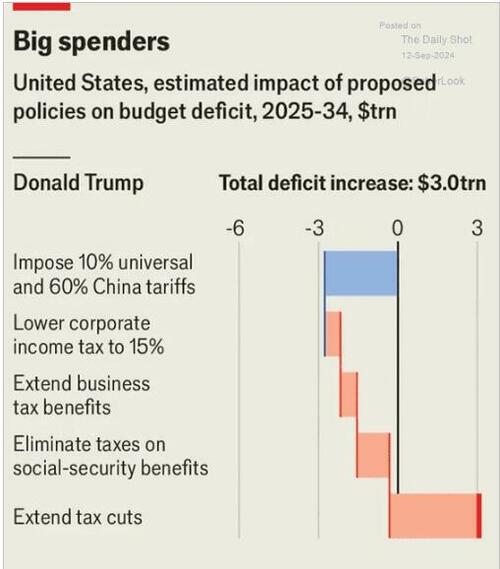

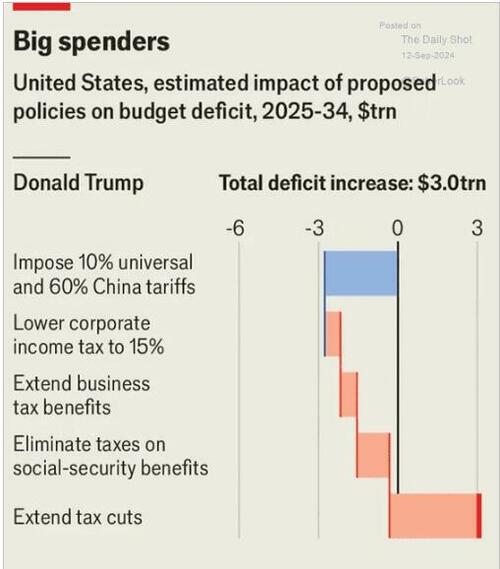

An analysis of Presidential Candidate Trump’s policy proposals recently suggests that tax cuts will increase the deficit. While the raw analysis is correct, as it subtracts the potential for reduced tax collections from the tariff revenue, it ignores the impact on economic growth.

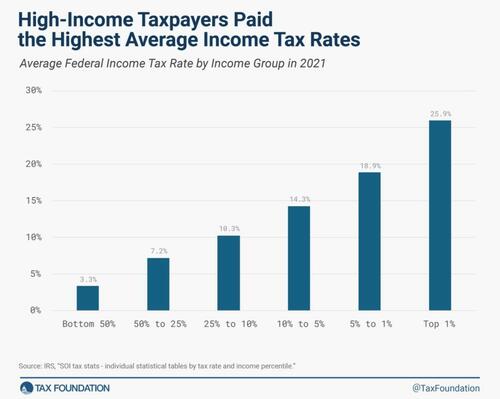

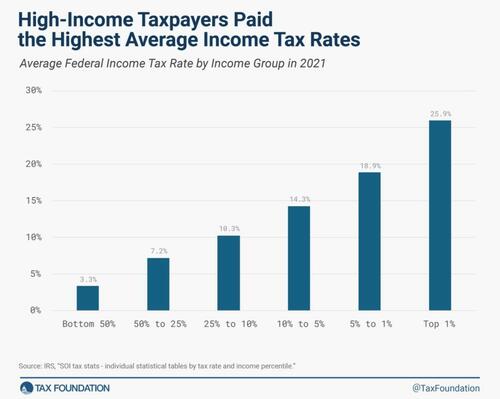

There is much rhetoric about the impact of tax cuts, mostly centering around “only benefitting the rich.” While it may seem that “the rich” are the ones who benefit, there are two important points to consider. First, “the rich” already pay most of the taxes. The Tax Foundation shows that the top 10% of income earners paid 59.1% of taxes. The top 25% of income earners comprised nearly 70% of all tax revenue, with the top 50% paying 97% of all taxes.

Of course, such begs the question of those claiming the “rich should pay their fair share” what that fair share is.

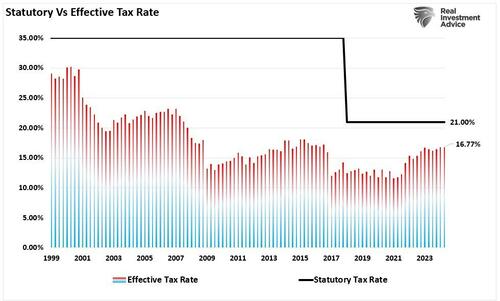

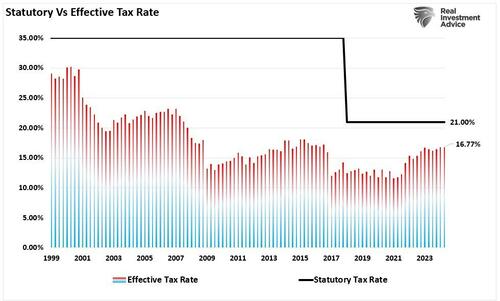

Secondly, due to the complexities of the current tax code, there is a significant difference between the “statutory” tax rate and what corporations pay (the effective rate). In 2018, the effective corporate tax rate was reduced to 21%, yet at the time, the actual tax rate paid was around 14%. Today, despite no change to the statutory rate, the effective tax rate has risen to almost 17%.

