US stock-index futures fell, pointing toward a continued selloff on Wall Street after a slump Tuesday, when dire manufacturing PMI and ISM data led to renewed concern that a recession may be looming. Futures on the S&P 500 dropped 0.4% while contracts on the Nasdaq 100 Index declined 0.8% at 8.00 am ET, as NVDA extended its record losses which saw a historic $280 billion in market cap wiped out in Tuesday’s session, after a Bloomberg report hit just after the close that Kamala’s DOJ sent subpoenas to the chipmaker. NVDA sparked Nasdaq’s 3.2% Tuesday rout: the stock has been falling since the company’s earnings last week failed to live up to the highest expectations. Losses in Europe and Asia were deeper, with traders still rattled by the speed and severity of the US retreat while the VIX climbed above 22. Treasury yields dropped 2bps to 3.82% while the dollar weakened for the first time in six as the yen extended gains and the USDJPY traded at 145. On the macro front, we have mortgage applications (1.6% vs 0.5% last week), trade balance, JOLTS job openings, as well as the final July factory orders and durable goods reports.

In premarket trarding, Nvidia slid 1.9% after Bloomberg reported that the US DOJ sent subpoenas to the chipmaker, as well as other companies, as it sought evidence that the dominant provider of AI processors violated antitrust laws. Zscaler plunged 16% after the security-software company gave a full-year forecast that is weaker than expected on both adjusted earnings and revenue. Here are some other notable premarket movers:

- Asana tumbles 12% after posting 2Q results and providing a 3Q forecast. The company also said CFO Tim Wan is exiting the post and will be succeeded by Sonalee Parekh.

- Clover Health rises 10% after its Counterpart unit won a contract with Iowa Clinic, a healthcare group.

- Dollar Tree falls 12% after management lowered the company’s full-year guidance as the chain’s higher income consumers remain cautious in their spending.

- GitLab climbs 12% after the company reported second-quarter results that beat expectations and raised its full-year forecast.

- Hormel Foods falls 5.4% after the company lowered its fiscal-year sales outlook.

- PagerDuty slides 14% after the company cut its full-year revenue forecast.

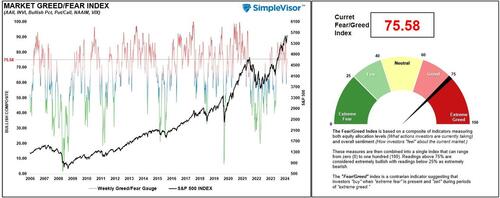

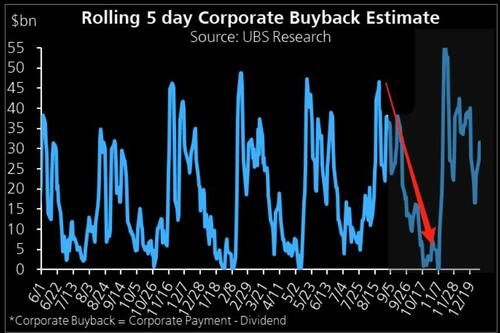

The S&P 500 on Tuesday fell the most since Aug. 5, when recession fears triggered a brief meltdown, while the Nasdaq 100 had its biggest decline since July 24 as Nvidia crashed. The declines came after the ISM’s manufacturing gauge showed that activity shrank for a fifth straight month, while commentary in the S&P PMI manufacturing report was downright apocalyptic.

The sudden souring of risk sentiment comes just as US equities were edging back toward the all-time high set in mid-July. Other key data to watch this week include July job openings on Wednesday, services PMI and jobless claims on Thursday and non-farm payrolls on Friday. These readouts may shed further light on how much and how quickly the Federal Reserve will lower interest rates, after Chair Jerome Powell last month telegraphed a September cut.

“Investors are in a wait-and-see mode and trying to decipher the probabilities a US recession and how the Fed would adjust,” said Vincent Juvyns, global market strategist at J.P. Morgan Asset Management. “But even if we had disappointing data on US employment this week, for us, it’s too early to call a recession, notably with consumption being resilient.”

The US job openings report due on Wednesday is expected to show further cooling in the labor market, following yesterday’s data showing a fifth consecutive month of contraction in manufacturing activity. As the market’s focus shifts from inflation to concerns over economic growth, negative macro data is increasingly translating into pain for stocks and other risk assets.

