“The Policy Sounds Quite Weak”: China’s MOF Stimulus Announcement Disappoints

As expected, Saturday’s much-anticipated press conference by China’s Ministry of Finance, where many China watchers were expecting another major stimulus announcement with some hoping for a number as large as 10 trillion rmb, was a dud.

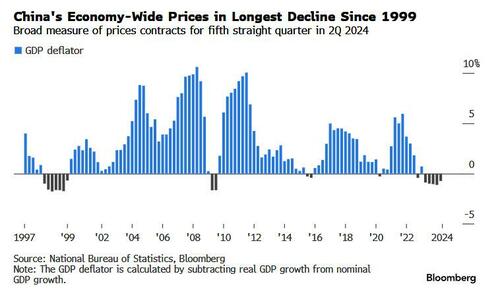

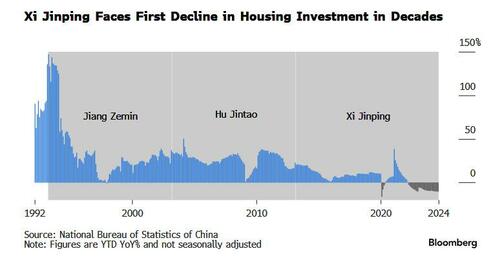

To be sure, China did announce intentions to further ramp up support for the economy, promising more aid for the slumping property sector and indebted local governments. But, as Bloomberg reported, officials again failed to convince economists that they’re doing enough to defeat deflation.

At today’s highly anticipated briefing, Finance Minister Lan Fo’an refrained from putting a price tag on China’s fiscal stimulus as many investors expected, signaling instead that – as Goldman warned on Friday – details would come when China’s legislature meets in the coming weeks. More importantly, Lan did not announce any new stimulus on consumption/household subsidies, and instead he said he will introduce further incremental measures in the near future without providing more details. Lan also suggested some of the proposed measures would require approval by the NPC Standing Committee, which is expected to meet tin the coming weeks. Expectations on fiscal stimulus size heading into today’s event was wide at 1t to 1-t yuan, with no clear consensus on the outcome.

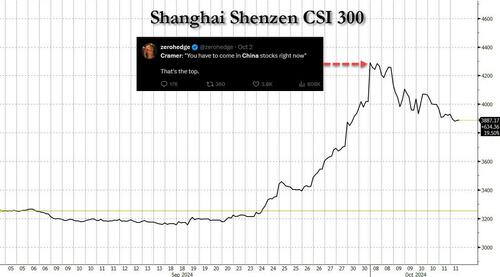

The supportive measures he did announce, however, gave little indication Chinese authorities felt any urgency to ramp up consumption, which many economists see as essential to reflating the economy and putting it on a more positive growth trajectory yet which the market was convinced would happen which is why Chinese stocks erupted in a 30% frenzy in recent weeks. The problem is that the post-meltup hangover comes next, and stocks will plunge, draining what little “wealth effect” had been created.

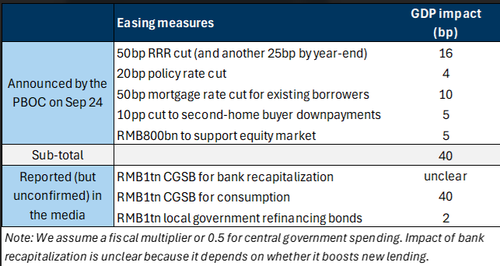

Here is a snapshot of the package announced by the MOF, courtesy of Goldman who writes that major fiscal stimulus measures include:

- Raising the government debt limit “by a relatively large amount in a one-off effort” to accelerate local government debt resolution, with the magnitude of debt resolution to be the largest in recent years;

- Increasing local government funding by RMB400bn through the unspent bond issuance quota accumulated from previous years;

- Issuing additional central government special bonds (CGSB) to help large state-owned banks replenish their equity capital;

- Allowing local government special bonds (LGSB) to be used for land acquisition and redevelopment, as well as the purchase of housing inventory;

- Increasing the transfer payment to students.

- On forward guidance, MOF Head Mr. Lan Fo’an emphasized that the central government has relatively large space for debt expansion and deficit increases, and flagged that policymakers are studying other incremental policy tools.

- Goldman views today’s MOF meeting as largely in line with the market’s wide-ranging expectations, with the upside from clear forward guidance on multi-year fiscal expansion, a larger-scale local government debt resolution, and more central government debt financing, but downside from a lack of specifics on the size of stimulus, and little detail on the RMB1tn CGSB to support consumption speculated by markets previously.

