Hershey Cuts Full-Year Sales Outlook As Americans Dial Back On Snack Consumption

Cash-strapped consumers had no joy and happiness in the third quarter as they dialed back spending on chocolate and salty snacks produced by Hershey Co. The company slashed its net sales growth and earnings outlook after consumers balked at rising retail snack prices due to soaring cocoa costs.

Hershey reported third-quarter adjusted earnings per share of $2.34, missing the $2.56 forecast held by analysts tracked by Bloomberg. Salty snack sales in the quarter plummeted in the US, while candy sales were marginally higher.

Here’s a snapshot of the third quarter results:

Adjusted EPS $2.34 vs. $2.60 y/y, estimate $2.56

Net sales $2.99 billion, -1.4% y/y, estimate $3.07 billion

- North America confectionery net sales $2.48 billion, +0.8% y/y, estimate $2.53 billion

- North America salty snacks net sales $291.8 million, -15% y/y, estimate $313.9 million

- International net sales $218.4 million, -3.9% y/y, estimate $243 million

Net sales at organic constant FX -1% vs. +10.7% y/y, estimate +1.91%

- North America confectionery sales at constant FX +0.9% vs. +10.1% y/y, estimate +2.86%

- North America salty snacks sales at constant FX -15.5% vs. +25.5% y/y, estimate -9.59%

- International net sales at organic constant FX +0.2% vs. -1.2% y/y, estimate +8.65%

Adjusted gross profit $1.20 billion, -12% y/y, estimate $1.29 billion

Adjusted gross margin 40.3% vs. 44.9% y/y, estimate 41.7%

On an earnings call on Thursday, CEO Michele Buck told investors that “pressure in the snacking categories are really driven by the consumers feeling pressured financially.”

Hershey has warned several times that record-high cocoa prices would pressure consumers and thus “limit earnings” this year.

-

Hershey CEO Warns ‘Earnings Limited’ As Cocoa Prices Hyperinflate

-

“Not So Transitory”: Hershey Hit With Downgrade As Cocoa Crisis Hyperinflates Prices

-

Americans Can’t Even Afford Chocolate: Hershey Sales Crater, Guidance Melts

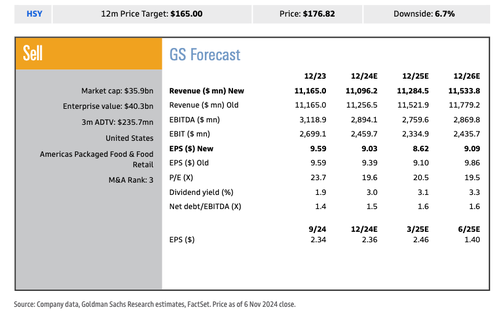

On Thursday, Goldman’s Leah Jordan penned a note for clients about the dismal demand story around Herhsey, reiterating a “Sell” rating…

HSY closed down -2.3% (vs S&P 500 +0.8% and XLP +0.4%) after its 3Q miss and lowered FY24 guidance, which revealed incremental demand headwinds given shifting consumption trends (resulting in inventory reductions at retailers) coupled with increasing competitive pressures across the portfolio as smaller brands and private label gain ground. While HSY sounded more constructive on the longer term outlook for cocoa prices and the impact on its business, there is still uncertainty surrounding the margin pressure from higher cocoa costs for FY25. Furthermore, we believe it will be difficult for the stock to work until we see better demand for the category and market share trends for HSY. We reiterate our Sell rating for HSY with an updated 12-month price target of $165.

Jordan offered clients her top three takeaways from earnings:

-

Softer top line trends due to lower consumption and increasing competitive pressures: Organic Net Sales tracked at -1.0%, primarily driven by lower volumes (-3.0%), partially offset by net price realization (+2.0%). This volume weakness was largely attributed to a more challenged consumer (including a deceleration in c-store trends), while highlighting the estimated impact from rising GLP-1 usage has been mild. As a result of this softer demand, retailers are managing inventory more tightly across both confection and salty. HSY also called out increasing competitive pressures across its portfolio, including smaller brands and private label within domestic confection, along with price investments from peers in international confection (namely Mexico/Brazil). We expect these market share pressures to persist given lower barriers to entry today (supported by social media, lower for sweets vs chocolate), along with rising consumer adoption of private label and increasing investments in its quality by retailers. Additionally, we observed incremental commentary around mis-execution, which keeps us cautious. The company is proactively aiming to address these issues, including new leadership for US confection, a step-up in its innovation pipeline, updated marketing for evolving consumer needs, and refocused efforts for the c-store channel (adding variety brands, expanding its Gold Standard planogram).

