Futures Slide As Bond Yields Jump To 6 Month High

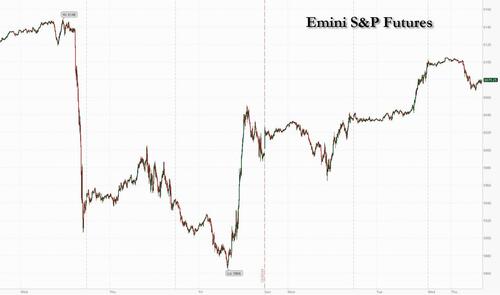

US stock futures and Treasuries dropped as muted trading resumed after the Christmas holiday, with investors looking to initial jobless claims data and a government bond auction later on Thursday. At 8:00am, S&P futures fell 0.3%; the index closed 1.1% higher on Tuesday, extending this year’s advance to 27%, and on pace for the best full-year return this century. Nasdaq futures slipped 0.4% after adding 1.4% on Tuesday, as a bout of selling started after the Europe open. Most major markets in Europe are still shut for holidays. Treasuries extended their selloff, pushing 10Y yields to a fresh 6 month high of 4.63%, a level which will start denting the Christmas rally meltup. The dollar also gained as the Bloomberg Dollar Index hit a new two year high. The only even on today’s calendar is jobless claims at 8:30am.

In premarket trading, cryptocurrency-tied stocks like MicroStrategy Inc. and Riot Platforms Inc. declined, tracking a drop in Bitcoin. Here are some other notable premarket movers:

- Alibaba Group Holding agreed to merge its South Korean operations with E-Mart Inc.’s e-commerce platform to better compete in the country’s fast-paced online retail sector.

- Rapt Therapeutics shares are up 0.6% in premarket trading, after HC Wainwright & Co. LLC upgraded the biotech company to buy from neutral.

- Apple’s price target is being raised to a Street-high of $325 from $300 at Wedbush, which writes that the company is “heading into a multi-year AI-driven iPhone upgrade cycle.”

- Progressive is upgraded to outperform from market perform at Raymond James, which writes that the company’s “long-term record of growth and value creation makes it a core holding for large cap growth investors.”

With US stocks on pace for another blowout year, bulls are pinning their hopes on the “Santa Claus rally” in which stocks rise during the final five trading sessions of a year and the first two of the new one. Separately, with Trump’s inauguration slated for Jan. 20, investors are awaiting insights on his proposed policies, including tax cuts and tariffs which is set to keep the rally going. Driven by optimism about the strength of the US economy and developments in artificial intelligence, the S&P 500 is set for its largest jump relative to the rest of the world since 1997.

European markets were mostly closed while in Asia, the MSCI Asia Pacific Index climbed for a fourth day, the longest winning streak since September, led by Japan and Taiwan. Japanese shares also rose after central bank governor Kazuo Ueda on Wednesday avoided giving any clues about a possible interest-rate hike. Japanese retail shares also gained after the country agreed with China to introduce more measures to promote tourist visits. The two nations also agreed that Beijing’s top diplomat should visit Japan in 2025, adding to signs the two nations are repairing ties that have been strained in recent years. Shares of Chinese computing-equipment makers advanced after the nation said it planned to include the sector into the investment scope of local government special bonds. Kingsignal Technology surged as much as 20% as did Broadex Technologies.

The dollar was broadly steady against its Group-of-10 peers, while the yen extended its losses after BOJ head Ueda refused to offer any hawkish hints about an imminent rate hike. “Weakness in the yen on the back of recent Fed-BOJ policy divergence has offered some support for Japanese equities in today’s session, coupled with the year-end positive seasonality around the Santa Claus rally,” said Jun Rong Yeap, a market strategist at IG Asia Pte in Singapore.

In rates, treasuries are under pressure as US trading gets under way following Wednesday’s US holiday. 10-year yields climbed four basis points to 4.63% before the US auctions $44 billion of seven-year notes on Thursday. The year’s final coupon auction at 1pm New York time, a $44 billion 7-year note sale. Demand was firm for 2- and 5-year note auctions Monday and during Tuesday’s holiday-shortened session, halting a selloff in which 5- to 30-year yields reached highest levels in months.

In commodities, oil held gains after an advance before the Christmas break, with China’s stimulus measures and the outlook for US stockpiles in focus.

Looking at today’s calendar, US economic data calendar includes only weekly jobless claims at 8:30am. The Fed speaker slate is blank for the rest of the week.

Market Snapshot

- S&P 500 futures down 0.2% to 6,083.50

- MXAP up 0.3% to 182.31

- MXAPJ down 0.1% to 574.63

- Nikkei up 1.1% to 39,568.06

- Topix up 1.2% to 2,766.78

- Hang Seng Index up 1.1% to 20,098.29

- Shanghai Composite up 0.1% to 3,398.08

- Sensex little changed at 78,460.42

- Australia S&P/ASX 200 up 0.2% to 8,220.86

- Kospi down 0.4% to 2,429.67

- Brent Futures up 0.5% to $73.96/bbl

- Gold spot up 0.4% to $2,626.75

- US Dollar Index little changed at 108.20

Top Overnight News

- China is allowing local officials to invest in more areas with a key government bond while also simplifying its approval process in a bid to make better use of an important source of public funding to drive the economy

- Japan’s auction of two-year government notes Thursday showed solid demand as expectations recede for an interest-rate hike by the BOJ soon. The bid-to-cover ratio rose to 3.95 from 3.63 at last month’s sale

- Bitcoin rose on Thursday after the digital asset’s stockpiler MicroStrategy announced a plan to issue more shares, a move that would allow it to buy even more tokens.

- China abruptly ousted two military lawmakers from its national parliament without explanation, as a purge of key personnel in the upper echelons of the nation’s defense establishment shows no sign of easing

- Market players widely expect Japan’s benchmark 10-year government bond yield to continue to gradually rise next year, but the extent of the increase will depend on whether the central bank is able to lift interest rates smoothly

- Japanese Prime Minister Shigeru Ishiba’s cabinet is expected to approve a record initial budget Friday for the next fiscal year that will ramp up spending on defense and support for local economies

Tyler Durden

Thu, 12/26/2024 – 08:14

via ZeroHedge News https://ift.tt/uOvlDMz Tyler Durden