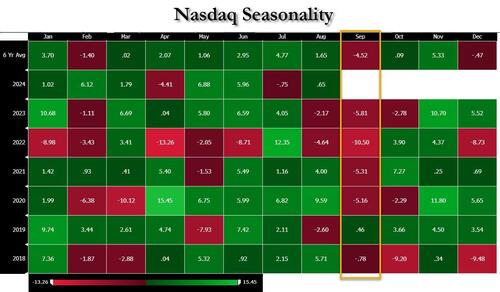

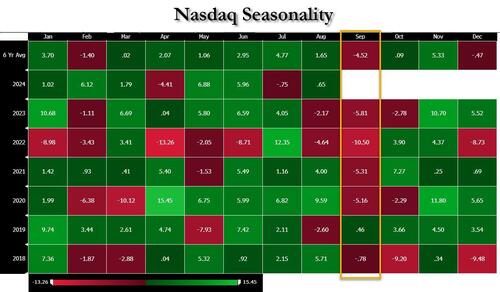

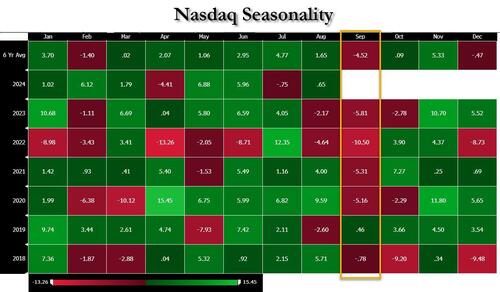

Global equities began September on the back foot as investors prepared for what’s typically the worst month for stocks in general, and tech in particular.

After the S&P 500 came close to an all-time high on Friday, US equity futures were fractionally in the red ahead of today’s holiday closure in the cash session thanks to the Labor Day holiday. The Treasury market was also closed while the dollar was steady.

September has traditionally been a very ugly month for stocks over the past four years, while the dollar typically outperforms. The VIX has risen every September since 2021, a month which has proven to be the ugliest for the S&P over the past decade.

And if this Friday’s job report is ugly, the trend will likely continue, although now that nearly 1 million jobs have been “revised” away, it is much more likely that the payrolls print will come in well stronger than expected: after all, the BLS has to make sure it generates enough fake data to ensure that the deep state’s chosen candidate wins. Meanwhile, traders are pricing the US easing cycle will begin this month, with a roughly one-in-four chance of a 50 basis-point cut.

“I think the market is pretty well versed with what it thinks is going to happen — there will be some kind of cut,” Fiona Boal, global head of equities at S&P Dow Jones Indices, told Bloomberg Television. “As we move through autumn, we will see the VIX move more to thinking about the markets, thinking about political issues.”

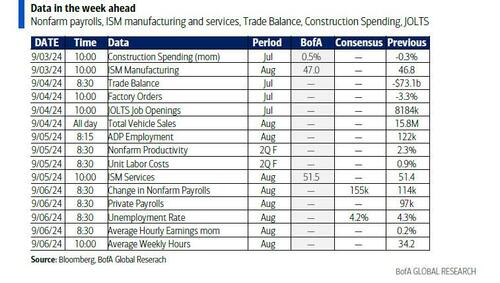

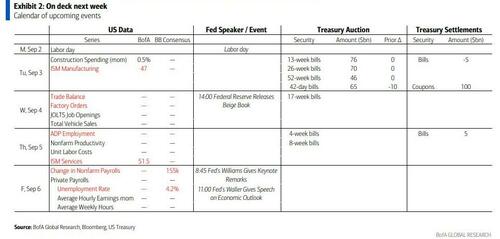

Ahead of the Friday payrolls report we will get the latest figures on July job vacancies in Wednesday’s JOLTS report. The number of open positions, a measure of labor demand, is seen easing to a three-month low of 8.1 million — just above a more than three-year low.

Meanwhile, reprising the role of JPM’s favorite now-departed uber bear Marko Kolanovic, another Croat at the world’s largest bank, Mislav Matejka, wrote that the equity-market rally may stall even if the Fed starts its rate-cutting cycle as any policy easing would be in response to slowing growth, while the seasonal trend for September would be another impediment. “We are not out of the woods yet,” Matejka said, reiterating his preference for defensive sectors against the backdrop of a pullback in bond yields. “Sentiment and positioning indicators look far from attractive, political and geopolitical uncertainty is elevated, and seasonals are more challenging.”

