Facebook engaged in a multi-year effort to trick kids and their parents into racking up massive charges based on deceptive in-game purchases – then refused to give the money back, according to unsealed records in a class action lawsuit.

The in-game charges which added up to hundreds or even thousands of dollars were part of a system of “friendly fraud,” according to Reveal News‘ Nathan Halverson, citing over 135 pages of unsealed documents which include employee emails, Facebook memos and secret strategies.

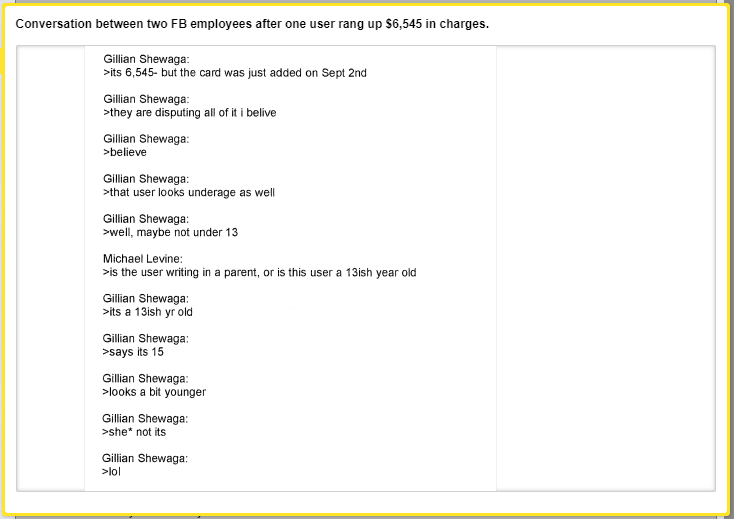

When parents found out how much their children had spent – one 15-year-old racked up $6,500 in charges in about two weeks playing games on Facebook – the company denied requests for refunds. Facebook employees referred to these children as “whales” – a term borrowed from the casino industry to describe profligate spenders. A child could spend hundreds of dollars a day on in-game features such as arming their character with a flaming sword or a new magic spell to defeat an enemy – even if they didn’t realize it until the credit card bill arrived. –Reveal News

According to an internal document which reveals Facebook’s strategy, the “friendly fraud” by game developers was encouraged in order to maximize revenues. Another internal Facebook report shows that the company knew that in-game purchase options defaulted to “the highest-cost setting,” and that it “doesn’t necessarily look like “real” money to a minor – nor that their parents’ credit cards were linked to their Facebook account in order to spend real money in the games.

The “friendly fraud” was particularly rampant among the games “PetVille, Happy Aquarium, Wild Ones, Barn Buddy and any Ninja game.”

Facebook was well aware of the issue – even developing a method that would have mitigated the excessive in-game purchases, however the company did not implement it, “and instead told game developers that the social media giant was focused on maximizing revenues,” reports Reveal.

Some parents turned to the Better Business Bureau (BBB) to lodge complaints, while others turned to the courts or their credit card companies for a refund. Facebook’s chargeback rate of 9 percent far exceeded the Federal Trade Commission’s red-flag level of 2 percent for a “deceptive” business.

U.S. District Court Judge Beth Freeman ordered the documents unsealed on Jan. 14 after Reveal from The Center for Investigative Reporting intervened last year arguing the public had a right to know how Facebook targeted children. The judge gave Facebook until January 24 to unseal the documents, although she allowed the company to keep a few of the records sealed or partially redacted. The documents span a time period of 2010 to 2014. –Reveal News

Facebook had a fix – and shelved it

“If the devs are really concerned about the cbs and not refunds it could make sense to start refunding for blatant FF-minor,” wrote Facebook employee Tara Stewart to a colleague on July 8, 2011 – suggesting that perhaps the company should just refund money to parents when their minor children clearly used a credit card without permission.

Several months before this email, Stewart launched an internal initiative to help Facebook minimize credit card chargebacks from outraged parents who said their kids were tricked into the in-app purchases. An internal Facebook survey found that a lot of parents had no idea Facebook was even retaining their credit card information, nor did they know their children could use them without re-entering a password or another type of verification.

In order to test whether kids were being duped, Stewart and her colleagues conducted an experiment in which children were required to re-enter the first six numbers of their parents’ credit card on certain games before they were allowed to spend money. The test worked, according to Stewart – who called it a “good first step” as it lowered the number of refund and chargeback requests.

“It forces the minor to prove he is in possession of the credit card,” wrote Stewart. “Often refunds/cbs occur because a parent permits his child to spend at a small denomination and doesn’t realize that the CC info will be stored.”

Unfortunately for Stewart’s idea – it would likely hurt Facebook’s revenue, so the company never implemented the changes that would block children from unwittingly spending their parents’ money into the thousands of dollars in some cases.

A few months before she launched her project in mid 2011, Facebook had uncovered some troubling data about the children playing its games. They were requesting refunds and demanding chargebacks at extraordinarily high rates.

The company had analyzed data on game revenue from children for the time period Oct. 12, 2010 to Jan. 12, 2011. The children had “spent a whopping $3.6 million” during the three-month period, according to the report.

But the company had discovered that more than 9 percent of the money it made from children was being clawed back by the credit card companies.

In comparison, the average chargeback rate for businesses is 0.5 percent, according to the Merchant Risk Council, a nonprofit that helps businesses manage risk. –Reveal News

Rovio, maker of Angry Birds, expressed concern over Facebook’s high chargeback rates according to an email exchange between companies.

“We have been seeing refund rates of 5-10 percent in terms of credits spent so far on Angry Birds. This seems quite high to me, but it might just be normal for games on Facebook,” reads the email from Rovio to Facebook.

After an internal analysis, Facebook determined that in 93% of cases, chargebacks for Angry Birds were due to the credit card holder not being aware that the game was charging their account – while the average age of those playing the game was 5-years-old.

“In nearly all cases the parent knew their child was playing Angry Birds, but didn’t think the child would be allowed to buy anything without their password or authorization first (Like in iOS),” wrote a Facebook employee. “If we were to build risk models to reduce it, we would most likely block good TPV.” (TPV = total purchase value, or revenue)

Read the rest of the report here.

via ZeroHedge News http://bit.ly/2TeZzCu Tyler Durden