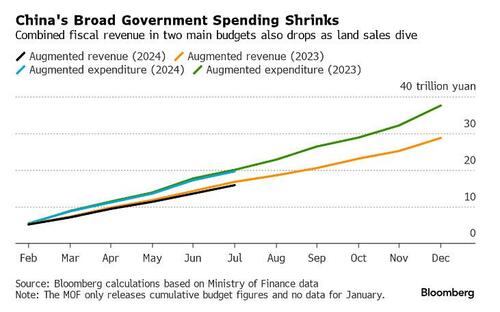

- Given falling tax and land sales revenue, we estimate the gap between government revenue (including on-budget fiscal revenue and off-budget government-managed fund revenue) out-turns and MOF projections made in the 2024 budget could be RMB2.3tn this year,

- Goldman expects policymakers to approve an additional RMB1-2tn in ultra-long-term (ULT) CGSB quota in the next NPC standing committee meeting (around late Oct – early Nov), scale up the local government debt swap plan potentially to the magnitude of around RMB5tn for multiple years, and plan notably higher government bond issuance quotas in 2025 and beyond vs. the 2024 budget (by setting a higher official deficit target and larger ULT CGSB quota).

“The policy to support consumption sounds quite weak,” said Jacqueline Rong, chief China economist at BNP Paribas SA. “It is still too early to call an imminent significant turnaround in deflationary pressure or a bottoming-out of the property market, which are the two key issues faced by the Chinese economy.”

As noted yesterday, investors and analysts expected China to deploy about 2 trillion yuan ($283 billion) in fresh fiscal stimulus (and as much as 11 trillion yuan on the high end), including potential subsidies, consumption vouchers and financial support for families with children. That still might come in a few weeks: Last year, the Standing Committee of the National People’s Congress, China’s legislature, used a late-October meeting to announce a budget revision and additional bonds. But every delay shows that – once again – Beijing is making the cardinal error of failing to stimulate forcefully, and instead hopes that the market meltup, meant to spark a virtuous wealth effect circle, will reinforce itself. Spoiler alert: it won’t, and instead both stocks and the economy will crater, forcing Beijing to stimulate that much more later (as described in “China Must Do QE Now, “Or It Will End Up In A Bigger Hole In 12 Months“).

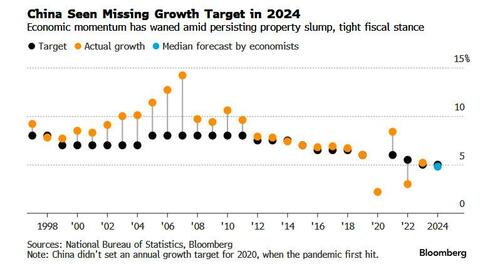

Worse, Lan’s remarks on Saturday signaled that China is comfortable with the overall direction of the economy, where recent measures should be sufficient to push GDP just above the 5% target, but not more.

He vowed to allow local governments to use special bonds to buy unsold homes and promised the biggest effort in recent years to relieve the debt burden of local authorities, neither of which is likely to provide a short-term boost to growth.

“My sense is that the fiscal policy moves will take a little too long to roll out for us to hit 5% this year, unless the ultimate scale of fiscal stimulus ends up being much larger than forecast,” said Lynn Song, chief economist for Greater China at ING Bank N.V., referring to China’s economic growth target for 2024.

Others were more hopeful. In his comments this morning, Goldman economist Philip Sun wrote that “the most important sentences in Minister Lan’s speech was the following:

我再补充一点,逆周期调节绝不仅仅是以上的四点,这四点是目前已经进入决策程序的政策,我们还有其他政策工具也正在研究中。比如中央财政还有较大的举债空间和赤字提升空间。

Translation:

“Let me add a comment. Couter-cyclical adjustments are ABSOLUTELY constrained just within the 4 points I mentioned above. These 4 points are the policies that already entered the formal decision-making process. We are studying other policy tools, too. For example: Central Government still has relatively big room for increasing the debts and there is room for increasing the fiscal deficit.”

The 4 points that Lan referred to:

- Raising the government debt limit “by a relatively large amount in a one-off effort” to accelerate local government debt resolution, with the magnitude of debt resolution to be the largest in recent years; Increasing local government funding by RMB400bn through the unspent bond issuance quota accumulated from previous years;

- Issuing additional central government special bonds (CGSB) to help large state-owned banks replenish their equity capital;

- Allowing local government special bonds (LGSB) to be used for land acquisition and redevelopment, as well as the purchase of housing inventory;

- Increasing the transfer payment to students.

In this context, Sun said that most of the clients he talks to said they feel: (1) The forward guidance is strong enough. (2) There were a lot of concrete RMB numbers mentioned in the speech associated with specific initiatives; (3) The manner with Minister Lan delivered the messages clearly showed: “We have much more to come.”

When answering the “X trillion RMB” stimulus, Minister of Finance Mr. Lan’s mentioned it as the end of a long paragraph of speech: 关于你提到的具体资金数量安排问题,经过法定程序后,会及时向社会公开。Translation: regarding the specific RMB amount you asked, we will disclose promptly to the general society after the proper legal procedures have been passed.

We’ll see if this cheerful take is correct come Monday’s open (as a reminder, Goldman top-ticked the Chinese stock market meltup by going overweight China just as Chinese stocks resumed their plunge, as we warned they would).

Data on Sunday are expected to show consumer prices in September were stuck below 1% for a 19th straight month as factory-price deflation deepened, highlighting sluggish demand before the recent stimulus bonanza. Officials spoke little about deflation at the hourlong briefing on Saturday, which confirms that China is stuck in a debt-deflationary vortex.