Elsewhere, as reported over the weekend, German Chancellor Olaf Scholz’s ruling coalition was punished in two regional elections on Sunday, with the far right clinching its first triumph in a state ballot since World War II. Still, political parties moved to block the Alternative for Germany from power in the eastern states of Thuringia and Saxony.

Taking a look at markets that are actually open, Europe’s Stoxx 600 fell 0.4% from Friday’s record high, with the automotive and consumer goods sectors particularly affected. This downturn followed data showing a fourth consecutive month of contraction in Chinese manufacturing activity, alongside a deepening slump in the country’s residential property market. Europe’s mining giants such as Rio Tinto and BHP Group slumped after iron ore prices dropped. In London, Rightmove surged more than 20% after Rupert Murdoch’s REA Group Ltd. said it’s exploring a possible cash and share offer.

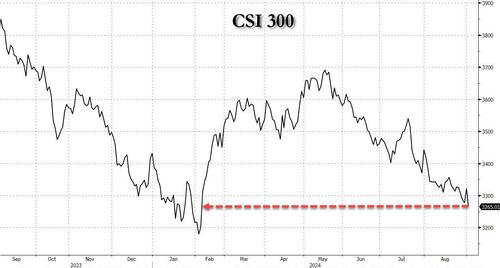

Earlier in the session, most Asian stock markets started the new month under pressure following weak Chinese data over the weekend. Hang Seng dropped about 1.8% and H shares tumble almost 2%. Chinese equities had rallied on Friday after Bloomberg reported that the government is considering allowing homeowners to refinance as much as $5.4 trillion of mortgages to lower borrowing costs. But the benchmark gauge fell 1.7% on Monday, wiping out all of Friday’s gain, and tumbling to a seven-month low, helping to push the emerging-market benchmark lower for the fourth time in five days, as data showing weakness in the world’s second-biggest economy stoked concern Beijing’s stimulus plan isn’t working.

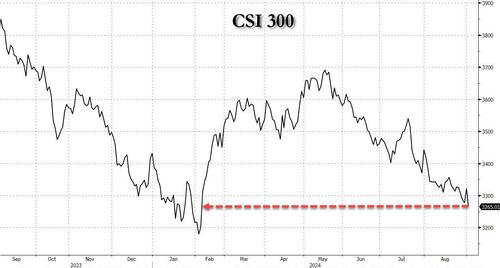

The Shanghai Shenzhen CSI 300 Index dropped to lowest level since Feb. 5, as mainland stocks that have erased $1.12 trillion since May extend losses.

Weekend releases showed factory activity contracted for fourth straight month, value of new-home sales fell almost 27% from year earlier and disappointing earnings from companies including China Vanke also soured sentiment. With consumer demand already weak, data show industry also slowing, raising urgency for further stimulus.

“I think there’s a huge problem — by now everybody recognizes that,” Hao Ong, chief economist at Grow Investment Group, told Bloomberg’s David Ingles and Yvonne Man in an interview. “The government needs to do substantially more.”

Elsewhere in Asia, Japanese indexes reversed opening gains while those in Taiwan and Australia weaken.

In FX, the Bloomberg Dollar Spot Index is slightly higher in a quiet session while the yen resumes its plunge, and was last trading 147/USD while kiwi dollar underperforms G-10 peers.

In rates, TSY futures consolidate around 113-18 with cash Treasuries closed for US holiday. Australian yields rise 3-4bps across the curve. JGB futures remain better offered ahead of this week’s long-end supply.

In commodities, oil steadied as traders weigh a planned production increase from OPEC+ next month against currently lower output in Libya, while staying mindful of economic headwinds in China.

Top Overnight News

- China has threatened severe economic retaliation against Japan if Tokyo further restricts sales and servicing of chipmaking equipment to Chinese firms, complicating US-led efforts to cut the world’s second-largest economy off from advanced technology.

- Political parties in two eastern regions moved to block the Alternative for Germany from power after the far-right party won Sunday’s election in Thuringia and came a close second in neighboring Saxony.

- Israel’s largest labor union led a nationwide strike on Monday in protest over the government’s failure to secure a hostage-release deal, after the killing by Hamas of six hostages in captivity spurred one of the largest mass demonstrations since the Oct. 7 attack that started the war in Gaza: WSJ

- Super Micro Computer (SMCI) said it filed a non-timely 10-k with US SEC. Parties working diligently to complete review. Does not anticipate form 10-k NT will contain any material changes to results for FY and quarter ended June 30th, 2024.

