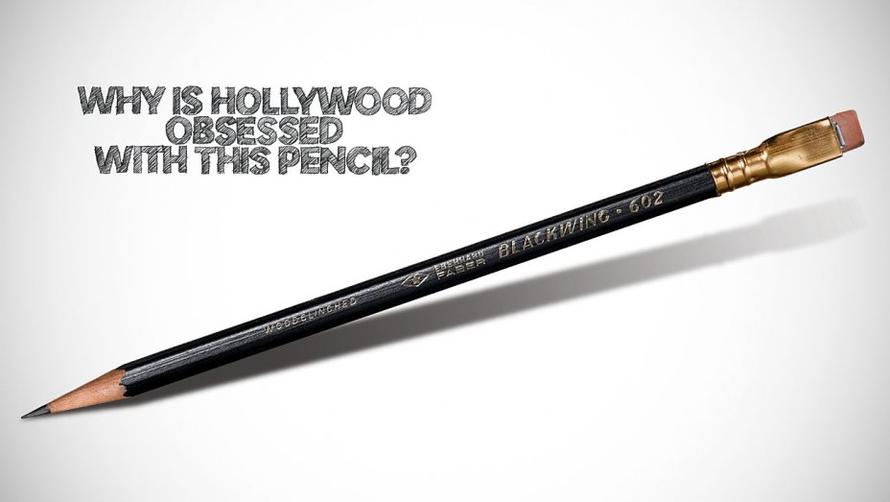

Whenever I hear the phrase “sharpening a pencil” to do some detailed analytical work, I think about the Eberhard Faber Blackwing 602 – the most famous pencil in the world. Developed during the Great Depression as a premium writing instrument, the Blackwing became the preferred daily instrument for everyone from John Steinbeck to Quincy Jones, Truman Capote to Stephen Sondheim. Production stopped in 1998, and vintage examples go on eBay for +$30 apiece. If you want to delve into pencil-geekdom, there is a link at the end of this section with more information.

Today we’ll sharpen only the proverbial pencil on the question of global equity valuations. After last year’s parlous performance in both Emerging Markets (down 19%) and EAFE (non-US developed equities, down 15%), how do the world’s stock markets shape up in terms of relative valuation to US equities?

Three points on this topic:

#1. The rest of the world’s equities markets do, in fact, trade at a significant discount to US stocks just now. The data from MSCI (link here):

- US stocks trade for 15.4x forward earnings; non-US stocks trade for 12.0x the same measure.

- Breaking down the rest-of-world valuations, EAFE (developed Europe, Asia, Far East) stocks trade for 12.4x forward earnings. Within that region, Europe (11.8x) and Japan (11.7x) show similar forward valuations and are slightly cheaper than the rest of the EAFE index.

- Emerging Markets trade for 11.0x forward earnings, but the regional variations are wider than EAFE: Asia (11.3x), Eastern Europe (6.3x), and Latin America (12.6x).

Summary: non-US stocks trade for a 19% (EAFE) to 29% (Emerging Markets) discount to US equities.

#2. The disparity between US and non-US stocks has been growing since the Great Financial Crisis.

- Both US and non-US equities bottomed at 14x forward earnings in 2009.

- The valuation gap between these two asset classes peaked in late 2017/early 2018 at just over 4 points. At that time “rest-of-world” equities traded for 14x forward earnings while US stocks sported an 18.5x multiple.

- That gap has narrowed to 3.4 PE points now.

Summary: the discounts for EAFE and Emerging Market equities are nothing new. They have been in place for almost 10 years to varying degrees. The best thing one can say is that they have narrowed (modestly) over the past year.

#3. Fundamentals like sector/country allocations drive long-term valuations, and these explain both historical differences and are the cornerstone issue to assessing potential future returns.

- In both Emerging Markets and EAFE indices, Financials hold the largest allocations at 24% and 19% respectively. In the S&P 500, the group only holds a 14% weight.

Importantly, Financials tend to have lower valuations regardless of geography so larger weights will tend to reduce PE ratios, as the data in point #1 clearly shows.

- Technology weightings tell a similar story in reverse, because in the US the S&P is 20% Tech (and more like 30% if you count FB, GOOG, and AMZN). Compare that to the 14% weighting for Tech in Emerging Markets and just 6% in the EAFE Index.

As with Financials, these weightings skew headline valuation measures like forward PE ratios, with Tech regularly enjoying higher PE ratios regardless of geography.

- Country weightings also play a role.

Half of the EAFE index is Japan (11.7x forward earnings PE), UK (11.7x) and France (12.1x), three countries with distinct demographic and economic challenges that likely merit their low valuations.

The Emerging Markets index is 54% China (10.4x forward PE), South Korea (8.8x) and Taiwan (13.2x). Considering the role current US/China trade negotiations play across these countries’ future economic growth, those lower-than-US valuations make sense to us.

The bottom line to all this: “cheap for a reason” comes to mind when discussing the relative undervaluation of non-US stocks. The valuation gap has been growing for years, driven by sector and geographic fundamentals. It is neither an anomaly nor an investment positive that rest-of-world stocks have lower valuations.

Just like those $30 Blackwings on eBay, US stocks are expensive for a reason.

via ZeroHedge News http://bit.ly/2RZx1QJ Tyler Durden