Authored by Lance Roberts via RealInvestmentAdvice.com,

…as I noted two weeks ago in this missive, these were all of the ingredients necessary to bring the bear market that began in 2018 to its end.

For now.

The Fed Is Limited

While the Fed certainly gave the markets what it wanted in the near-term, in the longer-term there is actually very little the Fed will be able to do to stem the next recessionary bear market.

The chart below shows why.

In 2008, when the Fed launched into their “accommodative policy” emergency strategy to bail out the financial markets, the Fed’s balance sheet was only about $915 Billion. The Fed Funds rate was at 4.2%.

If the market fell into a recession tomorrow, the Fed would be starting with roughly a $4 Trillion dollar balance sheet with interest rates 2% lower than they were in 2009. In other words, the ability of the Fed to “bail out” the markets today, is much more limited than it was in 2008.

“So what? There are plenty of bonds to buy.”

True, but there are other factors at play which will also dramatically limit the effectiveness of further rounds of accommodation.

When the Fed launched QE in 2009, market valuations had been reverted to below the long-term average and investor sentiment had been completely washed out. The massive selling that occurred as the markets collapsed left a huge amount of “pent up” demand for equities.

Today, that is no longer the case.

Valuations are no longer cheap by historical standards, but instead are expensive by virtually every measure.

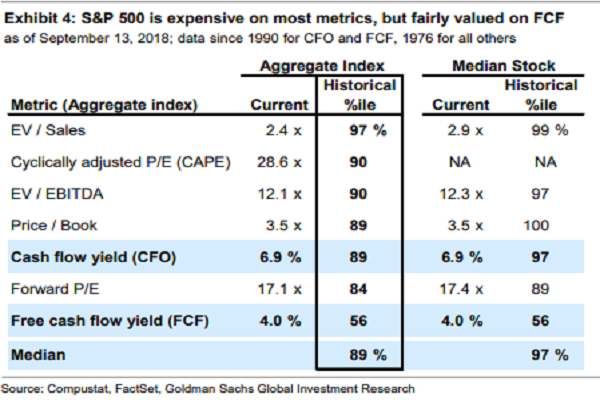

As Goldman Sachs pointed out recently, the market is pushing the 89% percentile or higher in 6 out of 7 valuation metrics.

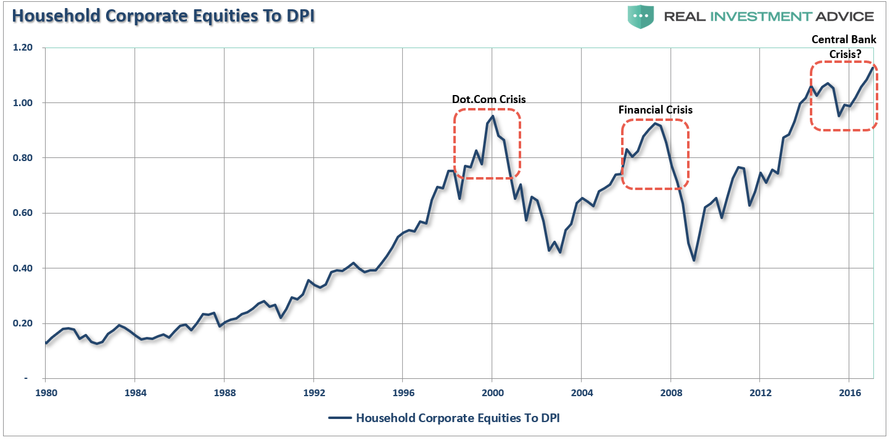

There is no longer a “pent up” demand for equity ownership as households now have more equity exposure than at any other point in history.

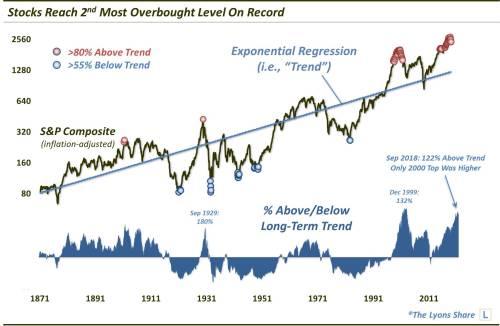

Furthermore, the market is not grossly oversold and deviated well below long-term trends as it was in 2008. As Dana Lyons recently penned:

“We used exponential regression smoothing to find the ‘best fit’ trend line on the [Shiller data] series from 1871 (h/t to Doug Short for the concept.)

After finding the best fit trend line for the composite, we can measure how far above or below prices are at a given time. As it turns out, this past September saw the composite reach 122% above the trend line, i.e., it was 122% “overbought”. In nearly 150 years, the only months that saw prices more overbought than that were those encompassing the 1999-2000 market top — the most excessive, bubbly top in U.S. market history.”

While markets can certainly remain extended for much longer than logic would predict, they can not, and ultimately will not, stay overly extended indefinitely.

The important point here is simply this. While the Fed may have curtailed the 2018 bear market temporarily, the environment today is vastly different than it was in 2008-2009. Here are a few more differences:

-

Unemployment is 4%, not 10+%

-

Jobless claims are at historic lows, rather than historic highs.

-

Consumer confidence is optimistic, not pessimistic.

-

Corporate debt is a record levels and the quality of that debt has deteriorated.

-

The government is already running a $1 trillion deficit in an expansion not half that rate as prior to the last recession.

-

The economy is extremely long is a growth cycle, not emerging from a recession.

-

Pent up demand for houses, cars, and other durables has been absorbed

-

Production and Services measures recently peaked, not bottomed.

In other words, the world is exactly the opposite of what it was when the Fed launched “monetary accommodation”previously. Logic suggests that such an environment will make further interventions by the Fed less effective.

The only question is how long will it take the markets to figure it out?

via ZeroHedge News http://bit.ly/2DQKkKB Tyler Durden