Mirror, Mirror On The Wall, Which Is The Most Worrisome EU Country Of Them All?

Authored by Robert Burrows via BondVigilantes.com,

Renewed concerns of European fragmentation: France’s economic and political struggles…

Source: Bloomberg, as at November 2024

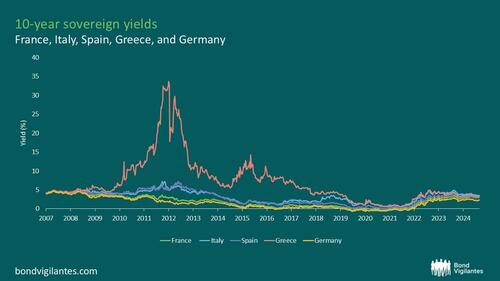

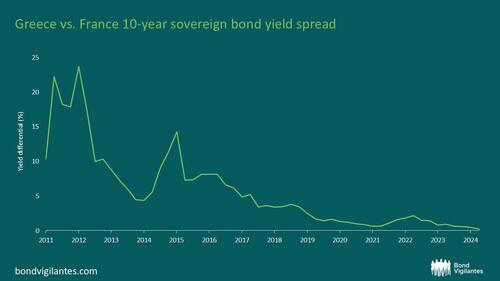

What is incredibly surprising is how little differentiation there is among European issuers. Perhaps this signals that there are no concerns within Europe and that the European Central Bank (ECB) has all the necessary tools to stem any divergence. Perhaps investors already view the bloc as a shared fiscal union, suggesting there should be no differentiation.

Source: Bloomberg, as at November 2024

As France grapples with deepening economic and political challenges, the possibility of European fragmentation will likely become a topic of discussion once again. The country’s long-standing fiscal pressures, political instability, and rising populism are troubling for France and the broader European Union (EU). With France playing a pivotal role in the EU’s economic and political structure, its struggles raise questions about the strength of European unity, especially in an era marked by increasing global uncertainty.

France’s economic troubles: debt and stagnation

France’s economic challenges are rooted in years of sluggish growth, high unemployment, and rising public debt. The nation’s debt-to-GDP ratio now exceeds 110%, a level that puts increasing strain on the government’s ability to invest in its economy.

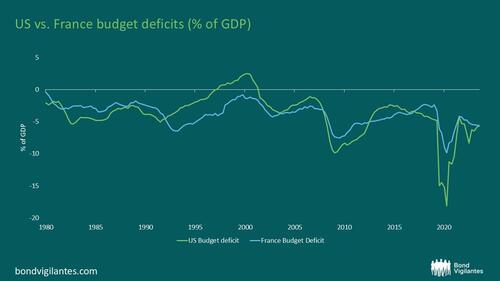

France continues to run worrying deficits akin to the equally worrying US.

Source: Bloomberg, as at November 2024

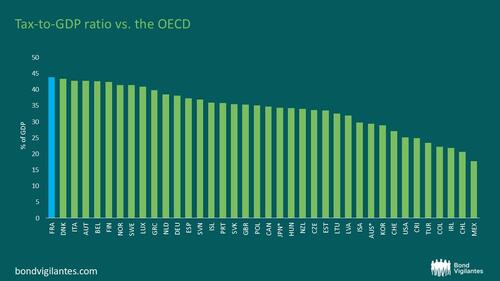

However, the difference between France and the US is that the US is in a position to raise taxes. Whether the US does is another story altogether, but at least it is in the position to do so. France, on the other hand, is likely at or close to peak tax-raising levels. If there are any further tax increases, the tax revenue could in fact fall as per the Laffer curve1 That leaves reduced spending as the only viable option to bring deficits under control. It is doubtful that the electorate will tolerate significant reductions in spending. Another consideration is that the US can control its monetary policy. In contrast, France is a hostage to the policy set by the ECB for the EU as a whole.

Source: OECD. Provisional 2023 data. *Japan and Australia unable to provide provisional, therefore numbers used are 2022 data.

Meanwhile, inflationary pressures from rising energy prices, supply chain disruptions, and the global fallout from the Ukraine war are making life increasingly difficult for French citizens.

Fiscal constraints, including the country’s ‘excessive deficit procedure’ limit the government’s ability to spend its way out of these problems. This economic stagnation has hit low- and middle-income families the hardest, fuelling social unrest and discontent. With a growing sense that economic inequality is deepening, populist movements are gaining traction in France, pushing back against traditional political parties and calling into question the benefits of European integration.

Political instability and fragmentation in France

France’s political landscape has fractured, as seen in the recent election. The traditional parties of the centre-left and centre-right, which have long dominated French politics, have weakened considerably. The recent election saw no party win a majority; a left-leaning coalition won 188 seats, the centrist coalition won 161 seats, and the far-right won 142 seats. Consequently, the far right became the single largest party and no party was able to claim a majority. The outcome was a fragile centre-right government propped up by Marine Le Pen’s far-right party.

