Authored by Mike Shedlock via MishTalk,

63 out of America’s largest 75 cities can’t pay their bills, acquired $330 billion in unfunded debt.

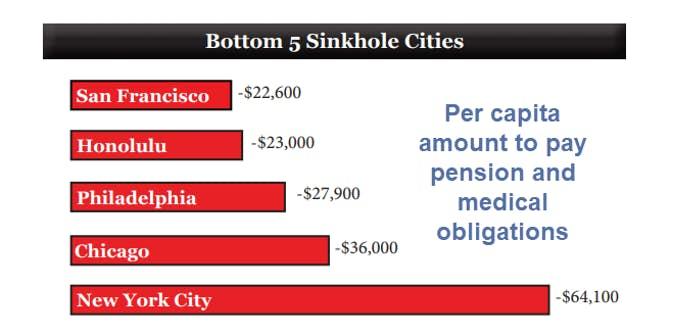

Via a report on Watchdog, analysis of the 75 most populous cities in the U.S., shows that 63 of them can’t pay their bills. The total amount of unfunded debt among them is nearly $330 billion. Most of the debt is due to unfunded retiree benefits such as pension and health care costs.

Financial State of Cities

“This year, pension debt accounts for $189.1 billion, and other post-employment benefits (OPEB) – mainly retiree health care liabilities – totaled $139.2 billion,” the third annual “Financial State of the Cities” report produced by the Chicago-based research organization, Truth in Accounting (TIA), states.

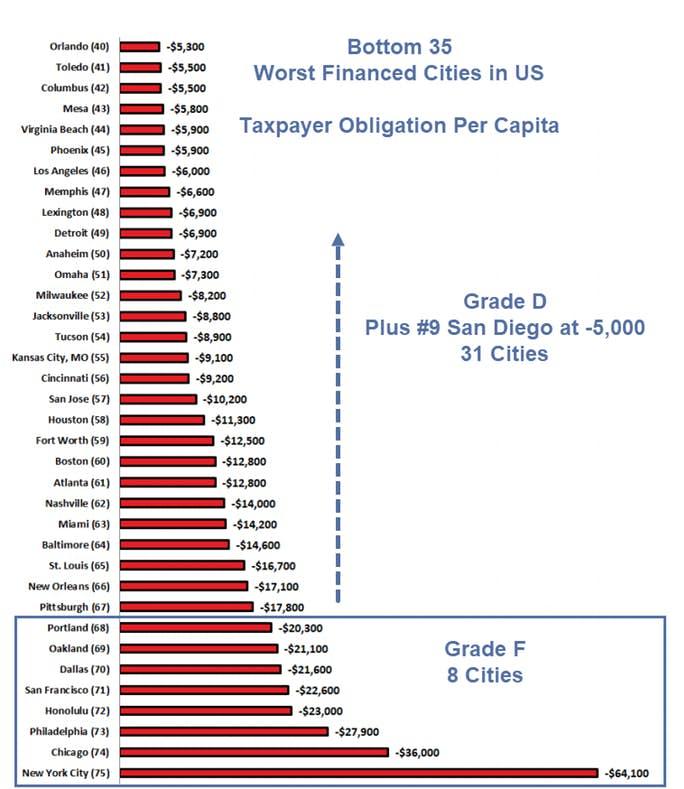

Bottom 35

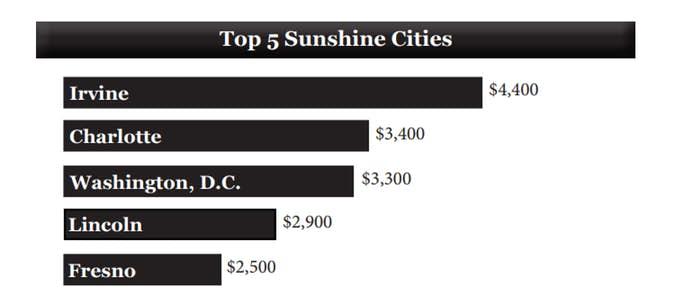

Top 5 Cities

Grading the Cities

-

A grade: Taxpayer Surplus greater than $10,000 (0 cities)

-

B grade: Taxpayer Surplus between $100 and $10,000 (12 cities)

-

C grade: Taxpayer Burden between $0 and $4,900 (24 cities)

-

D grade: Taxpayer Burden between $5,000 and $20,000 (31 cities)

-

F grade: Taxpayer Burden greater than $20,000 (8 cities)

Truth in Accounting’s grading system for the 75 cities gives greater meaning to each city’s Taxpayer Burden or Taxpayer Surplus. A municipal government receives a “C,” or passing grade, if it comes close to meeting its balanced budget requirement, which is reflected by a small Taxpayer Burden. An “A” or “B” grade is given to governments that have met their balanced budget requirements and have a Taxpayer Surplus. “D” and “F” grades apply to governments that have not balanced their budgets and have significant Taxpayer Burdens.

What a miserable report.

The most shocking thing is not how bad the worst cities are, but rather some cities in California actually appear to be solvent.

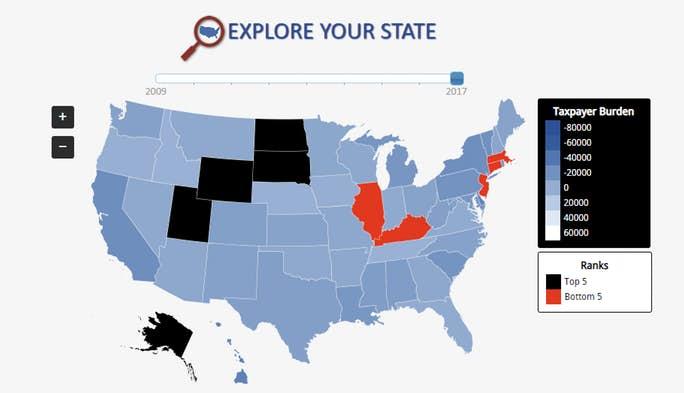

By State

The above analysis is by city. Also consider State Level Liabilities.

Bottom Five

-

New Jersey: -64,000

-

Connecticut: -53,400

-

Illinois: -50,800

-

Kentucky -39,200

-

Massachusetts: -33,500

Congratulations Chicago!

On a combined liability basis, Chicago is the winner. Each Chicagoan owes the state $50,800 and the city an additional $36,000 for a total of $86,800 per capita.

New York City residents “only” owe $21,500 to the state plus $64,100 to the city for a grand total $85,600 per capita.

Second City No More!

via ZeroHedge News http://bit.ly/2MUoyc1 Tyler Durden