Authored by Charles Hugh Smith via OfTwoMinds blog,

There are hundreds of extraordinarily diverse labor markets in the U.S. economy, and it takes a much more granulated approach to make any sense of this highly fragmented and dynamic marketplace.

Conventional economists/media pundits typically view the labor market as monolithic, i.e. as one unified market. The reality is the labor market is highly fragmented. Thus it’s little wonder that conventional measures are giving mixed signals on employment, wage inflation, etc.

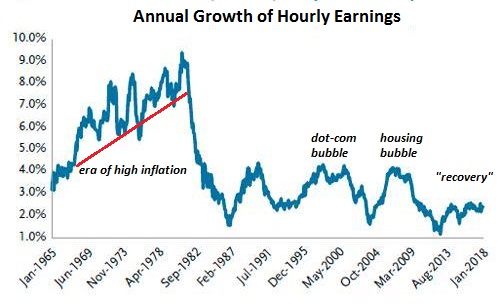

Here is a typical chart of the labor market: the annual rate of change in hourly earnings, going back to the late 1960s. I’ve annotated the chart to show that hourly earning rose sharply in the inflationary 1970s, but since then have only popped higher in asset bubbles–the dot-com era and the housing bubble:

Gneralized measures that lump all wage earners together give us a snapshot of trends, but they fail to describe the realities of today’s labor markets. The reality is much more complex, and thus beyond the outdated conventions that divide the labor force into broad sectors:

1. While most workers are receiving little in the way of wage increases, employers’ total compensation costs are soaring due to skyrocketing healthcare premiums and other labor-overhead costs such as workers compensation.

Economists puzzled by the lack of wage inflation in an era of “full employment” should look at total compensation costs instead of wages: the inflation is in the labor-overhead costs, not employee compensation.

2. Regions dominated by a handful of employers do not offer many opportunities for employees to jump to other employers for higher pay. This lack of competition enables dominant employers to suppress wage growth.

3. Scarcities of skills and experience that drive wages higher tend to be sector-specific and are often localized. Across the broad spectrum of basic skills and experience (for example, white-collar work performed by employees with non-technical college diplomas), there are few scarcities that could push wages higher.

4. Regardless of labor availability/scarcity, many small-business employers can’t afford to pay higher wages, given their soaring labor-overhead expenses. If wages rise, their options include selling out, closing down, or doing more of the work themselves. Paying higher wages will simply guarantee monthly losses. If you’re losing money operating an enterprise, why be in business?

5. Employers demand a great deal now of lower-wage service sector employees. Fast-food jobs (for example) require high levels of productivity in a rigidly structured factory setting. There are few “easy” jobs left in the U.S. economy that require little training and pay for low productivity.

As a result, a great many people do not have the ability or willingness to take these grueling jobs. Reasons include physical limitations, pride (“I’m not wearing that dumb uniform”), a black market income that’s much easier than available conventional jobs, inability to pass mandatory drug tests, etc.

6. The opioid epidemic and other drug addictions have removed millions of people from the work force. Disability is now the option of choice for those who qualify.

7. These factors turn the conventional wisdom on its head: rather than there being a surplus of lower-wage, lower skilled workers and a shortage of college-educated workers, there are shortages of lower-wage, lower skilled workers and a surplus of college-educated workers.

8. The cultural and educational bias in favor of “clean work” and high-visibility finance and entertainment has generated scarcities of skilled welders, pipefitters, etc., (“dirty physical work”) and an astounding over-abundance of people who expect to earn a living as musicians, entertainers, writers, pro athletes, smart-phone app entrepreneurs, restaurateurs, hedge fund managers, etc., fields in which a relative handful of people earn most of the income.

The reality is these are winner take most fields of endeavor, and the vast majority of hopefuls will earn a tiny piece of the long-tail of income distribution.

In tandem with the general erosion in real-world skills (i.e. preference for watching cooking shows over actually cooking 95% of your own meals, inability to change the oil in one’s vehicle, grow food, prune fruit trees, repair rotted stairs, fix appliances, repair a leaky faucet, install a solar panel, and so on), this cultural and educational bias in favor of narrow service skills and extreme specialization has left the work force poorly adapted on multiple fronts.

Skills such as welding and plumbing don’t change much; once mastered, the skills can be applied for decades with little retraining being required. But the sort of “clean work” service jobs people favor are the ones most easily disrupted by automation, software and AI.

As for over-specialization, as often noted here, issuing 100,000 new graduate-level STEM diplomas (science, technology, engineering, math) does not magically create 100,000 high-paying secure jobs for the graduates.

Instead, we have a system of higher education that implicitly over-promises the rewards of law degrees, masters degrees in social sciences, MBA diplomas, STEM PhDs, etc., an institutional bias that has created a structural over-supply of over-educated, under-skilled specialists, a labor pool that doesn’t align with the actual needs of real-world employers.

Averages and medians tell us very little about real-world labor markets. There are hundreds of extraordinarily diverse labor markets in the U.S. economy, and it takes a much more granulated approach to make any sense of this highly fragmented and dynamic marketplace.

Of related interest:

Career Advice to 20-Somethings: Create Value as a Mobile Creative

* * *

My new book Money and Work Unchained is $9.95 for the Kindle ebook and $20 for the print edition. Read the first section for free in PDF format. If you found value in this content, please join me in seeking solutions by becoming a $1/month patron of my work via patreon.com.

via Zero Hedge http://ift.tt/2F19eJJ Tyler Durden