- Microsoft backed OpenAI is considering changes to its corporate structure amid latest funding talks. OpenAI named political veteran Chris Lehane as head of global policy, according to NYT.

- Intel CEO is to present a plan to the board to sell off assets, according to Reuters source. CEO and executives will present plans at the mid-September board meeting, and plans could include selling Altera programmable chip unit, sources say. Sources added capital spending cuts may include a German factory which is expected to cost USD 32bln, but Intel has no current plans to sell its manufacturing business.

- Hospitality union Unite Here said about 10k hotel workers across US are on strike at 24 hotels in eight cities: Reuters.

- The equity market rally may stall near record highs even if the Federal Reserve starts a highly anticipated rate-cutting cycle: JPMorgan

- China’s remaining growth engines are showing signs of sputtering while the property market continues to drag on the economy, highlighting the urgency of government intervention to keep an increasingly unlikely growth target in sight: BBG

- September has traditionally been a terrible month for traders and risks being even harder to navigate in 2024 given lingering questions about the Federal Reserve’s anticipated interest-rate cut: BBG

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mostly lower despite the gains seen on Wall Street on Friday, with the mood in the APAC region dampened by the continued decline in Chinese NBS Manufacturing PMI whilst traders look ahead to key risks this week including the US jobs report amid the Fed’s shifted focus on employment. ASX 200 opened with modest gains but quickly fell into the red, with the gold miners seeing the deepest losses following the USD-induced losses in the yellow metal on Friday. Nikkei 225 initially outperformed and was underpinned by the weaker JPY, although gains gradually faded throughout the session. Hang Seng and Shanghai Comp fell in which Hong Kong was the regional laggard with property name New World slumping double-digit percentages after it said on Friday it is to post its first annual loss in two decades. Furthermore, auto stocks are slipping after earnings. Meanwhile, the mainland was lower after seeing mixed PMI data in which the NBS manufacturing fell to a six-month low whilst the Caixin Manufacturing saw a revision to above 50.0.

Top Asian News

- China reportedly warns Japan of retaliation over new potential new chip curbs, according to Bloomberg.

- China’s Global Times, on the Caixin Manufacturing PMI, says “The data indicates a pickup in demand, steady employment levels, and improving business confidence.”

- PBoC injected CNY 3.5bln via 7-day Reverse Repo at maintained rate of 1.70%.

FX

- DXY resided in a tight 101.64-79 range after Friday’s rise from 101.24 lows to 101.78 highs, with the next level to the upside the 21 DMA (102.02).

- EUR/USD was trading in tandem with the USD in a 1.1040-55 range vs Friday’s 1.1043-94 parameter, with the pair finding support near its 21 DMA (1.1042)

- GBP/USD saw movement in-fitting with Dollar action, with the pair caged in a 1.3117-38 parameter and well within Friday’s bounds between 1.3106-1.3199.

- USD/JPY experiencing modest upside as APAC traders react to Friday’s USD and bond movement. Little reaction was seen to Japanese data which included higher-than-prior Q2 Capex and a revision higher in August manufacturing PMI. USD/JPY resided in a 145.89-146.59 range after rising above its 21 DMA (145.97) on Friday

- Antipodeans eventually fell with the NZD lagging and giving back some of last week’s gains, whilst the AUD fell in tandem with base metals but recovered off worst levels.

- Yuan was weaker following the Chinese NBS Manufacturing figure over the weekend, with little reaction seen to the Caixin metric.

- PBoC sets USD/CNY mid-point at 7.1027 vs exp. 7.1030 (prev. 7.1124); strongest CNY fixing since May 16th

Fixed Income

- 10yr UST futures experienced uneventful trade after Friday’s selloff, with price action today likely to be limited amid the absence of US traders on account of the Labor Day holiday.

- Bund futures was slightly softer and catching up to some of the UST losses on Friday, with sentiment across German bonds also somewhat dampened by German regional elections in which the AfD’s projected win in Thuringia “would mark the first time since the defeat of Nazi Germany in World War II that a far-right party has won a statewide election in the country”, dpa said.

- 10yr JGB futures was subdued following price action in USTs on Friday with the contract in a 144.51-76 range thus far vs Friday’s 144.49-80 parameter.

Commodities

- Crude futures traded lower amid a lack of major geopolitical escalations over the weekend coupled with the Chinese NBS Manufacturing PMI data falling to a six-month low, not boding well for the China-related demand side of the equation. Furthermore, APAC players reacted to OPEC sources from Friday which suggested OPEC+ is likely to proceed with a planned gradual oil production increase from October.