For now, traders are anticipating the Federal Reserve will start easing policy in September and reduce rates by more than two full percentage points over the next 12 months — the steepest drop outside of a downturn since the 1980s. Payrolls data due on Friday is considered crucial in shaping the magnitude of the initial rate cut. “A disappointing number will spook markets a little bit,” said Neil Birrell, chief investment officer at Premier Miton Investors. “There’s just a lack of certainty around. I’m not brave enough to say buy the dip on Wednesday when the numbers are out on Friday.”

European stocks followed their Asian counterparts lower after Wall Street’s worst day since the August meltdown. The Stoxx 600 falls 1%, led lower by technology shares. European luxury stocks fell, with LVMH and Richemont notable underperformers as Morgan Stanley cut its price targets on the two stocks amid worries over weakening demand from Chinese customers. Adding to the gloom, Swiss luxury watchmakers are turning to the government for financial aid to help them weather a downturn in demand

Among individual movers, LVMH -2.4%, Richemont -4.3%, Hermes -1.3%, Swatch -2%, Ferragamo -2.3%, Moncler -2.2%, Kering -2%, Brunello Cucinelli -1.5%, Hugo Boss -1.3%, Burberry -1.1%. In separate notes, Morgan Stanley analyst Edouard Aubin cuts equal-weight-rated LVMH’s PT to €715 from €760, as well as lowering estimates

Earlier in the session, Asian equities suffered broad-based losses following Tuesday’s tech-led US selloff. Taiwan’s Taiex index plunged as much as 5.3% with TSMC tumbling amid Nvidia’s record wipeout. Japan’s Nikkei slumps more than 3.5% as the yen soared, while Korea’s Kospi sheds almost 3%. Chinese indexes are relative outperformers, with the CSI 300 down less than 0.5%. Hang Seng drops about 1.1%.

In FX, the yen is the strongest of the G-10 currencies, rising 0.2%. The Bloomberg Dollar Spot Index falls 0.1%.

In rates, treasuries are richer across the curve with gains led by front-end and belly, steepening 2s10s and 5s30s spreads to unwind most of Tuesday’s flattening moves. Front-end US yields are richer by about 3bp, long-end yields by less than 2bp, leaving 2s10s, 5s30s spreads slightly steeper. 10-year around 3.81% is ~2bp richer on the day, trailing bunds in the sector by ~3bp, gilts by 1.5bp. Wider gains across core European rates follow a sharp selloff in Asia equities as risk-aversion takes hold globally. The US session includes several pieces of economic data led by JOLTS job openings, with Fed policymakers attuned to signs of weakness in labor market to guide policy.

In commodities, oil rose slightly after crashing to a nine-month low as Reuters reversed its Friday story, and now “reports” that OPEC+ may not boost output after all (just as we said). Brent futures, the international benchmark, advanced above $74 a barrel following a near 5% meltdown on Tuesday. West Texas Intermediate rose 0.8%, after dropping under $70 for the first time since early January. Spot gold drops $14 to around $2,479/oz. Iron ore and copper are also in the red.

Looking at today’s calendar, we get the July trade balance (8:30am), July JOLTS job openings and factory orders (10am) and Fed Beige Book (2pm). No Fed speakers are scheduled; Williams and Waller are slated to speak Friday

Market Snapshot

- S&P 500 futures down 0.4% to 5,521

- STOXX Europe 600 down 0.9% to 515.19

- MXAP down 2.5% to 181.21

- MXAPJ down 1.9% to 561.58

- Nikkei down 4.2% to 37,047.61

- Topix down 3.7% to 2,633.49

- Hang Seng Index down 1.1% to 17,457.34

- Shanghai Composite down 0.7% to 2,784.28

- Sensex down 0.3% to 82,284.17

- Australia S&P/ASX 200 down 1.9% to 7,950.48

- Kospi down 3.1% to 2,580.80

- German 10Y yield down 3.4 bps at 2.24%

- Euro up 0.1% to $1.1056

- Brent Futures down 0.4% to $73.49/bbl

- Gold spot down 0.6% to $2,479.05

- US Dollar Index down 0.18% to 101.65

Top Overnight News

- Nvidia looks set to extend yesterday’s $279 billion loss of value — the biggest ever for a US stock. The DOJ sent subpoenas to Nvidia and other tech firms as part of an escalating antitrust probe. BBG

- OPEC+ is discussing a possible delay to an oil output increase planned for October, delegates said, after prices crashed to the lowest since last year. WTI crude rose after earlier sliding below $70. Reuters