-

Gross margin pressure increases; uncertainty on cocoa costs clouds the outlook: Gross margin of 40.3% (-460 bps y/y) came in well below Street expectations, as well as internal targets by the company, with greater than expected pressure from the volume deleverage (including reduction in inventory from retailers) and mix (from c-store weakness). While detail on the outlook for FY25 was limited, cocoa remains the biggest cost headwind along with pressure in sugar and labor, which the company aims to partially offset through pricing action, productivity gains, and cost optimization. Regarding cocoa, management noted the outlook has improved with a global supply surplus likely in 2025, supported by a better crop expected in West Africa and increased production in ROW. That said, some challenges persist, including a lack of liquidity on the exchange, suggesting a more gradual pricing recovery is likely. As a result, we expect meaningful margin pressure from cocoa in FY25, along with continued mix headwinds due to channel shifts (namely in 1H). While the company’s new allocation methodology creates noise in y/y compares for next year, we generally expect its margin profile to improve throughout year as pricing is implemented and cocoa costs are layered in.

-

FY24 guidance lowered; initial look on FY25 suggests hitting top-line algo: HSY lowered its FY24 adj EPS guidance to -MSD from down slightly, driven by a reduction in organic net sales to flat vs +2% prior and a lower gross margin outlook (-250 bps y/y vs -200 bps prior), with the implied 4Q outlook light vs expectations. For FY25, management indicated it should be able to hit its top line algorithm for +2-4% growth, supported by pricing (+LSD to +MSD) and a strong innovation line-up, while the longer Easter season next year could generate up to 1pp benefit based on historical trends. That said, margin pressures should be meaningful next year, thus we expect further EPS compression, recognizing the company’s view was limited with formal FY25 guidance expected next quarter. Additionally, HSY noted FY26 could be an on-algorithm year (+6-8% EPS growth) should cocoa stabilize, while declines could lead to potential upside, although we believe investors will also be watching category demand and HSY’s market share trends to gain confidence in this outlook.

Jordan reiterated Hershey’s “Sell” rating and lowered her 12-month price target to $165 from $185.

Here’s what other Wall Street analysts told clients:

DA DAVIDSON (neutral), Brian Holland

- 3Q “once again lagged tempered expectations,” and in addition to “moving parts around inventory and shipment timing, underlying demand” remains weaker than expected, Holland writes

- The reduced 2024 guidance reflects the 3Q shortfall, but also implies that both his and the Street’s 4Q estimates are too high

- “Beyond cocoa, the combination of weaker snacking trends and reinvestment needs figures to pressure both the top & bottom line in the near to intermediate term,’ he says

- “Without a clearer picture of when/where the bottom is in the cycle, valuation nearer trough levels alone is not compelling enough to make us more constructive here”

BERNSTEIN (market perform), Alexia Howard

- “It seems that over and above the obvious cocoa pressures on margins, category growth remains lackluster even against particularly easy” y/y comparables, Howard writes

- “Begs the question” of what the GLP-1 drug impact might be having on “indulgent snacking categories and how Hershey’s core chocolate volumes might fare as the company attempts to take pricing, even as it acknowledges that incremental promotion and revenue growth management efforts are needed”

- These challenges may intensify as “cocoa input cost pressures step up and the volume outlook for the US chocolate category remains highly uncertain”

MIZUHO (neutral), John Baumgartner

- “Halloween shipments/sell-through met expectations (+LSD%), but total US snacking industry consumption decelerated (+0.1% vs. 2Q’s +0.9%),” Baumgartner writes

- Market share losses are increasing amid competition from smaller companies, private label and multinationals, while consumer shopping is shifting more toward club stores/dollar stores/online and less at convenience and drug stores

- “Our concerns are rising for FY25 (consensus EPS not low enough) as HSY’s main response appears to be pursuing retail productivity/merchandising & promo optimization,” he says

BARCLAYS (equal-weight), Andrew Lazar

- 3Q results were “well below even our well-below-consensus” hurt by “both industry-wide and Hershey-specific challenges,” Lazar writes

- “Total snacking consumption has softened and consumers are channel shifting from c-store and drug [store] where the category overindexes to club and mass merchandisers where the category is less developed” and retailers “continued to take down” inventory levels across both North America Confectionery and North America Salty Snacks

- From a company-specific perspective, Hershey continues to lose market share in core confection business amid increased competition, and hit by execution issues in both Confectionery and Salty Snacks

- While a 2024 EPS guidance reduction was likely anticipated, the cut is “greater than most had expected” and 2025 EPS will probably decline “well below current Street estimates”

- “While sentiment on HSY shares is already quite negative, in our opinion, we think the magnitude of the 2024 EPS cut combined with underlying fundamental trends that remain challenged will still likely result in some additional share weakness on the open,” he says

The big takeaway is that food inflation remains sticky, and cash-strapped consumers have balked at expensive, leading brands and traded down to generic ones – or, in some cases, entirely pulled back on spending.

Tyler Durden

Fri, 11/08/2024 – 09:35

via ZeroHedge News https://ift.tt/rUwo4Dp Tyler Durden