Authored by Tommi Utoslahti, Bloomberg Markets Live Commentator

Don’t get too comfortable with the idea of a sustained rebound in U.S. stocks this year. There are multiple reasons to prepare for a full-blown cyclical bear market in the S&P 500 Index.

Based on Bloomberg surveys, market participants and my MLIV colleagues both expect a hearty double-digit percentage rally for the S&P 500 this year. In contrast, I would argue the balance of risks is now clearly tilted to the downside.

All the reasons behind the warning of severe market turbulence in my 2018 outlook, exactly a year ago today, are still present. Instead of ameliorating, most of them have escalated into even more serious dangers.

Trade tensions play an important part but they also mask a host of other concerns that may drag equity valuations lower. Higher borrowing costs, record debt levels, political gridlock and the fading stimulus impact are a toxic cocktail for U.S. equities. Consequently, the stock market cycle looks ready to move on from the high-volatility phase of 2018 to a fully developed bear market.

The recent warnings from tech heavyweights such as Apple cast a long shadow over earnings optimism. Analysts have cut global profit forecasts by the most since 2009, according to Citigroup Inc.’s Earnings Revision Index. It may be too early to conclude that profits are hitting a cyclical peak, but declining earnings growth combined with record debt levels certainly limit the upside from share buybacks and M&A activity.

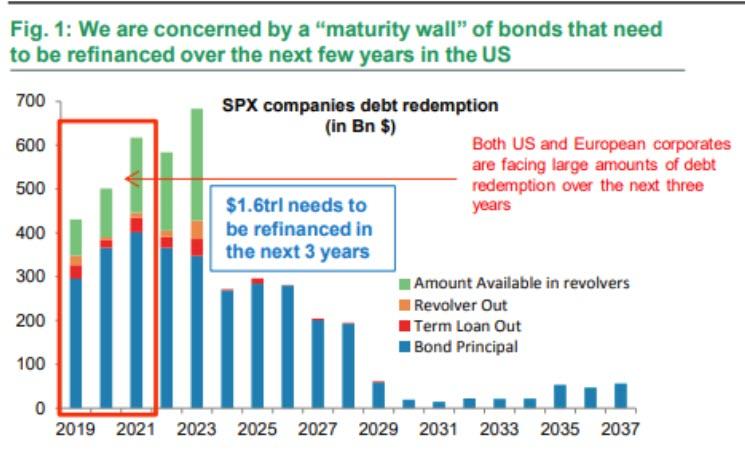

The need to refinance a massive corporate debt load underscores one of the biggest risks to companies: an addiction to cheap post-crisis funding. The likelihood of wider credit spreads looms large over balance sheets amid ongoing monetary policy normalization.

The rates market may have gotten ahead of itself in pricing out future Fed hikes, suggesting more stock market angst if benchmark yields resume their climb. Equity weakness won’t stop the Fed from tightening further if a strong labor market and rising wage costs threaten to leave the central bank behind the curve.

Mid-term election uncertainty has morphed into political paralysis in Washington (never mind the ongoing Mueller investigation) and risks hindering U.S. growth just as the positive effect from fiscal stimulus is wearing off.

North Korea’s suspension of nuclear and missile tests eased fears of an imminent armed conflict, but geopolitical risks remain elevated on many levels. External concerns are compounded by uncertainty surrounding Brexit, Italy’s finances and political unrest in France.

Even successful U.S-China trade talks won’t completely neutralize the threat from protectionism that hangs over equities. Any deal with Beijing will take considerable time to implement and enforce before it can undo the damage already caused to international trade.

via RSS http://bit.ly/2TJzgUz Tyler Durden