Tomorrow, as DB’s Jim Reid reminds us, marks the first year anniversary of Powell becoming Chair of the Federal Reserve while today is his birthday. More apropos to markets, after eight meetings at the helm it was notable that last week’s was the first where the S&P 500 rose on FOMC announcement day for obvious reasons: after a year of being mostly on the hawkish side, Powell performed a 180 degree pivot in 2019.

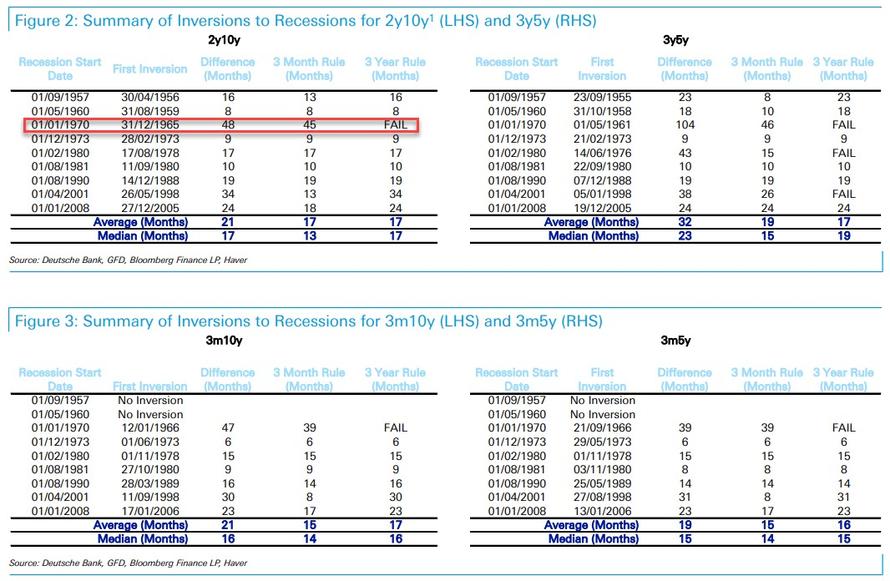

Looking at Jim Reid’s favorite economic indicator, the yield curve, following the Fed’s U-turn the probability of an inversion has fallen or at least when it occurs might have been delayed according to the DB strategist, who then looks at the only notable “false positive” in the 70-year series of yield curve inversions as a precursor to recessions, which took place in the late 1960s where the first inversion happened around 48 months before the recession, “breaking” with the 3-year max interval between curve inversion and recession.

And yet there is a reason for this false positive: what happened in the 1960s is that in the face of rising inflation but a falling stock market, the Fed made what has since been described as a “policy error” by keeping policy too loose especially in the face of higher government spending on the Vietnam War and on the start of Medicare/Medicaid.

Sound familiar? If not consider this sequence of events: the yield curve first inverted in December 1965, inflation spiked in early 1966 (with the US at full employment) and continued rising and the S&P 500 fell over 20% from January 1966 peaks.

And, just like now, the Fed seemed more concerned by the stock market and stayed on hold in 1966 and even cut rates in early 1967 as growth, fiscal spending and inflation went higher. While this likely prolonged the cycle and re-steepened the curve, it also reinforced higher inflation and by the end of 1967 the Fed were forced to reverse course and start a hiking cycle. The curve then re-inverted and by the end of the decade the recession arrived four years after the first inversion.

Reid made this point to show that cycles can be manipulated by policy makers that deviate policy away from what may have been a more appropriate course.

* * *

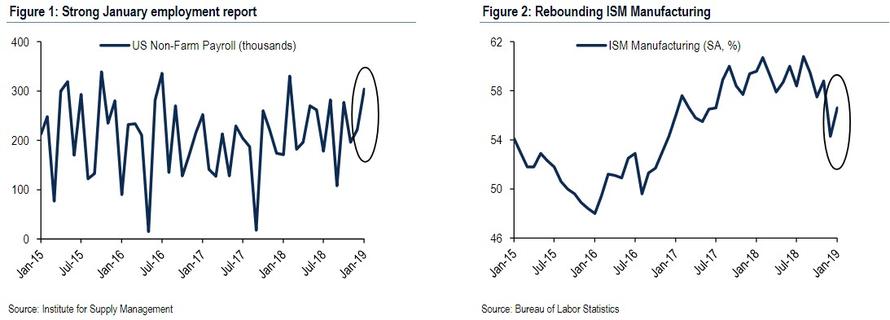

So assuming that the Fed, which as we explained previously was already trapped between the market on one side and the economy on the other, was merely engaging in policy error in its desperate pursuit of higher stock prices, what is the biggest risk? Well, according to a new note from Bank of America, January’s combination of a strong employment report and rebounding ISM Manufacturing highlights that the key risk for investors to focus on is not recession but that the Fed eventually will resume its rate hiking cycle, just as it did in the 1960s.

As a result BofA forecasts that while financial conditions – including credit spreads – can improve relatively quickly, it appears likely the Fed will wait and monitor economic data through 2Q for confirmation the US economy is indeed sufficiently strong to weather foreign weakness, trade war and the government shutdown.

To BofA, this means the next rate hike is unlikely in 1H but probable in 2H, and as such, the bank remains overweight and bullish credit spreads, but obviously would become more negative into Fed rate hikes.

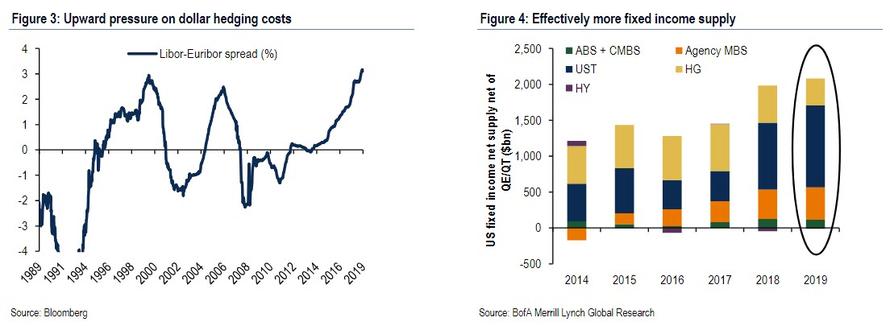

Our view remains that this hiking cycle is particularly challenging, as the Fed is the only major central bank to hike – which puts upward pressure on dollar hedging costs and leads to less demand for US fixed income (Figure 3) – and QT effectively means more fixed income supply (Figure 4).

Hence in the bank’s opinion interest rate risk is particularly high this hiking cycle, because not only the yield curve, but stocks too are now entirely reliant on just when the Fed will concede it made yet another policy mistake and turn hawkish again, in the process launching the next bear market, forcing it to engage in yet another policy mistake a few months later when it will once again turn dovish, and so forth, as Powell is now nothing more than the market’s whipping boy.

via ZeroHedge News http://bit.ly/2ScpKxd Tyler Durden