Pound Jumps After BOE’s Last Rate Cut Of 2024, Warns Reeves Budget Will Spike Inflation

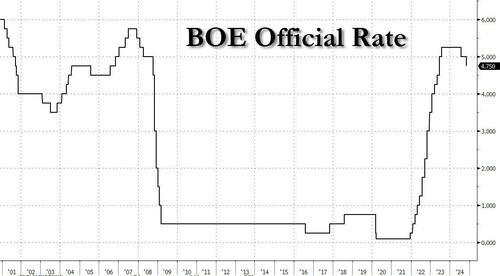

Just hours before the Fed’s second rate cut this cycle, the Bank of England cut interest rates to 4.75% – as all economists expected – its second rate hike this cycle (it kept rates on hold at its previous meeting in September, following a reduction in August)…

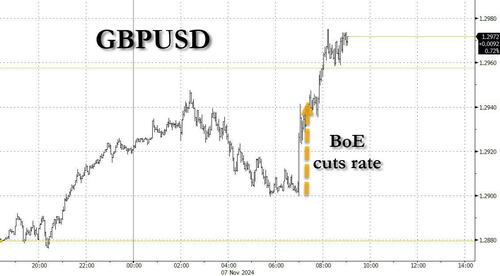

…. after inflation fell to a three-year low in September; however the cut was seen as hawkish by the market, sending the pound up 0.7% to session highs after Governor Andrew Bailey signaled that a further move is unlikely before early 2025 as rates are likely to fall only “gradually from here” and that last week’s UK budget will lift inflation by just under half a percentage point at its peak.

The Monetary Policy Committee voted by a majority of 8-1 to reduce #BankRate to 4.75%. Find out more in our #MonetaryPolicyReport: https://t.co/lEYCgPolsz pic.twitter.com/bX4TpXQqB6

— Bank of England (@bankofengland) November 7, 2024

“We need to make sure inflation stays close to target, so we can’t cut interest rates too quickly or by too much,” said BoE governor Andrew Bailey on Thursday. “But if the economy evolves as we expect, it’s likely that interest rates will continue to fall gradually from here,” he added.

As the FT notes, this week’s decision suggests the BoE is taking a cautious approach to lowering rates as it weighs the impact of chancellor Reeves’ inflationary Budget last week, which aggressively loosened fiscal policy. The outlook has also been affected by Donald Trump’s victory in this week’s US election, particularly because of his support for higher tariffs, which many economists argue could stoke inflation.

The BoE said the Budget would increase consumer price inflation by just under 0.5 percentage points at its peak compared with previous projections, as well as boosting GDP by 0.75 per cent in a year’s time.

Inflation hit 1.7% in September, the first time it has dipped below the BoE’s 2% target since 2021, but the central bank expects it to increase in coming quarters. Partly as a result of the Budget, the BoE considers that inflation will now take longer than previously expected to return to target, reaching 2.2% in two years’ time before falling to 1.8% by the end of the following year. At the same time, growth will pick up from 1% this year to 1.5% in 2025 the BOE predicted, before easing back to 1.25 per cent in 2026.

In an indication of the Budget’s impact on UK businesses, J Sainsbury warned on Thursday that Reeves’ changes would be “inflationary”, as it complained that they would subject it to an “unexpected” and “significant” £140mn “barrage of costs.” BT also described the Budget as a “new inflationary pressure”, as it said it would now be hit by a £100mn increase in costs.

As we discussed previously, the Budget unveiled a £40bn increase in taxes, most of which will come from national insurance paid by employers. It also boosted government borrowing by an average of £28bn a year over the course of the parliament as Reeves increases.

The BOE’s inflation outlook prompted traders to trim their expectations of a further quarter-point cut at the BoE’s next meeting in December from about 30% to about 20%, which in turn led to tightening in financial conditions and sent the pound to session highs, up 0.7% on the day against the dollar at $1.297. The 10-year gilt yield was steady at 4.54 per cent.

Hussain Mehdi, a strategist at HSBC Asset Management, said he now expected a “fairly shallow easing cycle” that would put upward pressure on bond yields, in part due to the Budget’s impact on inflation.

Tyler Durden

Thu, 11/07/2024 – 09:06

via ZeroHedge News https://ift.tt/L8lCNfy Tyler Durden