- China is considering cutting interest rates on as much as $5.3 trillion of mortgages in two steps to lower borrowing costs for millions of families while mitigating the profit squeeze on its banking system. Financial regulators have proposed reducing rates on outstanding mortgages nationwide by a total of about 80 basis points, part of a package that includes an accelerated timeline for when mortgages become eligible for refinancing. BBG

- Investment banks are cutting their growth forecasts for China, believing Beijing risks undershooting its official target of about 5 per cent as confidence wanes in the world’s second-largest economy. FT

- Chile’s central bank cut rates by 25bp on Tues, as expected, and Canada’s central bank is expected to do the same at 9:45amET today (followed by cuts from the ECB on 9/12 and the FOMC on 9/18). BBG

- Volkswagen defended plans to consider closing German factories, saying flagging sales left it with about two plants too many. BBG

- US prepares for final “take it or leave it” ceasefire push in Gaza, with Netanyahu’s insistence of retaining IDF troops along the Gaza-Egypt border the main obstacle to a deal. WaPo

- Kamala Harris is set to propose expanding a tax break for start-ups, one of a series of policy ideas her campaign is rolling out this week aimed at helping entrepreneurs and small businesses. The plan, which Ms. Harris will announce during a speech in New Hampshire, would allow new companies to deduct up to $50,000 in start-up expenses, a campaign official said. The move would increase by tenfold a $5,000 deduction that companies can now claim for expenses, like advertising and salaries, that they incurred before they started operating. NYT

- US Steel would close plants and probably move its headquarters out of Pittsburgh if its planned sale to Nippon Steel collapses. WSJ

- US homebuilders are facing their biggest credit crunch in more than a decade, with banks cutting lending for residential construction by more than 10%. US banks had $92bn of loans outstanding to fund the construction of dwellings for one to four families in the quarter to the end of June, down from $102bn a year ago. This is the largest year-on-year drop in more than a decade, according to an analysis by BankRegData of the most recent data from the Federal Deposit Insurance Corp. It was also the fifth consecutive quarter in which lending for home construction fell. FT

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded with losses across the board following the dire session on Wall Street, which saw a tech rout led by downside in chips, with a similar picture seen in APAC with the likes of SK Hynix opening lower by over 9%. ASX 200 saw losses led by miners and tech following a similar sectoral picture stateside, whilst the downside was somewhat cushioned by heavyweight healthcare and telecoms. The index extended on losses after the QQ GDP miss. Nikkei 225 felt a double-whammy from the tech-led downside coupled with the stronger JPY, with the index slipping under 38k and eventually 37k from a 38,728.50 close on Tuesday. Hang Seng and Shanghai Comp also fell victim to the regional losses, with the former seeing its large-cap oil names with the deepest losses, whilst the mainland saw shallower losses. Caixin Services PMI deteriorated, but accompanying commentary was rosier.

Top Asian News

- Bank of America cut its 2024 China GDP forecast to 4.8% (prev. 5.0%).

- Japan’s Chief Cabinet Secretary Hayashi said closely watching domestic and overseas market moves with a sense of urgency; will conduct fiscal and economic policy management while working closely with BoJ; Important to make assessment of market moves calmly.

- PBoC injected CNY 700mln via 7-day Reverse Repo at a maintained rate of 1.70%

- China August prelim retail car sales -1% Y/Y, via PCA; +11% M/M.

- China mulls cutting mortgage rates in two steps to shield banks, via Bloomberg citing sources; regulators have proposed reducing rates on outstanding mortgages by a total of 80bpsPart of a package incl. an accelerated timeline for when mortgages become eligible for refinancing.

European bourses, Stoxx 600 (-1%) began the session significantly lower, taking impetus from a weak APAC session overnight as it continued the AI-led pressure seen on Wall St. on Tuesday. Thereafter, sentiment gradually improved, but remains firmly in the red. European sectors are entirely in the red; Food Beverage and Tobacco takes the top spot, whilst Tech is the clear laggard. The likes of ASML opened lower by around 6%, playing catch-up to the NVIDIA weakness seen on Tuesday. US Equity Futures (ES -0.3%, NQ -0.5%, RTY -0.2%) are on the backfoot, continuing the NVIDIA-led weakness seen in the prior session, as risk sentiment continues to remain subdued.

Top European News

- ECB’s Kazaks said the ECB can take steps to lower rates at the next meeting; pace of wage growth is slowing; says we can lower rates but must remain cautious.

- ECB’s Cipollone said investment remains weak, which suggest that firms do not believe a strong recovery, via Le Monde; broadly on track to for inflation; data so far confirms our direction of travel and hopes that this will allow the ECB to continue to be less restrictive. Adds, there is a real risk that the stance could become too restrictive.