- Spot gold gradually edged lower in-fitting with broader price action across commodities and dipped under the USD 2,500/oz mark.

- Copper futures were subdued with upside capped by the disappointing Chinese NBS Manufacturing data which showed a decline to a six-month low.

- Baker Hughes Rig Count: Oil unchanged at 483, Natgas -2 at 95, Total -2 at 583.

- Libya’s NOC said recent oilfields closures have caused loss of approximately 63% of total oil production.

- Iraq to offer 10 gas exploration blocks for US firms, according to the Iraqi oil minister.

- Russian President Putin says preparatory works on construction of Russia’s gas pipeline to China via Mongolia are proceeding as scheduled, according to Reuters.

Geopolitics: Middle East

- US President Biden is considering presenting Israel and Hamas a final proposal for a hostage-release and ceasefire in Gaza deal later this week, according to Axios sources.

- Israel recovered the bodies of six hostages from a tunnel in Gaza, according to Sky News.

- Israeli PM Netanyahu, following the weekend death of six hostages in Gaza, said Israel will not rest until it reaches those in Hamas who murdered the hostages. He added that he and his government are committed to achieving a deal to release remaining hostages and ensure Israel’s security, according to a statement.

- Hamas official blamed Israel for the death of hostages, and said Israel is unwilling to reach a deal, according to Reuters.

- Yemen’s Houthis said they targeted MV Groton vessel in Gulf of Aden for second time, according to Reuters.

- UKMTO said it has received report of an incident 70NM northwest of Yemen’s Saleef, according to Reuters.

- “US official: Washington will hold intensive contacts in the coming hours to see the possibility of reaching an agreement”, according to Sky News Arabia.

- Israel union calls for general strike as protesters across country demand Gaza hostage deal, according to BBC.

Geopolitics: Ukraine

- Russia will make changes to its nuclear doctrine, according to TASS citing the Deputy Foreign Minister.

- A fire caused by an drone strike at the Moscow Oil Refinery has been contained, according to TASS.

- Several blasts heard in Ukraine capital Kyiv, according to Reuters witnesses. “A series of explosions in Kyiv… as Russians attacked with a combination of cruise missiles, ballistic missiles and kamikaze drones.”, according to KyivPost.

- Poland activated its aircraft to ensure airspace security, Polish Armed Forces said, following Russia’s air attack on Ukraine.

Geopolitics: Other

- A China Coast Guard vessel deliberately collided three times with a Philippine Coast Guard vessel exercising its freedom of navigation in the Philippines, according to US State Department.

US Event Calendar

- Labor Day holiday closure

DB’s Jim Reid concludes the overnight wrap

Welcome to September. Although given the track record of recent years, perhaps we should say beware rather than welcome. For what it’s worth, the S&P 500 and the STOXX 600 have lost ground in each of the last 4 Septembers. And if you’re hoping for respite in fixed income, there hasn’t been any there either. In fact, Bloomberg’s global bond aggregate is down in each of the last 7 Septembers. So if we do manage to get some positivity this month, that would fly in the face of a succession of negative performances.

Given it’s the start of the month, we’ve also just released our monthly performance review for August. Despite the turmoil at the start, which led to sharp losses across global markets, August was actually a pretty decent month overall in performance terms. For instance, both the S&P 500 and US Treasuries advanced for a 4th consecutive month. That said, there were points of weakness, and the Dollar index had its worst month since last November as investors priced in more aggressive rate cuts from the Fed.

Speaking of the Fed, all roads this week lead to the US jobs report on Friday, which is going to be pivotal in terms of how much they cut rates by at their next meeting. As it stands, futures still see a 25bp move as more likely, but a 50bp move is being priced with a 31% probability this morning, so it’s in the balance as far as markets are concerned. And as we found out last month, an underwhelming jobs report can quickly shift expectations.

In terms of what to expect this time around, DB’s US economists are forecasting that nonfarm payrolls will come in at +150k in August. That assumes a rebound from potential weather-related disruptions in the July report, and they also see the unemployment rate ticking down a tenth to 4.2%. Of course, much of the focus will be on how Fed officials react, although they won’t have long to discuss the data, as the blackout period ahead of the September meeting begins the day after the jobs report.

