Bank Deposits & Money-Markets See Huge Inflows As Tax-Day Passes

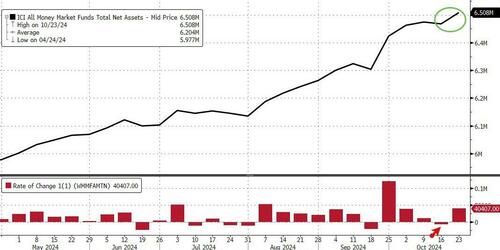

After last week’s small $6.5BN outflow, money-market funds saw a massive $40.4BN inflow this week, taking total AUM to fresh record high above $6.5 TN…

Source: Bloomberg

And following last week’s huge deposit outflows (which we assumed were somewhat related to deferred tax payments coming due), US banks saw deposits (on a seasonally-adjusted basis) surged back higher (by $84BN) in the week ending 10/16 (the latest data released today)…

Source: Bloomberg

On a non-seasonally-adjusted basis, total deposits also rebounded from last week’s plunge (+$66BN)…

Source: Bloomberg

Excluding foreign deposits, domestic deposits rebounded from last week’s puke. Seasonally-0adjusted deposits rose $73.7BN while non-seasonally-adjusted deposits rose $60.5BN…

Source: Bloomberg

Large banks dominated the deposit inflows (+46BN NSA, $67.7BN SA) while Small banks added $14.5BN NSA and $6BN SA.

Given all that, it is perhaps rather surprising that loan volumes exploded higher in the week ending `0/16 with Larg bank loans rising $20.7BN and Small bank loans increasing by $5.3BN. That is the biggest since April 2023…

Source: Bloomberg

Finally, the bank bailout facility continued to be drained (down $7.1BN this week) as the initial loans roll out of the facility…

Source: Bloomberg

And from a liquidity need perspective, The Fed’s reverse repo facility continued to be drained this week (to cycle lows since the quarter-end surge)…

Source: Bloomberg

In the crude world, we call this ‘tank bottoms’ – and we’re fearful that the plumbing is going to start creaking sooner rather than later.

Tyler Durden

Fri, 10/25/2024 – 16:40

via ZeroHedge News https://ift.tt/6TGONoE Tyler Durden