- ECB’s Stournaras says even with more rate cuts policy will remain restrictive.

- German economy is seen contracting 0.1% in 2024 (prev. forecast +0.2%), via IFW/Kiel; 2025 0.5% (prev. forecast 1.1%)

- Volkswagen (VOW3 GY) CFO sees industry-wide demand in Europe 2mln cars below peak; Europe’s car market will not return to former size; its Europe overcapacity is 500k cars or two plants. Needs to increase productivity and reduce costs/reduce complexity.

- UK banking representatives are expected to meet Chancellor Reeves in the coming days to discuss concerns over a possible increase in bank taxes, via Reuters citing sources; sources expect the Treasury will seek to increase an existing surcharge on profits

FX

- Dollar is flat and trading within a fairly busy 101.57-73 range; currently within the confines of the prior day’s range. Today see’s US JOLTS job openings data.

- EUR is incrementally firmer and trading towards the upper end of today’s 1.1039-62 range, and generally unmoved by a number of ECB speakers. EZ Composite Final PMIs were revised marginally lower, but ultimately had little impact on the Single-Currency.

- GBP is flat and holds within a tight 1.3102-27 range. Cable holds well within the confines of the prior day’s fairly wide 1.3088-3148 range; the docket ahead remains thin from a UK-specific standpoint.

- JPY is firmer today, largely attributed to its safe haven status, given the continued slump in risk sentiment; price action which is largely a continuation of the hefty pressure seen in USD/JPY in the prior session. USD/JPY towards the mid-point of a 144.76-145.56 range.

- The Antipodeans are the slight laggards vs G10 peers, weighed on by the continued risk-off sentiment seen across markets. Alongside this, Chinese Caixin Services PMIs was weaker than the prior, adding to the already weak Chinese demand narrative.

- PBoC set USD/CNY mid-point at 7.1148 vs exp. 7.1167 (prev. 7.1112)

Fixed Income

- USTs are slightly firmer ahead of US JOLTS Job Openings, which marks the first jobs release ahead of ADP and NFP throughout the week. Currently, toward the mid-point of 114-00+ to 114-09 bounds, eclipsing yesterday’s best.

- Bunds are bid given the general risk tone. A busy morning of data and ECB speak but nothing that has sparked any real price action. Bunds have run into a bit of resistance around the 134.37 peak, with the 28th Aug. high just above at 134.39.

- Gilts are firmer, in-fitting with the above. UK Final PMIs were subject to modest upward revisions, but in-fitting with EZ metrics sparked no reaction. Gilts holding at Tuesday’s 99.25 WTD peak.

- Germany sells EUR 0.438bln vs exp. EUR 0.5bln 1.00% 2038 Bund & EUR 0.818bln vs exp. 1bln 2.60% 2041 Bund.

Commodities

- Crude in the red once again. In short, the price action is a continuation of the moves on Tuesday which were driven by Libya/returning of various refineries/risk tone with further pressure coming from soft Chinese PMIs. Benchmarks are currently off lows amid reports that China is planning to cut mortgage rates. Brent’Nov holds around USD 73.85/bbl, after going as low as USD 72.63/bbl.

- Spot gold is in the red, slipping further from the USD 2500/oz mark despite the downbeat risk tone with the JPY once again outmuscling XAU; currently down to a USD 2480/oz low, just below the 21-DMA at USD 2483/oz.

- Base metals are trading on the backfoot, in-fitting with the general tone. 3M LME Copper continues to fall below the USD 9k mark.

- Russia’s Deputy Energy Minister Sorokin, says global LNG demand may rise to 580-600mln tons per year in the next few years; Western sanction against Russia will not halt development of LNG sector.

- Teamsters at Marathon Petroleum’s Detroit refinery (140k bpd) go on strike on Sept 4th.

Geopolitics: Middle East

- “Estimates that Washington will present its new plan for the exchange deal by Friday”, according to Sky News Arabia citing Walla News.

- Israeli Broadcasting Authority said Israeli officials informed mediators of Tel Aviv’s approval to withdraw from the Philadelphi corridor in the second phase of the deal, via Sky News Arabia.

- “US military announces destruction of Houthi missile system in area under their control in Yemen”, according to Sky News Arabia.

Geopolitics: Ukraine/Russia

- Ukraine’s air defence engaged in repelling the second wave of Russian air attacks on Kyiv overnight, according to the country’s military; engaged in repelling a drone attack on the western city of Lviv, near the Polish border.

