Boeing Union Urges Members To “Lock In Gains” With New Labor Offer

After rejecting two previous labor contract deals from Boeing, the planemaker’s union, the International Association of Machinists and Aerospace Workers, reached a tentative agreement overnight, urging 33,000 striking union members to vote on the new and improved contract this Monday.

“Your Union is endorsing and recommending the latest IAM/Boeing Contract Proposal. It is time for our Members to lock in these gains and confidently declare victory,” IAM District 751 wrote on X.

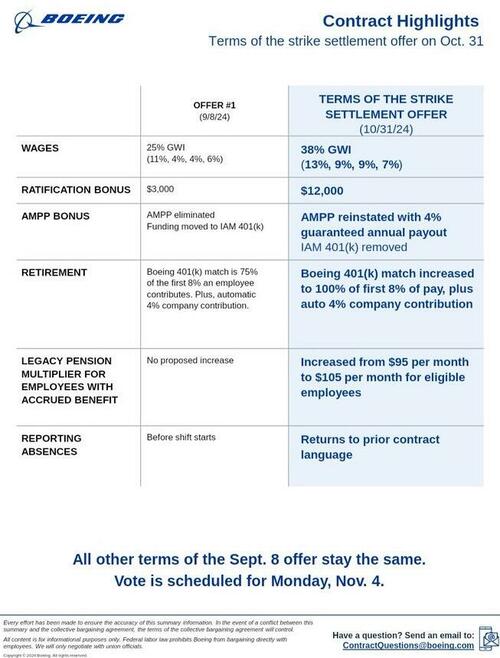

Boeing and IAM negotiators found common ground, agreeing on a 38% wage increase over a new four-year labor contract, which includes a $12,000 signing bonus.

IAM District 751 stated, “In every negotiation and strike, there is a point where we have extracted everything that we can in bargaining and by withholding our labor,” adding, “We are at that point now and risk a regressive or lesser offer in the future.”

The union highlighted two major changes in the contract:

-

A 38% General Wage Increase (GWI) over four years, broken down as 13%, 9%, 9%, and 7%, compounding to 43.65% over the life of the agreement.

-

A $12,000 Ratification bonus, combining the previous $7,000 ratification bonus and a $5,000 lump sum into the 401(k). Members can now choose how this amount is received—in their paycheck, as a contribution to their 401(k), or a combination of both.

Here are the highlights of the new labor deal:

In short, IAM District 751 has emphasized to its members that they’ve reached the end of the negotiation process—this deal is as good as it’s going to get.

Boeing shares rose a little more than 2% in premarket trading in New York. As of Thursday’s close, they are down 43% for the year.

The nearly two-month labor action has taken a financial toll on Boeing, with production lines of its commercial jets shuttered on the West Coast. On Monday, the company announced a $21 billion capital raise to offset the cash drain and strengthen its balance sheet to protect its prized investment-grade credit rating.

Tyler Durden

Fri, 11/01/2024 – 07:45

via ZeroHedge News https://ift.tt/UpjVu85 Tyler Durden