Gruesome, Tailing 3Y Auction Sees Plunge In Foreign Demand As Buyers Flee

One would think that the first coupon auction after the Fed’s rate cut would have passed better; one would be wrong.

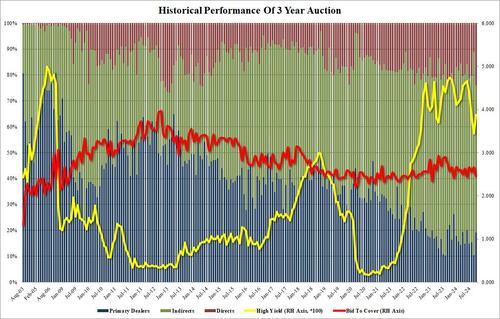

Moments ago the Treasury sold $58 billion in 3Y paper, matching the all time high issuance for the tenor, in an auction that was unexpectedly ugly. The sale stopped at a high yield of 3.878%, the highest since July, and tailing the When Issued 3.871% by 0.7bps, the first and biggest tail since June and followed the biggest stop through since August 2023.

The Bid to Cover slumped to 2.452 from 2.662, the lowest since June and well below the six-auction average of 2.574.

The internals were especially ugly, with Indirects crashing from a record high 78.2 last month to just 56.9, the lowest of 2024.

Curiously, Direct bidders took down 24.0, the highest in a decade, leaving Dealers holding to 19.2% of the final allocation, the highest since June.

Overall, this was a very ugly auction, which considering the sharp spike in yields in recent weeks now that the market no longer expects the Fed to cut rates aggressively in the coming months, was to be expected.

The bigger question is when do we get a more sustained selloff across the curve, one which – with trillions of debt issuance on deck – would force the Fed to rush back in with promises of easier monetary policy.

Tyler Durden

Tue, 10/08/2024 – 13:40

via ZeroHedge News https://ift.tt/ERKT5co Tyler Durden