- Poland activated aircraft to ensure airspace security for the third time in eight days after Russia launched strikes on Ukraine, according to Polish armed forces.

- Russia’s Kremlin said Russia takes into account that Ukraine “will” use US long-range weapons in its attacks deep into Russian territory.

- Russia’s Kremlin said work on changing Russia’s nuclear doctrine is caused by actions of the West, according to Ria.

- Russia and China are working on President Xi’s participation in the BRICS summit in Russia’s Kazan, according to Ria.

US Event Calendar

- 07:00: Aug. MBA Mortgage Applications, prior 0.5%

- 08:30: July Trade Balance, est. -$79b, prior -$73.1b

- 10:00: July JOLTs Job Openings, est. 8.1m, prior 8.18m

- 10:00: July Factory Orders, est. 4.8%, prior -3.3%

- July Factory Orders Ex Trans, prior 0.1%

- 10:00: July Durable Goods Orders, est. 9.9%, prior 9.9%

- July Durables-Less Transportation, est. -0.2%, prior -0.2%

- July Cap Goods Ship Nondef Ex Air, prior -0.4%

- July Cap Goods Orders Nondef Ex Air, prior -0.1%

- 14:00: Federal Reserve Releases Beige Book

DB’s Jim Reid concludes the overnight wrap

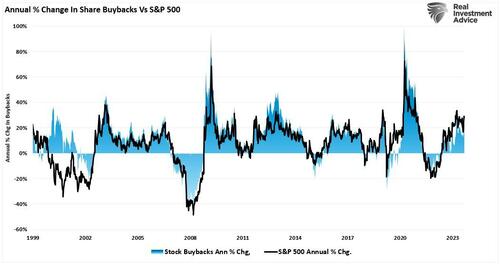

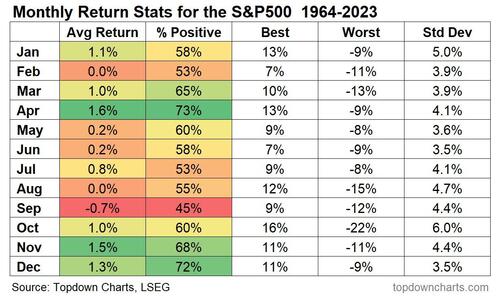

As September got going after the Labor Day holiday on Monday, the month yesterday started living up to its billing as the worst month of the year for risk with a notable sell-off. The S&P 500 (-2.12%) posted its worst daily performance since the global turmoil on August 5th and included the largest market cap drop in history for a single stock. Nvidia (-9.53%) lost $279bn on the day.

The main catalyst for the sell-off was initially the latest ISM manufacturing print, which renewed investors’ concerns that the US economy is running out of a bit of momentum. The release came in beneath expectations yet again, at 47.2 in August (vs. 47.5 expected), which was only a modest pickup from the disappointing July reading. On top of that, the new orders subcomponent fell to its lowest since May 2023, at 44.6. So there really wasn’t much good news to focus on at all, and it’s added to the downbeat backdrop ahead of Friday’s all-important US jobs report. On that the employment subcomponent did pick up from a 4-year low of 43.4 last month to 46.0 but this is still low, and the 17th month below 50 in the last 20 months. However, this has been a period when overall payrolls have been strong so the manufacturing read-through to the rest of the economy is certainly not automatic.

All things considered it was viewed as a soft report and in response risk assets saw a sharp selloff that only extended as the session progressed. The losses were driven by the more cyclical sectors, with the NASDAQ (-3.26%) and the Mag-7 (-3.36%) posting even larger declines than the S&P 500. The Philadelphia Semiconductor Index (-7.75%) saw its worst daily slump since March 2020 amidst a sharp fall from Nvidia (-9.53%), which saw its worst decline since April. Even more remarkably, this marked the largest global daily decline in a company’s market capitalisation, with $279bn wiped off Nvidia’s valuation. Nvidia came under further pressure after-hours after Bloomberg reported that it had received a subpoena from the US Justice Department which is investigating its position as the dominant AI computing provider. S&P 500 and NASDAQ futures have extended their losses overnight, down -0.49% and -0.67% respectively.