Notably, changes to the statutory rate are far more symbolic than actual. However, employers experience a strong psychological impact when tax rates are changed. Increases in tax rates often lead to companies’ defensive posturing to offset the impact of higher taxes. Decreases in tax rates, while there may be very little impact on the effective rate, tend to provide economic benefits.

3 Examples The Economic Benefit Of Corporate Tax Cuts

Corporate tax rate reductions have long been a cornerstone of economic policy discussions in the United States. Proponents argue that reducing corporate taxes can stimulate investment, create jobs, and enhance the country’s global competitiveness. Critics often claim that such tax cuts primarily benefit large corporations and wealthy shareholders, with limited trickle-down effects on the broader economy. There is certainly truth in that statement. As we argued previously, corporate tax cuts often find their way into enriching corporate executives

However, this article explores the three key economic benefits of corporate tax rate reductions supported by real-world examples. Let’s begin with one of the most significant benefits: a boost to capital investment. With lower tax burdens, companies retain more profits, which can be reinvested into expanding operations, developing new technologies, and conducting research and development (R&D). These investments improve productivity, drive innovation and foster long-term economic growth.

Example 1: The Tax Cuts and Jobs Act of 2017

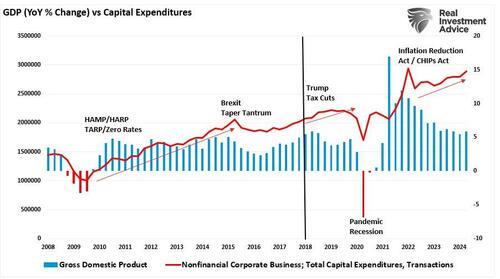

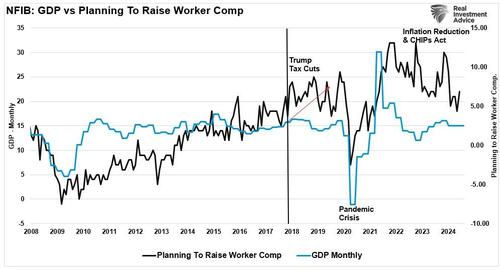

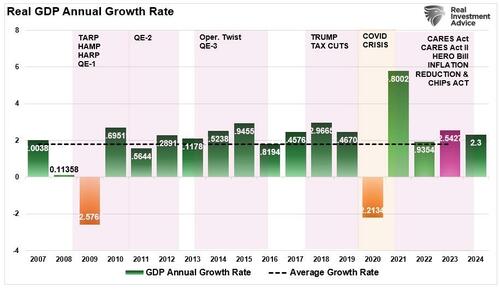

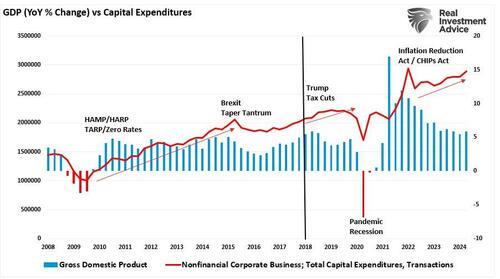

A prominent example of the relationship between corporate tax reductions and increased investment is the Tax Cuts and Jobs Act (TCJA) of 2017. The TCJA slashed the U.S. federal corporate tax rate from 35% to 21%, creating a more favorable environment for business investment. In the aftermath, several major corporations announced significant capital investments in the U.S. economy. Following those tax cuts, capital expenditures grew until 2019 as the economy started worrying about the pandemic and the shutdown.

A good example was Apple, which committed to investing $350 billion in the U.S. over five years, with a portion of the investment attributed to the savings from the tax cuts. This included plans for a new campus, data centers, and technology infrastructure to further drive innovation in artificial intelligence and 5G technology.

Additionally, the TCJA spurred investment across various sectors, particularly in manufacturing and energy, where companies used their tax savings to modernize facilities, adopt new technologies, and expand production capacity. However, the onset of the pandemic and subsequent massive monetary interventions have obscured the longer-term effects of the tax cuts.

