Bonds Drop, Dollar Pops As Traders Brace For Jobs

US markets chopped around today after yesterday’s risk off tape as Geopolitics remain the focus, and while Chinese stocks rallied, Goldman Sachs trading desk noted that for the first time in a week they’re seeing more balance in their China flows:

“Seeing both HF and LO sell tickets today across the complex.”

Certainly didn’t slow the upward trajectory for now (remember China is closed for Golden Week)…

Source: Bloomberg

On the US side, things were quieter… Small Caps lagged, Nasdaq led the gains but the majors traded in a narrow range (which is unexpected given the drop in gamma)…

We note that the S&P 500 is back within the post-Powell spike range…

Mag7 stocks are back down into the post-Powell squeeze range…

Source: Bloomberg

But the vol market readying itself for chaos on Friday as payrolls prints…

Source: Bloomberg

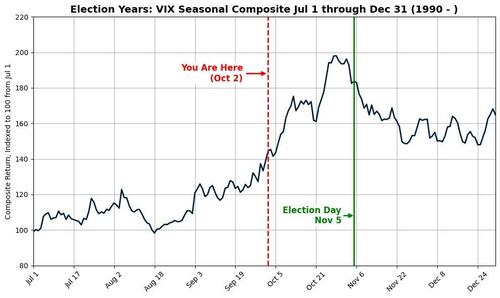

Bear in mind that ‘seasonally’, shit’s about to get real for vol markets…

Source: Goldman Sachs

Treasury yields were higher across the board today with the long-end lagging (2Y +3bps, 30Y +6bps). All yields are higher on the week…

Source: Bloomberg

The dollar extended its rebound, back up to the post-Powell spike on FOMC day…

Source: Bloomberg

…as JPY weakened, erasing all of Friday’s election panic bid…

Source: Bloomberg

Gold ended marginally lower on the day…

Source: Bloomberg

Crypto was monkeyhammered again with Bitcoin dumped back to FOMC-Day levels ($60,000)…

Source: Bloomberg

Crude prices pumped and dumped amid inventory data, further escalations in Israel/Lebanon, and OPEC+ headlines…

Source: Bloomberg

Finally, despite the fact that we have crossed the month-/quarter-end rubicon, the plumbing in the financial services sewage remains a little clogged…

Source: Bloomberg

The last time this happened, the repo market blew up… just saying.

Tyler Durden

Wed, 10/02/2024 – 16:00

via ZeroHedge News https://ift.tt/KAXkdRJ Tyler Durden