While tech stocks led yesterday’s losses, the reversal was pretty broad-based, and the small-cap Russell 2000 also fell -3.09%. The equal-weighted S&P 500 was down -1.33%, with defensive sectors limiting its decline. The renewed volatility also saw the VIX volatility index jump +5.17pts to 20.72, which is its second largest jump in two years, behind August 5th this year, and its highest close this year apart from the 7 days in early August. Other risk assets also came under pressure, with US IG (+4bps) and HY (+16bps) spreads seeing the largest widening since the August 5th vol shock.

With that ISM release in hand, investors also ratcheted up the chance that the Fed would start with a 50bp rate cut in a couple of weeks’ time. Indeed, futures raised the probability from 31% on Monday to 34% by the close yesterday. That more dovish pricing was evident at a longer horizon as well, and futures are now pricing in 102bps of cuts by the December meeting, up from 97bps the previous day. And 205bps of rate cuts are now priced in over the next 12 months, an amount of easing that since the 1980s has materialised only amid recessions.

As investors priced in more rate cuts, that led to a fresh rally among US Treasuries that took the 2yr yield (-5.3bps) to just 3.86%. That’s the lowest closing level for the 2yr yield since the regional banking turmoil in early 2023, and the 10yr yield (-7.2bps) also saw a sharp decline to 3.83% with a small additional -0.38bps dip overnight. This is bucking the seasonal trend as September has seen the Global Bond Ag decline for the last seven years with 10yr UST yields up in 7 of the last 8 Septembers. Still nearly 4 weeks of the month left though.

Clearly, a lot of September will be dictated by how the jobs report turns out on Friday (DB expect +150k for payrolls). But today, the US labour market will remain in focus with the JOLTS job openings release for July. That’s one that Fed Chair Powell has often cited, and recent months have provided evidence that the labour market is cooling off. Among others, the quits rate of those voluntarily leaving their job came in at 2.1% in June, the joint-lowest since 2020. And the ratio of unemployed individuals per vacancy was down to a three-year low of 1.20. So if today’s report adds to the signs that the labour market is weakening, that could further raise expectations that the Fed will open with a 50bp cut (not our base case though).

One factor that pushed yields lower was a fresh decline in oil prices yesterday, which helped to ease fears about any lingering inflationary pressures. For instance, WTI crude oil prices were down -4.36% on the day to $70.34/bbl, which is their lowest closing level of 2024 so far, and also marks their worst daily performance since last November. In part, that’s been driven by demand factors, including fears about a weakening US economy. But supply factors were also at play, and there was a noticeable decline in prices yesterday after Bloomberg reported that a deal could emerge to restore Libyan production again, based on comments from Sadiq Al-Kabir, the central bank governor who’d fled Libya. With the risk-off mood continuing in Asian hours, oil prices are down another several tenths overnight with WTI falling below $70/bbl.

Over in Europe, markets followed a similar if milder pattern as the US, trading in line with the broader risk-off tone at the time of the close. That meant the STOXX 600 (-0.97%) lost ground for a second day running, with the index also posting its worst daily performance since August 5. Interestingly though, we did get comments from Lithuania’s central bank governor Simkus, who referred to an October rate cut after September as “quite unlikely”. So that offered some pushback against those expecting rate cuts might happen more than once per quarter. Market pricing was reflective of that, with the chance of an October rate cut down to 34% yesterday. Even so, sovereign bonds still rallied in line with the global trend, and yields on 10yr bunds (-5.9bps), OATs (-3.6bps) and BTPs (-3.3bps) all fell back.

The risk sell-off is continuing in the Asian session with Japan’s Nikkei (-3.31%) leading losses in the region after slightly recovering from an initial -4.04% drop while the KOSPI (-2.67%) is also trading noticeably lower. Elsewhere, the Hang Seng (-1.06%) is also edging lower after sliding to its lowest in three weeks with the CSI (-0.31%) and the Shanghai Composite (-0.48%) also trading in the red, but marching to their own beat as they have done for most of this year.

Early morning data showed that China’s Caixin services PMI for August expanded at a slower rate compared to July, with the index falling to 51.6 (v/s 51.8 expected) from 52.1. Australia’s second quarter GDP growth slowed to +1.0% y/y (v/s +0.9% expected), the weakest annual pace since the 1990’s recession, outside of the Covid-19 pandemic period. It followed an upwardly revised gain of +1.3% in the previous quarter.

To the day ahead now, and US data releases include the JOLTS job openings, factory orders and the trade balance for July. Meanwhile in Europe, we’ll get the final services and composite PMIs for August, and the Euro Area PPI reading for July. From central banks, the Bank of Canada will announce their latest policy decision, the Fed will release their Beige Book, and we’ll hear from the ECB’s Villeroy.