2. Job Creation and Wage Growth

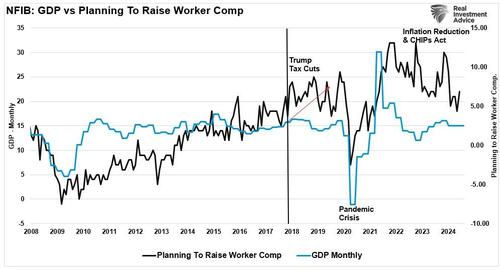

Corporate tax cuts can also lead to job creation and wage growth. When companies reinvest their tax savings into business expansion, they often need to hire more workers to support the growth. Additionally, businesses may pass some of their tax savings to employees through higher wages, bonuses, or enhanced benefits. Again, that happened in the short run, particularly in small and mid-sized businesses. However, as noted, the pandemic-related crisis confounded the longer-term effects.

Example 2: Walmart’s Wage Increases and Bonuses

Following the TCJA’s enactment, Walmart, the largest private employer in the U.S., announced it would raise its starting wage to $11 per hour and provide bonuses of up to $1,000 to more than a million employees. While Walmart’s decision was partially driven by a competitive labor market, the company explicitly credited the tax cuts as a factor in its ability to increase wages and offer bonuses.

Walmart’s actions underscore the potential for corporate tax reductions to positively impact employees. By lowering tax liabilities, companies have greater flexibility to reward their workforce through wage increases, bonuses, or improved benefits. As discussed in “Labor Market Impact.” increased wages stimulate consumer spending, a critical driver of economic growth.

Beyond individual companies, studies have shown that reductions in corporate tax rates can have a broader positive impact on wages. According to the National Bureau of Economic Research, a one percentage point reduction in corporate tax rates can lead to a 0.5% wage increase over the long term. This is especially true in industries where businesses are highly profitable and can pass on some of their tax savings to employees. Although the effects are often more gradual, corporate tax cuts can support wage growth across various sectors.

3. Enhanced U.S. Competitiveness in a Global Economy

In the era of globalization, corporate tax rates play a crucial role in determining a nation’s ability to attract and retain businesses. High corporate tax rates can make a country less competitive compared to others with lower tax rates, potentially driving businesses to relocate operations abroad. By reducing corporate tax rates, the U.S. can enhance its attractiveness to domestic and foreign corporations, encouraging investment and job creation within its borders.

Example 3: Repatriation of Foreign Profits After the TCJA

The Tax Cuts and Jobs Act included provisions encouraging U.S. companies to repatriate overseas profits. Before the TCJA, U.S. corporations faced high taxes on foreign earnings, which led many companies to keep profits offshore rather than bringing them back to the U.S. The TCJA’s shift to a territorial tax system and a one-time tax on repatriated profits led to a significant influx of capital returning to the U.S.

According to the U.S. Bureau of Economic Analysis, U.S. companies repatriated more than $664 billion in foreign profits in the year following the tax reform. That capital repatriation significantly boosted the U.S. economy, with many companies using the funds to pay down debt and invest in domestic operations. They also used the capital to boost stock buybacks and issue dividends. Again, as noted, while there may have been longer-term benefits, the pandemic-related crisis cut them short.

Notably, the TCJA made the U.S. a more attractive destination for business investment by aligning the corporate tax rate more closely with other developed nations. This has been particularly important in industries such as technology and pharmaceuticals, where companies weigh corporate tax rates heavily when deciding where to base their operations. For example, Pfizer, one of the largest pharmaceutical companies in the world, explicitly mentioned the positive effects of the U.S. tax reform on its global competitiveness and financial strategy.

Conclusion

Corporate tax rate reductions in the United States have delivered tangible economic benefits, including increased capital investment, job creation, wage growth, and enhanced global competitiveness. The Tax Cuts and Jobs Act of 2017 is a key example of how reducing corporate tax rates can stimulate economic activity. Companies like Apple, Walmart, and Pfizer have used their tax savings to reinvest in the U.S. economy, create jobs, raise wages, and bolster their global standing.

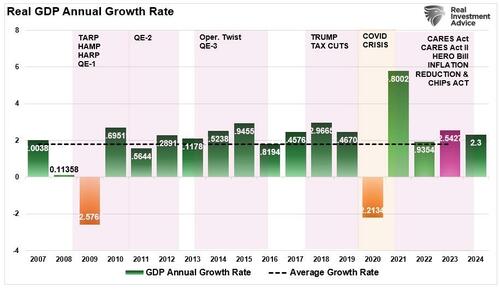

While the long-term effects of corporate tax cuts continue to be debated, there is no denying that, when implemented strategically, they can positively impact the broader economy. Furthermore, following the TCJA, tax receipts increased even though tax rates declined. Such is expected if the economy benefits from tax cuts. However, as noted above, those benefits were cut short by the onset of the pandemic and confounded by the massive interventions following.

As the U.S. continues to navigate global economic challenges, corporate tax policy will remain important for encouraging business investment, job creation, and sustained economic growth.

Tax policies of the next administration will play a key role in the economy and markets going forward.