The rise of Marine Le Pen’s far-right National Rally and Jean-Luc Mélenchon’s far-left La France Insoumise reflects deep divisions within French society. These parties tap into frustrations over economic stagnation, immigration, and disillusionment with the EU’s role in France’s domestic affairs.

This political fragmentation has not just created a challenging environment for Emmanuel Macron’s government, but it has severely hampered its ability to push through much-needed reforms. Macron’s centrist platform, which was supposed to bridge the political spectrum, has instead alienated both sides, and attempts at pension reform, labour law changes, and economic liberalisation have been met with widespread protests, most notably the ‘Yellow Vest’ movement.

The inability to implement structural reforms is compounding France’s economic challenges. With the government hamstrung by opposition forces and increasing populist sentiment, France’s political future is uncertain. As France teeters on the edge of further instability, the implications for the European Union are significant.

A recent hint of concern for the EU came from the European Commission’s acceptance of France’s budget proposals (which are unlikely to come to fruition given the government’s instability) and allowing France to postpone its deficit reduction efforts from 2027 to 2029. In contrast, the Commission’s judgement on the Dutch budget, which is well within the rules, has been delayed. Perhaps the Commission is fretting over larger issues.

The European Union: a fragile union?

France and Germany have always been key pillars of the European Union. However, as economic and political instability deepens in both France and, more recently, Germany, it brings into question the stability of the EU itself. In recent years, the EU has already faced major challenges, from Brexit to the sovereign debt crises in Greece, Italy, and Spain. The COVID-19 pandemic, followed by the energy crisis and the war in Ukraine, have further tested the bloc’s resilience.

In France, populist leaders like Marine Le Pen have openly criticised the EU’s bureaucracy and called for reclaiming French sovereignty, particularly in immigration, trade, and economic policy. Though Le Pen’s position on leaving the EU has softened in recent years, her anti-EU rhetoric still resonates with a sizable portion of the French electorate. This raises concerns about France’s continued commitment to EU integration.

Should France’s economic situation deteriorate further, and populist movements gain even more ground, it could trigger renewed debates over the future of the EU. The rise of populism in one of the EU’s core member states could embolden other Eurosceptic movements across the continent, leading to renewed fragmentation pressures.

Energy crisis and inflation: pressures across Europe

The energy crisis and surging inflation are not unique to France, but they have heightened economic tensions across Europe. Germany, once the EU’s economic engine, is also facing severe challenges due to rising energy prices, weakening manufacturing and industrial sectors, and constrained fiscal spending due to the debt brake. Countries like Italy and Spain, which have already faced sovereign debt crises in the past, remain vulnerable to economic shocks.

While the EU has shown resilience in the face of these challenges, France’s fiscal problems could add further strain. If one of the EU’s key economies falters, it would complicate efforts to maintain unity, especially when fiscal solidarity is already a contentious issue. A divided French government could struggle to support broader EU initiatives, such as energy transition policies and climate goals, which require unified political will and significant financial investment.

The consequences of French economic decline for the EU

If France’s economic and political situation worsens, it could destabilise the European Union in several ways. First, the loss of French leadership in EU policy debates could leave a vacuum that is difficult to fill. France has long been an advocate of closer European integration, especially in areas like defence, foreign policy, and economic regulation. A weakened France could slow the pace of EU reforms and complicate decision-making within the bloc.

Second, France’s decline could embolden other Eurosceptic countries. Italy’s populist movements, Hungary’s nationalist government, and Poland’s increasing resistance to EU authority all point to a growing sense of disillusionment with European integration. France’s struggles could add fuel to this fire, leading to more calls for looser ties within the EU or, in extreme cases, further exits from the union.

Finally, renewed economic fragmentation could strain the ECB’s ability to manage monetary policy across the eurozone. As countries face diverging economic challenges, the ECB could find it increasingly difficult to balance inflation control with the need for growth stimulus in struggling economies. This could lead to further financial instability, making it harder to hold the eurozone together.

Conclusion

France’s economic and political difficulties are not just a domestic issue; they have profound implications for the European Union as a whole. The combination of rising debt, political fragmentation, and populist movements within France could exacerbate concerns about the future of European integration. As one of the EU’s most important members, France’s trajectory will play a crucial role in shaping the future of the union. While the EU has survived numerous challenges in the past, France’s ongoing struggles could spark renewed debates over fragmentation, threatening the unity that has been a cornerstone of the European project for decades.

Tyler Durden

Mon, 12/02/2024 – 05:00

via ZeroHedge News https://ift.tt/BL2FwWm Tyler Durden