No One On Wall Street Expects A Bad 2025

Authored by Phil Rosen via Opening Bell Daily,

It’s true that stocks usually go up most of the time, but the market’s latest two-year run makes any cliché sound like an understatement.

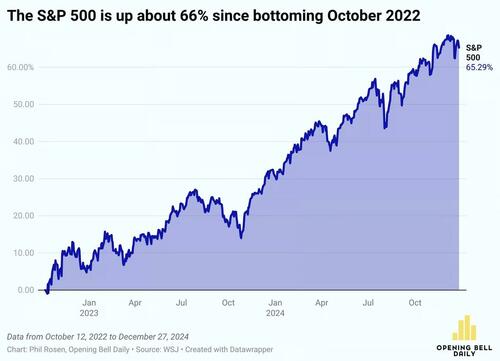

Since bottoming in October 2022, the S&P 500 has returned roughly 66%.

The index is on track for back-to-back annual returns of more than 20% for the first time in over two decades, handily outpacing the 10% gain seen in an average year.

As you might guess, no one on Wall Street expects stocks to fall in 2025.

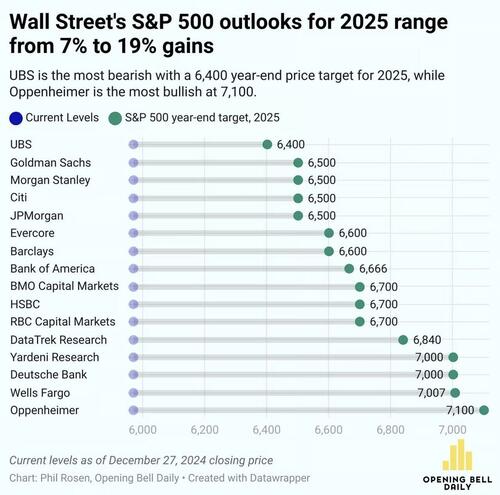

Among the 16 firms tracked by Opening Bell Daily, S&P 500 forecasts for the new year range between a 7% and 19% annual return from Friday’s closing price.

UBS holds the most bearish view with a year-end price target of 6,400, while Oppenheimer is the most optimistic at 7,100.

Traders on the prediction market Kalshi, meanwhile, see 17% odds the S&P 500 ends 2025 between 6,400 and 6,599, which lands in the middle of Wall Street’s forecasts.

Depending who you ask, the combination of Trump 2.0, hawkish Fed policy, inflation and fluctuations in the AI trade will provide either a tailwind or roadblock for equities.

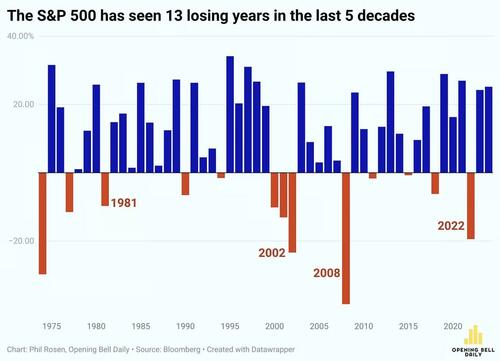

It’s worth noting that Wall Street effectively never predicts a down year.

Even the weakest year-ahead forecasts of the last several decades have afforded stocks marginal gains. Those predictions don’t always hold — the S&P 500 has notched 13 losing years in the last 50 — but it’s rare to find a formal expectation for a loss.

Notably, over the last 24 years, forecasters’ price targets have actually missed the mark by 14% on average, according to Bespoke Investment Research.

Of course, even the most paltry track record won’t deter well-paid strategists from publishing their next prediction.

In any case, historical data favors the optimists. Across any 12-month stretch, stocks have finished higher three in four times.

Expand that time frame to five years and stocks trade higher nearly 90% of the time.

“We believe 2025 will see another year of healthy stock market returns, but with more volatility as investors return to reading every Federal Reserve tea leave and as we start to parse policy action out of Washington, especially when it comes to tariffs and taxes,” said Carol Schleif, chief market strategist for BMO Private Wealth.

Comments or feedback? Let me know on X @philrosenn.

Tyler Durden

Tue, 12/31/2024 – 06:55

via ZeroHedge News https://ift.tt/TMwbK8Q Tyler Durden