Lan also hinted at room for issuing more sovereign bonds and greater government spending, steps that could be announced when legislators meet later this month or early November. However, neither involves the massive bazooka that markets assumed was coming at the end of September when even Xi effectively announced China’s “whatever it takes” moment.

Allowing local governments to swap their debt with cheaper loans will free up money for public services and encourage the authorities to spend more. And enabling them to use special bonds to buy unsold apartments and turn them into social housing may help stabilize a downturn in real estate prices, giving homeowners a greater sense of security.

The Finance Ministry didn’t provide an exact value for either measure. But these are among steps that lead economists to think “this time can be different” after previous stimulus efforts faltered, according to Societe Generale SA.

“The prospects for a sustained recovery and reflation are improving, with better chances of housing stabilization and less pressure from local government deleveraging,” Wei Yao and Michelle Lam, both economists at the bank, said in a note.

As far as direct subsides are concerned, Lan said Saturday that China would hand out twice the number of scholarships and step up financial aid to students, a move that comes after youth unemployment soared to a record high this year. He also vowed to continue to provide support to groups in need, citing a one-off handout to the poor last month as an example.

The lack of large-scale handouts is unsurprising, as Beijing – unlike the Democrat administration in the US – has long looked down on what it calls “welfarism.”

“No free food for lazy people is the fundamental thinking of policymakers as to why large-scale subsidy for the whole nation is unlikely,” said Bruce Pang, chief economist for Greater China at Jones Lang LaSalle Inc, referring to a similar comment made by the country’s top economic planning agency.

Economists have long urged a shift in priorities for fiscal policy to focus more on domestic consumption. Such a move toward a more balanced and sustainable growth model would reduce the country’s reliance on exports to power the economy amid rising trade tensions. The old playbook of using debt-fueled investment into public projects — from roads to bridges — has become less effective after decades of urbanization left the country saturated with infrastructure. Because of a lack of high-quality projects, authorities have more money at their disposal than projects to spend it on.

The Finance Ministry also said the government will expand the sectors eligible to receive funding support from the issuance of special local bonds. This could infuse the economy with as much as 1 trillion yuan now sitting idle, according to Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc.

The finance woes of local governments are closely linked with the property downturn. Land sales, a major driver of revenue, are dwindling just as a broader slowdown reduces taxes and other income sources. After going on a borrowing binge following the 2008 financial crisis to prop up growth, and then dealing with a costly pandemic, many localities are now struggling to meet daily spending needs, like paying civil servants.

As Bloomberg notes, some regions have opted to delay payments to contractors, impose hefty fines and slap companies with tax bills dating back decades. The moves have dealt a further blow to already fragile confidence in the private sector, prompting Beijing to warn local officials against excessive penalties.

By allowing local governments to swap more “hidden debt,” Beijing is also trying to rein in credit risks at companies that borrowed aggressively on behalf of local governments in past years to help fund infrastructure. However, bonds spent for debt swaps generate no new growth in the economy even though they help maintain financial and social stability.

Efforts to tackle local government debt risks “largely involve shifting debt from one arm of the state to another” and will have limited impact on near-term demand, said Julian Evans-Pritchard, head of China economics at Capital Economics. He maintained his 2024 growth forecast at 4.8% and revised up the forecast for next year to 4.5% from 4.3%, citing the fiscal boost.

Larry Hu, head of China economics at Macquarie Group, said that China’s two-speed growth model in which it relies on manufacturing and exports to offset the property sector is “increasingly unsustainable.” He said authorities will need to pivot once exports weaken or domestic demand deteriorates further, leading to social unrest.

“The strong sense of urgency from the September Politburo meeting suggests that it’s the pivot moment,” Hu wrote in a note on Saturday. “But to confirm this, we need more evidence.”

Unfortunately for China’s markets and the country’s “wealth effect”, investors who bought into the frenzy, will not demonstrate the patience demanded of them and will proceed to dump Chinese stocks at first opportunity. The good news is that anyone who listened to Cramer, knew exactly when to sell.

Finally, for those who, like Goldman, believe that somehow Saturday’s announcement will meet market demand and want to implement a bullish view (besides just buying single stocks, or CSI or Hang Seng index calls), Goldman’s Delta One desk has the following recommendation (full notes available to pro subs here and here).

Implied vol remains high and call wing skew now extremely inverted – those looking to take advantage that can consider HSCEI Jan call spreads, 110/120% gets you 5x max payoff where you collect 1.5v diff on the further strike. My US colleague also like collaring China longs (buy put / sell call) – for example, 3m 80% / 120% collars line up for a credit. For those looking to cheapen initial premium outlay but keeping a max loss = prem paid risk profile, Dec24 HSCEI up / USDCNH up dual digis can get you ~13x payoff. Do reach out to the desk for more details – all pricing above indicative only.

For everyone else: sell.

Tyler Durden

Sat, 10/12/2024 – 17:11

via ZeroHedge News https://ift.tt/LoPxD4m Tyler Durden