Although last month’s jobs report was underwhelming, it’s also worth noting that much of the data since then has looked more positive. The weekly initial jobless claims have fallen from their levels in late-July, the latest retail sales print was very strong as well, and the revisions to Q2 GDP growth saw it adjusted up to an annualised pace of +3.0%, which isn’t consistent with a recession. Moreover, Friday saw the Atlanta Fed’s GDPNow estimate for Q3 move up to +2.5%, so again pointing away from a recession. This week we should get some more details on the August picture, as we’ll get the ISM manufacturing and services prints, which are coming out on Tuesday and Thursday respectively. The JOLTS report on Wednesday will also be worth looking at, although that’s a bit more backward-looking as it’s the July reading.

Aside from the US data, it’s a fairly subdued calendar this week, and US markets are themselves closed today for the Labor Day holiday. One thing we will get though is the Bank of Canada’s latest policy decision on Wednesday, where they’re widely expected to cut rates by 25bps for a third consecutive meeting, which would take their policy rate down to 4.25%.

As the week begins, markets in Asia have got off to a weak start. In part, that’s been driven by concerns about the Chinese economy, and the official manufacturing PMI that came out on Saturday fell to a 6-month low of 49.1 in August (vs. 49.5 expected). The non-manufacturing PMI did pick up to 50.3 (vs. 50.1 expected), but this was barely above the 50.2 reading from the previous month, which had marked the lowest print so far this year. In light of this, Chinese equities have fallen back this morning, including the CSI 300 (-1.21%) and the Shanghai Comp (-0.62%). Elsewhere, things are a bit stronger though, with Japan’s Nikkei (+0.03%) seeing little change, while the KOSPI is up by +0.26%.

Meanwhile over the weekend, there were important political developments in Germany, where state elections took place in the eastern states of Thuringia and Saxony. In Thuringia, the far-right AfD came in first place with 32.8% of the vote on the preliminary results, which is the first time that the party have come first in a German state election. And in Saxony, the AfD were in second place on 30.6% of the vote, not far behind the CDU on 31.9%. At the same time, the results were poor for the three parties in the federal coalition, with Chancellor Scholz’s SPD scoring just 6.1% in Thuringia and 7.3% in Saxony. The Greens were even further behind, on just 3.2% in Thuringia and 5.1% in Saxony. And the FDP was on just 1.1% in Thuringia and 0.9% in Saxony. The next state election is taking place in Brandenburg on September 22.

Recapping last week now, markets put in a decent performance overall, with the S&P 500 climbing +0.24% last week (+1.01% Friday). That was its 3rd consecutive weekly gain, and it now leaves the index just -0.33% beneath its all-time high from mid-July. However, the index was held back by the Magnificent 7, which fell -1.89% over the week (+1.57% Friday), including a -7.73% decline for Nvidia (+1.51% Friday) amidst its latest earnings announcement. Aside from the weakness in US tech stocks though, several indices hit all-time records by Friday, including the equal-weighted S&P 500 and the Dow Jones. Meanwhile in Europe, the STOXX 600 closed at an all-time high as well, having posted a +1.34% gain last week (+0.09% Friday).

On Friday itself, the main development came from the latest US PCE inflation data for July, which is the measure the Fed officially target. That showed core PCE coming in at a monthly pace of +0.16%, which brought down the 3m annualised rate falling to +1.7%. The year-on-year rate also remained at +2.6% for a third consecutive month (vs. +2.7% expected). So the report was seen as confirming that the Fed would still be able to cut rates next month, and there were also some positive details in the components For instance, the core services ex housing measure, which Powell has cited in the past, fell to just +2.0% on a 3m annualised basis, which is the lowest it’s been since November 2020.

Friday also brought some inflation data from the Euro Area, where the flash CPI release for August came in at +2.2% as expected. That’s the lowest inflation for the Euro Area since July 2021, so that was seen as keeping the path open to another ECB rate cut at the September meeting. In addition, core inflation fell to +2.8% as expected.

With all that data in hand, investors remained confident that central banks would be delivering substantial rate cuts over the months ahead. In the US, they slightly dialled back the cuts priced in, with the chance of a 50bp move in September falling from 35% to 32% over the week. Similarly, the number of cuts priced in by December’s meeting fell back a bit from 103bps to 100bps. In response, the 2yr Treasury yield was little changed over the week, up just +0.1bp to 3.92%, whilst the 10yr yield saw a larger +10.5bps move to 3.90%. Meanwhile in Europe, yields on 10yr bunds ended the week up +7.4bps at 2.30%.