‘Trump-Quake’ Sparks Market Euphoria; Gold Dips As Dollar Rips

Where to start?

The ‘Trump Trade’ in stocks was a big winner…

Source: Bloomberg

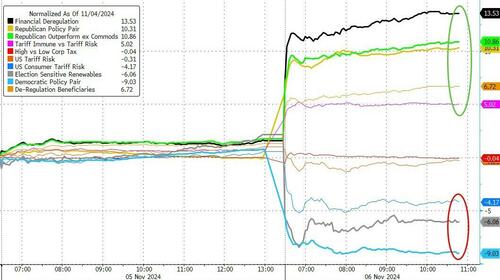

Other Election Themes exploded (or imploded) on the day with ‘Deregulation Gainers’ winning and ‘Renewables’ and ‘Tariff Risks’ losing…

Source: Bloomberg

Overall, all the majors were up bigly on the day led by a massive short-squeeze in Small Caps (up almost 6%). A little profit-taking at the cash-open was quickly met with BTFD algos…

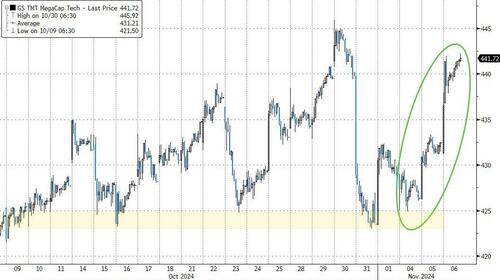

Mega-Cap tech soared back near record highs…

Source: Bloomberg

TSLA shares soared 15% to their highest since July 2023

DJT is also up bigly after a lot of noise in the last few days…

And Most Shorted stocks exploded higher…

Source: Bloomberg

With ‘some’ of the uncertainty over (FOMC tomorrow), VIX was clubbed like a baby seal today…

Source: Bloomberg

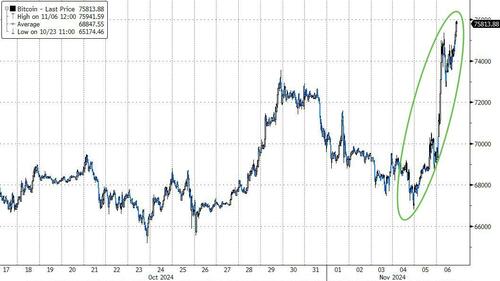

Crypto loves Trump and Bitcoin exploded to a new record high of $76000…

Source: Bloomberg

…next stop $100k-plus?

Source: Bloomberg

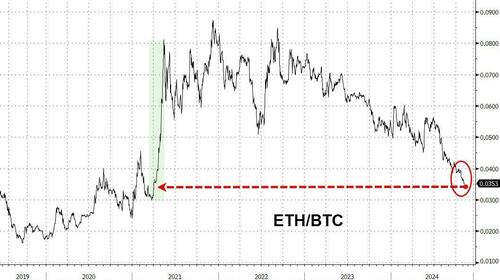

Ethereum also soared back above $2700, but relative to Bitcoin remains a majoir laggard having erased the DeFi boom gains…

Source: Bloomberg

Treasury yields soared on the Trump victory with the long-end lagging notably (30Y +17bps, 2Y +9bps) pushing everything higher on the week…

Source: Bloomberg

UST Yields are now back at their highest since early July…

Source: Bloomberg

Inflation Breakevens smashed higher on Trump’s win – 2Y BEs at their highest since April…

Source: Bloomberg

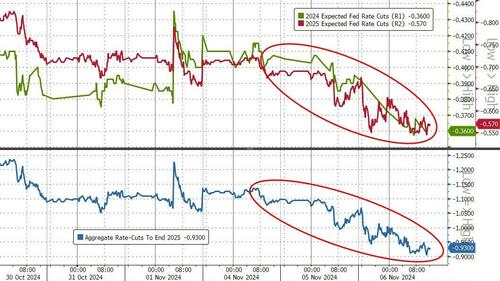

Rate-cut expectations plunged with 2025 now pricing in just 57bps of cuts!!! The aggregate rate cut expectation from now until the end of the 2025 is less than 100bps (less than 4x25bp cuts)…

Source: Bloomberg

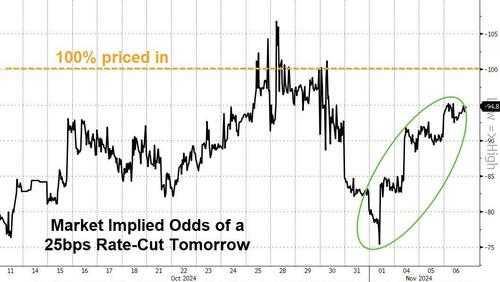

Tomorrow’s 25bps rate-cut appears to be a lock (95% odds implied by the market)… but after that who knows?

Source: Bloomberg

The dollar exploded higher, hitting 12-month highs at its peak overnight. This was the dollar’s biggest daily gain since Feb 2023..

Source: Bloomberg

The dollar strength was just too much for gold to handle and it was monkeyhammered lower. This was Gold’s worst day since June and pushed it down to test the 50DMA…

Source: Bloomberg

Despite the ‘drill, baby, drill’ fears of supply, crude prices ended higher on the day (economic growth) with WTI back above $72…

Source: Bloomberg

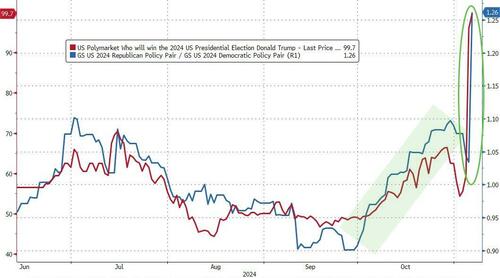

Finally, after the Biden exit and Harris endorsement, Goldman’s Republican policy pair (GSP24REP) underperformed by ~-7% until October 1st and attempted to recover after the VP debate. While today’s move is in line with expectations, Goldman’s trading desk expects further upside in their Republican Policy Pair (GSP24REP) through inauguration day…

Source: Bloomberg

Trade Accordingly.

Tyler Durden

Wed, 11/06/2024 – 16:00

via ZeroHedge News https://ift.tt/pGUrCMk Tyler Durden